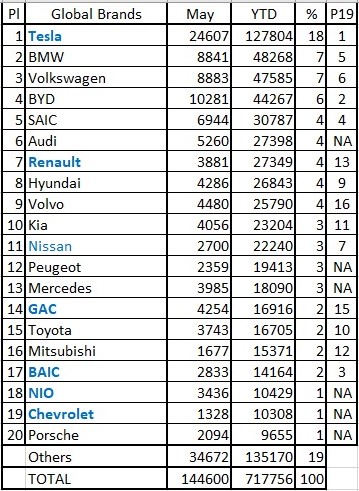

EV Sales: Global Top 20 May 2020

These numbers are for May 2020. We now know that Tesla delivered 179k in H1. This is an average of nearly 30k per month. Smoothing this out to 5 months is 149k, so the 127,804 plugged in above (as of June 30) is on the conservative side. This is fair enough as Tesla load more deliveries into the third month of the quarter than the first.

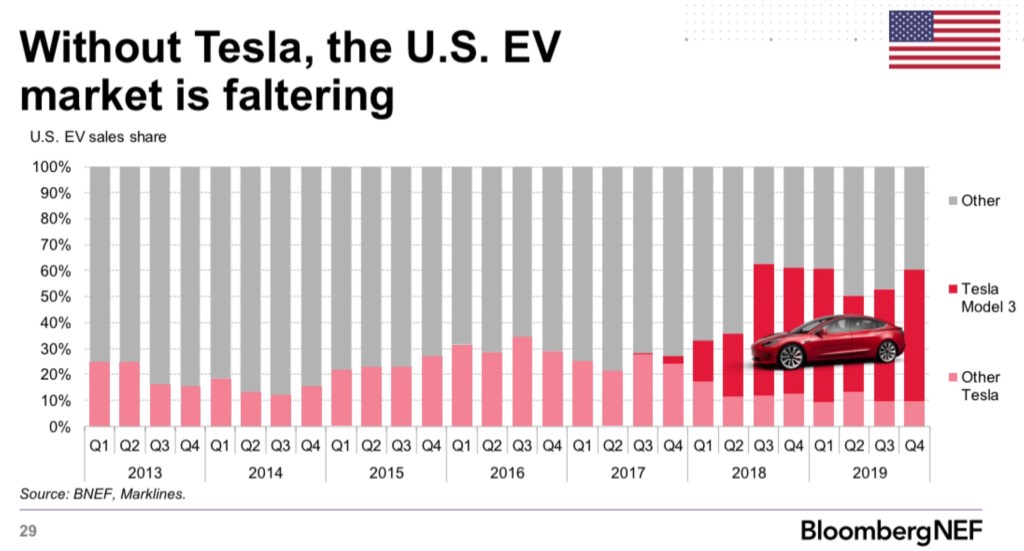

So Tesla is holding a very strong lead over all others, 18% share of market. Hard to see anyone catching up.

It is sad to see BYD and SAIC fall back so much. I know its been hard for everyone to deal with Covid.

As a long shot,

@Doggydogworld says, VW has game and could lead the pack by year end. I guess the VW would include Audi and Porsche, which would be 84,638 for YTD May or 17k per month. VW would need to crank out more than 43k per month in H2. Let's see.

That would be a pretty spectacular come back in the second half. Let's see some lively competition.

I wonder how much the market cap of VW could grow if it could sell more than 43k EVs per month in H2 2020. VW has a market cap of $80B, while Tesla is at $224B. Would matching annual EV sales along with Tesla now argue for a comparable market cap? It could. This could imply a tripling of share price. I think investors are hungry for EV maker stocks that can stake a serious claim in this market. Mine goat, just look at the money tossed at Nikola! That's a quarter the market cap of VW just for having plucky audacity and visual aids. Of course VW has much more going on in the EV space than Nikola. I think the key thing they lack is to deliver on serious volume, albeit this implies that they must be able to build competitive EVs priced right with a healthy gross margin.

Perhaps I should state this more simply, if VW group were well positioned for the BEV market to match Tesla on revenue, it would be worth more than Toyota and about as much as Tesla. This also implies that the VW BEV business would be worth at least twice the ICE business. If they could realize that sort of market valuation, it would seem much easier to divest the ICE business. If they could match Tesla on BEVs, they could divest or close down all the ICE business and still merit a valuation comparable to Tesla. I think Tesla becoming a mega-cap (mkt cap > $200B) could radically change how VW looks at its own valuation.