I think this actually can be exploited not just for margin management, but also when deciding whether to close out a position early and take the gains or not. The reason why I would potentially close a position out early is not only to take the gains, but because I feel that the share price could potentially move closer to my SP. Instead of closing out the position completely, I could roll it down to something that I am comfortable would expire worthless.Ok - so something like this. My 630/730 spread - roll the 730 down to 710 ($20); that frees up a bit of margin - it definitely lowers my risk by a lot and probably makes it mentally trivial to let the position go through to expiration worthless (which might easy make up the premium I'm buying back early). Besides the risk reduction the other reason to do this is I don't want to open a replacement position until Monday, so maxing out the gain this week is valuable.

Let's roll that into a 630/710 spread. The 730 is going for 3.20 and the 710 is going for 1.60. So buy down the 730 to 710 for a really big risk reduction and create a meaningful probability that I'd just let it expire worthless.

Yet another reason I like this thread so much - this idea of buying out some but not all of the value in an open position isn't one that would have occurred to me. And yet I can see some value, as well as having my thinking about the world expanded in new directions.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

derpFed: Seems like a mixed message. I think our covered calls are safe.

this opens up another possibility. I opened these 630/730s because it was over a week to expiration and I didn't have a good sense of the closing price this week. I was being aggressive but I thought safe and the wide spread helped me with that combination (relatively aggressive, while also more management choices in case I'm badly wrong). Now here on Wednesday I think that 730 is completely safe. I can just allow this position to continue aging, OR a new idea that just occurred to me.

Roll from my 1x 630/730 position to 2x680/730 positions. I'll collect the current premium - 3.25 on the additional 1x positions, while paying the difference in premium for the current insurance, and adding the full cost of the new position.

So the current position at 3.25 - .22 becomes two positions at 3.25 - .70. I gain 2.55 on the new position and pay back .22 rolling the existing up for a net 2.30 per current position I am doubling up on. H'mm...

Hmm. The whole point of the $100 spread was to be safe and give options in case of the unexpected. If there was no risk adversity, why not 3x the count at a $30 spread to begin with?

I agree that $730 feels safe for this week. I do not agree that there’s no more chance of the unexpected. Monday‘s market action was completely out of left field for me. The Fed minutes look to have been taken well, but the Evergrande story is still open, and now we have a debt ceiling crisis shaping up. I guess I’m not expecting the situation to be so dire that you couldn’t roll to next week and stay afloat… but I don’t think things are spectacularly stable right now either. It seems an odd time to cut your risk buffer in half.

But I’ll admit, with prices already exceeding my weekly goal and needing some quick cash for home improvement, I took the bird in hand earlier today and moved my puts to next week. It’s looking like I need to either increase my weekly goal or increase my risk buffer (decrease put strikes relative to stock price) to bring the two in line going forward. What a problem to have!

Hmm. The whole point of the $100 spread was to be safe and give options in case of the unexpected. If there was no risk adversity, why not 3x the count at a $30 spread to begin with?

I agree that $730 feels safe for this week. I do not agree that there’s no more chance of the unexpected. Monday‘s market action was completely out of left field for me. The Fed minutes look to have been taken well, but the Evergrande story is still open, and now we have a debt ceiling crisis shaping up. I guess I’m not expecting the situation to be so dire that you couldn’t roll to next week and stay afloat… but I don’t think things are spectacularly stable right now either. It seems an odd time to cut your risk buffer in half.

But I’ll admit, with prices already exceeding my weekly goal and needing some quick cash for home improvement, I took the bird in hand earlier today and moved my puts to next week. It’s looking like I need to either increase my weekly goal or increase my risk buffer (decrease put strikes relative to stock price) to bring the two in line going forward. What a problem to have!

An interesting line of inquiry, and we quickly get into personal opinion and outlook. But there are some bits that generalize.

Yes - the point of the big spread was to keep my management choices open and avoiding risk (mostly avoiding risk by having management choices).

But - I opened these about a week ago; definitely before last weekend, and I didn't yet have the view into what I thought would happen this week. Today I have the benefit of several incremental trading days and a steadily narrowing window in which I believe the shares will end at. The $100 wide spread isn't really something I need today to feel safe. AND I'm not yet ready to move into next week. Give me another 15 minutes and that might change

You point to reasons for a sudden and sharp drop still being on the table, and your observations make sense to me. This is where the personal view into things comes in - I'm giving that sort of reaction little credence (that doesn't make me right of course).

You also point out, rightly, that I could have gone with a $30 spread and opened 3x as many!! I definitely couldn't have done that last week when I started this position, any more than I could have started it with a $50 spread width.

But I did think, briefly, about a $30 spread width (or heck - $25 for a nice round 4x), for today's roll and open. That's a dangerous thought for me. The danger arises from a bias towards using all of that leverage. This is a second benefit I get from the wide spread size. The higher capital intensity helps me keep my position count down and from using too much leverage. This is an emotional / mental thing rather than something that is desirable mechanically.

Or another way to think about it - the wide spread gets me into puts that behave very much like short puts, but with leverage so I can open more of them. WIth so little time to expiration the $50 wide spread gets me that short put behavior as the insurance is so cheap at this point, where the dynamic wouldn't have been so close with 7 or 8 trading days to expiration.

So I'll see how this week goes (it's looking really good so far!) with the change in position, and put this manage-for-profit scheme into my hip pocket. I won't do this every week of course, but now I have an additional choice beyond rolling the whole position closer. I can keep my distance while increasing the premium to decay as a second management option. And of course I have the roll-to-next-week as always, as a third mechanism to getting the decaying premium cranked back up.

So many possibilities

I tried a little bit of a different risk management strategy this week. On Friday I opened a bunch of 640/-720p spreads. Monday morning was quite shocking, and while I'm ok with dips and recoveries the overall uncertainty regarding the china situation had me much more concerned about a multi-day prolonged drop. I felt rather stressed at that moment pre-market, so I decided that I would take the loss immediately at open and then welcome a farther drop to get back in hopefully at higher IV as well. So I closed my position for a loss... it was ~5-6% of max loss, nothing too terrible. The immediate release of stress was very welcome and allowed me to think clearly and go about my day. Later in the day I decided to try something a little different based on my very strong conviction of good Q3 numbers and so I sold a bunch of 600/-700p spreads for Oct 29 for a rather large credit but not with the intent of holding the entire time though it would be close to my target income per week over the next six weeks if I did. At the very end of the day when it seemed like things would blow over I also sold some naked 700p for this week. Today I bought back those naked puts for ~90% profit. The medium term spreads are now up 30% as well and I expect them to continue decaying nicely. I'm probably targeting 50% to consider closing them, hopefully before the end of next week. All in all I've gained back my loss plus 40% of my premium I would have had for this week if I just held, and I'm feeling very good about the upcoming weeks.

As a sort of post-mortem I looked back at Monday and considered my other options. Obviously just holding my position would have worked out just fine it seems. I really did not enjoy the stress though, and I am certain I would have rolled or modified my position when it hit ATM anyway. Ultimately it was nice to see what taking an early loss looked like, and it felt very good.

As a sort of post-mortem I looked back at Monday and considered my other options. Obviously just holding my position would have worked out just fine it seems. I really did not enjoy the stress though, and I am certain I would have rolled or modified my position when it hit ATM anyway. Ultimately it was nice to see what taking an early loss looked like, and it felt very good.

corduroy

Active Member

Trying to wrap my head around this. Were the number of contracts the same? Isn't that a net debit?I'm trying out my BPS management-for-more profit technique. I've rolled the 630/730s up to 680/730s, cutting the margin requirement in half (but only down to $50 - still a pretty wide spread compared to most around these parts).

I tried to enter a similar roll (moving the long put 1/2 closer short put) in TD Ameritrade and it give me "cannot find that spread" invalid message.

You need to roll only the one leg not the whole spread, as you are not actually rolling the spread.Trying to wrap my head around this. Were the number of contracts the same? Isn't that a net debit?

I tried to enter a similar roll (moving the long put 1/2 closer short put) in TD Ameritrade and it give me "cannot find that spread" invalid message.

Good question and something I meant to be clearer about.Trying to wrap my head around this. Were the number of contracts the same? Isn't that a net debit?

I tried to enter a similar roll (moving the long put 1/2 closer short put) in TD Ameritrade and it give me "cannot find that spread" invalid message.

The mechanics on this roll (going from 630/730).

I did this as two transaction tickets. Ticket #1 was a roll from a long 630 put to a long 680 put. This was for a net debit, though that debit was small due to being 3 days from expiration and so far OTM. I think it was .30 or so, and left my initial BPS as 1 630/730 turns into 1 680/730 for that small net debit. The purpose of this ticket is to free up margin (I'm keeping it simple in today's exercise by cutting it in half).

I executed a second transaction where I entered a new BPS position - in this case a 685/735 - go with the 680/730 first position. The purpose of this ticket was to make use of the margin freed up by ticket #1. So I entered 1 new BPS for each BPS I already had open, leaving me with a net double in contracts at 1/2 the spread size.

