Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Am I getting hosed on my insurance(Allstate)?

- Thread starter Strmtrper6

- Start date

Been with ACSC (AAA) all of my driving career and have been happy until I insured my M3 yesterday $3600 per year. Clean record, mult vehicle discount etc... Time to research......

You're in CA? AAA and State Farm have consistently had extremely high quotes reported. A couple others too (All State?). Like others, in CA, the rates on the Model 3 vary extremely wildly. I mean the spread is absurd. FWIW, I have insurance through Costco (Ameriprise) and I'm paying a little over $600/year for the Model 3. I have another car whose MSRP was within $500 and bought just a little over a month later and is only $3 cheaper every 6 months.

DB-Cooper

Member

Even if you got a decent price from Allstate, I don't know a single person that has been happy with their claims process. Some of my friends had a single claim and Allstate dropped them. People rave about USAA, so you if you have father, mother or you yourself are a veteran you might try them.

I had one hit and run claim on my wife's Volvo. Was able to file the claim online, upload pictures through the app, get rental car arranged and it was all seamless and I was able to use the shop of my choice. No adjuster needed, all done through the app. They haven't dropped me yet. My agent is real good and hyper-responsive although he's not directly involved in the majority of the claims process, I do trust he'd go to bat for me if under a bad situation.

HabibiHany

New Member

Man.. i am in north carolina and im trying to get insurance for my M3 and i cant find anything under 2k a year. im 32, no accidents or tickets in over 8 years credit in the low 700s. this is crazy! progressive was the cheapest so far but i've looked EVERYwhere. anyone have any other suggestions? Im thinking of asking my parents to see if i can join their plan again like back in the day!

woodisgood

Optimustic Pessimist

It was time for our Progressive renewal and the rate literally doubled. I think insurance companies are having to total these cars for relatively minor collisions...

caskater47

Member

Kichwas

Member

I gather Tesla’s are very safe but also very pricey to fix...

So some companies are pricing up or backing out.

I removed my 2011 VW diesel jetta and added my 2018 M3 at the same time with progressive and added in a perk for payoff car if totaling isn’t enough to pay it out... and in that change my insurance only went up by $100 over 6 months for a new higher end car with an added benefit...

If you’re getting a bad deal, shop around. But also read up on how well they pay out. Remember that some companies will suddenly vanish or get hostile when it comes time to file a claim...

So some companies are pricing up or backing out.

I removed my 2011 VW diesel jetta and added my 2018 M3 at the same time with progressive and added in a perk for payoff car if totaling isn’t enough to pay it out... and in that change my insurance only went up by $100 over 6 months for a new higher end car with an added benefit...

If you’re getting a bad deal, shop around. But also read up on how well they pay out. Remember that some companies will suddenly vanish or get hostile when it comes time to file a claim...

SSonnentag

埃隆•馬斯克

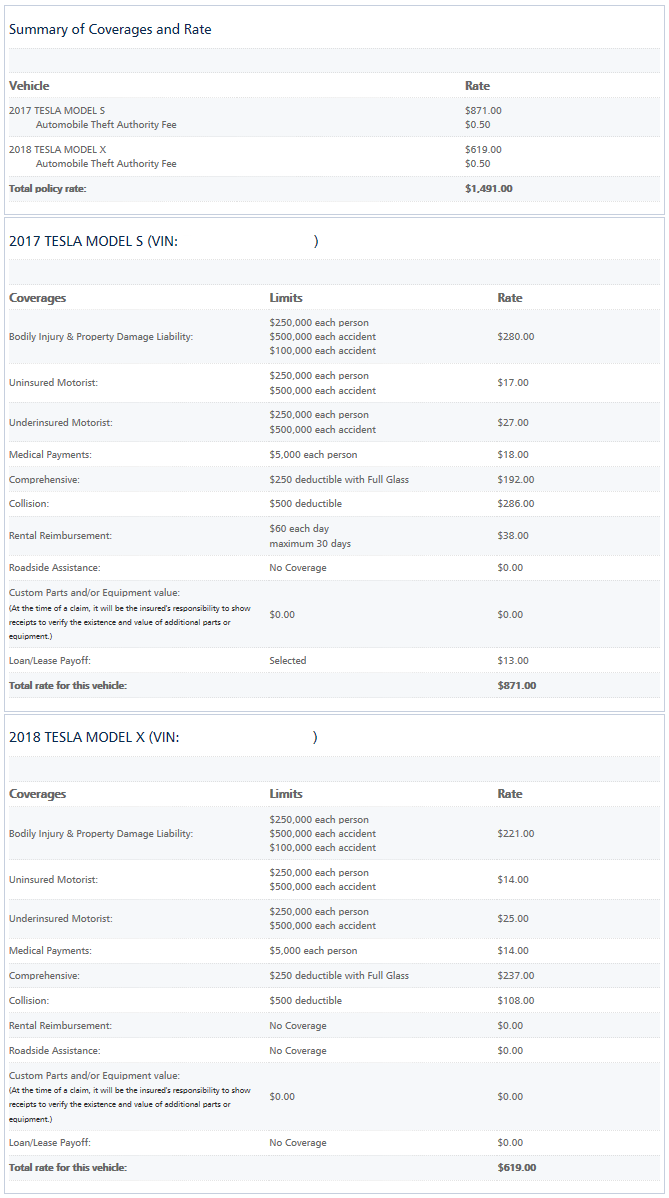

Progressive rate for 6 months for Model S and X. My wife and I, over 40, credit score around 800, no tickets., one at fault accident in the past year, which raised the rate by about 40% for the next 35 months.  Hey, at least it wasn't me that had the accident.

Hey, at least it wasn't me that had the accident.

The rate for the S is higher than the X because the S is my daily commuter (~35,000 miles/year) and the X is for pleasure only (~10,000 miles/year).

The rate for the S is higher than the X because the S is my daily commuter (~35,000 miles/year) and the X is for pleasure only (~10,000 miles/year).

jumper4000

Member

I just signed up with this new insurance, called ClearCover. Before, with Geico, I was paying $204/mo just for myself and one Mercedes. Now, I'm paying $207/mo for the Mercedes, the Tesla, and a Toyota. AND, now my wife and my mom are on the insurance too. AND, now I have a little better coverage than w Geico - 300k/500k coverage,100 comprehensive, 500 collisions, 50/day rental. It's the bargain of the century. I'm not sure how good ClearCover is yet, but it's getting rave reviews. Oh, and I live in LA.

Just got my Model 3, have been with Allstate for years and have everything with them. 43 with a clean driving record, live 30 minutes from NYC, 520 for six months with Allstate (that does include multi car discount and discounts for bundling everything). I fully expected to be switching insurance based on this thread and others, but was pleasantly surprised. Perhaps things are getting better with more Model 3’s in the road.

TankoftheNorth

Member

I've had Allstate for about a year and a half. I bought my AWD Model 3 the first week of September and expected I might have to switch. But like you, they offered me a good rate so I stayed with them. I haven't had to make any claims yet, which is when you find out if your insurance company is worth what you pay or not, but I've been happy with them so far.

Similar threads

- Replies

- 360

- Views

- 19K

- Replies

- 8

- Views

- 769

- Replies

- 1

- Views

- 755

- Replies

- 4

- Views

- 857