You only read it twice??Just finished re-reading Elon's Part 2. Found it to be an excellent reminder of how incredibly out-of-touch analysts today are with TSLA's mission statement.

Master Plan, Part Deux

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

If quarter revenues are good, 300 will be locked I think (it will become the new 180). Then it will probably be a tenuous rise to 350, until M3 start production around July. Then 350 will be locked I think.

jhm

Well-Known Member

Wow, that is a really nice analysis, about a 50% improvement in first 6 quarter deliveries. I'll be looking forward to seeing how the Model 3 ramp compares. 370k in the first 6 quarters, a ten-fold increase over Model X ramp, would be awesome.Yes, they did. During first six quarters of sales Model X delivered 36,983 cars vs. Model S delivering only 25,127 cars after being six quarters on sale. I suspect M3 will be multiples of combined MS and MX.

What is your point again?

May I suggest doing your homework before annoying forum with fart posts?

View attachment 221621

jhm

Well-Known Member

And you haven't lost your mind yet! So glad.i've got the gross margin guidance for next 2 quarters. anyone have any company statements / info on operating expense guidance? thanks in advance.

my confidence is growing that tesla is on track to report record revenue and earnings.

i continue to be amazed at how far offsides the analyst community is as a whole.

jon, this year the cost to participate in upside is much higher than it was in 2013. for example i remember buying for 5c a "great many" $40 calls that got me through earnings in 2013. that $10 move at the time would have happened with a $1.2 billion bump in market cap.

this year yes the may 400s which are proportionately the same amount out of the money are at 50c (divide it all by 10, it's just like $40 calls at 5c). however to get to $400 you need a $16 billion bump in market cap. i just don't believe even on a blowout that tesla would gap to $400 where in 2013 i could easily see a $10-15 move up on earnings.

another difference: in 2013 the cost to borrow tesla was extremely high, which meant that the shorts were really wound up very tight. this time the cost to borrow is very low and short interest is on the lower end of recent ranges. so i don't feel the same squeeze potential exists.

i do think you will see a squeeze though -a longs' squeeze to get in! it will happen closer to once tesla puts together 4 quarters of positive gaap eps. i think that trend starts with this quarter. 4 quarters of positive gaap eps trigger a lot of things: 1. stock becomes a candidate for s&p 500 and other index inclusion. 2. william o'neill type price/earnings momentum funds can get involved once earnings are positive. 3. credit ratings increase meaningfully and positive earnings + better credit rating will allow other institutional investors who have various restrictions to participate. that's a lot of longs that will need to get in, and many of those entities listed are the pay any price types.

longs' squeezing can be very powerful, for an example stretch back to the giant run apple had in 2012. that was institutions of every variety who *had* to get in. some on momentum. some on dividends. some on earnings strength. some on valuation. and some who were closet indexers that wanted some hope of beating the s&p 500. apple outperformed the s&p so much those people had to be equal weight or overweight - anyone "underweight" was basically squeezed in. if you recall it was after the death of steve jobs when many had underweighted apple or felt their best days were behind them. the market forced even long-only investors to buy apple.

my plan is to hang on until those guys are murdering each other getting in, and then cash out a good chunk and head back to the beach where i belong!

they're not buying it or they can't buy it now, but they will be forced to buy it later - if the eps can deliver.

this year yes the may 400s which are proportionately the same amount out of the money are at 50c (divide it all by 10, it's just like $40 calls at 5c). however to get to $400 you need a $16 billion bump in market cap. i just don't believe even on a blowout that tesla would gap to $400 where in 2013 i could easily see a $10-15 move up on earnings.

another difference: in 2013 the cost to borrow tesla was extremely high, which meant that the shorts were really wound up very tight. this time the cost to borrow is very low and short interest is on the lower end of recent ranges. so i don't feel the same squeeze potential exists.

i do think you will see a squeeze though -a longs' squeeze to get in! it will happen closer to once tesla puts together 4 quarters of positive gaap eps. i think that trend starts with this quarter. 4 quarters of positive gaap eps trigger a lot of things: 1. stock becomes a candidate for s&p 500 and other index inclusion. 2. william o'neill type price/earnings momentum funds can get involved once earnings are positive. 3. credit ratings increase meaningfully and positive earnings + better credit rating will allow other institutional investors who have various restrictions to participate. that's a lot of longs that will need to get in, and many of those entities listed are the pay any price types.

longs' squeezing can be very powerful, for an example stretch back to the giant run apple had in 2012. that was institutions of every variety who *had* to get in. some on momentum. some on dividends. some on earnings strength. some on valuation. and some who were closet indexers that wanted some hope of beating the s&p 500. apple outperformed the s&p so much those people had to be equal weight or overweight - anyone "underweight" was basically squeezed in. if you recall it was after the death of steve jobs when many had underweighted apple or felt their best days were behind them. the market forced even long-only investors to buy apple.

my plan is to hang on until those guys are murdering each other getting in, and then cash out a good chunk and head back to the beach where i belong!

they're not buying it or they can't buy it now, but they will be forced to buy it later - if the eps can deliver.

So you aren't going to buy a ton of Jan 2014 $40 calls for peanuts? (was that you? 2013 seems so long ago lol)

Last edited:

This was linked to an MIT alum site. Since some of you are entrepreneurs and "movers and shakers" you might be interested in this guy's approach to innovation combined with commercial application. I'm a bit embarrassed by this since it is the most blatant puff piece ever seen, but that's Harvard. (The yahd used to call us the "vocational school" down the river, while our humor magazine once spoofed the humanities curriculum as dominated by "elements of sports car talk," yada, yada.)

The Edison of Medicine

The Edison of Medicine

JRP3

Hyperactive Member

am i hallucinating, or does the "Tesla Fireflies" video look strikingly like the 3?

Looks a lot more like the Model S. So I vote "hallucinating".

It's just backwards. The model three looks like a baby S, but it doesn't have the father's nose.Looks a lot more like the Model S. So I vote "hallucinating".

The silhouettes are similar, so much I'm worried about getting in (rigor mortis is already symptomatic in my case) and we may have to buy an X.

Last edited:

T3slaTulips

Member

Really. I thought all us cultists were supposed to read it at the start of every day.You only read it twice??

Or joyously partake of a hot dog on Fridays...

Something like that.

drinkerofkoolaid

Active Member

Just came across this article from a few months ago. First I've heard of this. Have there been any updated comments about this?

Tesla wants to sell future cars with insurance and maintenance included in the price

Tesla wants to sell future cars with insurance and maintenance included in the price

Just came across this article from a few months ago. First I've heard of this. Have there been any updated comments about this?

Tesla wants to sell future cars with insurance and maintenance included in the price

Believe this was mentioned in their Q4 call.

drinkerofkoolaid

Active Member

Believe this was mentioned in their Q4 call.

Not sure how I missed this. This is a very big deal.

Not sure how I missed this. This is a very big deal.

It really is. Streamlines owning a car to a whole new level.

RobStark

Well-Known Member

Mixed but mostly positive 19 month long term Model S review. Much more in the link.

2015 Tesla Model S P85D - Long-Term Road Test Wrap-Up

LONG-TERM ROAD TEST WRAP-UP

2015 Tesla Model S P85D

Witnessing change in 36,000 miles, plus one really long road trip.

From the April 2017 issue

We knew that Tesla was driving massive changes in a century-plus-old industry, but we’d soon be surprised to discover that the Model S was itself capable of change. When we took delivery of the car, Tesla was touting 691 horsepower from a car that would practically drive itself—just as soon as the engineers finished writing the software. Plugging the Model S in behind the office, we could feed the car with our 40-amp circuit, adding 22 miles of predicted range per hour of charging.

Nineteen months later, when our Model S embarked on a 4000-mile sendoff from Ann Arbor to Los Angeles via New York City, the car that completed that journey could steer itself down the highway, its two electric motors were now understood to make a combined 463 horsepower, and the 17-inch touchscreen, twice upgraded by software updates, had learned to plot the necessary high-speed-charging breaks on long-distance routes. Those stops would be dictated by Tesla’s network of proprietary Superchargers, which had grown from 188 U.S. locations to 325 during our time with the car, including a station just three miles from our Ann Arbor office. When we needed a quick jolt of electricity, that Supercharger could refill the battery at a rate roughly 10 times faster than that very first charge at 1585 Eisenhower Place. Our Model S was still red when it completed its 40,000-mile tour of duty, but in many ways, it was as if we were living with a different car.

Our car’s big battery pack made electric living easy. The EPA rates the P85D at 253 miles per charge while our own real-world range test extracted 206 miles during a 75-mph highway cruise. There’s good reason newer EVs are targeting the 200-mile threshold that Tesla cracked.

Any trip that requires one or two Supercharger stops is relatively painless. Anything longer, however, quickly becomes tedious.

December 5, 2016

40,000 miles: Model S finishes its long-term tour

Tesla should be celebrated for building the infrastructure that’s crucial to electric-vehicle adoption. No other automaker has made such a commitment. The difference between a Tesla Model S and a Nissan Leaf is as much about the Supercharger network as it is the larger-capacity battery pack.

Time certainly made our Tesla smarter. A software update in October 2015 enabled Autopilot, which combines adaptive cruise control, a self-steering lane-keeping program, and automated lane changes (activated by triggering the turn signal). Autopilot can cover scores of highway miles without driver involvement, and yet it occasionally yanked—suddenly and alarmingly—at the steering wheel when it lost the scent of lane markers, causing the vehicle to swerve out of its lane.

While the instrument cluster implores the driver to keep their hands on the wheel during Autopilot use, the system’s seeming competence easily lulls you into false confidence and dumb behavior such as texting or, in the case of our drivers, writing notes in the car’s logbook.

We’ve been promised that EVs will reduce operating costs, but Tesla’s service prices don’t reflect its vehicles’ simplicity. The 12,500-mile maintenance stop involves replacing the cabin air filter, the windshield-wiper blades, and the key-fob batteries and performing an inspection. It cost $432. Every second service calls for replacing the brake fluid and the air-conditioning desiccant bag, upping the price to $756. It appears that even in the electric future, the service department remains a profit center.

In the big picture, our Model S proved dependable, with none of the showstopping battery or motor failures that troubled some early cars. Several build-quality issues did remind us, however, that Tesla is the youngest automaker by a large margin. Adding to the irritation, the service center was often slow to schedule minor warranty work. Note the three-month lag between ordering and installing the third driver’s seat in our Service Timeline. That driver’s seat (along with the first replacement) developed enough play in the frame to noisily rub against the center console. Halfway through the test, the sunroof began to leak during rainstorms and required two service visits to correct. The chrome trim on the rear hatch had to be replaced after the original allowed moisture into the tail lamps. The 5010-pound P85D also consumed a control arm and an anti-roll-bar end link, and it wore through its Michelin Pilot Sport PS2s in 15,000 miles. We sacrificed one windshield, one tire, and one wheel to Michigan roads.

The Model S’s novel and distinctive aura is equal parts Silicon Valley ingenuity and startup naiveté. In its quest to redefine the user experience, Tesla forgot several simple features that we take for granted. There are no grab handles above the doors, no sunshade for the glass roof, and no rear wiper. The fixed rear headrests impinge on rearward sightlines, and our seven-passenger Model S had just three cupholders.

While the in-car technology feels so very of-the-moment, less sophisticated cars better withstand the test of time. Our Model S’s 3G modem was outmoded the day it arrived at our office, and the navigation system frequently displayed blank gray tiles while Google Maps loaded. Simpler tasks such as changing radio stations left the impression that the 17-inch touchscreen was aging ungracefully, slowing down the way an old smartphone does. That complaint first appeared in the logbook with just 11,861 miles on the clock, while another driver counted a 10-second lag between tapping the screen and hearing a new station.

With immediately available torque and no need to downshift, the P85D accelerates from 30 to 50 mph in 1.9 seconds. A Bugatti Veyron does it in 1.8.

We averaged 69 MPGe, well below the EPA’s 93 combined MPGe. With electricity at a national average of 13 cents per kWh, running our Tesla cost the same as driving a 38-mpg car with gas at $2.40 per gallon.

Efficiency, though, seems like one of the less compelling arguments for buying a Tesla. The Model S’s appeal lies in the thrill of instant torque, the comfort of seamless acceleration, the tranquility of near-silent idling, and the convenience of at-home refueling. Tesla alone made EVs cool, with its focus on the primal desire for style and performance. We just hope that the company can embrace the kind of continuous improvement we witnessed in the Model S. If Musk can advance its build quality and send a SpaceX rocket to retrieve its pricing from the upper stratosphere, as he intends to with the $35,000 Model 3, Tesla’s transformation from startup to automotive institution will be complete.

WHAT WE DON’T LIKE: “If the first time I drove this car was in its current state, I don’t think I would be very impressed,” associate online editor Joseph Capparella noted in the Tesla’s logbook. Capparella pointed to the squeaky brakes, several rattles, worn-looking leather, and a driver’s seat that rocks on its mounts as evidence that our Model S has lost more luster than most of the vehicles that endure our long-term test regimen. “It just doesn’t feel solidly screwed together,” he wrote.

WHAT WE LIKE: Of all of the fast and slinky cars that pass through our parking lot, the Tesla Model S is the only one that consistently astounds automotive enthusiasts and agnostics in equal measure. We’re big fans of the P85D’s effortless 3.3-second zero-to-60-mph blast—sudden but never violent—but we’re even happier that Tesla seems to be getting average Americans excited about cars again.

2015 Tesla Model S P85D - Long-Term Road Test Wrap-Up

LONG-TERM ROAD TEST WRAP-UP

2015 Tesla Model S P85D

Witnessing change in 36,000 miles, plus one really long road trip.

From the April 2017 issue

We knew that Tesla was driving massive changes in a century-plus-old industry, but we’d soon be surprised to discover that the Model S was itself capable of change. When we took delivery of the car, Tesla was touting 691 horsepower from a car that would practically drive itself—just as soon as the engineers finished writing the software. Plugging the Model S in behind the office, we could feed the car with our 40-amp circuit, adding 22 miles of predicted range per hour of charging.

Nineteen months later, when our Model S embarked on a 4000-mile sendoff from Ann Arbor to Los Angeles via New York City, the car that completed that journey could steer itself down the highway, its two electric motors were now understood to make a combined 463 horsepower, and the 17-inch touchscreen, twice upgraded by software updates, had learned to plot the necessary high-speed-charging breaks on long-distance routes. Those stops would be dictated by Tesla’s network of proprietary Superchargers, which had grown from 188 U.S. locations to 325 during our time with the car, including a station just three miles from our Ann Arbor office. When we needed a quick jolt of electricity, that Supercharger could refill the battery at a rate roughly 10 times faster than that very first charge at 1585 Eisenhower Place. Our Model S was still red when it completed its 40,000-mile tour of duty, but in many ways, it was as if we were living with a different car.

Our car’s big battery pack made electric living easy. The EPA rates the P85D at 253 miles per charge while our own real-world range test extracted 206 miles during a 75-mph highway cruise. There’s good reason newer EVs are targeting the 200-mile threshold that Tesla cracked.

Any trip that requires one or two Supercharger stops is relatively painless. Anything longer, however, quickly becomes tedious.

December 5, 2016

40,000 miles: Model S finishes its long-term tour

Tesla should be celebrated for building the infrastructure that’s crucial to electric-vehicle adoption. No other automaker has made such a commitment. The difference between a Tesla Model S and a Nissan Leaf is as much about the Supercharger network as it is the larger-capacity battery pack.

Time certainly made our Tesla smarter. A software update in October 2015 enabled Autopilot, which combines adaptive cruise control, a self-steering lane-keeping program, and automated lane changes (activated by triggering the turn signal). Autopilot can cover scores of highway miles without driver involvement, and yet it occasionally yanked—suddenly and alarmingly—at the steering wheel when it lost the scent of lane markers, causing the vehicle to swerve out of its lane.

