'Existing models will continue to be sold until they no longer meet increasingly strict emissions regulations, when they will be withdrawn. European emissions regulations, which see brands fined if they fail to meet targets, have reportedly been the final straw for the Japanese company.

Mitsubishi currently offers a number of models in the UK. The line-up mostly comprises SUVs, including the ASX, Eclipse Cross and Outlander (which is offered as a plug-in hybrid), as well as the Mirage supermini. The announcement means that neither the new-generation Outlander PHEV nor the Eclipse Cross PHEV will come to the UK.'

Mitsubishi ends new models for the UK/

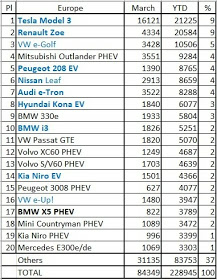

Even this year, the aging outlander phev sells pretty good in EU, a top 5 plugin vehicle

Mitsubishi currently offers a number of models in the UK. The line-up mostly comprises SUVs, including the ASX, Eclipse Cross and Outlander (which is offered as a plug-in hybrid), as well as the Mirage supermini. The announcement means that neither the new-generation Outlander PHEV nor the Eclipse Cross PHEV will come to the UK.'

Mitsubishi ends new models for the UK/

Even this year, the aging outlander phev sells pretty good in EU, a top 5 plugin vehicle