Some people I've talked to in PA are very concerned that the landowners are getting rich, but everyone suffers from a degraded environment, heavy equipment on roads, and imperiled water supplies. As long as royalties are not spread more broadly, matching the impact on others', there's going to be a lot of resistance to extended hydro-fracturing.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Coal Loses to Natural Gas

- Thread starter vfx

- Start date

-

- Tags

- Energy Environment Policy

A Sea Change in U.S. Generation

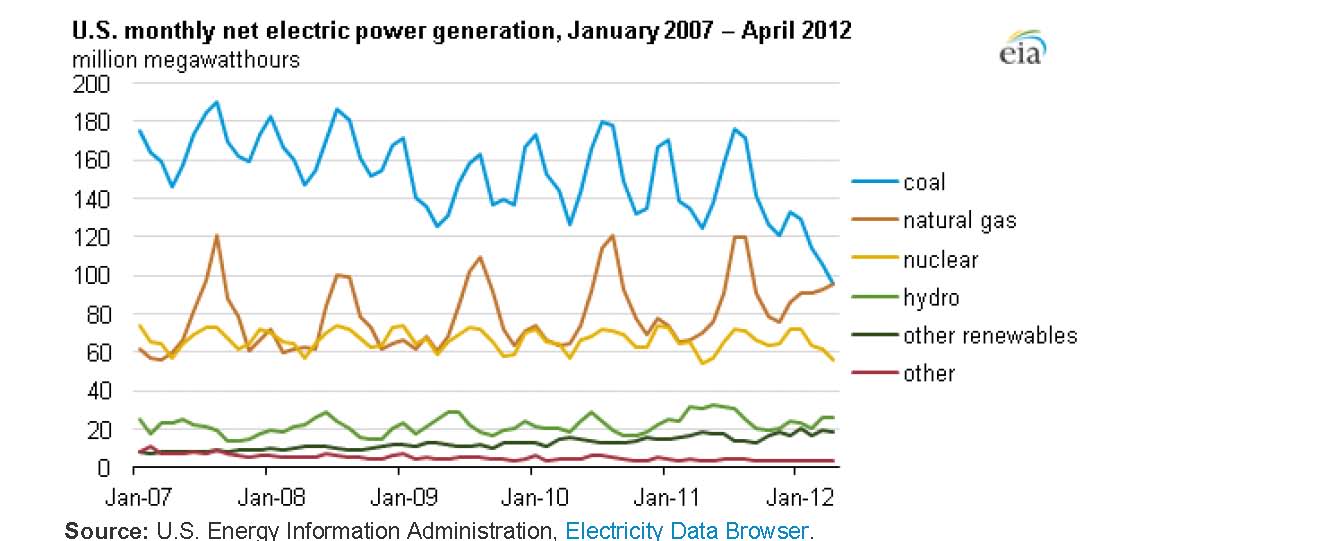

Ever since I can remember, a rough but useful rule of thumb to describe the sources of U.S. electricity generation is that 50% comes from coal-fired plants, 20% comes from nuclear, and the rest comes from natural gas, hydro, and various other renewable sources.

That steady relationship has been changing over the past few years and markedly so since the middle of 2011. So much so that this past Friday, the U.S. Energy Information Administration (EIA) announced that in April 2012, for the first time since EIA began collecting monthly data almost 40 years ago, generation from natural gas-fired plants was virtually equal to generation from coal-fired plants, with each fuel providing 32% of total megawatt-hours of power.

Ever since I can remember, a rough but useful rule of thumb to describe the sources of U.S. electricity generation is that 50% comes from coal-fired plants, 20% comes from nuclear, and the rest comes from natural gas, hydro, and various other renewable sources.

That steady relationship has been changing over the past few years and markedly so since the middle of 2011. So much so that this past Friday, the U.S. Energy Information Administration (EIA) announced that in April 2012, for the first time since EIA began collecting monthly data almost 40 years ago, generation from natural gas-fired plants was virtually equal to generation from coal-fired plants, with each fuel providing 32% of total megawatt-hours of power.

Citizen-T

Active Member

I'm bookmarking this for the next time someone writes in a comment that the electricity for an EV comes mostly from coal.

What makes this even more interesting is that very few of the announced coal plant closures have happened yet. Mostly they are slated for 2013/14, in advance of the new EPA regs that take effect in 2015.

JRP3

Hyperactive Member

One of the few coal plants we have here in NY that was shut down for the last few months has just started operating again :frown: I haven't seen any coal trains go by so they must just be testing with what's already on site.

That last 1/3 could fairly be called "zero-carbon sources".Messaging is:

The US grid is:

1/3 Natural Gas

1/3 Coal

1/3 Other (mostly renewable ('cept nukes))

rolosrevenge

Dr. EVS

Messaging is:

The US grid is:

1/3 Natural Gas

1/3 Coal

1/3 Other (mostly renewable ('cept nukes))

Since nukes are 20%, of the total, the remaining 33% is then mostly nukes.

In set notation:

{ Zero-carbon sources } = { Renewables } U { Nuclear }

It's always useful to note that oil (diesel, etc.) is a trivial fraction of electric generation fuels and almost entirely for "behind the meter" applications. IOW, if we didn't drive gas- and diesel-fueled cars, the U.S. wouldn't import oil. Even if we could halve the number of ICE vehicles, we wouldn't import oil.

{ Zero-carbon sources } = { Renewables } U { Nuclear }

It's always useful to note that oil (diesel, etc.) is a trivial fraction of electric generation fuels and almost entirely for "behind the meter" applications. IOW, if we didn't drive gas- and diesel-fueled cars, the U.S. wouldn't import oil. Even if we could halve the number of ICE vehicles, we wouldn't import oil.

I don't necessarily agree with the conclusion. Our consumption would go down (probably) but other forces (many political, some ideological) would yield lowering our domestic production rather than eliminating import entirely.In set notation:

{ Zero-carbon sources } = { Renewables } U { Nuclear }

It's always useful to note that oil (diesel, etc.) is a trivial fraction of electric generation fuels and almost entirely for "behind the meter" applications. IOW, if we didn't drive gas- and diesel-fueled cars, the U.S. wouldn't import oil. Even if we could halve the number of ICE vehicles, we wouldn't import oil.

I agree: Eliminating imports in an open economy is only possible with political edict. If prices for domestically produced oil exceed prices for imported oil, you will have imports. Mandating the import stop then leads to rising fuel prices, and I can imagine what public reaction that would spur.

Back to electricity grid mix. A similar discussion erupted in Germany: What is the point of shutting down nuclear plants, when electricity imported from European neighbor countries is generated using nuclear? As long as energy is traded across a region's borders, you cannot have your desired grid mix by regulating production in that one region.

Back to electricity grid mix. A similar discussion erupted in Germany: What is the point of shutting down nuclear plants, when electricity imported from European neighbor countries is generated using nuclear? As long as energy is traded across a region's borders, you cannot have your desired grid mix by regulating production in that one region.

Presumably because the "Chernobyl effect" would afflict some country other than your own. Germany is exporting nuclear risk, but continuing to pollute its air from coal power plants. Personally, I find this an odd balance: given the certainty of air pollution vs. the extremely small likelihood of a nuclear catastrophe, I would choose the latter. But that's a question that's certainly open to debate. Some would accuse me of setting up a false choice: close the nukes and build lots of renewables, improve energy efficiency, and have flexible demand. That's a very intriguing vision for the future grid, but there's a time gap in the resource planning that, in Germany, only coal can fill.What is the point of shutting down nuclear plants, when electricity imported from European neighbor countries is generated using nuclear? As long as energy is traded across a region's borders, you cannot have your desired grid mix by regulating production in that one region.

We import lots of stuff, leaving the associated risks with the producers. Clothing. Food (especially meat, Soy bean, Cocoa, Coffee). Electronics. Oil + Coal + NG. Modules for solar panels. Rare earth metals. So do most 'developed' countries.

All these produce emissions and harm the environment in the developing countries. China has 1/3 of its CO2 emissions attributed to exports. It's the back side of global trade between participants with different social & ecological standards. The German standard just was risen to "no nuclear plants older than 31 years, please" (edit: pre-1980).

I hope we find a better way than to chose between coal and nuclear. Germany installs some 7.5GW solar and 2GW wind annually. Solar and wind production in 2011 was 18.5TWh and 48TWh, respectively, of total production 579TWh. It takes boldness to go further, along with smart grid and electric power storage. Then we can say good bye, coal.

All these produce emissions and harm the environment in the developing countries. China has 1/3 of its CO2 emissions attributed to exports. It's the back side of global trade between participants with different social & ecological standards. The German standard just was risen to "no nuclear plants older than 31 years, please" (edit: pre-1980).

I hope we find a better way than to chose between coal and nuclear. Germany installs some 7.5GW solar and 2GW wind annually. Solar and wind production in 2011 was 18.5TWh and 48TWh, respectively, of total production 579TWh. It takes boldness to go further, along with smart grid and electric power storage. Then we can say good bye, coal.

Disagree. And no, that's not what I was suggesting.Eliminating imports in an open economy is only possible with political edict.

My point was that it's currently not at the top of the priorities to stop importing. It's near the top of some talking points, but it's never been at the top of the actual priorities. If it was, we'd see other actions and policies.

JRP3

Hyperactive Member

Glenn Doty is expecting NG prices to rise soon, reversing it's popularity as a generating fuel: Winter Is Coming - Natural Gas Prices Must Rise - Seeking Alpha

SByer

'08 #383

What worries me with the rapid decline in NG prices is that fracking is very under-regulated right now, and that can't last; in spite of all the empty promises from oil executives, it's a dangerous process and will end up being regulated, and that transition is likely to be a little jarring. I hope that transition doesn't end up bringing back any coal.

Glenn could have simply pointed to the NYMEX forward prices for natural gas. On open outcry, August closed today at $2.88/MMBtu; February (the winter peak) closed at $3.56. That's a pretty normal summer/winter spread. More interestingly, August 2013 closed at $3.64, and Feb 2014 closed at $4.10. The market is clearly seeing a trend increase in the price of NG, but disagrees with Glenn's thinking that there will be a crunch this winter.Glenn Doty is expecting NG prices to rise soon, reversing it's popularity as a generating fuel: Winter Is Coming - Natural Gas Prices Must Rise - Seeking Alpha

JRP3

Hyperactive Member

I guess the question is how accurate has the prediction been in the past, and how often are they updated to reflect changes? Also, at what point does increasing NG pricing make coal more competitive?

All predictions are wrong, but the NYMEX forwards have the advantage of $$millions being traded on these numbers -- this is not just the speculation of some blogger, but how serious market participants hedge future risk of prices rising or falling.I guess the question is how accurate has the prediction been in the past, and how often are they updated to reflect changes? Also, at what point does increasing NG pricing make coal more competitive?

There's no crossover point, where coal suddenly pops back onto the radar. Coal-fired generators have a range of efficiencies and fuel costs (depending on what sorts of coal they can burn and transportation costs), as do gas-fired plants. At this point, though, the retire/retrofit decisions have largely been made, and so gigawatts of coal-fired gen (mostly, the oldest and most-polluting) will be shut down by 2015, barring some radical shift in the landscape (e.g., a national ban on hydro-fracturing).

Similar threads

- Replies

- 14

- Views

- 2K

- Replies

- 19

- Views

- 1K

- Replies

- 19

- Views

- 4K

- Replies

- 3

- Views

- 1K

- Replies

- 10

- Views

- 582