Hello, my name is Eric Bergerson and I’m an industrial designer with an additional background in physics. I work as a consultant in the autonomous vehicle industry and I’m very interested in what’s going to happen when Uber, Lyft and their competitors in America and abroad start using cost effective autonomous vehicles. For a quick overview of these ideas and how this phenomenon will end up electrifying America’s automobile fleet, see my introductory post.

Electric cars, like solar power, have been a “feel good” technology that for decades couldn’t compete with the more common and environmentally destructive fossil fuel alternatives without the aid of subsidies. That’s all going to end. The big winners in this disruption are going to be electric vehicle manufacturers because the reality is that 95% of the trips people take in cars can be handled by electric vehicles equipped with current battery technology and the three main drawbacks of electric vehicles (initial purchase cost, range and recharging time) will all be negated by The Mobility Cloud.

The moderately higher purchase cost of an electric vehicle will be become inconsequential because in this usage model, now the vehicle’s purchase price is being amortized over tens of thousands of users over the useful life of that vehicle and that modest difference in initial cost becomes irrelevant. Keep in mind these shared vehicles are now operating as cabs and consequently will be doing ~70K miles per year rather than the 13.5K miles per year that private automobiles do on average. So what matters now is running costs, and running costs for electric vehicles are so much lower than gas vehicles that in terms of real dollars to the consumer and fleet manager, the electric vehicle will be much cheaper to operate than gasoline vehicles.

The charging time problem is eliminated because the consumer is only using the vehicle for the duration of one trip. He doesn’t have to worry about how long it takes for the battery to charge offline because the consumer has no exposure to that. The consumer won’t even be using the same vehicle for his return trip. The range problem is also largely eliminated for the same reason as the charging time problem. As long as the consumer’s one way trip is within the range of the electric vehicle, and 95% of trips fit that profile, range doesn’t affect the consumer. The range and the recharging time are the fleet provider’s responsibility to manage, not the consumer’s. So there’s now a situation where not only has The Mobility Cloud removed the primary barriers to consumers choosing electric vehicles, but electric vehicles are now able to significantly undercut gasoline vehicles fiscally almost from day one, which has never been the case before.

