Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best interest rate via Tesla financing?

- Thread starter rbaum0519

- Start date

- Status

- Not open for further replies.

sgalla04

Member

Users have confirmed in the past at least $500 monthly is sufficient. When I talked to a DCU rep a couple weeks ago and told her I only planned on depositing my monthly payment of a bit over $800, she said yes that will not be a problem to qualify for the 0.5% rate discount.Can you only have a portion of your paycheck direct deposited? Thinking I would just get my car payment amount deposited from my employer and then just pay the bill from my DCU account if I cannot get the Tesla match.

I was depositing $20 monthly just to initiate it and that did not trigger PLUS Membership status.

sgalla04

Member

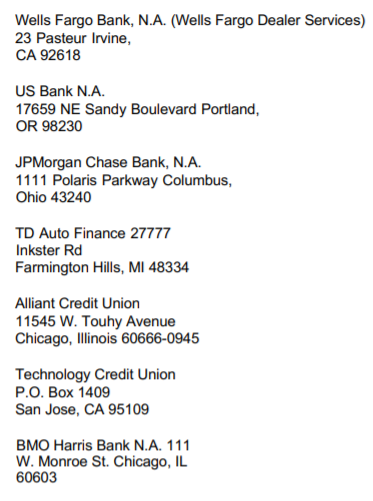

Some folks have been curious to what banks Tesla is sourcing for their financing. Sometimes you can even just ask Tesla for a better rate and they go to their various lenders to see a lower rate is possible. According to Tesla's Credit Application Terms & Conditions PDF, here are the banks they are using:

I have it approved from US Bank, on what basis they decide? May be location and credit?Some folks have been curious to what banks Tesla is sourcing for their financing. Sometimes you can even just ask Tesla for a better rate and they go to their various lenders to see a lower rate is possible. According to Tesla's Credit Application Terms & Conditions PDF, here are the banks they are using:

View attachment 673987

sgalla04

Member

They also gave me U.S. Bank and I am in Philadelphia.I have it approved from US Bank, on what basis they decide? May be location and credit?

SDM44

.

Can you only have a portion of your paycheck direct deposited? Thinking I would just get my car payment amount deposited from my employer and then just pay the bill from my DCU account if I cannot get the Tesla match.

Direct deposit is setup through your employer, and the bank doesn't know (nor do they need to know) how much of your paycheck is getting direct deposited. As long as you're depositing a minimum amount required for their loan or account requirements, then you should be fine.

quakerzombie

New Member

Anyone available to send me a DCU referral code? (I'm new so I cant send out DMs, please DM me if necessary)

I'm looking to open a DCU account to get a loan from DCU, hoping for a 1.49% or even lower! Btw, how are people getting under 1.0% from DCU?

quakerzombie

New Member

I can...but that requires you send me your email address and name. I am also new here so can't send DMsAnyone available to send me a DCU referral code? (I'm new so I cant send out DMs, please DM me if necessary)

I'm looking to open a DCU account to get a loan from DCU, hoping for a 1.49% or even lower! Btw, how are people getting under 1.0% from DCU?

Mod Y Guy

Supporting Member

I went ahead and signed up for a DCU account, with the $10 donation, and $5 savings account requirement. I will try to rate match the 1.24% through Tesla as I would rather not direct deposit through DCU since there are no branches in my state. I will most likely take advantage of the 6.17% APY savings account on the $1,000 though. I qualified for the 2.49% through Wells Fargo back on 5/18/21 but know I can do better than that and wouldn't mind shaving around $25 a month off my monthly payment. I will need that elusive VIN though. Current EDD is July 7 to 27.

For those looking into rate match, I was able to get that approved from tesla after delivery. I never got a MVPA from Tesla since I picked Tesla financing.

Post delivery, I applied for DCU refinancing (same promotions available) with the VIN and payoff amount. DCU approved me at 1.24% for 65 months, Tesla agreed to rebate the financing cost for the difference in interest (72 month term with Tesla). I initial had 2.24% with Chase.