I entered a new one of these for each of the old one's I'd previously had open, so my total margin reservation is flat, while seeing the contracts double and the spread size get cut in half.

My original plan was to keep the new positions the same. That would be easier to explain for sure - turn 1 630/730 into 2 680/730s with the same expiration. I decided to make the incremental position into 685/735s though for the extra premium (non-trivial) while still feeling quite safe.

(The positions counts are all ratios - I prefer focusing on the mechanics, rationale, techniques; rather than total position sizes. Does the learning change if it's really 10, 100, or 1000 contracts? One thing I've learned hanging around Tesla owners for most of a decade -- there is ALWAYS somebody working with a bigger pile, and somebody else working with a smaller pile. Position size doesn't change the insight into the why and mechanics, at least for me)

InTheShadows

Active Member

I think a lot of it has to do with DTE. Today a lot of my put spreads hit their targets and executed. I have been finding myself being comfortable with opening $20 and $30 spreads with less than -20 delta for the short leg on Wednesdays behind a put wall. I opened 4 new positions today like that. Also sold some 770 lcc/cc for this week. I’m more anxious about those than the tighter spreads I opened up.Hmm. The whole point of the $100 spread was to be safe and give options in case of the unexpected. If there was no risk adversity, why not 3x the count at a $30 spread to begin with?

willow_hiller

Well-Known Member

So if you could imagine the entire options chain like a hill-covered landscape, with open interest adding altitude to the surface at a given strike, the SP will tend to roll down those hills like a ball and settle in the nearest lowest valley; until someone gives it a kick up over a peak and then it will settle in the next lowest valley.

Went and back-tested this in case it was a useful framework. Where regardless of whether an option is a put or a call, delta-hedging will tend to move the underlying away from the strike in the direction it was last moving. So a single option looks a bit like a steep mountain that the SP will tend to prefer either side of:

The theory seems to hold true for last week, where a huge amount of open interest at 700 slopes the whole chart, and the SP tended to slide up because of it. But toward the end of the week, open interest built up at 750 for both 2021-09-17 and 2021-09-24, and the SP has just continued to move toward that peak this week regardless.

... So probably not a valuable theory. Ultimately it just looks like open interest peaks sometimes lag underlying movement, and sometimes try to lead it. I made a GIF out of the whole thing regardless. Red line is the underlying:

mickificki

Member

asking for some "not advice" here...I have 5x 9/24 CC 740 strike and 4x 9/24 CC 755 strike...seems like i may have gotten myself into a pickle.

yes, i'm one of those who thought the evergrande situation was more harmful than it appears to be...

I've considered rolling the 740's to 10/15 780's, should be close to even, but i'm not sure it'll even be in the 700's after the P&D report. Decisions decisions...

yes, i'm one of those who thought the evergrande situation was more harmful than it appears to be...

I've considered rolling the 740's to 10/15 780's, should be close to even, but i'm not sure it'll even be in the 700's after the P&D report. Decisions decisions...

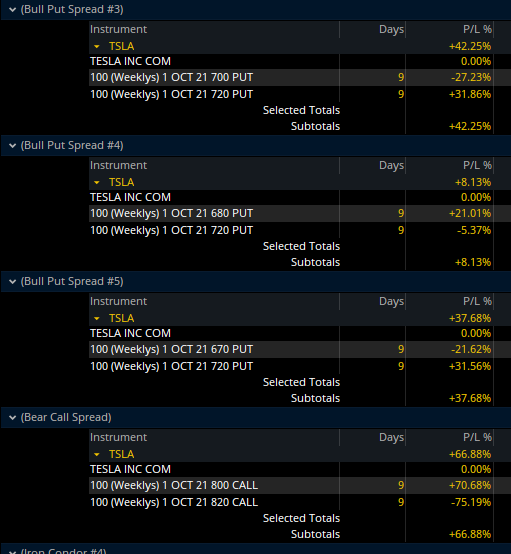

aside from CC, these are my 10/1 positions (they were all opened different DTE):

2 things left to do and i am done for 10/1

1) STO +p640/-p700 delta 17 (later roll to -p720 or -p730 when it looks safe)

2) gradually convert them all to IC for gravy (possibly -c800 delta 7)

2 things left to do and i am done for 10/1

1) STO +p640/-p700 delta 17 (later roll to -p720 or -p730 when it looks safe)

2) gradually convert them all to IC for gravy (possibly -c800 delta 7)

If you're bullish on the stock taking off over the next two weeks you could flip them to putsasking for some "not advice" here...I have 5x 9/24 CC 740 strike and 4x 9/24 CC 755 strike...seems like i may have gotten myself into a pickle.

yes, i'm one of those who thought the evergrande situation was more harmful than it appears to be...

