The team at Ark Invest published their latest model for $TSLA outlining a case for a $3000 price target by 2025. That would be a 4.5x increase from the ~$650/share that $TSLA closed at on Friday.

I haven't gone through the entire model and validated their assumptions, but some preliminary readings tell me it's quite a bit more farfetched then the previous 2024 model they had with a ($7k pre-split) $1400 price target.

I'll update this thread with my modeling assumptions and where I differ substantially from Ark.

You can find the model here: ARKInvest/ARK-Invest-Tesla-Valuation-Model

and the corresponding post on Ark's website here: ARK’s Price Target for Tesla in 2025 is $3,000 Per Share.

Update:

I fixed some of their assumptions and was able to derive a $1200 price target.

Be careful with the monte-carlo simulations, there is a bug in the spreadsheet where only the first simulation is updated based on parameters therefore all other simulation values remain the same and your mean statistics (price targets) are never updated.

Here is my valuation assumptions:

This is what Ark's model had initially:

For historical perspective, this is what they had on the original model they released a few years ago:

I haven't gone through the entire model and validated their assumptions, but some preliminary readings tell me it's quite a bit more farfetched then the previous 2024 model they had with a ($7k pre-split) $1400 price target.

I'll update this thread with my modeling assumptions and where I differ substantially from Ark.

You can find the model here: ARKInvest/ARK-Invest-Tesla-Valuation-Model

and the corresponding post on Ark's website here: ARK’s Price Target for Tesla in 2025 is $3,000 Per Share.

Update:

I fixed some of their assumptions and was able to derive a $1200 price target.

Be careful with the monte-carlo simulations, there is a bug in the spreadsheet where only the first simulation is updated based on parameters therefore all other simulation values remain the same and your mean statistics (price targets) are never updated.

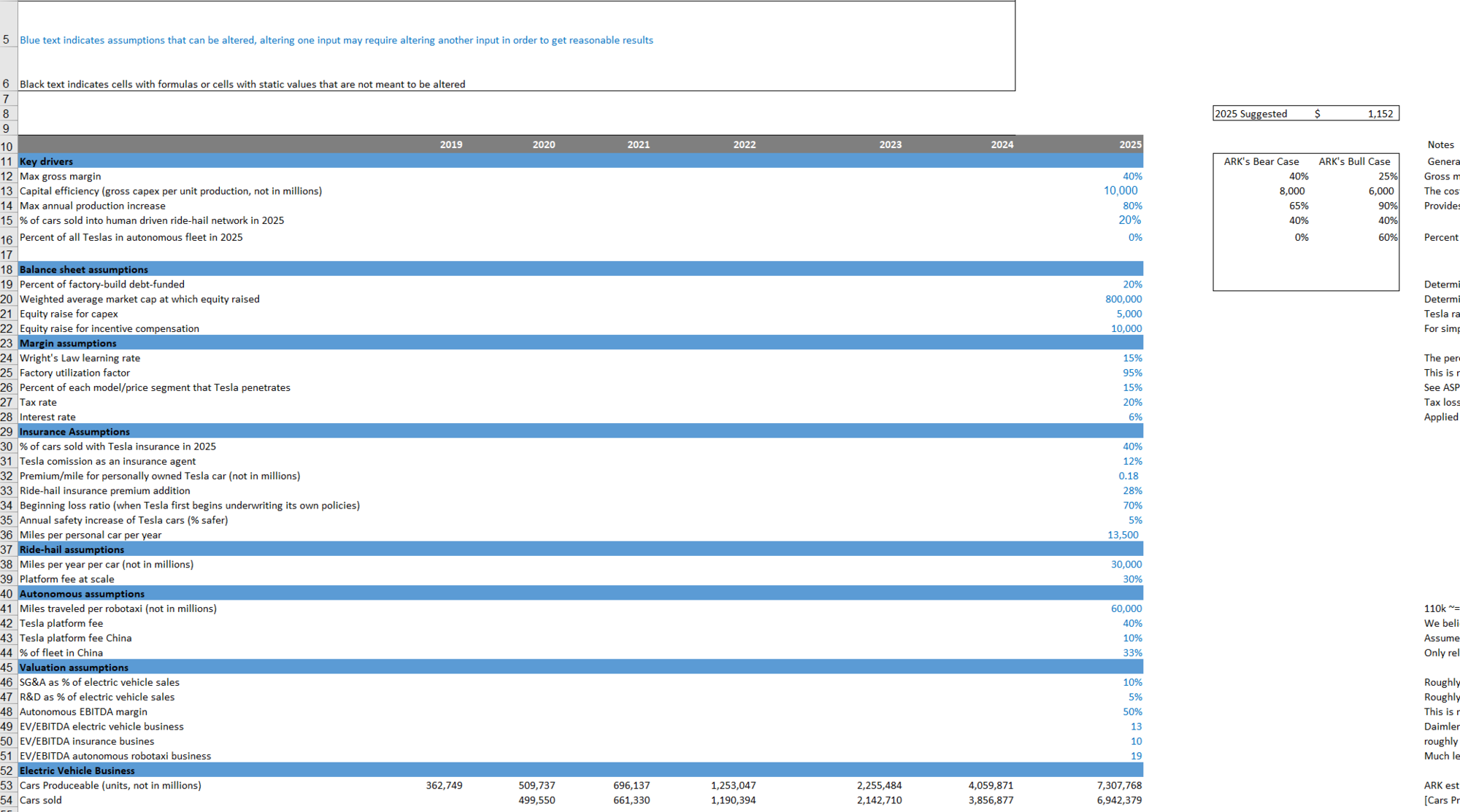

Here is my valuation assumptions:

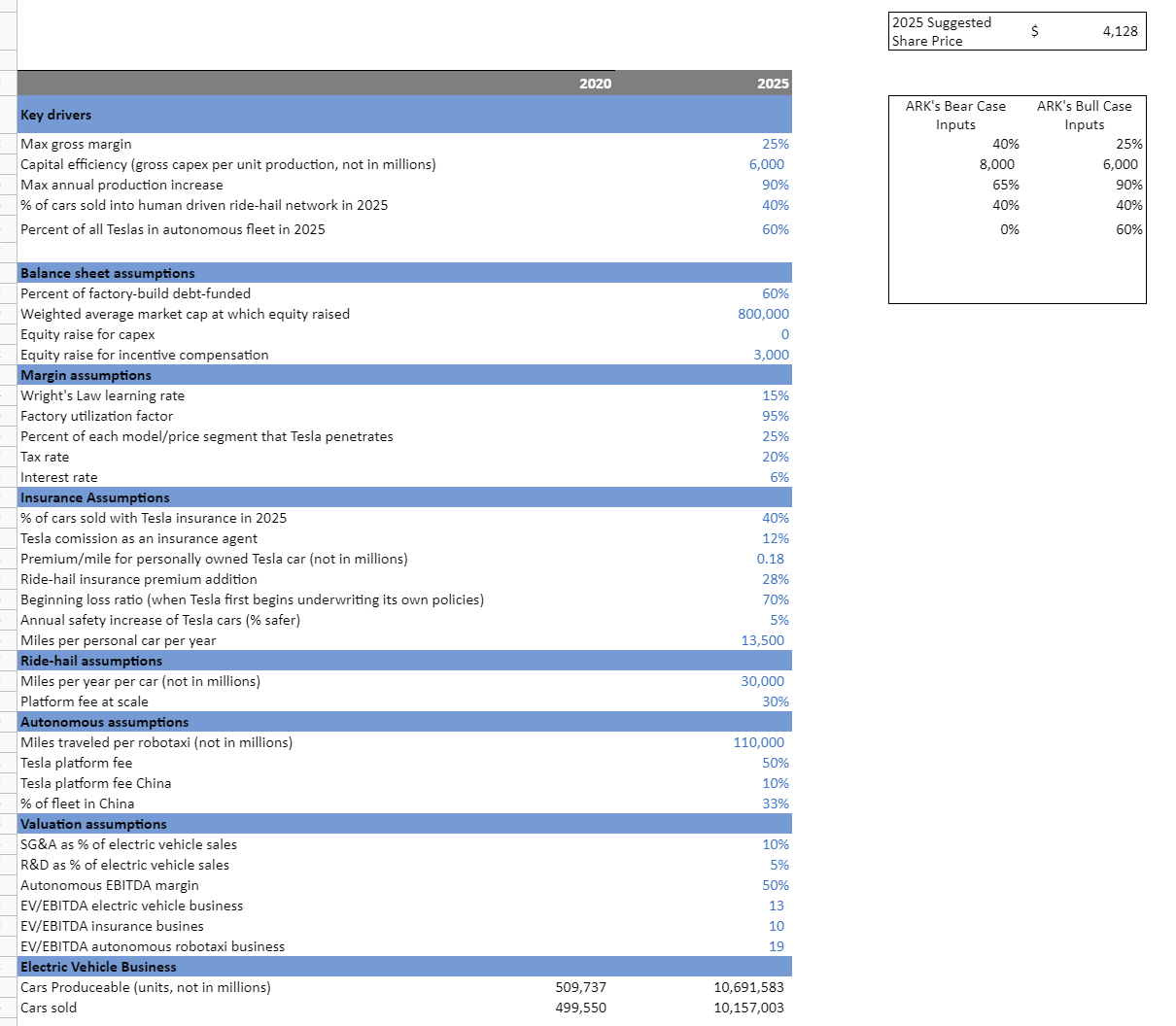

This is what Ark's model had initially:

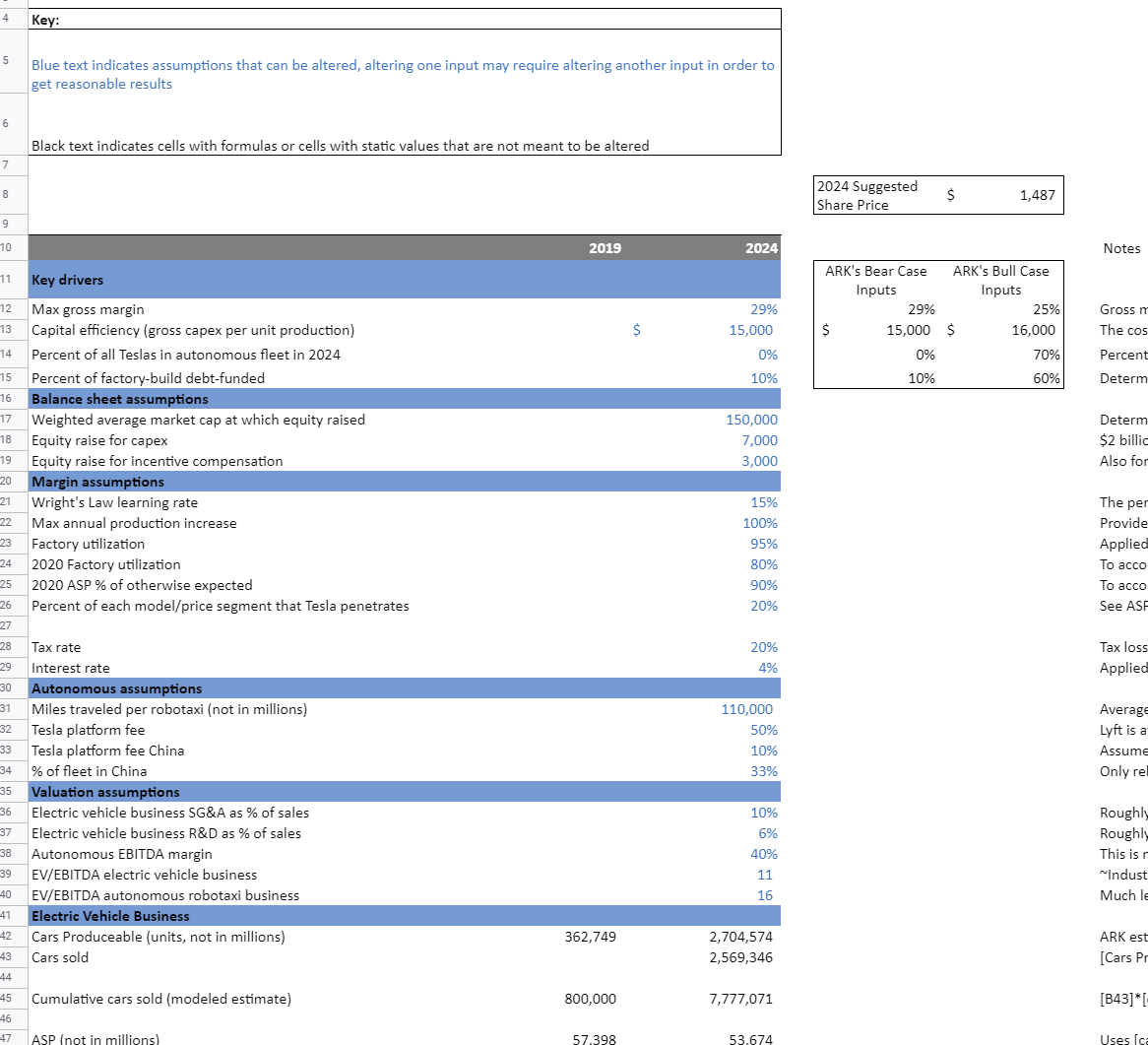

For historical perspective, this is what they had on the original model they released a few years ago:

Last edited: