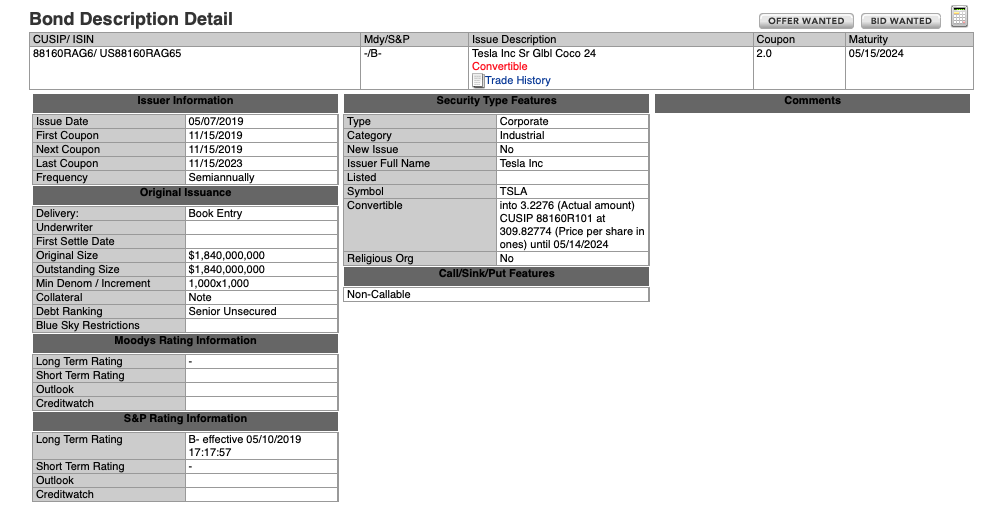

I bought some of Tesla's most recent convertible bonds. I haven't done much with bonds in general, and have a few questions.

Here's what ETrade says about the bond:

My first question is because I've tried to look it up and have conflicting answers. The coupon is 2%, and it's semi-annually. Does that mean that it is 2% per annum, or 4%? Edit: I guess I'll find out for sure in 7 days.

I can choose to convert it, since I'm the bondholder. It's effectively a call option with a strike of $309.82774. Tesla can't make that decision since it's non-callable. Investopedia basically says I should convert it if the current stock price minus the conversion price is greater than the expected interest (which is why the difference between 2% and 4% matters). Also I don't believe it... in case of bankxuptcy the bond is "more protected" and is returning interest, and I can just sit and convert it after the last coupon payment. Am I understanding correctly?

Here's what ETrade says about the bond:

My first question is because I've tried to look it up and have conflicting answers. The coupon is 2%, and it's semi-annually. Does that mean that it is 2% per annum, or 4%? Edit: I guess I'll find out for sure in 7 days.

I can choose to convert it, since I'm the bondholder. It's effectively a call option with a strike of $309.82774. Tesla can't make that decision since it's non-callable. Investopedia basically says I should convert it if the current stock price minus the conversion price is greater than the expected interest (which is why the difference between 2% and 4% matters). Also I don't believe it... in case of bankxuptcy the bond is "more protected" and is returning interest, and I can just sit and convert it after the last coupon payment. Am I understanding correctly?

Last edited: