Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

For AWD owners wanting a P3D-

- Thread starter Urbancowboy

- Start date

I bought the acceleration boost this morning. You can definitely feel the improvement from 0-60, but really feel it from 40-90.

congrats!

I’ve found that extra acceleration is a lot more legally useful than most people realize.

You’ll also find yourself smiling more than before too.

What on the software tab shows it has been upgraded. Mine did a reboot but it still looks like the same firmware number.I bought the acceleration boost this morning. You can definitely feel the improvement from 0-60, but really feel it from 40-90.

2019.40.2.1 38f55d9f9205

Remember that the peak HP number is only loosely correlated with the 0-60 number. What matters for the 0-60 is peak/max torque. E.g. The 0-30 times of the AWD and P could be made to match, with huge differences in peak HP.

It’s the area under the HP vs speed curve that matters for time.

The difference between AWD+ and P now appears to be about 15% in terms of max torque.

This was evident in the 0-60 times for the awd being managed down to keep P still significantly higher. But after 50 to 100 it opened up much more. Software power management is controlling speed.

Led Jetson

Member

I never said I was owed anything. Why would I need a lawyer?Did you, or did you not, receive the car you purchased at the price you agreed to pay?

If so, YOU ARE OWED NOTHING.

If not, you have a contractual issue. At this point, seek an attorney.

ras5500

Member

Unlikely at that price IMO. $2K buys you ~half the unlock. Full unlock will be $4-5K if they ever offer it.Thanks. Seems clear they are still artificially limiting acceleration. No higher top end, no track mode, and only 1/2 of the acceleration of the P3-. For 1K that would be fair, but for the same price as the P3- it should be a full unlock.

TESLA - raise the price to 3K and make it a full P3- unlock.

FWIW, the delta between the AWD and the P- was $11K when I bought my car a year ago (original order for AWD, upgraded to P- right after my test drive and then + shortly thereafter; total delta was $16K over the AWD).

It's a smaller delta today that Supercharging is no longer free with the P but I just don't see it going down to $2K. Who would buy the P at the published price then?

ras5500

Member

I'm in the same boat as you. I paid $16K more for my 3P than today's price for the exit same car. I am still fully supportive of Tesla driving prices lower to benefit more and more people and like you I don't feel like I am owed anything.I never said I was owed anything. Why would I need a lawyer?

I just don't get people who attack with statements like "you are owed nothing". There's a lot of negative sentiment against early buyers in these forums which I find hard to fathom. If the early buyers hadn't ponied up more (starting with early roadster and S buyers), Tesla wouldn't be in a position to lower prices today.

What on the software tab shows it has been upgraded. Mine did a reboot but it still looks like the same firmware number.

2019.40.2.1 38f55d9f9205

I don't think the firmware # changes. I think this is an unlock feature on the existing firmware. To confirm you got the unlock, go to Driving settings and confirm that you now see "Sport" mode under Acceleration.

CXNperformance

Member

My guess is that Tesla will add new gradual power boosts later on to those who get this update. Makes no sense they give away everything now. And this will ensure that the feature gets attention longer and get more people to buy it.

Yeap, thats why Tesla stands out. I'm pretty sure we will see Performance Speeds once they Give the Performance guys Ludicrous or something similar.

Knightshade

Well-Known Member

I'm in the same boat as you. I paid $16K more for my 3P than today's price for the exit same car.

But got a $5000 cash refund (or FUSC if you kept that instead and new buyers don't get that) and a $7500 tax credit, and $500 in hardware new cars don't come with.

(not sure where your extra 3k is from other than maybe paint/interior cost- but excluding those the net cost on a P ordered today is basically identical to net cost on one ordered fall of 2018.)

I have nothing against 2018 buyers (I am one)... I have something against bad math though.

Led Jetson

Member

You didn't get any state / federal tax credits?

Zero EV state credits in Florida, and for those that don’t get it, just because a $7,500 tax credit was offered doesn’t mean the buyer receives it unless they pay a full $7,500 in Federal Taxes that year.

Florida is not like the California tech world where everyone makes hundreds of thousands of dollars. It is the land of the Prius. I wish my P had a Prius detector to be honest. Our average age here is 54 or so and many are retired or on fixed income, but many of us have saved our hard earned income over the years to drop a nice down payment. For those that work in Florida, must are subject to the so called Sunshine tax, where you know your income and skills are going to be valued much less just by moving there.

No one from Tesla ever mentioned a $5,000 buyback for the Free Supercharging, but I don’t care about that. That was supposed to be free with the referral I used, and was the main reason why I bought the P in the first place. FWIW, I paid $73,500 plus the state taxes without the AP. The MSRP is the MSRP, nothing else should matter and the current MSRP IS nearly 20k less if you consider the cars now come standard with AP, which I also missed out on.

Tesla used and abused the Federal Tax credits. We are glad they are being discontinued as my wife didn’t qualify for her full $7,500 either and still has no AP. I did opt to pay $2,000 more for AP later in so I am all in at 75.5k plus tax, and the news ones aren’t much more than 55k. The Tax Credit shouldn’t even be part of the discussion. To do so acknowledges Tesla cheated the system as well as the tax payers, which they did.

Knightshade

Well-Known Member

No one from Tesla ever mentioned a $5,000 buyback for the Free Supercharging, but I don’t care about that.

New buyers don't get that though.

So unless you consider that to have no actual value (which clearly is not the case since you said it was the MAIN REASON you bought the car) you don't get to claim the price dropped by X for the same thing when new buyers do not get the same thing

The MSRP is the MSRP, nothing else should matter

...what?

Of course other things matter.

Actual net price to the buyer for example matters a whole lot more than MSRP to the actual buyer.

As noted today, for those who got the 5k FUSC refund and $7500 tax credit, their NET price for the car was virtually identical to the net price of someone ordering a P today

and the current MSRP IS nearly 20k less if you consider the cars now come standard with AP, which I also missed out on.

Tesla used and abused the Federal Tax credits. We are glad they are being discontinued as my wife didn’t qualify for her full $7,500 either and still has no AP. I did opt to pay $2,000 more for AP later in so I am all in at 75.5k plus tax, and the news ones aren’t much more than 55k. The Tax Credit shouldn’t even be part of the discussion. To do so acknowledges Tesla cheated the system as well as the tax payers, which they did.

There's nothing "abusive" or "cheating" about the tax credits and how Tesla interacted with them. All their terms are clearly spelled out for all involved parties up front.

Well it appears that all this talk of "bin numbers" was for naught. Got my invitation by email to increase acceleration to 3.9 for $2K. I assume everyone else did, as well(?)

I love Tesla's response to this petition.