I've considered rolling the 740's to 10/15 780's, should be close to even, but i'm not sure it'll even be in the 700's after the P&D report. Decisions decisions...

Example:

BTC 5x 9/24 740C

STO 5x 10/8 730P

This would be a break even trade. There are other strikes and dates obviously, but hopefully this gives you another idea on how to manage it.

mickificki

Member

Thanks, yes I probably could. But I'd have to wait for them to be assigned first then I can buy the cash secured puts (no margin or cash here, everything is in my ira and in tsla).If you're bullish on the stock taking off over the next two weeks you could flip them to puts

Example:

BTC 5x 9/24 740C

STO 5x 10/8 730P

This would be a break even trade. There are other strikes and dates obviously, but hopefully this gives you another idea on how to manage it.

I could maybe purchase some leaps, and do the wheel with the remainder (am i the only one here doing the wheel?

bkp_duke

Well-Known Member

asking for some "not advice" here...I have 5x 9/24 CC 740 strike and 4x 9/24 CC 755 strike...seems like i may have gotten myself into a pickle.

yes, i'm one of those who thought the evergrande situation was more harmful than it appears to be...

I've considered rolling the 740's to 10/15 780's, should be close to even, but i'm not sure it'll even be in the 700's after the P&D report. Decisions decisions...

In this position, my not advice is that I would watch tomorrow closely for a dip and either buy back for a loss, or roll. If no joy there, you can sweat them out through friday. That 755 will be close, but I will be surprised if Friday closes below 740.

If in a non-taxed account, you could always just take assignment and buy back at a future date.

Again, not advice.

I don't know why they call them "lotto tickets"... real lotto tickets are far more valuable since they can serve as toilet paper in a bindI, too, have been burned many a time buying options that you go in thinking you can’t lose. ‘Capital burn’ as a good descriptor of this. Selling only for me now, unless we are talking leaps…

asking for some "not advice" here...I have 5x 9/24 CC 740 strike and 4x 9/24 CC 755 strike...seems like i may have gotten myself into a pickle.

yes, i'm one of those who thought the evergrande situation was more harmful than it appears to be...

I've considered rolling the 740's to 10/15 780's, should be close to even, but i'm not sure it'll even be in the 700's after the P&D report. Decisions decisions...

If you definitely don't want to lose the shares, you might get a dip tomorrow to close them out. If it keeps going up, I would roll and keep rolling to keep the strike ahead of the SP. Eventually you should be able to roll out of it, or at least sell out at a lot higher price.

AquaY

Member

You have ( pardon the pun) no margin for error. IRA with no cash, limits what you can do.Thanks, yes I probably could. But I'd have to wait for them to be assigned first then I can buy the cash secured puts (no margin or cash here, everything is in my ira and in tsla).

I could maybe purchase some leaps, and do the wheel with the remainder (am i the only one here doing the wheel?). All y'alls doing the spread and iron condors and what not...sounds too complicated...also sounds like a kung fu movie...Bull put spread vs Iron Condor! Fight!

I agree with @MikeC Roll them out.

R

ReddyLeaf

Guest

Definitely roll up and out if you can. If you’re really out of cash, then perhaps you can call your brokerage and have a real person do the buyback/roll for you (thus not needing any cash or margin). I’m in a similar situation, but haven’t yet tried the phone broker route. Instead, I’ve managed to break the buyback/roll into multiple steps, thus only needing enough cash to buyback one call. Last week I split up the roll into two steps and manage roll up $15 strike for a small credit. Now I have more cash to manage this week.Thanks, yes I probably could. But I'd have to wait for them to be assigned first then I can buy the cash secured puts (no margin or cash here, everything is in my ira and in tsla).

I could maybe purchase some leaps, and do the wheel with the remainder (am i the only one here doing the wheel?). All y'alls doing the spread and iron condors and what not...sounds too complicated...also sounds like a kung fu movie...Bull put spread vs Iron Condor! Fight!

FYI, on Monday I was in an interesting position in one account: literally $400 free cash and some -p750s originally sold for $9.00 but valued at over $20 and still rising. I was resigned to getting put the shares (still am), but while waiting noticed that nice pop today and sold some -c750s at $5.60 to exactly balance the puts (finally an official strangle). Now I’ve got enough cash to buyback and roll the puts if I want. I’m still expecting a $749.89 close, but will wait it out and, as @Lycanthrope says, “I dare you.”

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K