Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Plug In America one isn't very accurate. It shows "Considering income tax and sales tax reductions". Texas doesn't have an income tax.

ChadS

Last tank of gas: March 2009

Todd Burch

14-Year Member

My Model S config will be about $86K. My only significant debt is $196,000 outstanding on our mortgage, which has a 3.5% interest rate.

I have the savings to pay cash for the car, and also will have enough for an emergency fund leftover.

If I can get an auto loan at around 2% or less (as I believe I can), it seems an obvious decision to me to finance the car and use the rest of the cash I would've used to pay for the car to instead pay down my mortgage. Since my mortgage's interest rate is 3.5% vs. the auto loan's 2%, I'll end up saving more money by putting the cash toward the house.

Someone please confirm my line of thought here .

.

I have the savings to pay cash for the car, and also will have enough for an emergency fund leftover.

If I can get an auto loan at around 2% or less (as I believe I can), it seems an obvious decision to me to finance the car and use the rest of the cash I would've used to pay for the car to instead pay down my mortgage. Since my mortgage's interest rate is 3.5% vs. the auto loan's 2%, I'll end up saving more money by putting the cash toward the house.

Someone please confirm my line of thought here

My Model S config will be about $86K. My only significant debt is $196,000 outstanding on our mortgage, which has a 3.5% interest rate.

I have the savings to pay cash for the car, and also will have enough for an emergency fund leftover.

If I can get an auto loan at around 2% or less (as I believe I can), it seems an obvious decision to me to finance the car and use the rest of the cash I would've used to pay for the car to instead pay down my mortgage. Since my mortgage's interest rate is 3.5% vs. the auto loan's 2%, I'll end up saving more money by putting the cash toward the house.

Someone please confirm my line of thought here.

I think the only way that doesn't make sense is if the next day your house (that you own) is taken by a hurricane and you live in your car (which you still owe money on).

There might also be some tax reasons for not doing that. I'm not certain though.

Todd Burch

14-Year Member

There might also be some tax reasons for not doing that. I'm not certain though.

The next line I expect to hear is that the mortgage interest deduction might make up for the difference in interest rate and it actually might be better to just pay for the car. Sigh. Guess I'll have to run the numbers myself!

Trnsl8r

S85 2012-2018, X90 since 2016, 3 since 2018

My Model S config will be about $86K. My only significant debt is $196,000 outstanding on our mortgage, which has a 3.5% interest rate.

I have the savings to pay cash for the car, and also will have enough for an emergency fund leftover.

If I can get an auto loan at around 2% or less (as I believe I can), it seems an obvious decision to me to finance the car and use the rest of the cash I would've used to pay for the car to instead pay down my mortgage. Since my mortgage's interest rate is 3.5% vs. the auto loan's 2%, I'll end up saving more money by putting the cash toward the house.

Someone please confirm my line of thought here.

It's not quite that simple. The interest you pay on a mortgage is tax deductible, the interest you pay on a car loan is not. Whether that is enough to offset the 1.5% difference depends on your situation, check with your CPA...

EDIT: ... and now I see that since it took me ten minutes to write two simple sentences you caught that already...

For what it's worth, I'd pay down the car rather than the mortgage. My thinking is if Tesla goes under and I have a lemon car, then the car at least is paid for and while I'm out money if I dump it at least I'm not underwater on the car. If you pay down the mortgage and Tesla goes under, you're left badly underwater on your car and you can't really pull the money back out of your house (well, you can, but that gets tricky depending on your house situation).Someone please confirm my line of thought here.

Obviously, my thinking is dominated by risk exposure rather than maximizing return on my money. If this was a BMW, I'd be comfortable taking a loan for as much as I could handle on monthly payments and putting the rest of the money into an index fund.

gg_got_a_tesla

Model S: VIN 65513, Model 3: VIN 1913

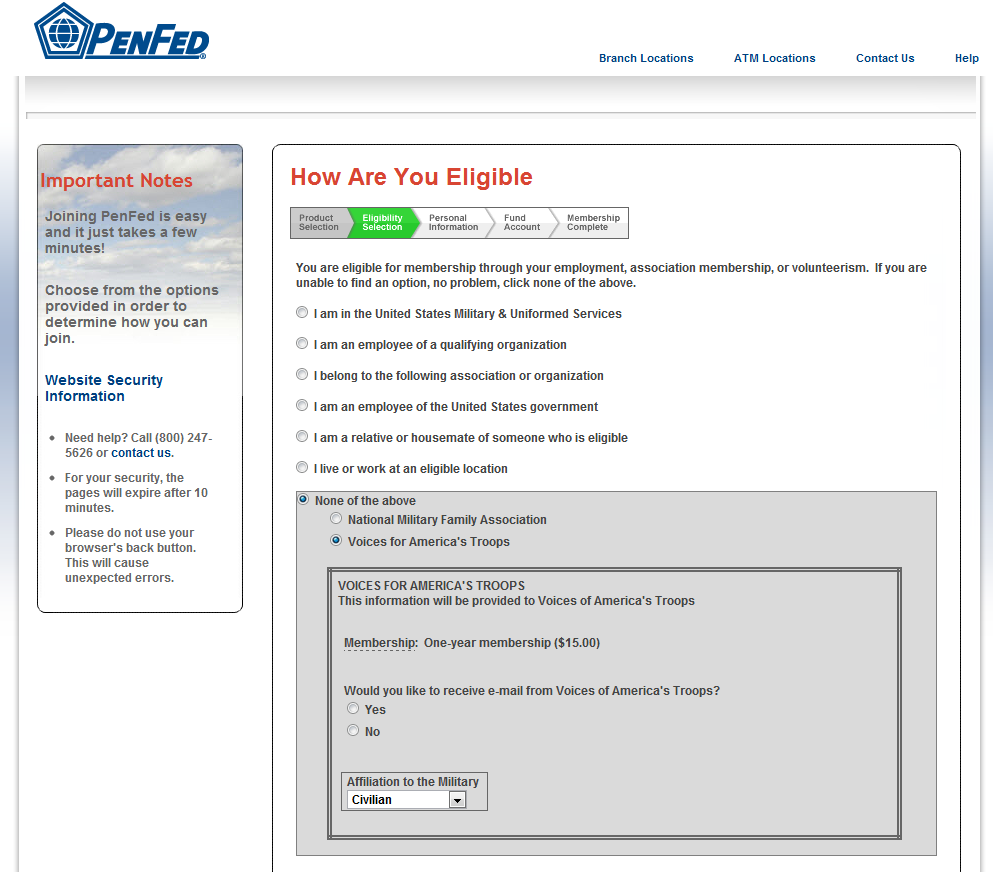

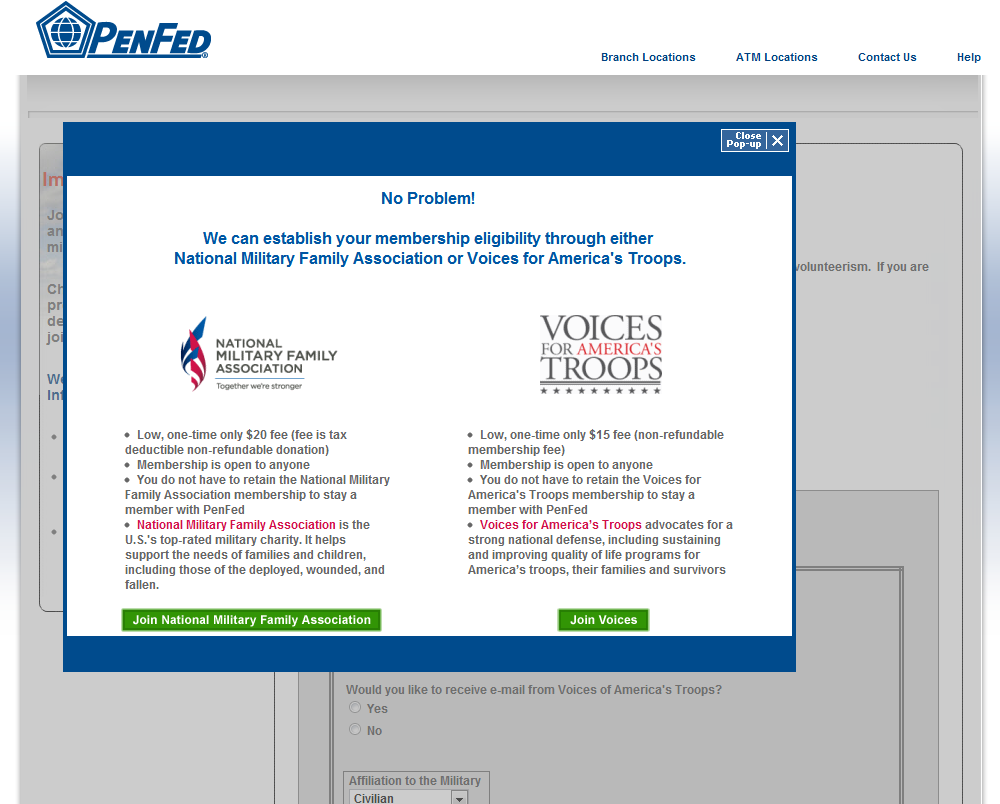

For those interested in financing your Model S, much like the USAA, the Pentagon Federal Credit Union (PenFed) is currently offering 1.99% APR on new cars for 60-month terms upto $70,000.

PenFed - New Auto Loans

But, unlike the USAA, you wouldn't need a military connection per se to join PenFed and then apply for the loan. During the sign-up process to join PenFed and open a Regular Share savings account (minimum balance of $5 and no recurring fee otherwise), I became eligible for PenFed by signing up for membership of "Voices for America's Troops" as a Civilian for a one-time membership fee of $15.

Hope this helps folks looking for a low interest rate to finance your Model S.

PenFed - New Auto Loans

But, unlike the USAA, you wouldn't need a military connection per se to join PenFed and then apply for the loan. During the sign-up process to join PenFed and open a Regular Share savings account (minimum balance of $5 and no recurring fee otherwise), I became eligible for PenFed by signing up for membership of "Voices for America's Troops" as a Civilian for a one-time membership fee of $15.

Hope this helps folks looking for a low interest rate to finance your Model S.

mlascano

S Sig #722

For those interested in financing your Model S, much like the USAA, the Pentagon Federal Credit Union (PenFed) is currently offering 1.99% APR on new cars for 60-month terms upto $70,000.

PenFed - New Auto Loans

Hope this helps folks looking for a low interest rate to finance your Model S.

Great info gg, thanks for sharing. 1.99% APR for 60 months is a great rate (my local credit union currently has a 2.5% for 60 mo). I will definitely check this out.

I don't plan on buying my Model S for 2 years, but I'm trying really hard to not have to to finance but I might finance the last $10k - $15k if I have to.

There are 2 setups I'm considering, 1 is the S Performance, and the other is the 85kw base model. With my selected configurations the base model will come to $82k - $84k (depending on interior selection). Where as if I get the Performance it will come to $95k. Mind you I'm Canadian so these prices I'm quoting are in American.

What are peoples opinions on leather? If I were to get the base model the leather is $1500 more and I kind of like the textile interior, but I'm kind of worried about people getting cigarette burns in the fabric and I think that would be less of a problem with leather.

I'm not really sure what I want. I know I absolutely must have the 85kw battery, but between base model and performance I'm torn. I'd really like to have that 0-60 in 4.4 seconds, but on the other hand I wouldn't mind saving $10k, especially if it means I won't have to finance.

This is my first car though, so that's kind of why I'm really leaning hard towards the Performance model because having been without a vehicle for all my life I think I'm going to want something really fun. What is 0-60 in 5.6 seconds like? Comparing it to 4.4 seconds, from my perspective it seems so slow, but I also have no experience to compare it to.

There are 2 setups I'm considering, 1 is the S Performance, and the other is the 85kw base model. With my selected configurations the base model will come to $82k - $84k (depending on interior selection). Where as if I get the Performance it will come to $95k. Mind you I'm Canadian so these prices I'm quoting are in American.

What are peoples opinions on leather? If I were to get the base model the leather is $1500 more and I kind of like the textile interior, but I'm kind of worried about people getting cigarette burns in the fabric and I think that would be less of a problem with leather.

I'm not really sure what I want. I know I absolutely must have the 85kw battery, but between base model and performance I'm torn. I'd really like to have that 0-60 in 4.4 seconds, but on the other hand I wouldn't mind saving $10k, especially if it means I won't have to finance.

This is my first car though, so that's kind of why I'm really leaning hard towards the Performance model because having been without a vehicle for all my life I think I'm going to want something really fun. What is 0-60 in 5.6 seconds like? Comparing it to 4.4 seconds, from my perspective it seems so slow, but I also have no experience to compare it to.

I don't plan on buying my Model S for 2 years, but I'm trying really hard to not have to to finance but I might finance the last $10k - $15k if I have to.

There are 2 setups I'm considering, 1 is the S Performance, and the other is the 85kw base model. With my selected configurations the base model will come to $82k - $84k (depending on interior selection). Where as if I get the Performance it will come to $95k. Mind you I'm Canadian so these prices I'm quoting are in American.

What are peoples opinions on leather? If I were to get the base model the leather is $1500 more and I kind of like the textile interior, but I'm kind of worried about people getting cigarette burns in the fabric and I think that would be less of a problem with leather.

I'm not really sure what I want. I know I absolutely must have the 85kw battery, but between base model and performance I'm torn. I'd really like to have that 0-60 in 4.4 seconds, but on the other hand I wouldn't mind saving $10k, especially if it means I won't have to finance.

This is my first car though, so that's kind of why I'm really leaning hard towards the Performance model because having been without a vehicle for all my life I think I'm going to want something really fun. What is 0-60 in 5.6 seconds like? Comparing it to 4.4 seconds, from my perspective it seems so slow, but I also have no experience to compare it to.

Good luck but just don't let people smoke in your awesome car and won't have to worry about burns. 5.6 seconds is still very quick. It might not throw you against the back of your seat but it is close. I've driven a 4.8 second M3 and it's is a blast so think the Model S at 5.6 seconds will feel similar.

gg_got_a_tesla

Model S: VIN 65513, Model 3: VIN 1913

5.6 seconds is still very quick. It might not throw you against the back of your seat but it is close.

Oh yes, it does, Dave

Yes, I'm still daydreaming about my 85 kWh

Good luck but just don't let people smoke in your awesome car and won't have to worry about burns. 5.6 seconds is still very quick. It might not throw you against the back of your seat but it is close. I've driven a 4.8 second M3 and it's is a blast so think the Model S at 5.6 seconds will feel similar.

That's a good point, why would I let people smoke in an $84k car? Lol. I'm still going to shoot fort the SP (am I the first to say that? S Performance), but yea *sugar* happens.

That's a good point, why would I let people smoke in an $84k car? Lol. I'm still going to shoot fort the SP (am I the first to say that? S Performance), but yea *sugar* happens.

Typically folks say MSP

Not to be confused with MSRP, which is somewhat spendy for MSP.Typically folks say MSP

mitch672

Active Member

Well, I have always paid cash for new cars, but this one is just too expensive to do that, and even if I had the cash availble, it would tap my entire reserves.

I am older (52), and I own 2 houses, outright (one was inhertied, I would rather they still be alive and lived in the house, but thats another story), the other house I live in, and it was paid off years ago. I could get an equity line of credit, but I dislike borrowing money against a paid off asset, intensly.

My other idea is a combinaton of cash, my trade in (which is an almost brand new Advanced Plug in Prius), and borrowing my own money ($50K) from my 401K, the rate is %4.25, but you are paying the money/ interest to yourself, the payment is automaticlly taken out of your paycheck, the only negative is if you leave the job, the loan becomes due within 90 days, or is considered a "disbursement" and you have to pay income taxes on the outstanding loan, plus a %10 early withdrawal penalty.

my backup plan if that where to happen is to get a home equity line of credit, in an emergency. I am also considering selling one of the houses in the next 2 years, so I can pay off the 401K loan that way as well. You might be saying, "yes, but you are taking $50K out of your 401K that could be invested". Not an issue, I pulled most of my money into cash over 8 months ago, when the market started going sideways. I have not regretted that decision once yet, since I look at the basket of funds/shares I had, and they would still be down over $10K even as of today. sometimes, you need to be in cash, and the stock market is not the place to be... I've made my money in the market the last 15 years, and in 2008 it really hurt to see a lot of it go away, I vowed to not let that happen again, and it hasn't.

