Many bulls and most bears point to Tesla's near-term liquidity need as the number one issue capping the stock price, but I expect Tesla's 3Q18 Free Cash Flow to surprise most market participants, and once and for all, resolve this conundrum in favor of bulls.

Free cash flow (FCF) is a measure of how much cash a business generates after accounting for capital expenditures such as buildings or equipment. This cash can be used for expansion, stock buybacks, dividends, reducing debt, or other purposes. It is calculated with the following formula:

FCF = Operating Cash Flow - Capital Expenditures

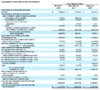

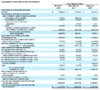

The following is the company's latest cash flow statement, included in the First Quarter 2018 Update Letter:

Please feel free to share your math and reasoning below. Thanks!

Free cash flow (FCF) is a measure of how much cash a business generates after accounting for capital expenditures such as buildings or equipment. This cash can be used for expansion, stock buybacks, dividends, reducing debt, or other purposes. It is calculated with the following formula:

FCF = Operating Cash Flow - Capital Expenditures

The following is the company's latest cash flow statement, included in the First Quarter 2018 Update Letter:

Please feel free to share your math and reasoning below. Thanks!