WTI $87.7/bbl

Brent $94.0/bbl

NL TTF gas €115MWh (EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

ZPPN woes

www.world-nuclear-news.org

and

www.world-nuclear-news.org

and

www.world-nuclear-news.org

www.world-nuclear-news.org

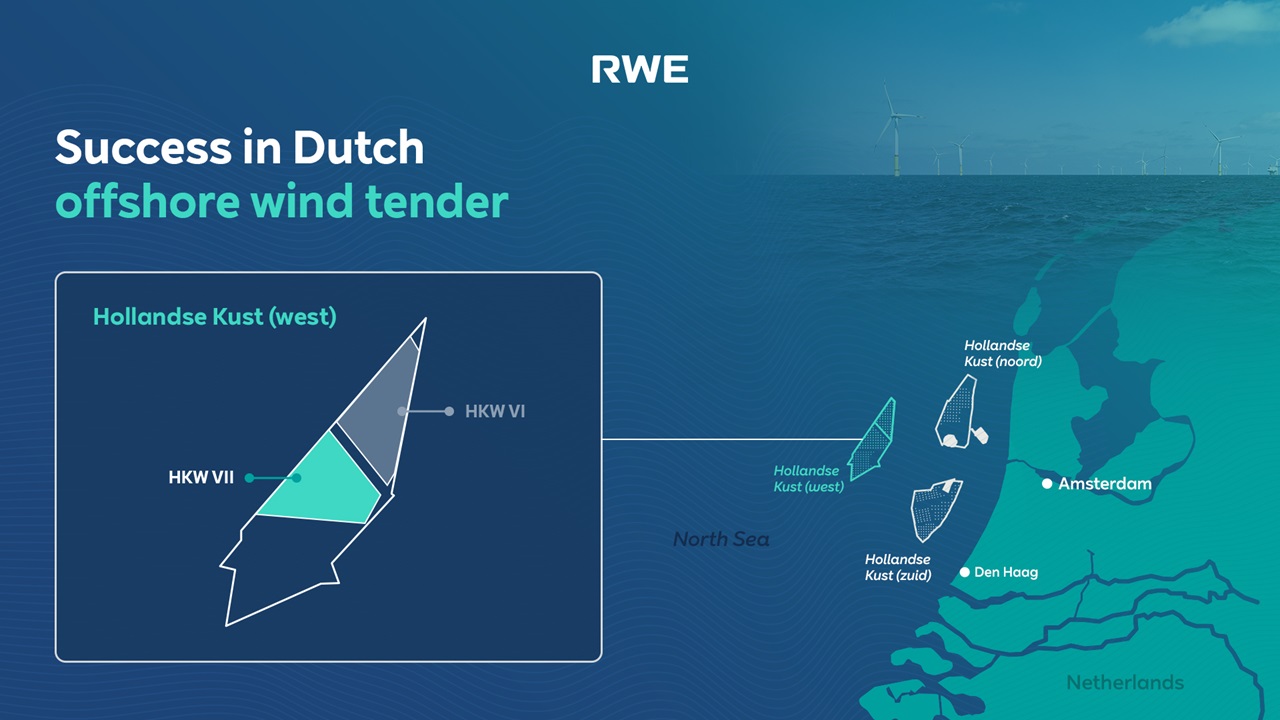

USA offshore delays cause spiralling costs and .... further delays

www.renewableenergyworld.com

www.renewableenergyworld.com

EU in a hurry

www.pv-magazine.com

www.pv-magazine.com

France in a hurry

www.world-nuclear-news.org

www.world-nuclear-news.org

and Poland

www.world-nuclear-news.org

www.world-nuclear-news.org

Finland not hurrying

www.world-nuclear-news.org

www.world-nuclear-news.org

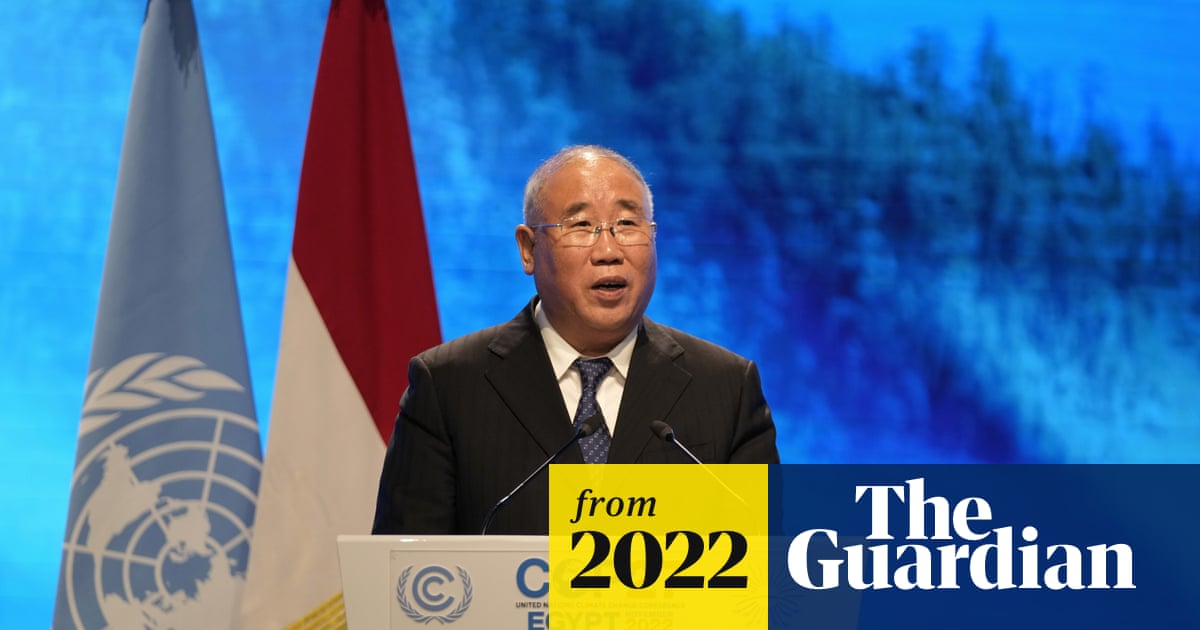

Ammonia - Egypt - Germany

www.pv-magazine.com

www.pv-magazine.com

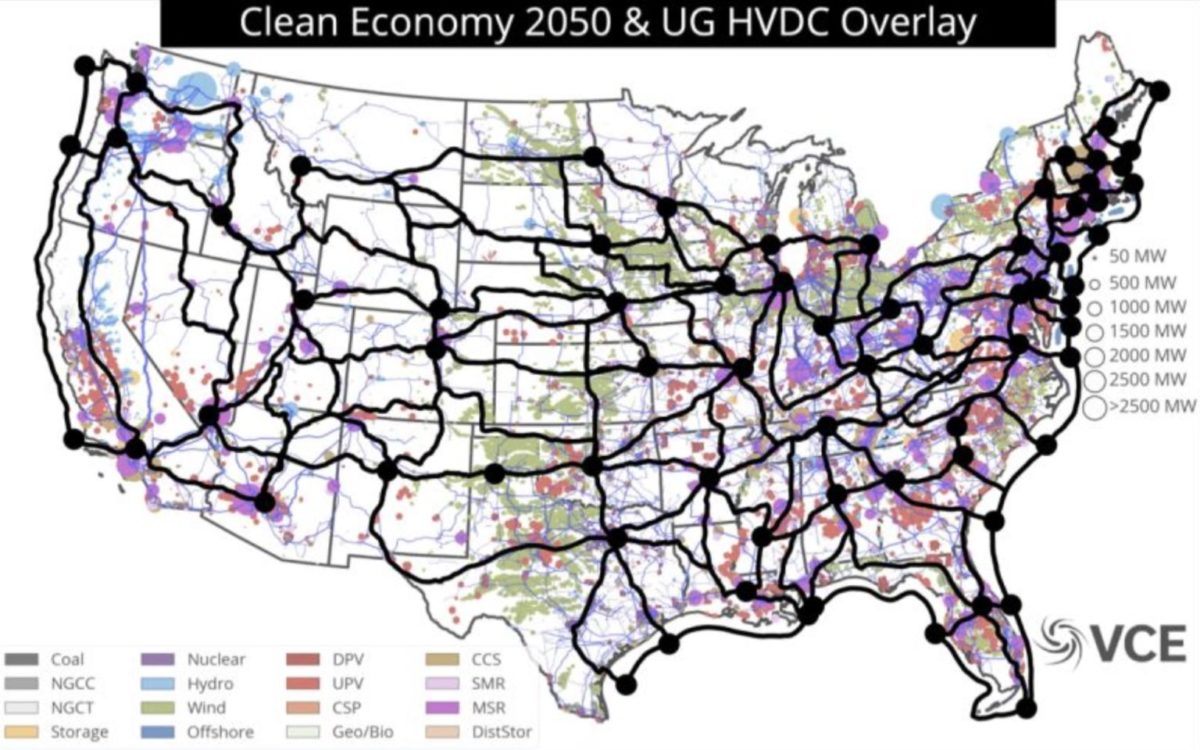

Storage helped California

www.utilitydive.com

www.utilitydive.com

