The iPhone ships in 2007. RIM's revenue in 2007 was $3 billion. RIM's revenues grow to a peak of almost $20 billion in 2011, 4 years later. Amazing 7x growth. But in 2013, it's $11 billion, and by 2015, it's back down to $3.3 billion. Now it's $1.3 billion.

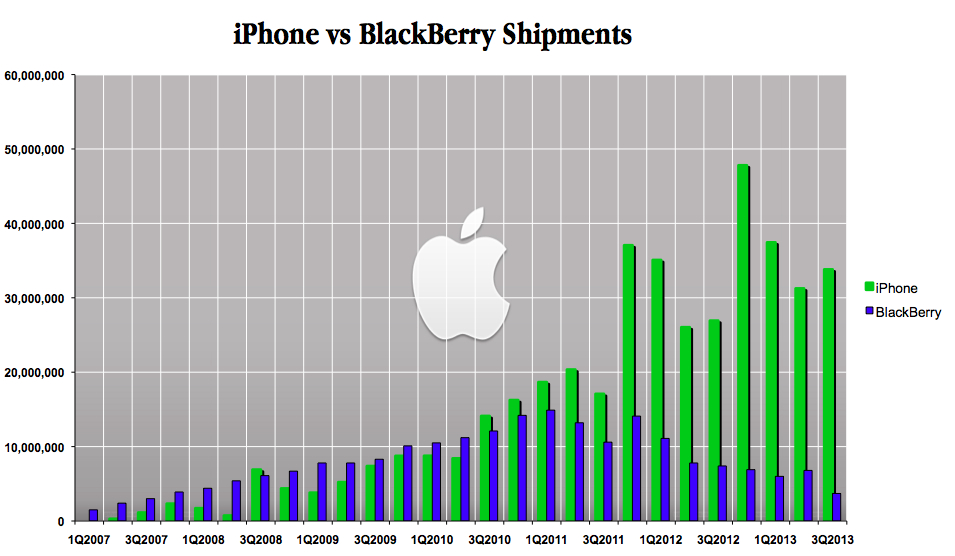

Blackberry's device shipments peak in 2011, well after the 2007 intro of the iPhone:

From:

iPhone vs BlackBerry

In 2007 and 2008, plenty of people thought Apple's iPhone was destined to fail, or at least just be a small niche product. It wasn't obviously apparent to pretty much everyone that the trajectories would be vastly different until 2010. Stephen Elop’s “Burning Platform” memo wasn't until 2011, when Nokia went from dominance to WTF do we do now?

It isn't always obvious when something new comes along that it will be the disruptor. Sure, the signs are there, but can it really do it? The thought that millions of 12-14 year olds will be entrusted with carrying around $600-1,000 digital devices every day with $15-30 monthly payments was completely absurd to lots of people in 2007/2008. By 2012, not so much.