Hi all,

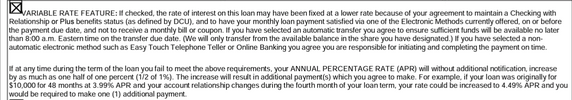

I'm potentially going to go with DCU for an auto loan, but I was wondering if it has always been "Rate is subject to change after consummation" i.e. a non-fixed rate. Is this in reference to the difference in rates (i.e. setting up direct deposit, buying an EV, etc)?

Thanks.

I'm potentially going to go with DCU for an auto loan, but I was wondering if it has always been "Rate is subject to change after consummation" i.e. a non-fixed rate. Is this in reference to the difference in rates (i.e. setting up direct deposit, buying an EV, etc)?

Thanks.