Ok, this one I did have to do some research on (exhausting!) to enliven the BS with a whiff of plausibility. I hope I did my math "right".

- - - Updated - - -

Tesla a $400B company? Yes!

By Tauren del Taureau

Disclosure: I am long TSLA, SCTY

Tesla has had an amazing 2013 so far, with a deservedly fast rise in the stock price after announcing Q1 earnings that blew out analyst’ expectations. Everyone agrees the stock is hugely undervalued and is soon set to surge further. The question is when, so I will try to lay out when that will be.

The Model S is feature packed:

The designers of the Tesla Model S threw away the recipe book when they designed their flagship product. Starting from the ground up, they put the battery-electric drivetrain along the bottom of the car, in a “skateboard” configuration. Everything above that is purely an opportunity to provide comfort and convenience to driver and passengers. For instance, rather than conventional door handles, the Model S handles recess into the car, helping to provide industry leading low drag coefficients. To open them, you simply approach the car with the key in your pocket. The door handles will hopefully extend for you. Then you don’t pull the handle like some sort of sloped brow barbarian, instead you hold the handle gently and after a second or so the door will hopefully open. Also, the Tesla model S includes the industry’s tiniest available sun visors (the 2014 refresh should feature even tinier ones). The car includes industry leading cupholder design and copious map pocket storage. The Model S’s advanced technology allows upgrades and updates to be broadcast and installed over the air! So adding additional map pockets is simply a software patch.

Long product lifetime:

One of the most intriguing characteristics of Tesla EV’s is that they have very few moving parts. As such, maintenance expense is minimal which is why Tesla offers 1,000,000 mile, 100,000 year warranties. The Tesla buyer can rest assured they have bought a car that will probably outlive them, and 1-2 generations of descendents. One concern for Tesla as a company is that repeat purchases might be somewhat lower, limited only to purchases of design refreshes.

Range:

So much has been made of so called “range anxiety”. Really, this issue is completely overblown. Most owners will simply charge at home, in the garages that everyone has. If you go on long trips, you can either use the supercharger locations that will soon blanket the country, or use the newly released battery swap facilities that will also be at the supercharger locations almost immediately. So there is no reason to complain about range being worse for a Model S, in most ways it is better than an ICE!

Tesla costs:

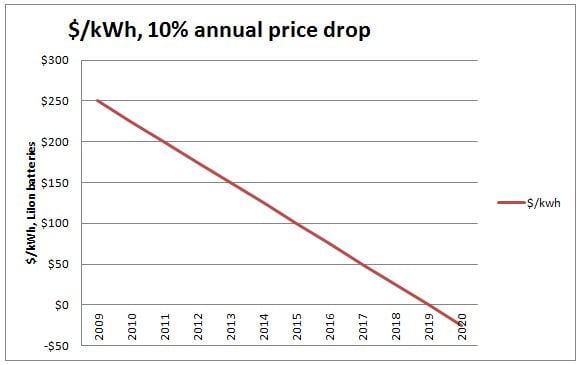

Much too much has been made of Li Ion battery costs. In fact, battery costs are much lower than the mainstream car industry thinks. Tesla has made the brilliant decision to use industry-standard 18650 form-factor batteries. By leveraging economies of scale, Tesla is able to get a much better cost/KWh, and prices are predicted to drop further:

Market potential:

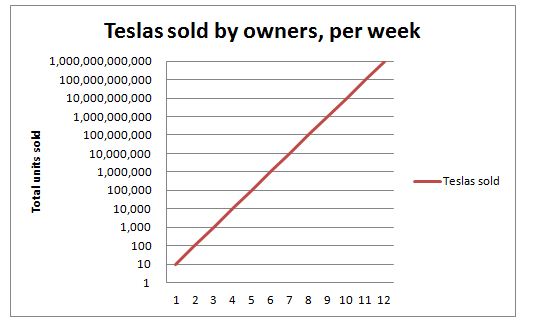

The best sales people are Tesla owners themselves! They are so impassioned by the product, they love to stop and talk to passers by, co-workers, family members, church groups, people surrounding them at the subway station, the people to whom they are passing out Tesla flyers, etc. Many Tesla owners note how many cars they have “sold”. It only takes each Tesla owner to sell 10 cars; then those people sell 10 cars, etc. Assuming everyone thinks about their purchase for a week (to select options and such) you get this result:

Market outlook:

Tesla’s EVs are an industry dominating product. Here I have modeled out to a medium-term date, 2020. By this time the smaller Gen III general-market product should be in full production. Here I am using some conservative assumptions, such as using 2011 volume numbers:

(Note the total money supply of the United States is only approximately 10.5 trillion, so Tesla's profits could cause instability in global markets. This is a grave concern for central bankers.)

So what value can shareholders expect?

Not bad at all. I think we can all agree it will be great to earn $578 per quarter per share. And enjoy over 8000% per year stock growth.

Power arbitrage:

One often overlooked revenue source for Tesla motors is Power rate arbitrage. They don’t really talk about it, but a simple analysis shows that this could be a large source of revenue. In the United States alone, once the car fleet has converted to Teslas, there will be something like 10,000 supercharger stations across the country. If each of them has 10,000 captive battery packs, and about 10,000 stored packs for swaps, that is 10,000*10,000*10,000= 1,000 billion 85kWh battery packs, or 8,500 billion kWh of storage. To put that in perspective, the US only uses about 4,138 Billion KWh per year. So Tesla power distribution can cause an enormously positive impact on the environment by allowing effective storage of variable sources like wind, solar and tidal. Also, Tesla can buy up the US supply and store it and double the price making billions on power rate arbitrage, and rule the nation with an iron fist if it so desires.

Other advantages:

Your kids won’t let you take them to an amusement park, they will be so insistent on taking a car ride instead! Your wife will want to borrow your car all the time, because it is so great. In fact you could find yourself driving her 2002 Honda CRV because it is so great!

Conclusion:

Tesla is THE Company of the century. In less than 10 years, Tesla will have dominated the auto industry, power industry, forced the big-3 automakers into restructuring as vintage car part merchandisers, and most likely be operating EV-only hyperloop intra-solar system interplanetary travel. At recent close, the stock is trading at about $107/share. I think this represents an attractive buy point based on the thesis I have laid out. But let me know what you think in the comments below!

- - - Updated - - -

Tesla a $400B company? Yes!

By Tauren del Taureau

Disclosure: I am long TSLA, SCTY

Tesla has had an amazing 2013 so far, with a deservedly fast rise in the stock price after announcing Q1 earnings that blew out analyst’ expectations. Everyone agrees the stock is hugely undervalued and is soon set to surge further. The question is when, so I will try to lay out when that will be.

The Model S is feature packed:

The designers of the Tesla Model S threw away the recipe book when they designed their flagship product. Starting from the ground up, they put the battery-electric drivetrain along the bottom of the car, in a “skateboard” configuration. Everything above that is purely an opportunity to provide comfort and convenience to driver and passengers. For instance, rather than conventional door handles, the Model S handles recess into the car, helping to provide industry leading low drag coefficients. To open them, you simply approach the car with the key in your pocket. The door handles will hopefully extend for you. Then you don’t pull the handle like some sort of sloped brow barbarian, instead you hold the handle gently and after a second or so the door will hopefully open. Also, the Tesla model S includes the industry’s tiniest available sun visors (the 2014 refresh should feature even tinier ones). The car includes industry leading cupholder design and copious map pocket storage. The Model S’s advanced technology allows upgrades and updates to be broadcast and installed over the air! So adding additional map pockets is simply a software patch.

Long product lifetime:

One of the most intriguing characteristics of Tesla EV’s is that they have very few moving parts. As such, maintenance expense is minimal which is why Tesla offers 1,000,000 mile, 100,000 year warranties. The Tesla buyer can rest assured they have bought a car that will probably outlive them, and 1-2 generations of descendents. One concern for Tesla as a company is that repeat purchases might be somewhat lower, limited only to purchases of design refreshes.

Range:

So much has been made of so called “range anxiety”. Really, this issue is completely overblown. Most owners will simply charge at home, in the garages that everyone has. If you go on long trips, you can either use the supercharger locations that will soon blanket the country, or use the newly released battery swap facilities that will also be at the supercharger locations almost immediately. So there is no reason to complain about range being worse for a Model S, in most ways it is better than an ICE!

Tesla costs:

Much too much has been made of Li Ion battery costs. In fact, battery costs are much lower than the mainstream car industry thinks. Tesla has made the brilliant decision to use industry-standard 18650 form-factor batteries. By leveraging economies of scale, Tesla is able to get a much better cost/KWh, and prices are predicted to drop further:

Market potential:

The best sales people are Tesla owners themselves! They are so impassioned by the product, they love to stop and talk to passers by, co-workers, family members, church groups, people surrounding them at the subway station, the people to whom they are passing out Tesla flyers, etc. Many Tesla owners note how many cars they have “sold”. It only takes each Tesla owner to sell 10 cars; then those people sell 10 cars, etc. Assuming everyone thinks about their purchase for a week (to select options and such) you get this result:

Market outlook:

Tesla’s EVs are an industry dominating product. Here I have modeled out to a medium-term date, 2020. By this time the smaller Gen III general-market product should be in full production. Here I am using some conservative assumptions, such as using 2011 volume numbers:

| Tesla estimated market position, 2020 | |

| total car market (2011) | 60,000,000 |

| Tesla market share | 85% |

| Tesla volume | 51,000,000 |

| Tesla average ASP | $50,000 |

| Profit margin | 25% |

| gross profit | $637,500,000,000 |

| P/E ($100 share price) | 0.000000000157 |

So what value can shareholders expect?

| Estimated dividend yield and share performance, 2020 | |

| gross profit | $637,500,000,000 |

| Capex (est) | 500,000,000 |

| Opex (est) | 1,000,000,000 |

| Ebitda | 636,000,000,000 |

| Tax | 127,200,000,000 |

| total GAAP profit | 508,800,000,000 |

| dividend allotment | 50% |

| shares outstanding | 110,000,000 |

| quarterly dividend | $ 578.18 |

| dividend yield ($100 share price) | 2313% |

| EPS | 5,795 |

| Share price (PE=10) | 57,955 |

| share performance (from 2013) | 57855% |

| Share performance (annualized) | 8265% |

| Market Cap | 6,375,000,000,000 |

Power arbitrage:

One often overlooked revenue source for Tesla motors is Power rate arbitrage. They don’t really talk about it, but a simple analysis shows that this could be a large source of revenue. In the United States alone, once the car fleet has converted to Teslas, there will be something like 10,000 supercharger stations across the country. If each of them has 10,000 captive battery packs, and about 10,000 stored packs for swaps, that is 10,000*10,000*10,000= 1,000 billion 85kWh battery packs, or 8,500 billion kWh of storage. To put that in perspective, the US only uses about 4,138 Billion KWh per year. So Tesla power distribution can cause an enormously positive impact on the environment by allowing effective storage of variable sources like wind, solar and tidal. Also, Tesla can buy up the US supply and store it and double the price making billions on power rate arbitrage, and rule the nation with an iron fist if it so desires.

Other advantages:

Your kids won’t let you take them to an amusement park, they will be so insistent on taking a car ride instead! Your wife will want to borrow your car all the time, because it is so great. In fact you could find yourself driving her 2002 Honda CRV because it is so great!

Conclusion:

Tesla is THE Company of the century. In less than 10 years, Tesla will have dominated the auto industry, power industry, forced the big-3 automakers into restructuring as vintage car part merchandisers, and most likely be operating EV-only hyperloop intra-solar system interplanetary travel. At recent close, the stock is trading at about $107/share. I think this represents an attractive buy point based on the thesis I have laid out. But let me know what you think in the comments below!