Someone posted here that the lot at Charlotte had appx 300 cars. But there are off-site storage fleet sites too, like Lathrop.

Dennis has good number estimates but the amount of service loaners is quite large and if you compute in the old $2000 per car for the supercharger network, I assume there is a similar, if not more, $3000 per car to handle service fleet costs that can be reduced as the cars are sold and the miles driven on them written off along with the discounting for age and other changes needed to complete the sale of the loaner vehicle. Dilution of the fleet valuation through discounted loaners does impact the eventual trade-in and value of used cars longer-term. They're able to sell more so the uniqueness drops as well so I don't get why someone wants to pay full price when buying "their own" custom order other than "they made it for me!" novelty. I have to think if the 12000 number is true, there's a car that matches nearly everyone's configuration somewhere and at a reasonably savings. Someone else posted here that after the car was on the lot for 30 days, the sales associated was sort-of surprised that it had an automatic $3600 discount.

Tesla can sell more off the inventory by listing it out in larger volume than they do. Making it seem like there is "light" inventory keeps what they actually do have in inventory quietly silent. And why charge $2000 transit fee for a car that is still in Fremont for someone who actually does pick up one off the inventory list? Ship it for free as if it were a custom order. I suspect the web site changes coming are possibly intended to allow for better inventory searching that will include new and loaner-program units.

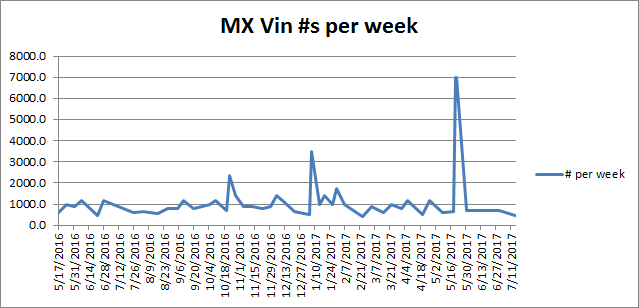

In terms of Model X inventory, Jon McNeil's claim for MX inventory may have been the vin #s planned out here - can you spot the spike? two 1000 Vin # blocks done in one day each. 52xxx and 53xxx on 5/20-5/21. Otherwise, average weekly vins following that have been 700wk. Waiting to see when 58999 comes about.

Dennis has good number estimates but the amount of service loaners is quite large and if you compute in the old $2000 per car for the supercharger network, I assume there is a similar, if not more, $3000 per car to handle service fleet costs that can be reduced as the cars are sold and the miles driven on them written off along with the discounting for age and other changes needed to complete the sale of the loaner vehicle. Dilution of the fleet valuation through discounted loaners does impact the eventual trade-in and value of used cars longer-term. They're able to sell more so the uniqueness drops as well so I don't get why someone wants to pay full price when buying "their own" custom order other than "they made it for me!" novelty. I have to think if the 12000 number is true, there's a car that matches nearly everyone's configuration somewhere and at a reasonably savings. Someone else posted here that after the car was on the lot for 30 days, the sales associated was sort-of surprised that it had an automatic $3600 discount.

Tesla can sell more off the inventory by listing it out in larger volume than they do. Making it seem like there is "light" inventory keeps what they actually do have in inventory quietly silent. And why charge $2000 transit fee for a car that is still in Fremont for someone who actually does pick up one off the inventory list? Ship it for free as if it were a custom order. I suspect the web site changes coming are possibly intended to allow for better inventory searching that will include new and loaner-program units.

In terms of Model X inventory, Jon McNeil's claim for MX inventory may have been the vin #s planned out here - can you spot the spike? two 1000 Vin # blocks done in one day each. 52xxx and 53xxx on 5/20-5/21. Otherwise, average weekly vins following that have been 700wk. Waiting to see when 58999 comes about.

Last edited: