Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tam

Well-Known Member

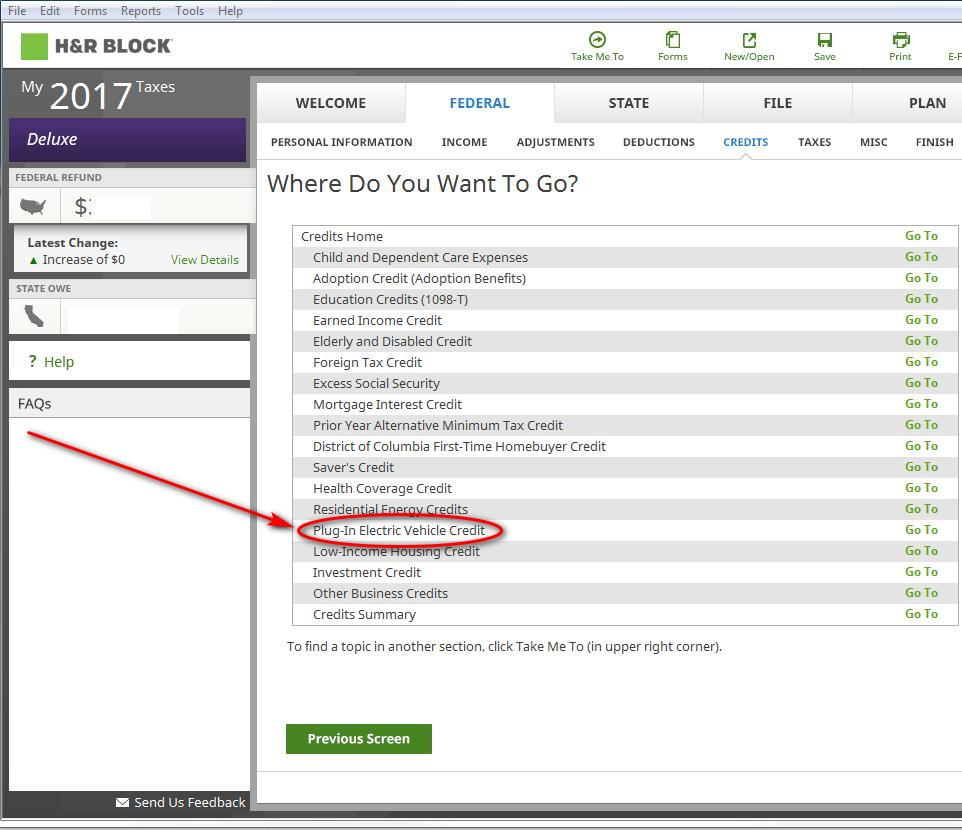

I don't know about Turbotax but for H&R, it has been there since I bought the tax software in 12/2017!

ItsNotAboutTheMoney

Well-Known Member

There always seems to be a delay on that form. I seem to remember that it took until mid February when I claimed it in 2014 (for 2013) for our Volt.

Maybe this time they're going to update ready for the 200,000 next year.

Maybe this time they're going to update ready for the 200,000 next year.

Tam

Well-Known Member

Last time I checked (a couple of weeks ago) taxact was not ready yet.

I don't see why putting up with cheaper incomplete tax software when you can get form 8936 with H&R Block Deluxe & State by paying up a little bit more for a price of $25.99.

You can do simple H&R Block for free online but if you want to use form 8936 online, it would cost you $34.99 for the Deluxe & State version.

ItsNotAboutTheMoney

Well-Known Member

H&R Block stuff...

Jeez, he was just noting that it didn't have the form available yet.

As I noted, there's often a delay on that form.

I use Free File Fillable Forms (simple tax affairs).

List of Available Free File Fillable Forms | Internal Revenue Service

That says it will be available on 3/1/2018 and

The Man said:Forms Available for Filing Season 2018 (TY 2017)

Form Number Form Name Available

...

