Inspired by above, I have recently become interested in crypto, mostly because I see great potential in

smart contracts.

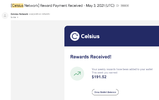

Financially, I can spare 1K$ for a play-account, for getting my feet wet.

My coding skills are *rusty*, but no contracts without code, so I guess I have to invest some time as well.

Initial 'research':

acc. to

wiki the default language for writing contracts, solidity, is not considered a mature language. Wikipedia actually boldly states that the obscurity/immaturity of solidity was partially to blame for the Dao affair. Sic.

Two takeaways: There was a security review pointing out the potential problem. Due to smart contracts being readable and open-source code this was actually discovered and published.

Very good! Hard to see how that would have happened in traditional finance without a whistleblower...!

Difficult to evaluate if solidity is a good language and has a good compiler without further study. One could hope that the DAO affair was a platform growing -up experience not to be repeated.

If DEFI is going to base future trillions of transactions of dollar-equivalent on code, the contract language and compiler (and EVM) had better be well-designed and built and vetted!

Questions:

- Any newbie advice? (wallets, trading platforms, development tips/starter kits or ...?)

- Anyone here writing contracts or doing development in this space and if yes, what are your takeaways/experiences?

- Are there tools to translate contracts into human language equivalent? (I know that solidity is what actually constitutes and executes the contract but written English can be easier/quicker to read than code when the language is new, and/or a supplement when learning to program contracts)