Post delivery, I applied for DCU refinancing (same promotions available) with the VIN and payoff amount. DCU approved me at 1.24% for 65 months, Tesla agreed to rebate the financing cost for the difference in interest (72 month term with Tesla). I initial had 2.24% with Chase.

acebrigade

Member

Instantly approved via Tesla for 72 mo @2.49% with Wells Fargo. Shockingly USAA which has been incredible for my family only approved me at 3.5%. Head scratcher.

Mod Y Guy

Supporting Member

Question: I placed my order on 5/18/21 and chose Tesla financing at the time. Instantly got the 2.49% for 72 months with Wells Fargo. However, some people are saying they never received a MVPA because they chose the Tesla financing option, rather than cash or 3rd party financing. Will I still get an MVPA that I can send to DCU, so they can then send me the 1.24% rate offer, that I can then send to Tesla rate match? Haha.

If your active mode of financing is through Tesla, you will not.Question: I placed my order on 5/18/21 and chose Tesla financing at the time. Instantly got the 2.49% for 72 months with Wells Fargo. However, some people are saying they never received a MVPA because they chose the Tesla financing option, rather than cash or 3rd party financing. Will I still get an MVPA that I can send to DCU, so they can then send me the 1.24% rate offer, that I can then send to Tesla rate match? Haha.

sgalla04

Member

Yes. You applied for financing too early. Don’t apply until you have a VIN. You might be able to ask your SA for help. They should be able to convert your account back to cash. You still had a credit hit, but then should be able to obtain an MVPA. People change their minds, so I don’t see why they can’t change you back to cash.Question: I placed my order on 5/18/21 and chose Tesla financing at the time. Instantly got the 2.49% for 72 months with Wells Fargo. However, some people are saying they never received a MVPA because they chose the Tesla financing option, rather than cash or 3rd party financing. Will I still get an MVPA that I can send to DCU, so they can then send me the 1.24% rate offer, that I can then send to Tesla rate match? Haha.

SDM44

.

I had my SA remove my existing Tesla financing so I could redo the numbers & down payment. However, she also mentioned to select “Self-Arranged Financing” for my payment option instead of Cash.

My goal is to use Tesla financing, but to get a lower rate from DCU and have Tesla rate match it. Since I’m now back at the ‘beginning’ stage of setting up my financing, what’s going the best option of doing this, and being able to get a MVPA doc since you don’t get one when you use Tesla Financing?

1) Setup the Self-Arranged Financing and when I get my MVPA and give it to DCU, then apply for a Tesla loan and ask them to rate match it?

2) Select Cash and then get a MVPA (do you even get one if you choose cash?) and give that to DCU to get a low rate, and then apply for a Tesla loan and ask them to rate match it?

3) Go back to Tesla Financing and select the numbers I want to use, then apply for the same amount with DCU and use my “Loan Doc” that I receive from Tesla for my DCU app? Will DCU even take that when applying for their loan?

Since I’m back to square one with setting up the financing, I wanted to do it the easiest way. Plus I was going to put down a little more on my initial down payment anyways so I can play with the financing numbers.

My goal is to use Tesla financing, but to get a lower rate from DCU and have Tesla rate match it. Since I’m now back at the ‘beginning’ stage of setting up my financing, what’s going the best option of doing this, and being able to get a MVPA doc since you don’t get one when you use Tesla Financing?

1) Setup the Self-Arranged Financing and when I get my MVPA and give it to DCU, then apply for a Tesla loan and ask them to rate match it?

2) Select Cash and then get a MVPA (do you even get one if you choose cash?) and give that to DCU to get a low rate, and then apply for a Tesla loan and ask them to rate match it?

3) Go back to Tesla Financing and select the numbers I want to use, then apply for the same amount with DCU and use my “Loan Doc” that I receive from Tesla for my DCU app? Will DCU even take that when applying for their loan?

Since I’m back to square one with setting up the financing, I wanted to do it the easiest way. Plus I was going to put down a little more on my initial down payment anyways so I can play with the financing numbers.