10-days China-Europe fixed

www.railfreight.com

www.railfreight.com

Brent $94.0/bbl

NL TTF gas €115MWh (EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

ZPPN woes

Zaporizhzhia reconnected, but 'it can’t go on like this', says IAEA : Regulation & Safety - World Nuclear News

Power supplies were reconnected to Ukraine and Europe’s largest nuclear power plant after two days of relying on emergency diesel generators, but International Atomic Energy Agency Director General Rafael Mariano Grossi says a safety zone around the plant must be established "before it is too late".

Zaporizhzhia relying on diesel generators after losing off-site power : Regulation & Safety - World Nuclear News

The Zaporizhzhia nuclear power plant's connection to its main 750 kV power line and its 330 kV back-up off-site power supply were lost late on Wednesday, with its emergency generators automatically switching on to provide the necessary power.

USA offshore delays cause spiralling costs and .... further delays

Regulators scold Avangrid over timing of 'no longer viable' claim for offshore wind

Regulators scold Avangrid over timing of 'no longer viable' claim for offshore wind Wind Power - Renewable Energy World

EU in a hurry

European Commission aims to accelerate renewable permits

The European Commission wants to bridge the time until the revised Renewable Energy Directive RED IV has been passed and translated into national law, partly by improving conditions for PV systems up to 50 KW in size.

France in a hurry

France outlines plans to speed new nuclear : New Nuclear - World Nuclear News

The French Council of Ministers has approved draft legislation intended to streamline the administrative and bureaucratic processes needed to build new nuclear power plants near, or within, existing sites.

and Poland

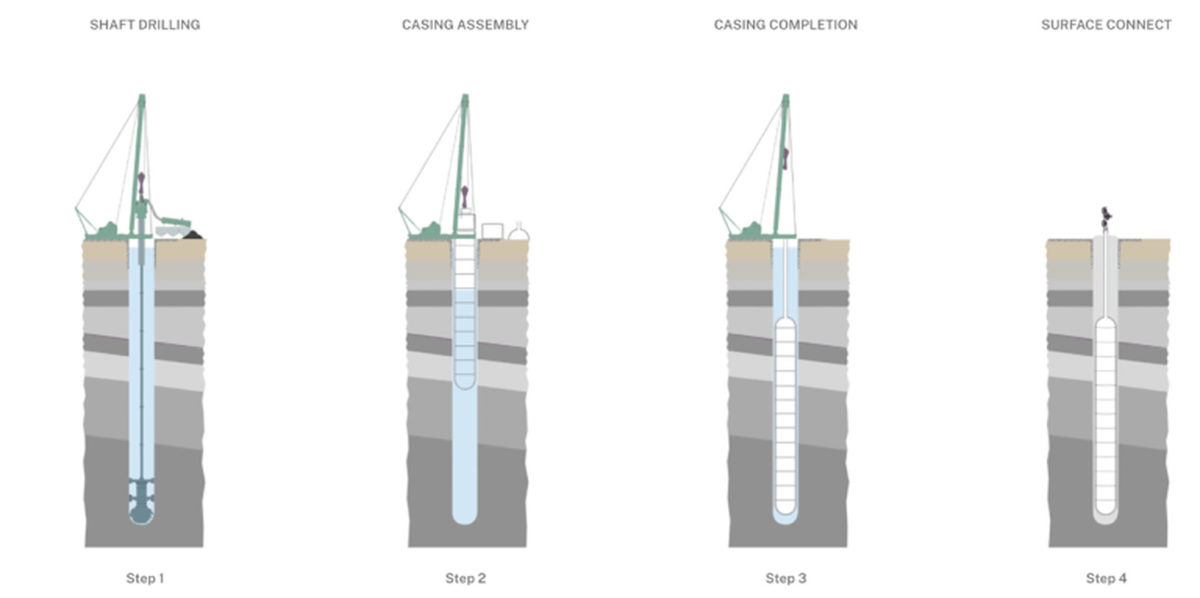

Poland's government confirms Westinghouse for nuclear plant : New Nuclear - World Nuclear News

The Council of Ministers has formally approved the decision that the first nuclear power plant in Poland will use three Westinghouse AP1000 reactors - with the US company calling it an "historic day" as it looks to build a fleet of the reactors in central Europe.

Finland not hurrying

Cause of OL3 feedwater pump damage yet to be determined : New Nuclear - World Nuclear News

It is not yet known when commissioning tests will resume at the Olkiluoto 3 EPR in Finland as investigations into the cause of damage in the feedwater pumps continue, Teollisuuden Voima Oyj has said.

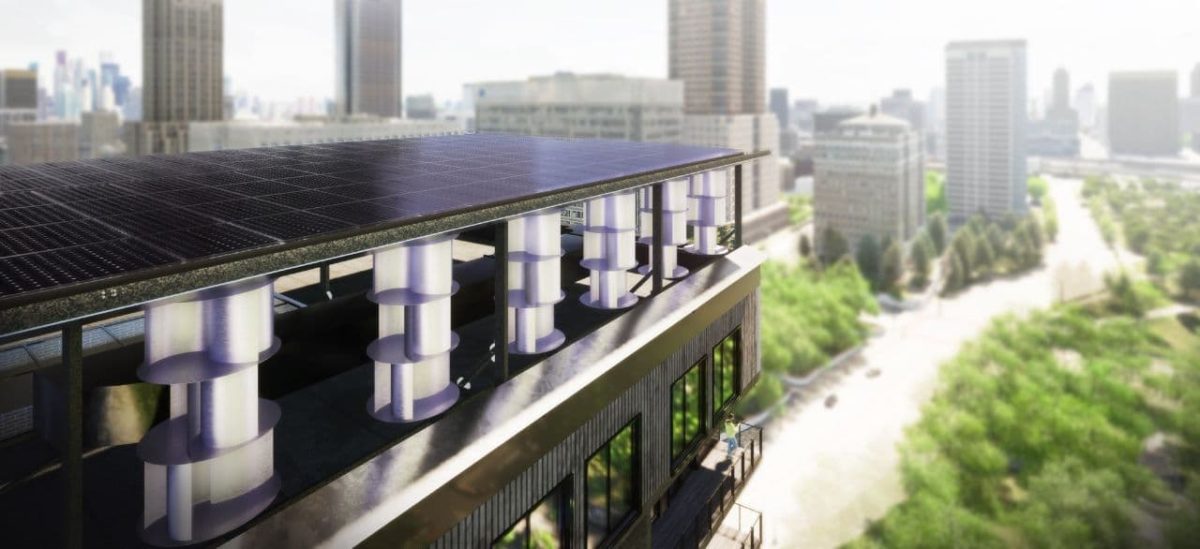

Ammonia - Egypt - Germany

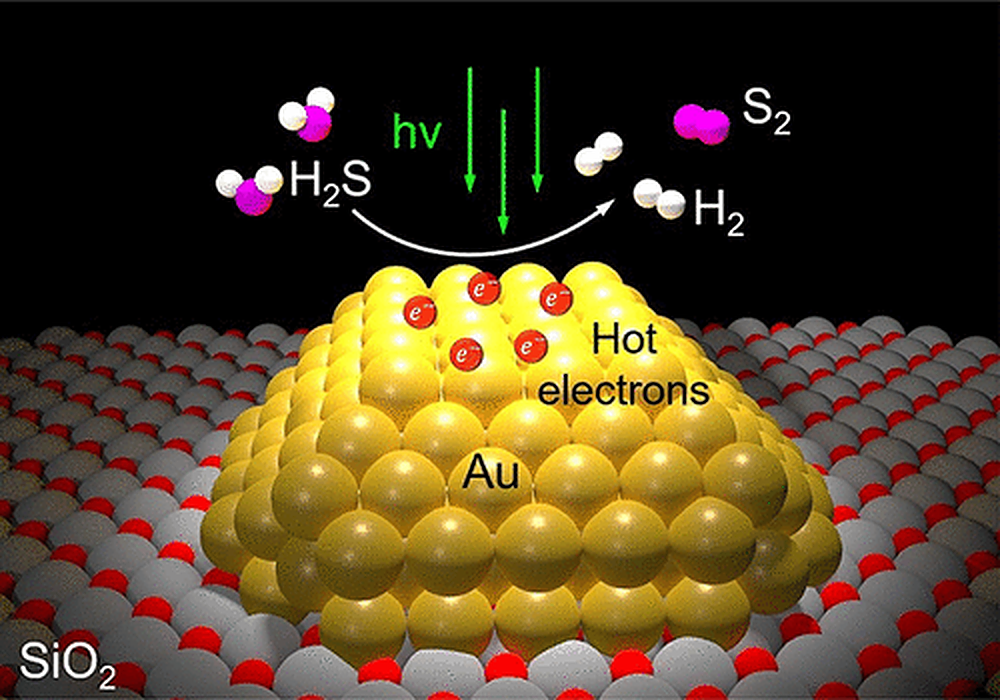

The Hydrogen Stream: Hydrogen production from industrial byproducts

US scientists have reported efficient plasmonic photocatalysis for the production of hydrogen from hydrogen sulfide, with no external heat source. Egypt, meanwhile, has started commissioning Africa's first integrated green hydrogen plant.

Storage helped California

CAISO avoided outages in September heat wave – a ‘remarkable outcome’ – with 4 GW storage, conservation

The state’s gas-fired plants were “critical” during the worst of the heat wave, but some were unavailable at times, California’s grid operator said in a report.

10-days China-Europe fixed

New Silk Road record: Xi’an-Duisburg in 10 days with fixed timetable

A record transit time was achieved for a train journey from Xi’an in China to Duisburg in Germany. The distance was covered in ten days, thanks to the newly established fixed timetable on the route. With this timetable, the train operates as if it is a long-distance passenger train. The regular...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/URD5QHQGONKI7GUIJCUCW2EHXQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CTGLAJPSNVNUJKYGEMNBNCEIDQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/NPTHDUDKLFKVJASVMVWOZF3TSY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5S44ATJR7JJU5GI3IIHXAT3R5E.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RRZUA3SZ4ZP2VBVGUKUO5PAU4E.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7XQ3XLLSLFN6TGJ3NQ6Q5PAR6U.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/AXWCEG2DRZKKZBBFCRP5AXEEQ4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Z24OM6EX5FMPLNT56PD42JJNGQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7D5EPY76P5JK7EARDQW3GLNRE4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6MVIOUHL7RMODDWZFEQZRZK2IQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YFC462FKSNIWJO4UWXY6KHZSN4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/P6HJEQK4NFPLNGUOFP3OF4XB3I.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DVDLWUIXCFLARAZJCQMQ5AKSCM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IYL3IGAH6VNGTHS2OJ22XLVFUY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/L6JDS673YRPT5ESPTUNR55ONBM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MAIIUDLJ65L45I5WXKVSNNRXXY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/45B5U7BAGZNW3IBNQC64H3D5HI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3FW4NSBTGJLGFIKLSGNLOEGUSA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5JC54N622FJ2PFTMADB7RLEZCE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MEIVTKAYJVPPNORFWFUONTOO7A.jpg)