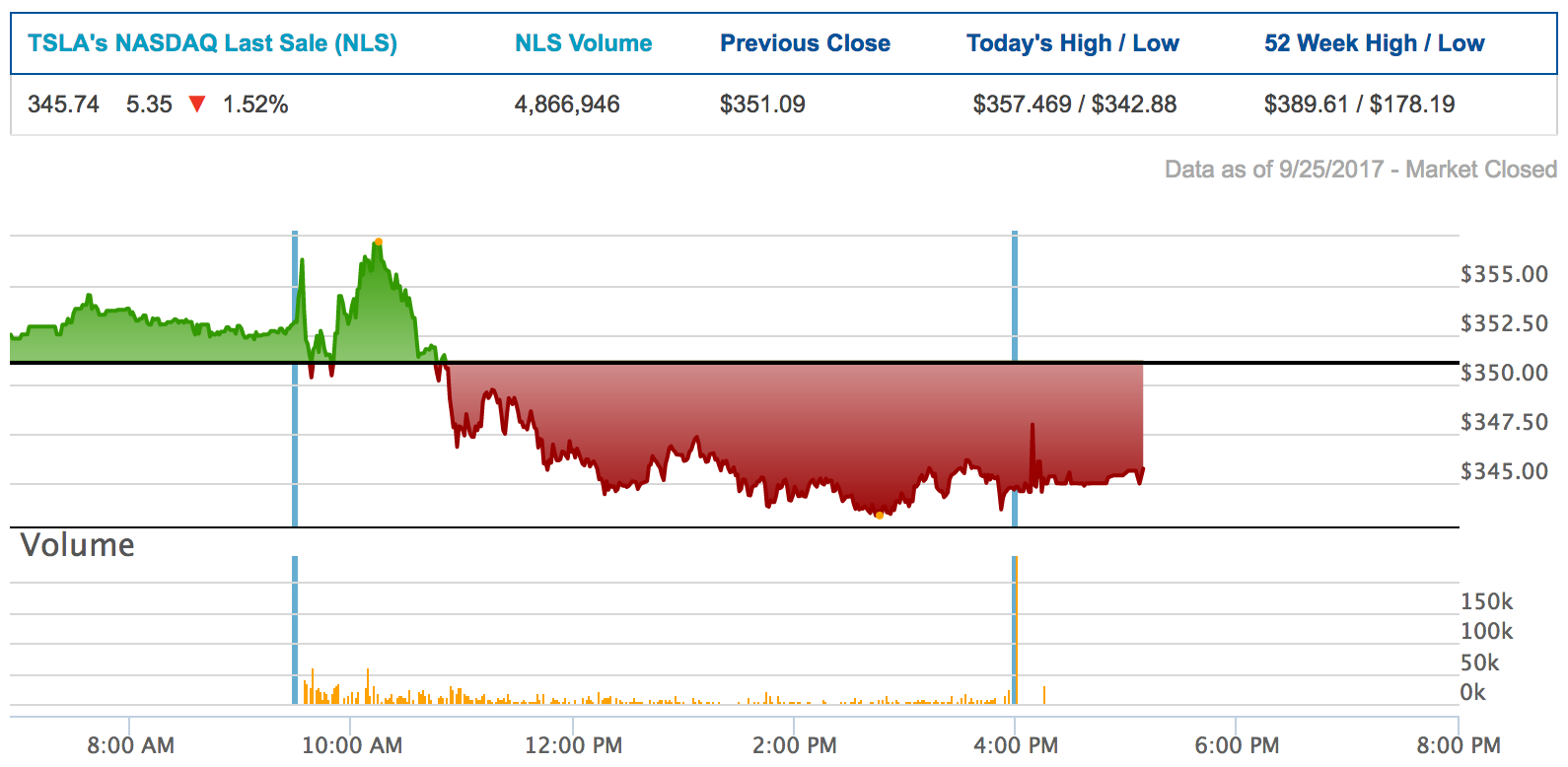

The day began with neither bulls nor bears trading many shares for the first couple of minutes on a Monday morning. It was eerie. The opening minute saw only 100 shares traded. Then bulls bid the price up a few dollars, shorts responded with selling and pushed the SP slightly into the red with good volume, the cycle repeated, and then the bulls bid TSLA above 357 in lively trading. Unfortunately, the shorts caught a lucky break with the NASDAQ making a dip beginning about 10:15 am, and TSLA followed it down. When the NASDAQ started recovering, shorts imposed the Sticky Dip strategy of pushed the stock even lower after the NASDAQ dip and with the morning rally squashed, the day belonged to the shorts. Notice the many deep dips, followed by immediate near-recoveries, which strongly suggests short-selling in blocks to keep nudging the stock price lower. The likely goal of the shorts? TSLA investors have found the 100 day moving average to be a strong support level over the previous six months (see chart below). With the 100DMA at 344.99 it took a lot of pushing to get the stock down that low. TSLA was at 343 and some change in a dip 8 minutes before closing and closed just a smidgen below the 100 dma at 344.78. Look at the 345 line and you can see that TSLA kept recovering from transgressions below that line. In after-market trading, TSLA is once again above the 100 DMA.

Was the market fooled that the 100 DMA had fallen? I think not because the volume during the final minute of trading was an enormous 242,000 shares, one of the highest closing volumes I have seen. Similarly, TSLA has recovered by about 80 cents as I write this, which again suggests that traders think tomorrow will be a better day. Will it? TSLA's trajectory tomorrow depends upon news, FUD, MACROs, and how much commitment shorts are willing to make to see the SP go lower. Today is also a good reason why technicals matter, if for no other reason than a great many large traders, both longs and shorts, believe in them.

Backing up a bit, TSLA was in a position to break out of a narrowing consolidation triangle around 350 when it broke upwards about two weeks ago and momentum carried it to a new ATH (by a small margin). Most of us expected the run upwards to a new ATH to be based upon confirmation that Model 3 is ramping up at a good rate, but the market jumped the gun and ran up from the consolidation triangle in anticipation of good news. The confirmation of successful ramping up has not been evident yet, though, and so this rally (which was based upon beating others to buying the stock before the good news actually came out) was an easy target for a sophisticated bear attack. Member

@techmaven cautioned us about the lack of confirmation of Model 3 production ramping up, but the buying frenzy was already too tempting for many of us. The combination of the Jefferies note, strategic short selling, and down macros led to a drop, and TSLA investors are careful about catching falling knives, so buyers have largely been standing on the sidelines, waiting for the stock price to bottom out. Now the 100 day moving average offers a historically significant support level, and of course the shorts are aiming at taking TSLA below that level for that very reason. Will they succeed? The 100 DMA's history, the volume of buying at close and the upward trend of the SP in after-market trading suggests no, but the ferocity of the shorts' selling must be factored in too.

I agree with

@bdy0627 that shorts for the most part held their fire until a small rally had transpired before using most of their ammunition. They've recently learned the power of the Sticky Dip, where the NASDSAQ's dip is used to pull the stock price down and then the capping and block selling by the shorts is used to either hold it, or (more often these days) depress it further. Most TSLA traders are aware of the mandatory morning dip, capping, and slow descent into close now, but now we need to identify the Sticky Dip when it is used, so that we don't confuse the tactics of the shorts with the reasonable workings of the market. Also, I think shorts are cautious about using the mandatory morning dip right now because a dip on opening that is defeated quickly can be the catalyst to a significant run up of the stock. They're being careful to not be caught failing right now, which is part of the reason for using this new tactic, the Sticky Dip.

TSLA still has an amazing 2018 ahead of it, but first we need to stabilize the price. Then, when true evidence of a successful Model 3 ramp up does become known, it's off to the races again and a new ATH is going to occur. That new ATH is much more likely to hold and be built upon, however, because it will be based upon successful execution by Tesla and not upon anticipation of good news at some future date.

Conditions:

* Dow down 54 (0.24%)

* NASDAQ down 56 (0.88%)

* TSLA 344.78, down 6.31 (1.80%)

* TSLA volume 7.3M shares

* Oil 52.22, up 1.56 (3.08%)