Mod Y Guy

Supporting Member

I “think” I know the answer to this. Haha. Someone else that knows better please correct me if I’m wrong. I basically was in the same spot, which many people are. I chose Tesla Financing right away and then found out you don’t get an MVPA going that route. I also didn’t care until I started shopping rates. 2.49% to 1.24% is about $25 a month so why not chase the lower rate I figured.I had my SA remove my existing Tesla financing so I could redo the numbers & down payment. However, she also mentioned to select “Self-Arranged Financing” for my payment option instead of Cash.

My goal is to use Tesla financing, but to get a lower rate from DCU and have Tesla rate match it. Since I’m now back at the ‘beginning’ stage of setting up my financing, what’s going the best option of doing this, and being able to get a MVPA doc since you don’t get one when you use Tesla Financing?

1) Setup the Self-Arranged Financing and when I get my MVPA and give it to DCU, then apply for a Tesla loan and ask them to rate match it?

2) Select Cash and then get a MVPA (do you even get one if you choose cash?) and give that to DCU to get a low rate, and then apply for a Tesla loan and ask them to rate match it?

3) Go back to Tesla Financing and select the numbers I want to use, then apply for the same amount with DCU and use my “Loan Doc” that I receive from Tesla for my DCU app? Will DCU even take that when applying for their loan?

Since I’m back to square one with setting up the financing, I wanted to do it the easiest way. Plus I was going to put down a little more on my initial down payment anyways so I can play with the financing numbers.

DCU won’t accept a “Loan Doc”. They want the MVPA. I believe choosing “Cash” or “Third Party Financing” are both fine. I literally just changed my payment option yesterday to paying with “Cash”. Doing that should in fact produce an MVPA once a VIN is assigned. I’ve already signed up for a DCU account and plan to have the 1.24% rate ready to send to rate match after I reapply with Tesla Financing. From reading all these posts, and getting help from other TMC members, I believe I should have success getting Tesla to rate match the 1.24% for 72 months, instead of 65. If not, I’ll just go with DCU and direct deposit only what is needed for my monthly payment on the Model Y.

Derrickd5

Member

Can we email you? CAnt dm yetI “think” I know the answer to this. Haha. Someone else that knows better please correct me if I’m wrong. I basically was in the same spot, which many people are. I chose Tesla Financing right away and then found out you don’t get an MVPA going that route. I also didn’t care until I started shopping rates. 2.49% to 1.24% is about $25 a month so why not chase the lower rate I figured.

DCU won’t accept a “Loan Doc”. They want the MVPA. I believe choosing “Cash” or “Third Party Financing” are both fine. I literally just changed my payment option yesterday to paying with “Cash”. Doing that should in fact produce an MVPA once a VIN is assigned. I’ve already signed up for a DCU account and plan to have the 1.24% rate ready to send to rate match after I reapply with Tesla Financing. From reading all these posts, and getting help from other TMC members, I believe I should have success getting Tesla to rate match the 1.24% for 72 months, instead of 65. If not, I’ll just go with DCU and direct deposit only what is needed for my monthly payment on the Model Y.

indianajns

Member

Found a Model Y Perf in existing stock and it will be delivered next week, Signed up with Tesla financing at 2.49% at 60 mo. Know I can get better at DCU. Talked to an SA yesterday and he said I can rate match that after I take delivery. After reading some of the posts here I'm not sure if that is possible? Can I refinance with DCU and ask tesla to rate match at that point (As long as its within 7 days of delivery)? Cheers and Thanks

I'm also interested in this as I'm not sure I'll have the DCU situation figured out before delivery but would like to match afterwards. I've heard it being done before but not sure how to go about it.Found a Model Y Perf in existing stock and it will be delivered next week, Signed up with Tesla financing at 2.49% at 60 mo. Know I can get better at DCU. Talked to an SA yesterday and he said I can rate match that after I take delivery. After reading some of the posts here I'm not sure if that is possible? Can I refinance with DCU and ask tesla to rate match at that point (As long as its within 7 days of delivery)? Cheers and Thanks

- Status

- Not open for further replies.

Similar threads

- Replies

- 3

- Views

- 2K

- Replies

- 697

- Views

- 43K

- Replies

- 40

- Views

- 8K

- Replies

- 4

- Views

- 2K

- Replies

- 1

- Views

- 713