CXNperformance

Member

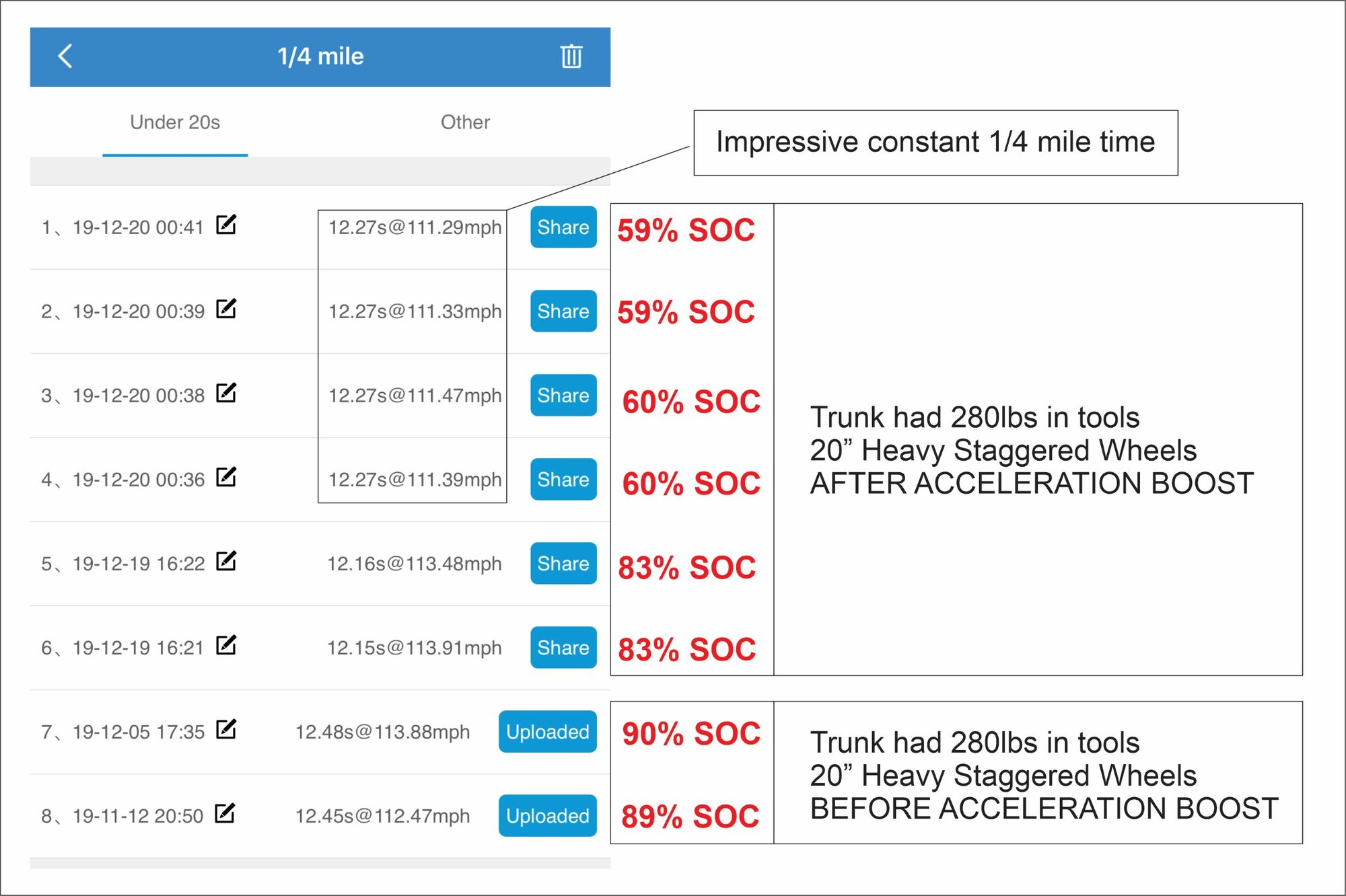

Here is my data, please keep in mind I have 20" Staggered heavy wheels, that coming from 18" aeros it droped almos 0.3 seconds from my 0-60mph.................. My 2019 LR AWD with Aero 18" made a best of 4.37sec and 12.4's in 1/4 mile before the 5% power increase of last month. When I installed the 20"s the best I could do 0-60mph with the 5% power increase was 4.44sec and 12.4's in the 1/4 mile.

Now with the Acceleration Boost Upgrade, I'm faster and my car has more weight. I plan to remove the weight this weekend and do better testing. But so far it improved a lot on how it pulls from 0-80mph, 20-80mph, you can feel the difference.

I manage to do 3.9sec 0-60mph this morning at 89% SOC with the 280lbs of tools in my trunk. I also weight 260lbs.

Its impressive how the computer really controls the speed on this car, constant 1/4 mile times with 60% SOC, still better than before with 100% SOC and no weight on the trunk.

$2k WORTH IT, is cheaper than trade in my car and get a sleeper.

Now with the Acceleration Boost Upgrade, I'm faster and my car has more weight. I plan to remove the weight this weekend and do better testing. But so far it improved a lot on how it pulls from 0-80mph, 20-80mph, you can feel the difference.

I manage to do 3.9sec 0-60mph this morning at 89% SOC with the 280lbs of tools in my trunk. I also weight 260lbs.

Its impressive how the computer really controls the speed on this car, constant 1/4 mile times with 60% SOC, still better than before with 100% SOC and no weight on the trunk.

$2k WORTH IT, is cheaper than trade in my car and get a sleeper.

I never said I was owed anything. Why would I need a lawyer?

These were your exact words upthread:

“Led Jetson” said:Thank you Tesla, you really owe a lot early adopters free FSD , or something, think about it....:-(

So yeah, you did.

m3-ricardo

Member

its not very hard to have a $7500 tax liability .. even if you're in some super low tax bracket .. like 10% .. you only need to make 75k in taxable income to get there ..

hard to imagine that you could buy and $60k+ car and not somehow be able to plan to have a 7.5k tax liability that you can then offset. (mind you, i did not say that you would normally have that liability, but that you would plan to have it so you can offset it) -- in taxes, planning is everything.

this discussion is drowning in people complaining about their butthurt about how much they paid, -- i think if you dislike this upgrade you are missing the point.

this company is listening to its customers, people wanted an unlock of the AWD and we have one -- it may not be perfect, but i think we can expect future upgrades and more updates.

$2k -- when you already spent $50-60k is not a big deal, if you want the speed, pay for it, if you dont, save your cash for the next update that costs something.

-- if $2k is putting you in the poorhouse after spending $50-60k .. then you probably should not have bought that car in the first place, you should probably invest in better financial planning -- maybe buy a book on that.

-- I for one, am still holding out -- i wanted track mode .. so the extra speed without track mode isn't that interesting. -- i plan to track my AWD, and eventually upgrade the brakes, suspension, tires .. going faster isn't going to make a huge difference in my track enjoyment ( i dont plan to race the car, just track days) .. but track mode would make a difference imo

hard to imagine that you could buy and $60k+ car and not somehow be able to plan to have a 7.5k tax liability that you can then offset. (mind you, i did not say that you would normally have that liability, but that you would plan to have it so you can offset it) -- in taxes, planning is everything.

this discussion is drowning in people complaining about their butthurt about how much they paid, -- i think if you dislike this upgrade you are missing the point.

this company is listening to its customers, people wanted an unlock of the AWD and we have one -- it may not be perfect, but i think we can expect future upgrades and more updates.

$2k -- when you already spent $50-60k is not a big deal, if you want the speed, pay for it, if you dont, save your cash for the next update that costs something.

-- if $2k is putting you in the poorhouse after spending $50-60k .. then you probably should not have bought that car in the first place, you should probably invest in better financial planning -- maybe buy a book on that.

-- I for one, am still holding out -- i wanted track mode .. so the extra speed without track mode isn't that interesting. -- i plan to track my AWD, and eventually upgrade the brakes, suspension, tires .. going faster isn't going to make a huge difference in my track enjoyment ( i dont plan to race the car, just track days) .. but track mode would make a difference imo

its not very hard to have a $7500 tax liability .. even if you're in some super low tax bracket .. like 10% .. you only need to make 75k in taxable income to get there ..

Not defending this person, but there are plenty of ways not to have tax liability. Earning the money in a combat zone. Income from tax advantaged bonds. Income from a Roth IRA. Income from a disability plan purchases with post tax dollars. Etc etc etc. Most of the posters points are way off base but it isn’t impossible to have a high income and owe no tax.

ras5500

Member

But got a $5000 cash refund (or FUSC if you kept that instead and new buyers don't get that) and a $7500 tax credit, and $500 in hardware new cars don't come with.

(not sure where your extra 3k is from other than maybe paint/interior cost- but excluding those the net cost on a P ordered today is basically identical to net cost on one ordered fall of 2018.)

I have nothing against 2018 buyers (I am one)... I have something against bad math though.

Hate to tell you my friend but it's your math that is totally wrong. Below is actual and exact math, check the table below for itemized detail:

2018 buyer: 3P, PUO, Blue color, white interior, EAP + FSD: $ 88.7K out the door

2019 buyer today: identical specs as above, $ 72K out the door.

