I think my Strangle Finder identifies Short Strangle candidates, where you sell both options. There is also a Long Strangle, which I think is buying both, but I'm not sure. I haven't gone beyond Covered Calls, Selling Naked Puts, and entering Synthetic Longs.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Advanced TSLA Options Trading

- Thread starter smorgasbord

- Start date

-

- Tags

- TSLA

@smorg

on your naked puts, I think you posted before using these to add stock position (or take the money and run); Based on your experience with these, what relative strike/expiration do you like?

My broker allows TSLA a 50% margin position so I have to cover half the put with cash (not currently an issue after taking call profits)

on your naked puts, I think you posted before using these to add stock position (or take the money and run); Based on your experience with these, what relative strike/expiration do you like?

My broker allows TSLA a 50% margin position so I have to cover half the put with cash (not currently an issue after taking call profits)

Here's a list of current Put Options suitable for writing, all for potentially acquiring TSLA at $80 or less (the "Break-Even $" column is your effective buy price):

- - - Updated - - -

I also note that Syn Longs for TSLA are equalizing around the $82.50 level. That is, selling a $82.50 Put and buying a $82.50 Call costs about nothing (For Sept and Later expirations). So with TSLA still hanging on above $90, you start out $7.50 ahead.

Code:

Symbol Expiration Strike Stock Last Bid Ask Days Break-Even $ B-E % Return% Annualized Return %

TSLA 20130622 - Jun 13 85.00 91.63 5.90 5.90 6.00 35 79.05 13.73% 7.00% 73.00%

TSLA 20130622 - Jun 13 82.50 91.63 4.62 4.80 5.00 35 77.60 15.31% 5.94% 61.94%

TSLA 20130720 - Jul 13 87.50 91.63 9.30 9.10 9.40 63 78.25 14.60% 10.57% 61.25%

TSLA 20130720 - Jul 13 85.00 91.63 8.10 7.90 8.10 63 77.00 15.97% 9.41% 54.53%

TSLA 20130622 - Jun 13 80.00 91.63 3.98 3.90 4.00 35 76.05 1 7.00% 4.94% 51.49%

TSLA 20130720 - Jul 13 82.50 91.63 6.70 6.70 6.90 63 75.70 17.39% 8.24% 47.75%

TSLA 20130921 - Sep 13 85.00 91.63 12.80 12.70 12.90 126 72.20 21.20% 15.06% 43.62%

TSLA 20130622 - Jun 13 77.50 91.63 3.20 3.10 3.30 35 74.30 18.91% 4.13% 43.06%

TSLA 20130720 - Jul 13 80.00 91.63 5.80 5.70 5.90 63 74.20 19.02% 7.25% 42.00%

TSLA 20130921 - Sep 13 82.50 91.63 11.10 11.30 11.60 126 71.05 22.46% 13.88% 40.20%

TSLA 20130921 - Sep 13 80.00 91.63 10.10 10.00 10.30 126 69.85 23.77% 12.69% 36.75%

TSLA 20130720 - Jul 13 77.50 91.63 5.40 4.70 4.90 63 72.70 20.66% 6.19% 35.88%

TSLA 20131221 - Dec 13 85.00 91.63 17.18 17.00 17.30 217 67.85 25.95% 20.18% 33.94%

TSLA 20130921 - Sep 13 77.50 91.63 9.40 8.80 9.10 126 68.55 25.19% 11.55% 33.45%

TSLA 20131221 - Dec 13 82.50 91.63 15.60 15.50 15.90 217 66.80 27.10% 19.03% 32.01%

TSLA 20140118 - Jan 14 85.00 91.63 19.00 17.60 18.00 245 67.20 26.66% 20.94% 31.20%

TSLA 20130720 - Jul 13 75.00 91.63 3.80 3.90 4.10 63 71.00 22.51% 5.33% 30.90%

TSLA 20130921 - Sep 13 75.00 91.63 8.80 7.80 8.00 126 67.10 26.77% 10.53% 30.51%

TSLA 20131221 - Dec 13 80.00 91.63 14.20 14.00 14.40 217 65.80 28.19% 17.75% 29.86%

TSLA 20140118 - Jan 14 82.50 91.63 0.00 16.10 16.40 245 66.25 27.70% 19.70% 29.34%

TSLA 20131221 - Dec 13 77.50 91.63 17.80 12.70 13.10 217 64.60 29.50% 16.65% 28.00%

TSLA 20140118 - Jan 14 80.00 91.63 15.40 14.70 15.00 245 65.15 28.90% 18.56% 27.65%

TSLA 20130921 - Sep 13 72.50 91.63 8.30 6.70 7.00 126 65.65 28.35% 9.45% 27.37%

TSLA 20131221 - Dec 13 75.00 91.63 12.20 11.50 11.70 217 63.40 30.81% 15.47% 26.02%

TSLA 20130720 - Jul 13 72.50 91.63 3.30 3.20 3.30 63 69.25 24.42% 4.48% 25.97%

TSLA 20140118 - Jan 14 77.50 91.63 14.60 13.30 13.60 245 64.05 30.10% 17.35% 25.86%

TSLA 20130921 - Sep 13 70.00 91.63 6.10 5.80 6.00 126 64.10 30.04% 8.43% 24.42%

TSLA 20131221 - Dec 13 72.50 91.63 10.60 10.30 10.50 217 62.10 32.23% 14.34% 24.13%

TSLA 20140118 - Jan 14 75.00 91.63 11.99 12.00 12.30 245 62.85 31.41% 16.20% 24.13%

TSLA 20140118 - Jan 14 72.50 91.63 11.10 10.80 11.00 245 61.60 32.77% 15.03% 22.40%

TSLA 20131221 - Dec 13 70.00 91.63 9.00 9.10 9.40 217 60.75 33.70% 13.21% 22.23%

TSLA 20130921 - Sep 13 67.50 91.63 5.10 4.90 5.20 126 62.45 31.85% 7.48% 21.67%

TSLA 20140118 - Jan 14 70.00 91.63 9.60 9.60 9.90 245 60.25 34.25% 13.93% 20.75%

TSLA 20131221 - Dec 13 67.50 91.63 10.30 8.00 8.30 217 59.35 35.23% 12.07% 20.31%

TSLA 20140118 - Jan 14 67.50 91.63 9.00 8.50 8.80 245 58.85 35.77% 12.81% 19.09%

TSLA 20131221 - Dec 13 65.00 91.63 7.50 7.00 7.30 217 57.85 36.87% 11.00% 18.50%

TSLA 20140118 - Jan 14 65.00 91.63 7.90 7.50 7.70 245 57.40 37.36% 11.69% 17.42%

TSLA 20131221 - Dec 13 62.50 91.63 6.68 6.10 6.40 217 56.25 38.61% 10.00% 16.82%

TSLA 20140118 - Jan 14 62.50 91.63 6.90 6.60 6.80 245 55.80 39.10% 10.72% 15.97%

TSLA 20131221 - Dec 13 60.00 91.63 5.50 5.20 5.50 217 54.65 40.36% 8.92% 15.00%

TSLA 20140118 - Jan 14 60.00 91.63 5.70 5.70 5.90 245 54.20 40.85% 9.67% 14.40%

TSLA 20131221 - Dec 13 57.50 91.63 4.70 4.50 4.70 217 52.90 42.27% 8.00% 13.46%

TSLA 20140118 - Jan 14 57.50 91.63 5.20 4.90 5.10 245 52.50 42.70% 8.70% 12.95%

TSLA 20131221 - Dec 13 55.00 91.63 3.90 3.80 4.00 217 51.10 44.23% 7.09% 11.93%

TSLA 20140118 - Jan 14 55.00 91.63 4.40 4.20 4.40 245 50.70 44.67% 7.82% 11.65%- - - Updated - - -

I also note that Syn Longs for TSLA are equalizing around the $82.50 level. That is, selling a $82.50 Put and buying a $82.50 Call costs about nothing (For Sept and Later expirations). So with TSLA still hanging on above $90, you start out $7.50 ahead.

