AZSTAD

Member

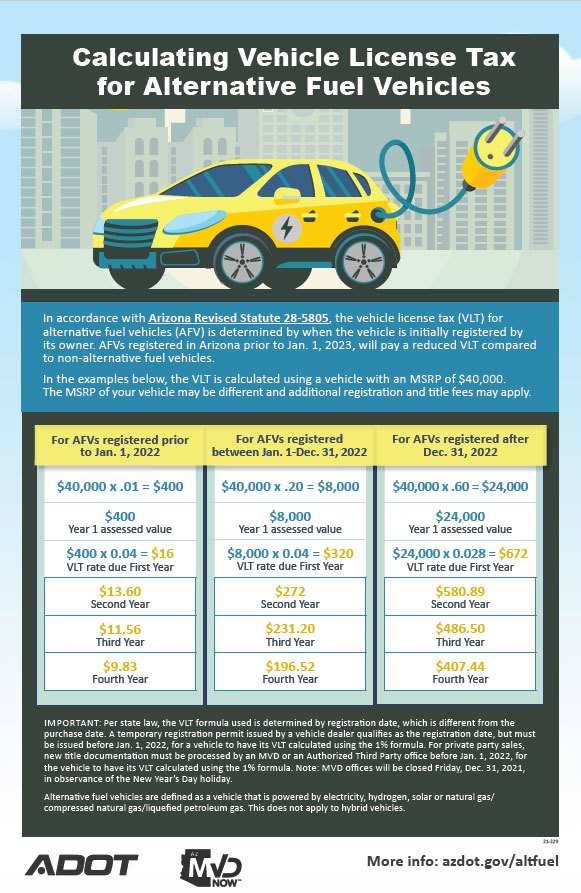

Can you point to where this is documented on an AZ state site? This may compel me to change to a MYP for sure - as my delivery date simply now says "January".We all NEED our new cars to be registered before 1/1/22. Currently EV's here in AZ have a registration fee of 1% of the vehicle cost which is nothing. It's all changing as beginning next year that's going up to 10% of cost, then for 2023 to 20% of the retail value - same as regular cars! But if you have an EV registered before 2022 you are grandfathered in. This is a big deal that for some reason I've not seen a lot of talk about.