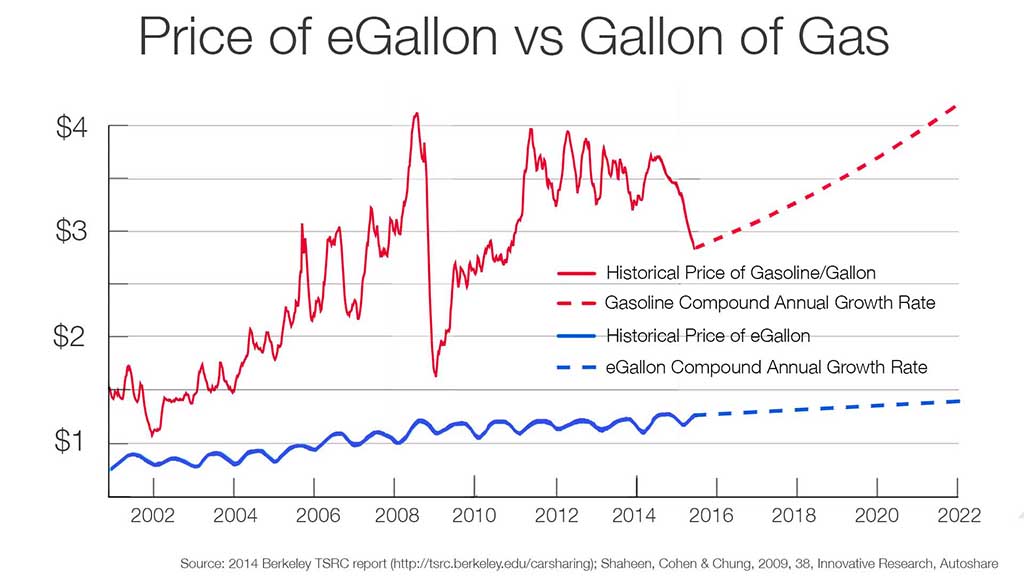

There’s no need for subsidies or incentives to sell electric vehicles anymore because they’re economically and functionally superior to gasoline vehicles on their own. It’s easy for naysayers to claim that will never happen because electric cars only constitute less than one percent of the market and they’ll never catch up, but that’s a linear claim in an exponential system. The Mobility Cloud will remove the convenience factors that currently serve as disincentives to consumers using electric vehicles. Once that’s happened, the economics of on-demand transportation will fiscally favor electric vehicles, and if gas prices rise back up (I’m writing this in 2017) to the level they’ve been at for the past 5 or 10 years then electric vehicles will be massively more advantageous. It’s meaningless to discuss the cost competitiveness of gas vs. electric power without first understanding the relationship between a gallon of gasoline and an eGallon, which is the electrical energy equivalent of a gallon of gas. See this slide that describes the historical relationship between the price of a gallon of gasoline and the price of an eGallon.

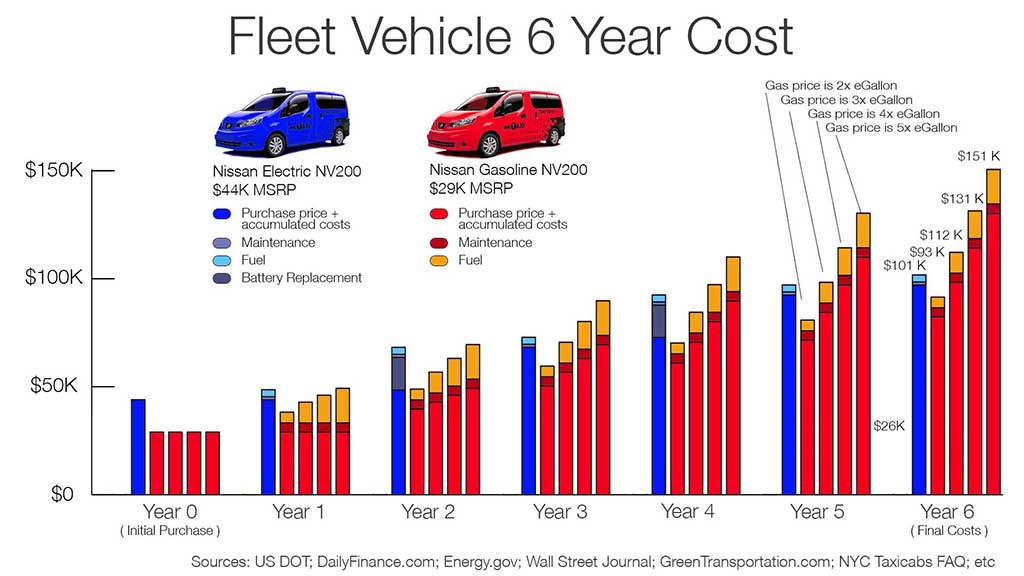

What we learn from this is that the price of electricity is extremely stable and predictable, and it’s even seasonably predictable. The price of gas, however, is completely unpredictable. It varies roughly between 1.5x and 4x the price of electricity on national average. This means that it doesn’t really make sense to analyze the cost effectiveness of electric vehicles in terms of just one fixed ratio of the price of electricity to the price of gas. In light of this, I’ve analyzed the economics of a gasoline vs. electric fleet vehicle in this slide at several different multiples of how much gas costs relative to electricity.

Even with having to replace the batteries in the electric vehicles every 150K miles, they still have cheaper running costs than gasoline vehicles at any multiple of gas prices more than about 2x the price of electricity. And don’t forget that gasoline engines are an ultra-mature technology that has benefitted from over a century of optimization. Electric vehicles are a very immature technology that have lots of room for improvement and growth. I would call the Tesla Model S, BMW i3 and any other current generation purpose-built electric vehicle version 1.0 of electric vehicle technology. I consider the Tesla Roadster, Nissan Leaf and any other EV that’s a derivative of a gasoline design the beta release of electric technology and I consider the GM EV-1 to be more the prototype phase of electric vehicle technology.

I mentioned that this analysis is budgeting for the replacement of the batteries every 150K miles (roughly every two years given taxicab annual mileage). The more we learn about the longevity of Tesla’s Roadster and Model S batteries, however, the more we learn that that estimate might be conservative and perhaps it might not be necessary to change the batteries that often, which means the electric advantage would be even greater.