Last edited:

johnnydop

Member

I think my Strangle Finder identifies Short Strangle candidates, where you sell both options. There is also a Long Strangle, which I think is buying both, but I'm not sure. I haven't gone beyond Covered Calls, Selling Naked Puts, and entering Synthetic Longs.

Going long straddles and strangles are for when you think the underlyer will have a large move up or down. Shorting them means the opposite, you expect the underlyer to remain at current levels.

Here's a list of current Put Options suitable for writing, all for potentially acquiring TSLA at $80 or less (the "Break-Even $) column is your effective buy price):

...

I also note that Syn Longs for TSLA are equalizing around the $82.50 level. That is, selling a $82.50 Put and buying a $82.50 Call costs about nothing (For Sept and Later expirations). So with TSLA still hanging on above $90, you start out $7.50 ahead.

great - thanks much; I'll study these over the weekend- plan to Put something on monday or tuesday- Need more long position, but Calls at these levels are major premium

Causalien

Prime 8 ball Oracle

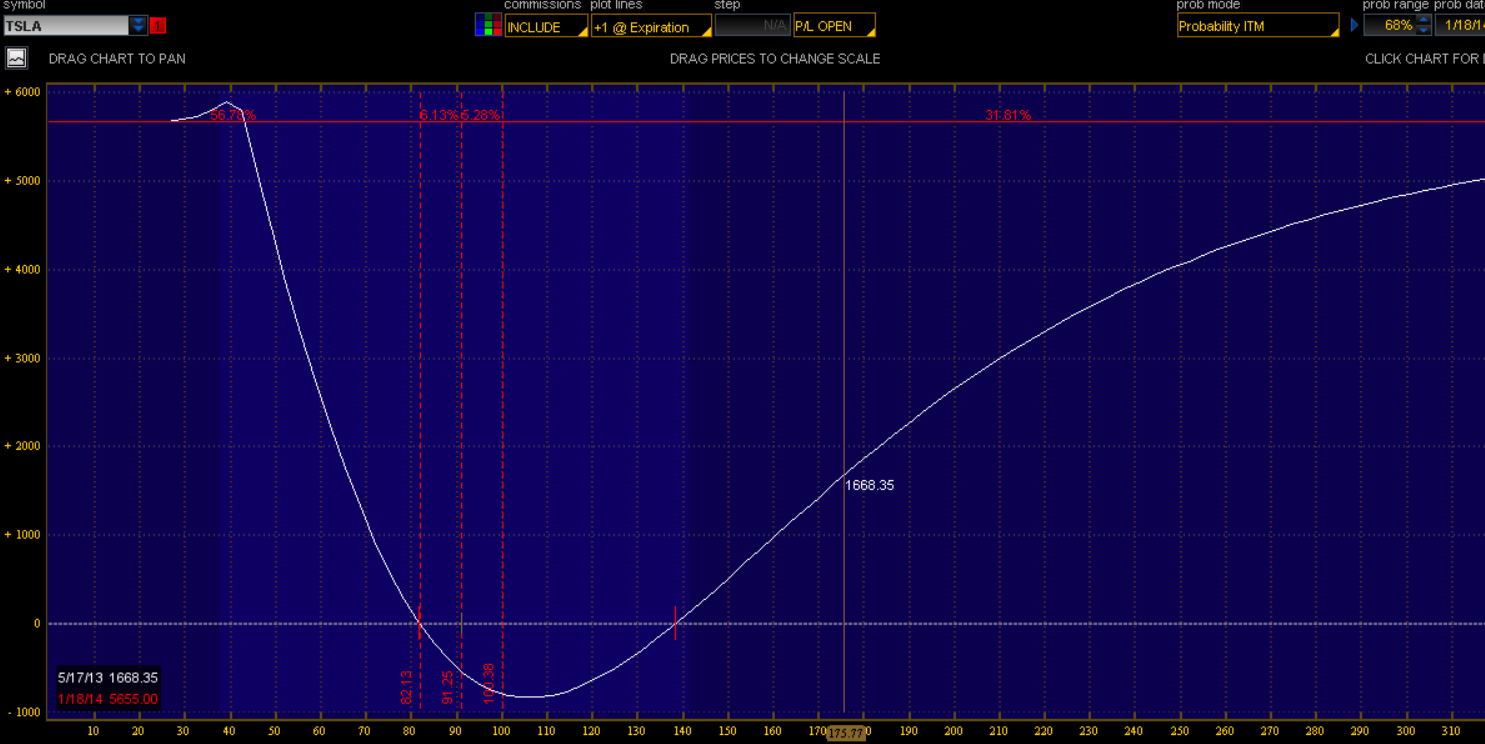

To get an idea of how messed up TSLA is right now. Look at this play. It's like a license to print money

I've been trying to find out the reason for the big short and three stooges theory and I think this is the underlying reason behind everything.

Then again, I am not 100% sure. This is too good to be true so I am asking you guys.

I've been trying to find out the reason for the big short and three stooges theory and I think this is the underlying reason behind everything.

Then again, I am not 100% sure. This is too good to be true so I am asking you guys.

mershaw2001

I'm short the short sellers

I feel kinda silly asking, but what play are you talking about and what is the point that we should be getting? I can't make out the detail in the graph.

To get an idea of how messed up TSLA is right now. Look at this play. It's like a license to print money

View attachment 22114

I've been trying to find out the reason for the big short and three stooges theory and I think this is the underlying reason behind everything.

Then again, I am not 100% sure. This is too good to be true so I am asking you guys.

Causalien

Prime 8 ball Oracle

This is the risk graph of a combination of trades. The red line indicate what the profits will be at expiration. The white line indicate the current profit and loss. X axis is the stock price. Y axis is the profit/loss. As you can see, there is some problems in the short term if the price stays the same, but you see that straight red line that is around $6000? It means that no matter what the stock price is going to be at, I will make $6000 of profit. This is the first time where I see a risk curve without any situations where you will lose money. So, I am not that smart which means someone else must've figured it out. A way to have guaranteed profit. The only limitation being, how much capital you have to deploy this strategy. Which explains why someone would short a deep ITM option with abandon and short the stock at whatever chance they have. I estimate at least guaranteed 24% profit.... until recently when Elon whipped out the Tsunami of hurt of course. I am hoping to find someone who sees the same thing. Cause it is pretty big if my deduction is correct.

Last edited:

Here's a list of current Put Options suitable for writing...

Just an added note to assist in choosing which Put to write.

If you're scared of paying too much for TSLA stock, then the last option is the one to choose. If Tesla doesn't drop below $55 by Jan 2014 you keep the $4.30, which is equivalent to an 11.65% annual rate of return on your money "at risk." That's calculated, I think by taking the price you get divided by the strike price and then dividing by the number of months till expiration, or: $4.30 / $55 * 12monthsPerYear/8monthsTillExpiration(approx). If Tesla does drop below $55 near expiration, you buy the stock for an effective $50.70 ($55 minus the $4.30 you were paid to sell the Put). This may be viewed by some as pretty safe for either outcome.

If you're aggressive, the first few trades might suit you. The Jun $85 Puts pay you about $6 each, but since they expire in a month that's an effective 73% annualized return. "Worst" case is that you buy stock at an effective $79.05.

BTW, the Puts I listed in all meet The Motley Fool's Put Writing Criteria, which is a good read and includes a table at the bottom if you want to do your own calculations.