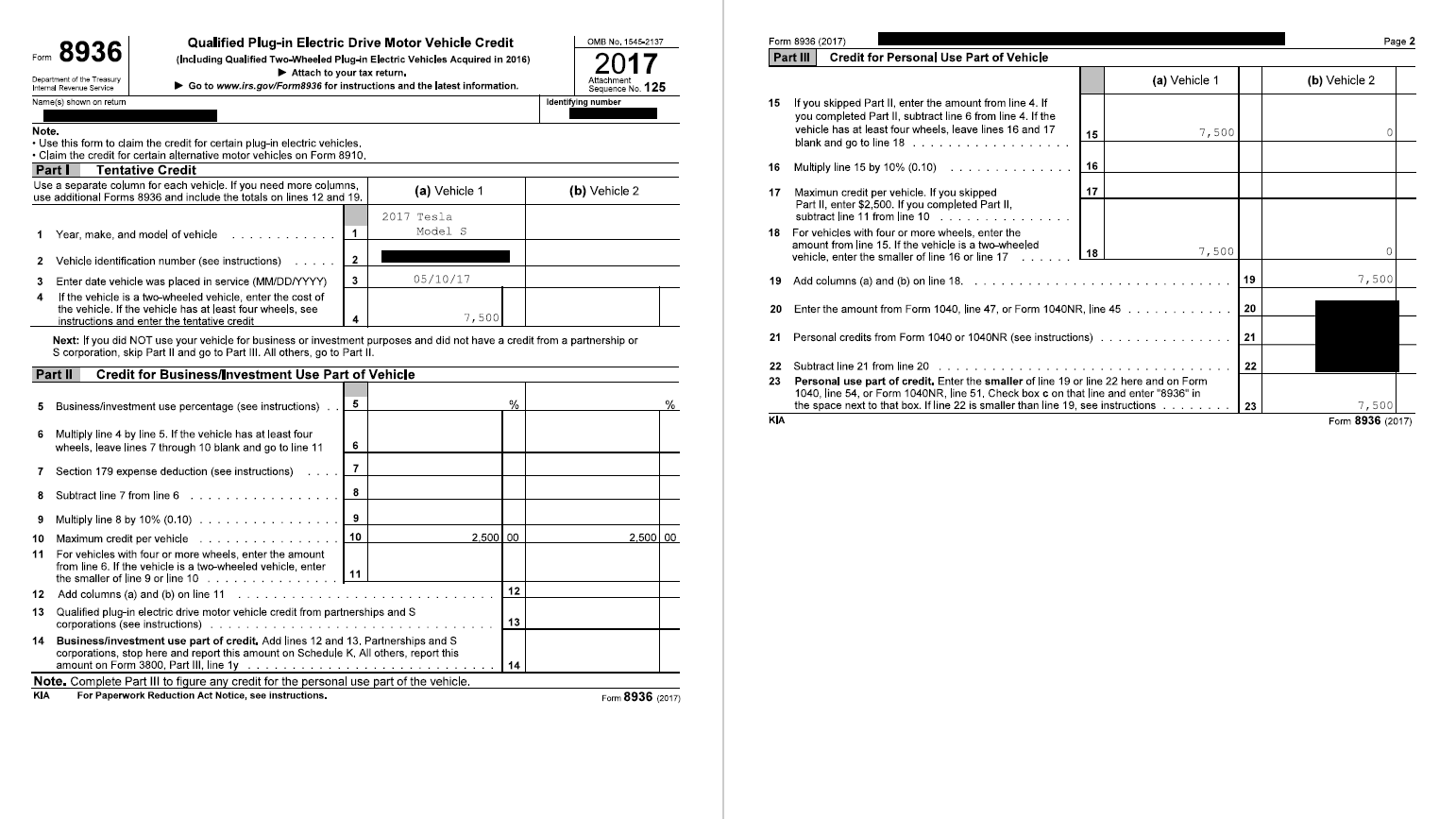

Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit - Known Limitations 3/1/2018

A limitation for Free File Fillable Forms will be that it will only allow 1 vehicle:

The Man said:Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit:

This form will only support one qualifying vehicle. If you are trying to claim more than one qualifying vehicle, you will not be able to use this form and e-file your return.

The 2016 and earlier form had Vehicle 1 and Vehicle 2. Maybe they've decided to make it one vehicle per form.

MurrayJimW

Member

According to Electrek, charging station installs have been retroactively made deductible for 2017 as well. I use TurboTax and this is not even addressed in the software yet (much less having the form available). If you installed a charging station in 2017, you may want to wait even a bit longer after form 8936 becomes available to see what must be done to receive this deduction as well.

Tam

Well-Known Member

...available on 3/1/2018...

Thanks for the news of the delay but I don't see why people delay if they can use it now as it has been available since I bought the software 3 months ago:

Mediocrates

Member

Thanks for the news of the delay but I don't see why people delay if they can use it now as it has been available since I bought the software 3 months ago:

You are confused as to which organization takes precedence in the chain of tax filing. It doesn't matter what the software says, the 2017 form has not been released by the IRS. You would not be able to file taxes with the H&R block software and take the relevant electric vehicle credit.

You can see this by examining the form and instructions here, which are still for 2016:

About Form 8936 | Internal Revenue Service

You can also review the IRS content provided by @ItsNotAboutTheMoney.

PhaseWhite

Member

It's odd, since there has been no changes to the EV Credit law that we would need a new form to be created every year and that there would be complexities that would cause a delay but what do I know.

Super_Popular

Well-Known Member

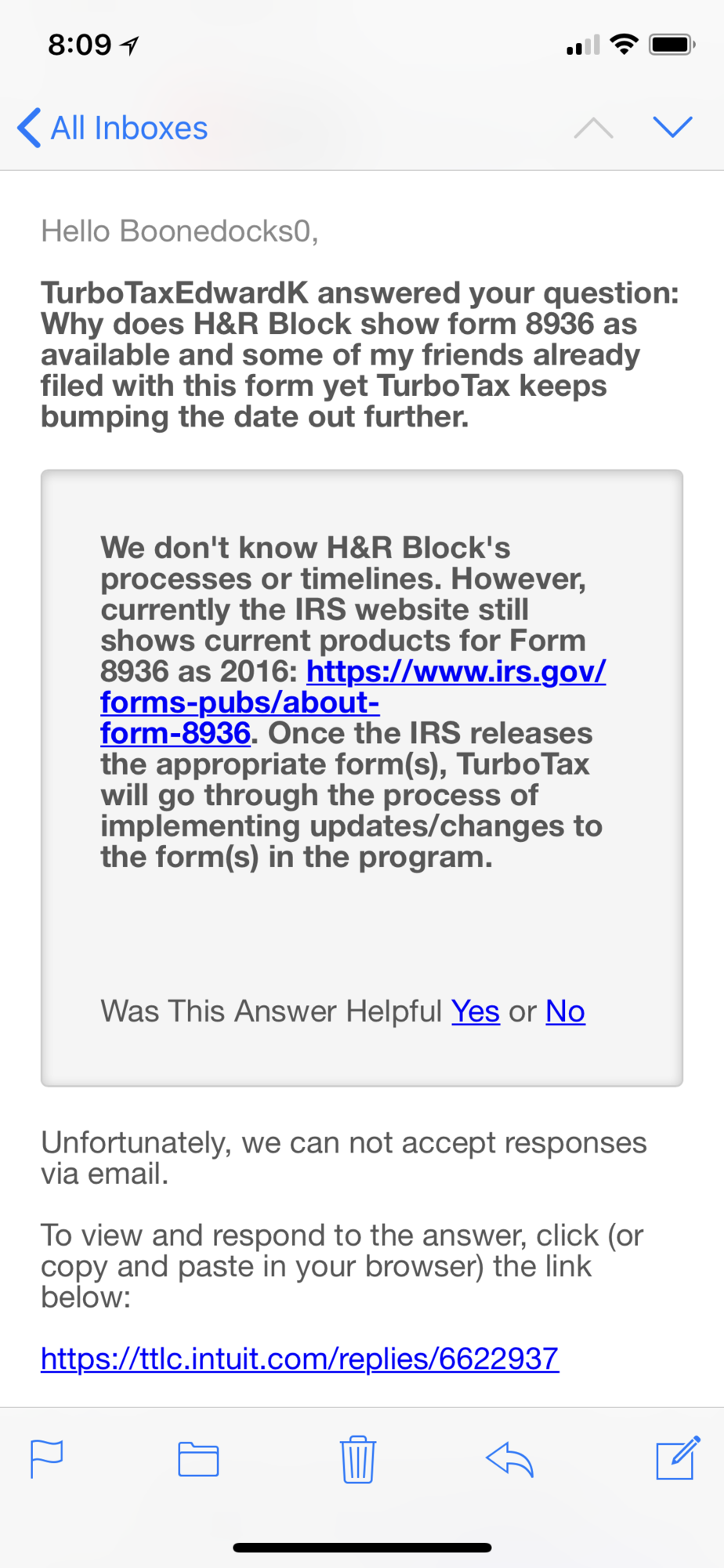

I do my taxes on Turbo Tax, I was told the 1st now it's the 23rd. Same thing happened last year.

dbldwn02

Active Member

I used H&R block software and filed already. Still processing for the last week and a half though. No updates.