Anyway, an $83K car is twice as much as I have ever spent on a car, do I need to? probably not, the Plug in Prius is doing just fine, but that's not the point, is it?

Mitch, P10010, Reserved 7/3/2012

I am older (52), and I own 2 houses, outright (one was inhertied, I would rather they still be alive and lived in the house, but thats another story), the other house I live in, and it was paid off years ago. I could get an equity line of credit, but I dislike borrowing money against a paid off asset, intensly.

My other idea is a combinaton of cash, my trade in (which is an almost brand new Advanced Plug in Prius), and borrowing my own money ($50K) from my 401K, the rate is %4.25, but you are paying the money/ interest to yourself, the payment is automaticlly taken out of your paycheck, the only negative is if you leave the job, the loan becomes due within 90 days, or is considered a "disbursement" and you have to pay income taxes on the outstanding loan, plus a %10 early withdrawal penalty.

my backup plan if that where to happen is to get a home equity line of credit, in an emergency. I am also considering selling one of the houses in the next 2 years, so I can pay off the 401K loan that way as well. You might be saying, "yes, but you are taking $50K out of your 401K that could be invested". Not an issue, I pulled most of my money into cash over 8 months ago, when the market started going sideways. I have not regretted that decision once yet, since I look at the basket of funds/shares I had, and they would still be down over $10K even as of today. sometimes, you need to be in cash, and the stock market is not the place to be... I've made my money in the market the last 15 years, and in 2008 it really hurt to see a lot of it go away, I vowed to not let that happen again, and it hasn't.

Anyway, an $83K car is twice as much as I have ever spent on a car, do I need to? probably not, the Plug in Prius is doing just fine, but that's not the point, is it?

Mitch, P10010, Reserved 7/3/2012

Last edited:

CyberDutchie

Active Member

I have a different scheme in mind for paying for the car. I'm putting it "on the house", using $50K from a home equity line of credit that carries a 3.25% interest. I don't have to pay principle, and can pay interest only which comes out at about $162 per month. Principle becomes due at the end of the home mortgage term, but that still is 25 years away. I will have sold the house well before that, so it is not an issue for me.

Today, I pay $375 per month for my leased Kia Optima. By getting out of the lease and buying the Model S, our monthly payment will actually go down by $213. Plus, there are fuel savings of about $180 per month (my Kia does 22 mpg on average and I drive 1,000 miles per month), while my electricity bill will go up by maybe $40 a month. And finally, the home equity interest payments are tax deductible, uncle Sam giving me back about 1/3 so that's another $54 savings per month.

So, if you do the math, I'm actually able to lower my monthly car costs by over $400. Yes, I may need to replace the battery after 8 years, but till then I'll enjoy $400 savings per month, and, be driving a Model S instead of a Kia!

My wife still scratches her head when I explain it to her, and keeps saying something smells fishy. :wink:

Edit: forgot to mention that I invested $20K in TSLA shares (hopefully worth $25K or more by early next year) which will go towards the car as well.

Today, I pay $375 per month for my leased Kia Optima. By getting out of the lease and buying the Model S, our monthly payment will actually go down by $213. Plus, there are fuel savings of about $180 per month (my Kia does 22 mpg on average and I drive 1,000 miles per month), while my electricity bill will go up by maybe $40 a month. And finally, the home equity interest payments are tax deductible, uncle Sam giving me back about 1/3 so that's another $54 savings per month.

So, if you do the math, I'm actually able to lower my monthly car costs by over $400. Yes, I may need to replace the battery after 8 years, but till then I'll enjoy $400 savings per month, and, be driving a Model S instead of a Kia!

My wife still scratches her head when I explain it to her, and keeps saying something smells fishy. :wink:

Edit: forgot to mention that I invested $20K in TSLA shares (hopefully worth $25K or more by early next year) which will go towards the car as well.

Last edited:

Similar threads

- Replies

- 19

- Views

- 719

- Replies

- 4

- Views

- 332

- Replies

- 74

- Views

- 12K

- Replies

- 143

- Views

- 7K