Norbert

TSLA will win

It means that no matter what the stock price is going to be at, I will make $6000 of profit.

I don't know how special this is. For example via loaning stocks to shorts, you also have a guaranteed profit (assuming the loan fee remains larger than zero, and that someone will continue to borrow your stock). (And except you can lose money on the stock itself.)

Perhaps that trade is an indirect way to loan something, depending on "how much capital" it does require.

Norbert

TSLA will win

And it requires that someone would participate in those trades. For example, you could get that graph by selling calls with a strike price of $400 for Jan 2014. But nobody would buy them (I guess).

Causalien

Prime 8 ball Oracle

It is actually a feedback loop that feeds itself. I mean I don't see why I shouldn't do this trade with all my capital right now. Guaranteed return of 24% on paper. Better than loaning out the shares because it has no capital exposure (on paper). I am trying to figure out how to unwind this and how the conditions that made this possible first occurred by looking back in time. it has proven to be a bad trade, as is evident by the more than 100% rise in tsla over the year, but still amazing to analyze.And it requires that someone would participate in those trades. For example, you could get that graph by selling calls with a strike price of $400 for Jan 2014. But nobody would buy them (I guess).

A

anon

Guest

It is actually a feedback loop that feeds itself. I mean I don't see why I shouldn't do this trade with all my capital right now. Guaranteed return of 24% on paper.

Does this involve selling any near the money options that would result in a loss if assigned soon (i.e. while still nearer to the white line than to the red one)?

The white line indicate the current profit and loss. As you can see, there is some problems in the short term if the price stays the same...

This is similar to a Long Strangle:

Nothing special about it, except for some reason your upside is capped in both directions, whereas the Strangle has theoretically unlimited upside.

.. but you see that straight red line that is around $6000? It means that no matter what the stock price is going to be at, I will make $6000 of profit.

I thought you said the white line represents your profit at different TSLA prices. Isn't the red line is the maximum profit you can make. Of course, you haven't yet shared what combination of plays gets you this behavior, so we can't double-check your math.

Causalien

Prime 8 ball Oracle

I am still verifying the thing so I don't appear stupid if it turns out to be wrong. Anyway, prices are frozen during the weekend so we have time. So I gather from the questions that none of you use the same program I use to analyze risk? The white line is the current profit and loss line at the current date. i.e what would today's profit be like at any given price of stock. The red line is the profit and loss at expiration at any stock price. For this scenario it represent the maximum profit, which is ~$6000 at any price. (In other strategies, the white line sometimes gives you more profit due to volatility). There are no negative consequence like a simple straddle or strangle. For a comparison, if you use a strange or straddle, the red line will have that V shape as well as the white. In this scenario, the red line is flat. And no it is not a straddle based or strangle based scheme. Everything was done using the prices on Friday.This is similar to a Long Strangle: View attachment 22169 Nothing special about it, except for some reason your upside is capped in both directions, whereas the Strangle has theoretically unlimited upside. I thought you said the white line represents your profit at different TSLA prices. Isn't the red line is the maximum profit you can make. Of course, you haven't yet shared what combination of plays gets you this behavior, so we can't double-check your math.

A

anon

Guest

I am still verifying the thing so I don't appear stupid if it turns out to be wrong. Anyway, prices are frozen during the weekend so we have time. So I gather from the questions that none of you use the same program I use to analyze risk? The white line is the current profit and loss line at the current date. i.e what would today's profit be like at any given price of stock. The red line is the profit and loss at expiration at any stock price. For this scenario it represent the maximum profit, which is ~$6000 at any price. (In other strategies, the white line sometimes gives you more profit due to volatility). There are no negative consequence like a simple straddle or strangle. For a comparison, if you use a strange or straddle, the red line will have that V shape as well as the white. In this scenario, the red line is flat. And no it is not a straddle based or strangle based scheme. Everything was done using the prices on Friday.

I use the same program, although I admittedly only recently started using it and so I may not have completely understood it yet. As far as I can tell, the red line assumes that none of the options were assigned before that date. How would your scenario be affected if sold options were assigned?

Causalien

Prime 8 ball Oracle

I've run through all the scenarios now and will move to execute this trade on Monday after speaking with my broker and I have analyzed the options chain data all the way back to the IPO of TSLA. It seems that it has been in play from day 1 but has only increased in profitability. There are still a few questions that needs to be clarified with the broker and their answer is the make or break part of this operation. I suspect again that this trade is impossible for retail investors to do. PS. Why is my formatting stripped out from my post all the time. All the spaces and line changes dissappeared.I use the same program, although I admittedly only recently started using it and so I may not have completely understood it yet. As far as I can tell, the red line assumes that none of the options were assigned before that date. How would your scenario be affected if sold options were assigned?

mershaw2001

I'm short the short sellers

Thanks for the explanation of the graph. I don't use the same software. So if those retailers among us cannot do it, would you still share what 'it' is just so we can get our kicks living vicariously? (or get our envy?) You might even get criticism as to why it might not be possible from the more advanced members here.

I've run through all the scenarios now and will move to execute this trade on Monday after speaking with my broker and I have analyzed the options chain data all the way back to the IPO of TSLA. It seems that it has been in play from day 1 but has only increased in profitability. There are still a few questions that needs to be clarified with the broker and their answer is the make or break part of this operation. I suspect again that this trade is impossible for retail investors to do. PS. Why is my formatting stripped out from my post all the time. All the spaces and line changes dissappeared.

Causalien

Prime 8 ball Oracle

Thanks for the explanation of the graph. I don't use the same software. So if those retailers among us cannot do it, would you still share what 'it' is just so we can get our kicks living vicariously? (or get our envy?) You might even get criticism as to why it might not be possible from the more advanced members here.

Yes I will. It is going to be a long post and it is hard to find time to type out detailed explanation as I have a business that's in the crucial initial phase to run.

Causalien

Prime 8 ball Oracle

The great short:

So, most of you have seen my graph by now and I have checked with the broker. Again, my suspicion was correct. Us retails can't do anything about it.

The underlying condition is a switch up from Smorgasbord's synthetic long, but with a twist. You short the same amount of stock, which result in a type of calendar play. The actual construction is as follows: assuming April 1st where the stock trades around $43. This is how I would construct it:

Naked Short 1000 stock

Buy 10 Jan 14 call option at strike of $45 for $4.5

Sell 10 Jan 14 put option at strike of $45 for $9.8

Which was impossible due to the fact that there's no TSLA stock to borrow. So we go on to the next best thing at about $500 hit to the profit

Sell 10 Apr 13 call option at strike of $25 for $19.9 (luvb2b's ear should perk up at this, remember 3 stooges?)

Buy 10 Jan 14 call option at strike of $45 for $4.5

Sell 10 Jan 14 put option at strike of $45 for $9.8

Since shorting ditm calls is effectively the same as naked shorting the stock. This will work. For every $50,000 you have, you gain $6000. Ah but the stuff doesn't end here. With $50,000 you usually get $100,000 of option purchasing power, which means that the actual amount of capital you get to deploy is $100,000 that nets you $12,000. Which kind of explain why the squeeze didn't happen until the stock jumped up by 40%. (normally it should start at a 20% jump) If you can get a loan from a bank, it is even more.

The trick is, at option expiration, if there are no shares to borrow, you will be forced by the broker to by in (for us retail investors). I am not familiar with how institution works, but I am pretty sure with enough money, I get first dib at TSLA shares to borrow. Which leads to the next phenomena in a perfectly balanced and arbitraged market. Cost to borrow shares. The cost to borrow shares, should roughly equals to the long term benefit of this play, except this structure has no capital risk as long as you are able to borrow shares to short. So where is the profit then?