H&R block software did not file my Colorado state rebate correctly. I got a notification from the DOR within 4 days saying I needed to fill out an additional form for the EV credit and send it in. I might take up H&R on their 100% satisfaction guarantee and get my $70 back. I'm only 99.9% satisfied. Lol.

H&R block software did not file my Colorado state rebate correctly. I got a notification from the DOR within 4 days saying I needed to fill out an additional form for the EV credit and send it in. I might take up H&R on their 100% satisfaction guarantee and get my $70 back. I'm only 99.9% satisfied. Lol.

boonedocks

MS LR Blk/Blk 19”

I used H&R block software and filed already. Still processing for the last week and a half though. No updates.

H&R block software did not file my Colorado state rebate correctly. I got a notification from the DOR within 4 days saying I needed to fill out an additional form for the EV credit and send it in. I might take up H&R on their 100% satisfaction guarantee and get my $70 back. I'm only 99.9% satisfied. Lol.

It will be interesting if the folks filing with H&R Block get their taxes bounced back or not. 2017 Form 8936 is NOT available yet and wont be for a couple of weeks according to the IRS.gov web site:

Form 8936

Qualified Plug-in Electric Drive Motor Vehicle Credit - Known Limitations

3/1/2018

Keep us up to date as to whether you get IRS confirmation or bounce back please. I have been a LONG time TurboTax user but if I could get a months jump on my refunds I would certainly consider changing next year.

ℬête Noire

Active Member

It will be interesting if the folks filing with H&R Block get their taxes bounced back or not. 2017 Form 8936 is NOT available yet and wont be for a couple of weeks according to the IRS.gov web site:

Form 8936

Qualified Plug-in Electric Drive Motor Vehicle Credit - Known Limitations

3/1/2018

Keep us up to date as to whether you get IRS confirmation or bounce back please. I have been a LONG time TurboTax user but if I could get a months jump on my refunds I would certainly consider changing next year.

Hmm, interesting. My accounting expected to have us sign and file early next week. I have about the same amount again as the rebate coming back, so I might get them to submit anyway and then file an amendment later when the 2017 ver. of the 8936 is released.

marine_cwo

Member

Keep us up to date as to whether you get IRS confirmation or bounce back please. I have been a LONG time TurboTax user but if I could get a months jump on my refunds I would certainly consider changing next year.[/QUOTE]

I filed my taxes through H&R Block a week ago and I received confirmation from IRS that my paperwork has been accepted. After seeing this thread I reached out to H&R Block and asked about the forms loaded within their software. It was explained to me that if the form was not valid it would not be loaded into the software. I was given examples of other forms that are not accessible and I was reassured that my paperwork would not get rejected because the EV Tax Credit form.

I will provide update if tax return gets rejected.

I filed my taxes through H&R Block a week ago and I received confirmation from IRS that my paperwork has been accepted. After seeing this thread I reached out to H&R Block and asked about the forms loaded within their software. It was explained to me that if the form was not valid it would not be loaded into the software. I was given examples of other forms that are not accessible and I was reassured that my paperwork would not get rejected because the EV Tax Credit form.

I will provide update if tax return gets rejected.

DarkMatter

Active Member

I took the rebate using Tax Slayer to do the prep. No issues from the IRS and the money has already hit my account. I might have to file an amended return because they sneak extended the energy efficiency home improvement credits, but that's another matter entirely.

dbldwn02

Active Member

boonedocks

MS LR Blk/Blk 19”

I sent an email to TurboTax about this earlier today and received this respines about 7:30pm EST tonight:

Similar threads

- Replies

- 20

- Views

- 897

- Replies

- 1

- Views

- 463

- Replies

- 37

- Views

- 6K