Odd for a cash flow article to appear here. Rivian can certainly go broke, but peak cash flow out occurs as production ramps. Also, the premise of the title of the article is ridiculous. This is basic stuff.

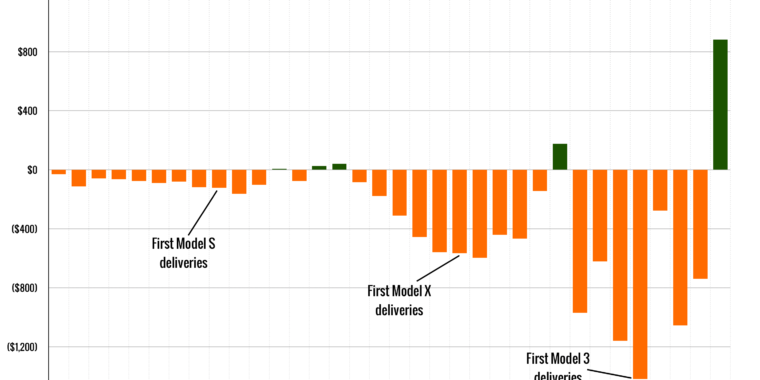

Critics said Tesla was "on the verge of bankruptcy." They were totally wrong.

arstechnica.com

(Not aimed at you

@zecar - just using your post as a staring point).

This was one of a host of articles, back in the day, that was intentionally or unintentionally demonstrating a basic misunderstanding of accounting. There's a reason for the 3 basic financial reports, and I commend basic (2-4 hours?) accounting education to all that invest seriously. Its readily available in an online format.

We heard this for years - "Tesla is losing money on every car they build - the more they build, the faster they go bankrupt".

Its been so nice not hearing this bullseye.

I'm not an accountant, so this is a higher level view (directionally accurate - good to assume I've got some details wrong).

There are (simplistically) two kinds of profitability that we need to be concerned about (and these days, Rivian investors need to be particularly concerned about).

Cash flow that we care about here is just cash coming and going in regards to each vehicle produced. Its actually the accounting treatment of the cash, rather than actual cash flow - when sales are made and when cash changes hands is the cash flow is an important nuance that I'm ignoring. The sorts of things we're looking at here is the direct labor that goes into building the truck and the parts / raw materials that go into the truck. Whether depreciation of the factory goes into this or not - I tend to exclude it from this most basic measure as the question we're answering is "does Rivian pay out more money to suppliers than it gets in from customers" for each truck. Higher direct payments for each truck, than is received for the sale, really does mean that the more trucks built, the faster the company is running out of cash (and will reach bankruptcy left to go on long enough).

Profitability is a different measure. Add on an amortized form of capital expenditures, mostly meaning the factory that builds the vehicles, but also research and some of these other longer term investments. In accounting the idea is to match up the business value of those investments with the period in which they are used (depreciation). Whether research or building factories, these represent investments in the future ability of the company to do what it does.

The difficulty, or opportunity if you're in the FUD business, is you add in these investments in capacity building on a per vehicle basis, and can quickly conclude that the business is spending more on each vehicle than it receives in payment. Well duh - the company is still building that capacity / infrastructure and until its much more fully utilized then this will be happening.

The 'rules' for exactly how this gets calculated is where GAAP (Generally Accepted Accounting Principles) comes from. And as the accountants will tell you there is still plenty of wiggle room in here for how to represent the business financials.

Actually there's a 3rd big bucket separate from these two that also matter to a company's profitability - the SG&A line (sales, general, adminstrative). These are the front office employees - HR, accounting, advertising, sales, IT. Its the overhead / everything else to running the company, as long as we define the company as the research / designers on the front end, and the manufacturing on the back end. This is also easy to divide by the number of vehicles built to help make each vehicle built look like a big loser.

As I remember things, Tesla was never cash flow negative at the vehicle level. Tesla has always received more for each vehicle than the parts / raw materials / labor that went into building it. Tesla has also always been doing technology research, and building capacity, at a really fast pace. So fast that for most of its existence that incremental build generated accounting losses once those investments were matched up with accounting periods.

The fact that Tesla is still investing and researching so aggressively, and is still generating both cash and profit is remarkable.

I don't follow Rivian closely enough to have an opinion or thought about where Rivian actually is in this picture. I assume that each vehicle produced costs less in labor and materials than is received from the customer. The problem (as I expect, and is typical for new businesses in capital intense industries) is that there isn't enough extra to pay for ongoing research, capacity building / investment, and company overhead.

The question (again no opinion) is whether each vehicle is contributing enough to not only pay for the vehicle, but also pay for the infrastructure / research, and the business overhead. The good thing about being in a capital intensive business - its is -VERY- dependent on volume. As I like to think of it - the FIRST unit is --really-- expensive to build. But the 2nd and later units are cheap. As long as you have enough of the 2nd and later units to pay for the first unit, these business are money printers.

Tesla has reached the money printing stage.

As an aside, this is why the semiconductor manufacturing business is so wickedly difficult, and so attractive. If you can clear the units needed to pay for the R&D and ongoing capital investment, then the incremental units are ridiculously cheap to manufacture and the company can be ridiculously profitable. I know Intel best - that is one example.

But its also why there is almost nobody left manufacturing the leading edge technology in the business. The moment your units drop below that threshold, the amazing profitability turns into an amazingly huge money pit. Big enough that nobody has climbed that mountain and become a new entrant in the business in forever. The research to be building the leading edge technology is mind boggling.