By looking at the white shape, you probably realized by now that in the long term, the cost to borrow will probably kill your profit if you let it expire, but if the price moves up or down either way, you will be able to exit early.

The reason why this is possible with TSLA is because of big put call premium skew that we've all observed since the beginning and the small shares float. The premium, I suspect, is due to the fact that people think there is a bigger possibility of a TSLA failure than they do of a success. However, since then, it has turned into a feed back loop. High put premium means more people doing this structure and hence more shorting, which leads to even higher put premium (people buying put to short or actually naked shorting stock).

If you were to bring this to any other stock, you have to structure the play in reverse to get the same effect, but will result in only 1 or 2% premium which really doesn't beat any CD at the bank.

So that concludes my analysis and I feel a bit silly since it all comes back to: Can you find any shares to borrow? And as some of the short have found out recently, a calendar play has timing risk, since your short term short might cause a margin call.

So, most of you have seen my graph by now and I have checked with the broker. Again, my suspicion was correct. Us retails can't do anything about it.

The underlying condition is a switch up from Smorgasbord's synthetic long, but with a twist. You short the same amount of stock, which result in a type of calendar play. The actual construction is as follows: assuming April 1st where the stock trades around $43. This is how I would construct it:

Naked Short 1000 stock

Buy 10 Jan 14 call option at strike of $45 for $4.5

Sell 10 Jan 14 put option at strike of $45 for $9.8

Which was impossible due to the fact that there's no TSLA stock to borrow. So we go on to the next best thing at about $500 hit to the profit

Sell 10 Apr 13 call option at strike of $25 for $19.9 (luvb2b's ear should perk up at this, remember 3 stooges?)

Buy 10 Jan 14 call option at strike of $45 for $4.5

Sell 10 Jan 14 put option at strike of $45 for $9.8

Since shorting ditm calls is effectively the same as naked shorting the stock. This will work. For every $50,000 you have, you gain $6000. Ah but the stuff doesn't end here. With $50,000 you usually get $100,000 of option purchasing power, which means that the actual amount of capital you get to deploy is $100,000 that nets you $12,000. Which kind of explain why the squeeze didn't happen until the stock jumped up by 40%. (normally it should start at a 20% jump) If you can get a loan from a bank, it is even more.

The trick is, at option expiration, if there are no shares to borrow, you will be forced by the broker to by in (for us retail investors). I am not familiar with how institution works, but I am pretty sure with enough money, I get first dib at TSLA shares to borrow. Which leads to the next phenomena in a perfectly balanced and arbitraged market. Cost to borrow shares. The cost to borrow shares, should roughly equals to the long term benefit of this play, except this structure has no capital risk as long as you are able to borrow shares to short. So where is the profit then?

By looking at the white shape, you probably realized by now that in the long term, the cost to borrow will probably kill your profit if you let it expire, but if the price moves up or down either way, you will be able to exit early.

The reason why this is possible with TSLA is because of big put call premium skew that we've all observed since the beginning and the small shares float. The premium, I suspect, is due to the fact that people think there is a bigger possibility of a TSLA failure than they do of a success. However, since then, it has turned into a feed back loop. High put premium means more people doing this structure and hence more shorting, which leads to even higher put premium (people buying put to short or actually naked shorting stock).

If you were to bring this to any other stock, you have to structure the play in reverse to get the same effect, but will result in only 1 or 2% premium which really doesn't beat any CD at the bank.

So that concludes my analysis and I feel a bit silly since it all comes back to: Can you find any shares to borrow? And as some of the short have found out recently, a calendar play has timing risk, since your short term short might cause a margin call.

Similar threads

- Replies

- 28

- Views

- 1K

- Locked

- Replies

- 0

- Views

- 3K

- Poll

- Replies

- 16

- Views

- 1K

- Replies

- 2

- Views

- 693