While the instrument cluster implores the driver to keep their hands on the wheel during Autopilot use, the system’s seeming competence easily lulls you into false confidence and dumb behavior such as texting or, in the case of our drivers, writing notes in the car’s logbook.

We’ve been promised that EVs will reduce operating costs, but Tesla’s service prices don’t reflect its vehicles’ simplicity. The 12,500-mile maintenance stop involves replacing the cabin air filter, the windshield-wiper blades, and the key-fob batteries and performing an inspection. It cost $432. Every second service calls for replacing the brake fluid and the air-conditioning desiccant bag, upping the price to $756. It appears that even in the electric future, the service department remains a profit center.

In the big picture, our Model S proved dependable, with none of the showstopping battery or motor failures that troubled some early cars. Several build-quality issues did remind us, however, that Tesla is the youngest automaker by a large margin. Adding to the irritation, the service center was often slow to schedule minor warranty work. Note the three-month lag between ordering and installing the third driver’s seat in our Service Timeline. That driver’s seat (along with the first replacement) developed enough play in the frame to noisily rub against the center console. Halfway through the test, the sunroof began to leak during rainstorms and required two service visits to correct. The chrome trim on the rear hatch had to be replaced after the original allowed moisture into the tail lamps. The 5010-pound P85D also consumed a control arm and an anti-roll-bar end link, and it wore through its Michelin Pilot Sport PS2s in 15,000 miles. We sacrificed one windshield, one tire, and one wheel to Michigan roads.

The Model S’s novel and distinctive aura is equal parts Silicon Valley ingenuity and startup naiveté. In its quest to redefine the user experience, Tesla forgot several simple features that we take for granted. There are no grab handles above the doors, no sunshade for the glass roof, and no rear wiper. The fixed rear headrests impinge on rearward sightlines, and our seven-passenger Model S had just three cupholders.

While the in-car technology feels so very of-the-moment, less sophisticated cars better withstand the test of time. Our Model S’s 3G modem was outmoded the day it arrived at our office, and the navigation system frequently displayed blank gray tiles while Google Maps loaded. Simpler tasks such as changing radio stations left the impression that the 17-inch touchscreen was aging ungracefully, slowing down the way an old smartphone does. That complaint first appeared in the logbook with just 11,861 miles on the clock, while another driver counted a 10-second lag between tapping the screen and hearing a new station.

With immediately available torque and no need to downshift, the P85D accelerates from 30 to 50 mph in 1.9 seconds. A Bugatti Veyron does it in 1.8.

We averaged 69 MPGe, well below the EPA’s 93 combined MPGe. With electricity at a national average of 13 cents per kWh, running our Tesla cost the same as driving a 38-mpg car with gas at $2.40 per gallon.

Efficiency, though, seems like one of the less compelling arguments for buying a Tesla. The Model S’s appeal lies in the thrill of instant torque, the comfort of seamless acceleration, the tranquility of near-silent idling, and the convenience of at-home refueling. Tesla alone made EVs cool, with its focus on the primal desire for style and performance. We just hope that the company can embrace the kind of continuous improvement we witnessed in the Model S. If Musk can advance its build quality and send a SpaceX rocket to retrieve its pricing from the upper stratosphere, as he intends to with the $35,000 Model 3, Tesla’s transformation from startup to automotive institution will be complete.

WHAT WE DON’T LIKE: “If the first time I drove this car was in its current state, I don’t think I would be very impressed,” associate online editor Joseph Capparella noted in the Tesla’s logbook. Capparella pointed to the squeaky brakes, several rattles, worn-looking leather, and a driver’s seat that rocks on its mounts as evidence that our Model S has lost more luster than most of the vehicles that endure our long-term test regimen. “It just doesn’t feel solidly screwed together,” he wrote.

WHAT WE LIKE: Of all of the fast and slinky cars that pass through our parking lot, the Tesla Model S is the only one that consistently astounds automotive enthusiasts and agnostics in equal measure. We’re big fans of the P85D’s effortless 3.3-second zero-to-60-mph blast—sudden but never violent—but we’re even happier that Tesla seems to be getting average Americans excited about cars again.