So I paid $ 16.7K more than a buyer today (and $18.7K more than someone who bought 2 months ago before the FSD price hike).

I got $ 7500 in federal credit and today's buyer gets $1,875. so the $ 16.7K delta becomes $ 11K delta. Still $ 11K more than the exact same car bought today (and $ 13K more than the same car bought 2 months ago).

So, a 2019 buyer paid $ 11-13K more than a 2018 buyer for the exact same car. Hardly paying the same price you claim.

As for the $5K FUSC credit, most people I know didn't ask Tesla for a refund because its in bad form. And it isn't worth $5K in actual charging fees for majority of people.

Knightshade

Well-Known Member

Hate to tell you my friend but it's your math that is totally wrong.

It's not of course.

You just added a bunch of additional items that weren't involved (like FSD- which BTW EAP alone, at 5k, gets you every single thing the $7000 FSD does as of today)... then you added sales tax based on...wherever you live I guess despite the fact your tax rate being insanely high compared to most people.

Then you also added paint/interior which I specifically said could represent an actual difference but only depending on which ones you picked so again NOT for everyone

For example a black interior black exterior is cheaper now. $0 for both things.

Not to mention I also specifically said "a P ordered today"

Which means your tax credit is $0.00 because it won't be delivered until after Dec 31.

And of course the $5000 refund counts. You don't get to exclude it because you personally thought it impolite to take free money.

And you ignored the extra HW '18 buyers get that 20 buyers do not.

So here's the "real" math for you if you wanna play let's cherry pick colors and whatnot-and I'll even toss in FSD to help you out.

2018-

$69,000 for P3D+

Black interior and exterior- $0.00

FSD (with EAP) $8000

Destination- $1200 (though if you really want nit pick- it was actually $1000 for most of 2018- got raised in the fall)

Oh, and I'm buying this car Delaware. No sales tax.

Total of- $78,200.

Then I take a $7500 tax credit, and a $5000 FUSC refund.

NET COST 2018 P3D+ black/black with FSD in Delaware= $65,700.

2020-

$56,990 for P3D+

Black interior and exterior- $1000

FSD- $7000

Destination- $1200

Sales tax still $0

Total of- $66,190.

Huh. The 2018 car is $490 cheaper...and we aren't even done yet

The 2019 car also needs about $500 more to add homelink, the 14-50 adapter, the mats, and the phone cables that the 2018 all came with for free.

So about $540 more expensive for the 2020 car.

If I wanted to cherry pick even more I'd knock off $200 destination by buying in late June 2018... and another $120 every single year because I got lifetime connectivity that way... and if we wanna play "functional equivalent" I can take the 3k of FSD off since EAP does the same stuff as of right this moment.

Hopefully you can understand why I stuck with "just the car" instead of getting into the weeds of color pricing and if your state has an insane sales tax or not.

And why the whining about I PAID 20k MORE is utter nonsense.

Even taking the worse case as you did if you were honest and counted the 5k refund and the equipment difference you'd barely crack a 5k difference... and just changing a few of those options totally evaporates that difference to the point it's cheaper to have bought the 2018.

and that's without adding up a year of savings not buying gasoline too.

Thus endeth yet another math lesson

m3-ricardo

Member

Not defending this person, but there are plenty of ways not to have tax liability. Earning the money in a combat zone. Income from tax advantaged bonds. Income from a Roth IRA. Income from a disability plan purchases with post tax dollars. Etc etc etc. Most of the posters points are way off base but it isn’t impossible to have a high income and owe no tax.

you missed my point ..

i'm saying that if you know that you are going to have a 7500 tax credit -- then you can plan to have a tax liability .. so that you can take full advantage of the credit.

someone who complains that they were not able to take advantage of the 7500 tax credit, failed to plan ahead of time.

Similar threads

- Replies

- 4

- Views

- 464

- Replies

- 7

- Views

- 2K

- Article

- Replies

- 16

- Views

- 1K

- Replies

- 200

- Views

- 5K