WTI $110.3

Brent $112.5

I've been wondering when this bad penny might drop, those LG pouch cells gotta go somewhere

www.pv-magazine.com

which followed

www.pv-magazine.com

which followed

www.solarquotes.com.au

www.solarquotes.com.au

Siemens moves

www.offshorewind.biz

www.offshorewind.biz

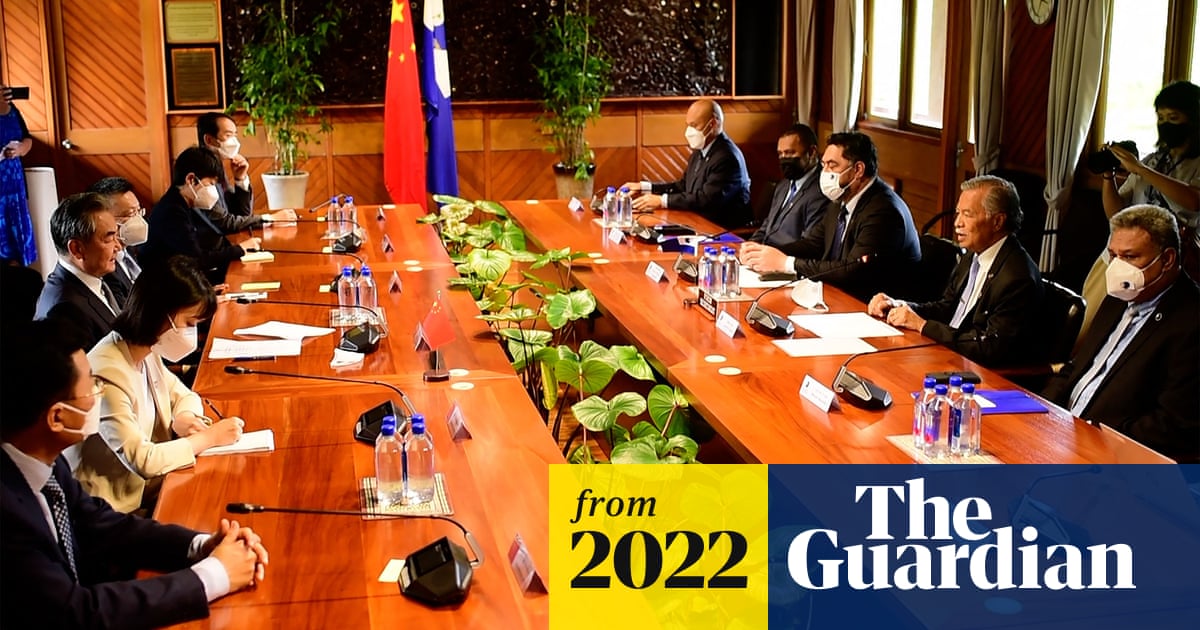

Another line in the sand, more clearly, Taiwan, (US officials rush to say no change)

www.theguardian.com

or

www.theguardian.com

or

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HNUYDHWPOJPLPKRRQKXKA5PWKE.jpg)

www.reuters.com

www.reuters.com

EU strategy critique

www.energymonitor.ai

www.energymonitor.ai

Going without Russia

www.energymonitor.ai

www.energymonitor.ai

German manufacturing suffers

www.energymonitor.ai

www.energymonitor.ai

Refiners ponder

www.thenationalnews.com

www.thenationalnews.com

No *sugar*, doubletalk

www.theguardian.com

www.theguardian.com

UK attempts to stick finger in manufacturing dyke

www.offshorewind.biz

www.offshorewind.biz

More islands

www.offshorewind.biz

www.offshorewind.biz

and that Hungary blocking EU thing ...........

www.euractiv.com

www.euractiv.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QIRK7CFNGVNVHFKMW465ZNMFGA.jpg)

www.reuters.com

www.reuters.com

euobserver.com

probably related .....

euobserver.com

probably related .....

www.rferl.org

www.rferl.org

Brent $112.5

I've been wondering when this bad penny might drop, those LG pouch cells gotta go somewhere

Australia’s consumer watchdog warns about LG home batteries

The Australian Competition and Consumer Commission has issued a call for homeowners to check their residential energy storage systems, amid a national recall of that batteries due to concerns about overheating.

Australian LG Chem Solar Battery Recall Announced

LG Energy Solution Australia issues a recall notice for various LG Chem RESU models and battery packs with cells from specific production lots

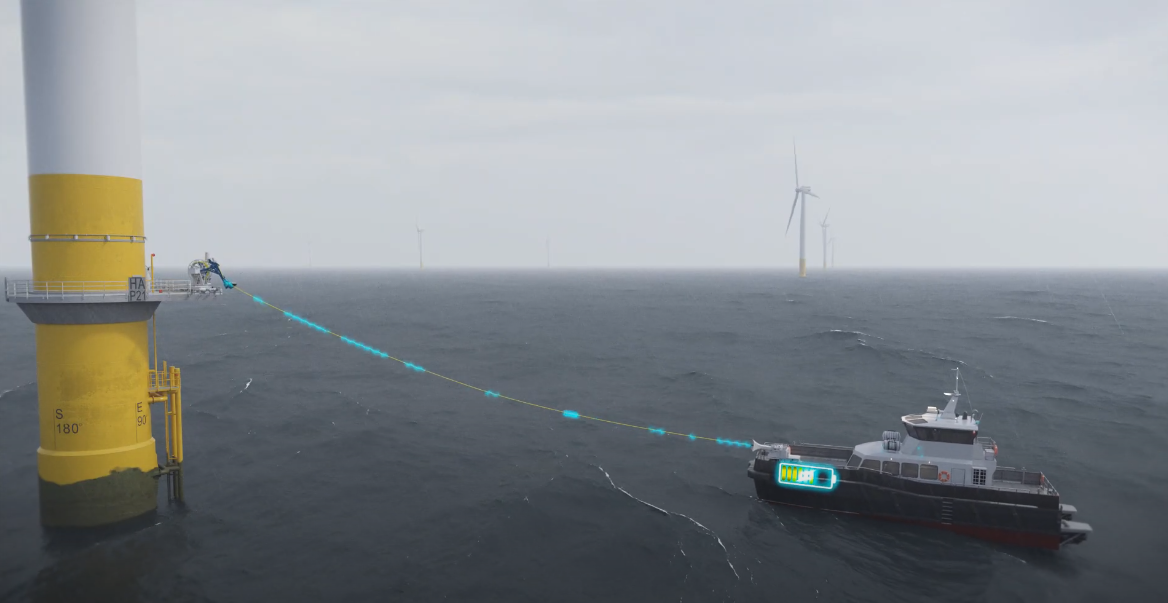

Siemens moves

Siemens Energy Makes EUR 4.04 Billion Siemens Gamesa Takeover Offer

Siemens Energy has launched a voluntary cash tender offer to acquire all outstanding shares in Siemens Gamesa Renewable Energy, or approximately 32.9 per cent of Siemens Gamesa's share capital which it does not already own.

Another line in the sand, more clearly, Taiwan, (US officials rush to say no change)

US would defend Taiwan if attacked by China, says Joe Biden

President says US’s responsibility to protect island is ‘even stronger’ after Russia’s invasion of Ukraine

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HNUYDHWPOJPLPKRRQKXKA5PWKE.jpg)

Biden says he would be willing to use force to defend Taiwan against China

U.S. President Joe Biden said on Monday he would be willing to use force to defend Taiwan against Chinese aggression in a comment that seemed to stretch the limits of the ambiguous U.S. policy towards the self-ruled island.

EU strategy critique

Opinion: REPowerEU can’t decide if it’s a climate or fossil plan

The European Commission's new REPowerEU package seems to be weighted toward replacing Russian fossil fuels with other fossil fuels.

Going without Russia

Weekly data: Can Bulgaria live without Russian gas?

Will LNG and interconnectors enable Bulgaria to survive what was unthinkable just weeks ago, an end to Russian gas imports?

German manufacturing suffers

How can a wind turbine factory still be closing in Europe in 2022?

German wind turbine manufacturer Nordex SE is due to close the country's last blade factory in June. How did we get here?

Refiners ponder

Business is booming for oil refiners but they are also facing a dilemma

Global refining margins – the gross profit for processing one barrel of crude – typically hover between $2 and $5

No *sugar*, doubletalk

Shell consultant quits, accusing firm of ‘extreme harms’ to environment

Caroline Dennett tells staff in video she made decision because of ‘double-talk on climate’

UK attempts to stick finger in manufacturing dyke

UK Opens GBP 160 Million Floating Offshore Wind Funding Round

The UK government has opened the GBP 160 million Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) for expressions of interest.

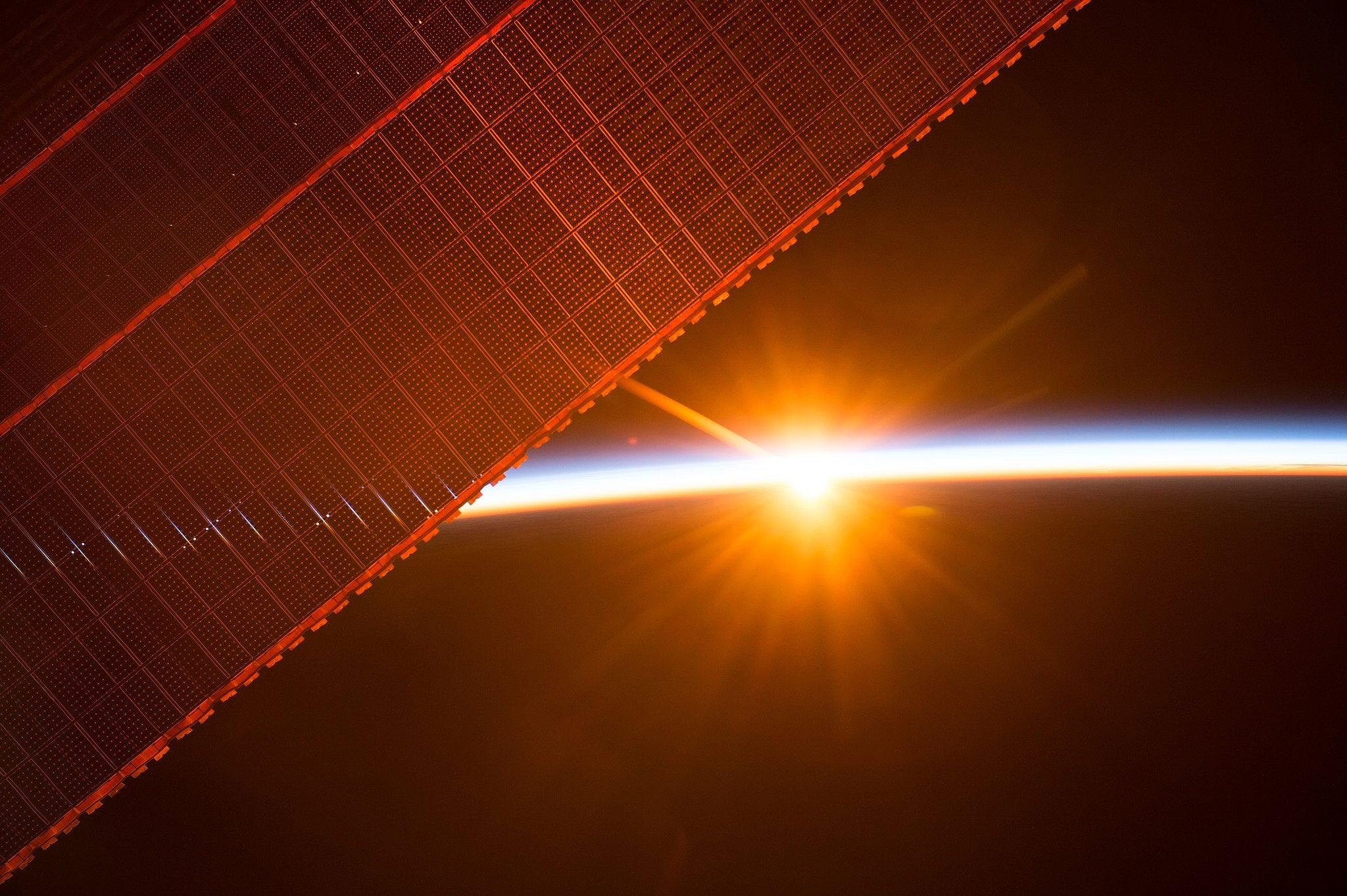

More islands

CIP Unveils Plans for Offshore Wind-to-Green Hydrogen Energy Islands in Germany and Denmark

Copenhagen Infrastructure Partners (CIP) has unveiled plans to build an artificial island dedicated to large-scale production of green hydrogen from offshore wind in Denmark and has entered an agreement with Allianz Investment Management (AIM) to perform a feasibility study for a similar project...

and that Hungary blocking EU thing ...........

EU reputation at stake as Hungary continues to block Russia sanctions

The EU has not found consensus on the new sanction package against Russia and an agreement could be still 'a week or two' away, EU's chief diplomat Josep Borrell said on 17 May, as Hungary said it would not lift its veto.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QIRK7CFNGVNVHFKMW465ZNMFGA.jpg)

Hungary must work with EU on Russian oil embargo, Germany's economy minister says

German Economy Minister Robert Habeck has warned Hungary against blocking efforts to impose an European Union-wide embargo on Russian oil imports in response to the war in Ukraine.

[Ticker] Germany would back Russia oil embargo without Hungary

German economy minister Robert Habeck has warned Hungary against blocking efforts to impose an EU-wide embargo on Russian oil imports in response to the war in Ukraine, Reuters reported. But the minister also added Germany would support the EU going ahead...

EU Commission Launches Procedure That Could Cut Funding To Hungary

The European Union's executive arm has started a disciplinary procedure against Hungary that could lead to the freezing of EU funds for backsliding on democratic norms.

www.rferl.org

www.rferl.org

Last edited:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/U3T2MDUIOZISZK6GEUOP6J6JAA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VRDUFF6UZRPSDO4X7YSI6OEMGM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2NQ7LEYJN5PXVN6TDHHOFXMGP4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2XLVPT75IROYPCKNNM5TDD6GYA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IBOO24U7YROBNFNLREMINS2ZTA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MZR4CKUWRRPE7GFI67AEWS543Q.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CFXQKPEMS5PZHKK7TGICEJBAXE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LONJUV6IBVNCVDEXKBV6R3AOTI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4DS73O2JNNMERFUFMFZQGKITPU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LBYXTADTHNLV3A2BFIUNFLFKNE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QNSLMD2O6BNCBFQDB35MR5BAGI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2N7IIWPYQVJ7DOA6H43J3RIWJE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ECY2MZGNFBJ5FKZWIOZWTP7OJI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ADPOVHXN2BOSHPGCHY4WRLLNNA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RDZ6H6H74BM25KEV72Z7G3HNSU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LIVKGSNQ7ZPNZFVI5CFFO4352I.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LIEQWCPZBVIZTELV3QUFKTRUAI.jpg)