Do you still believe the debt ceiling is a big deal & the US might default?2017 Investor Roundtable:General DiscussionNot sure how I missed this. This is a very big deal.

drinkerofkoolaid

Active Member

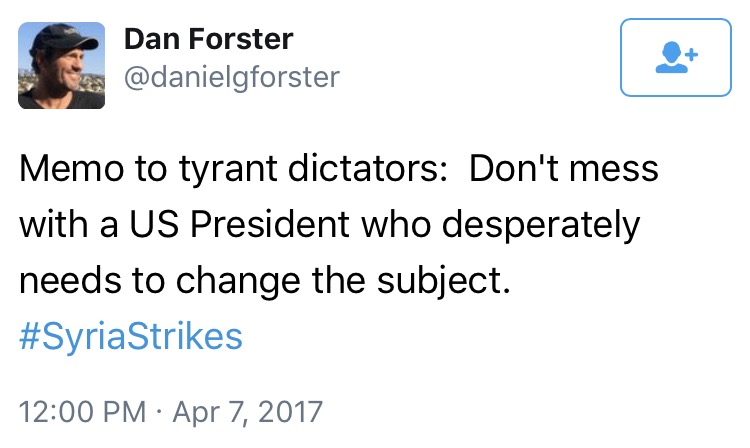

I hate conspiracy theories, but I think this might have merit, and reflects some of the concerns I mentioned in my past few posts about Trump's use of diversions.

Does anyone honestly think Trump used $100 million of missiles to launch an attack in Syria? Irrespective of whether or not the use of chemical weapons was immoral and a violation of international laws, there are serious reasons to question if Trump had the legal authority to order the attack without Congresional approval. This event will have repercussions, and a lot of people I've spoken with are concerned about what will happen next.

This event will certainly have broad market implications. Discuss?

Also, I suggest everyone watch this video.

Side note: If you haven't already heard, Google's new policy, that demonetizes videos that are political, even slightly contravercial, or that could be offensive to anyone, is going to make it very hard for channels like Secular Talk to continue to exist without support through websites like Patreons. If you can, I encourage you to support Secular Talk on Patreon.

Note: I don't work for or have any affiliation with Secular Talk. I'm a person who likes the hard work the people with Secular Talk put into reporting on and encouraging discusssions about important topics that are usually under reported on.

Does anyone honestly think Trump used $100 million of missiles to launch an attack in Syria? Irrespective of whether or not the use of chemical weapons was immoral and a violation of international laws, there are serious reasons to question if Trump had the legal authority to order the attack without Congresional approval. This event will have repercussions, and a lot of people I've spoken with are concerned about what will happen next.

This event will certainly have broad market implications. Discuss?

Also, I suggest everyone watch this video.

Side note: If you haven't already heard, Google's new policy, that demonetizes videos that are political, even slightly contravercial, or that could be offensive to anyone, is going to make it very hard for channels like Secular Talk to continue to exist without support through websites like Patreons. If you can, I encourage you to support Secular Talk on Patreon.

Note: I don't work for or have any affiliation with Secular Talk. I'm a person who likes the hard work the people with Secular Talk put into reporting on and encouraging discusssions about important topics that are usually under reported on.

Last edited:

Anyone notice that Elon's shortville tweet from 2013 came about a couple weeks before the epic run up on Q1 earnings? My guess is we are about to see some blow out earnings for Q1 2017.

i believe it's a virtual lock that we see record revenue and net income this quarter. if you were around in 2013, i'm not quite *that* confident, but still very very confident.

Seems like that was what Elon was hinting at with his tweet. He got first estimate of the numbers a few days after delivery numbers were released. At least that seems like a likely interpretation.

SW2Fiddler

We Are Cognitive Dissidents

Yea, that's commandment III.Or joyously partake of a hot dog on Fridays...

Forget not the very appropriate Commandment V: "...Prohibited of Believing what he reads."

- Status

- Not open for further replies.

Similar threads

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 453K

- Views

- 50M

- Locked

- Replies

- 27K

- Views

- 3M

- Replies

- 28

- Views

- 14K