Back in December 2020 I had a new credit card issued. As I updated all recurring bills I went to my tesla insurance page and entered the new number. Everything seemed to save fine. Well, apparently it didn't. I got a phone message yesterday asking if I wanted to " re-instate" my tesla insurance. Of course that made no sense so I logged in and discovered I had not been getting billed since the update. When I called today they said that I have not had insurance since FEBRUARY. She explained that credit card updates can only be done through customer service. Yes, you can enter new card in your account but you must call customer service to actually change to the new card WTF?! I asked why nobody had reached out until yesterday and she said I should have been emailed but they had a whole batch of customer account emails corrupted. again, WTF?! My options were to backpay the last 5 months to re-instate my policy, and pay for insurance I never had, or just start a new policy. Every part of the conversation seemed a little more bizarre then the previous. I chose to start a new policy. I understand I am partially responsible and should have noticed. I do check my cc statements every month. There are a LOT of charges between my wife and I. But, you only notice the charges that are not familiar, you don't notice the charges that are not there! The silver lining? My new policy is cheaper than my original one.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FYI Tesla insurance just called to let me know I haven't been insured since FEBRUARY

- Thread starter Flyguy

- Start date

Ostrichsak

Well-Known Member

Tam

Well-Known Member

...The silver lining? My new policy is cheaper than my original one.

Sounds like a happy ending story. But I am not sure you'll be lucky next time when you might get in an accident and Tesla Insurance would realize that it had not deducted your scheduled premium.

ucmndd

Well-Known Member

Tesla's insurance idea is clearly half-baked and has no regard for customer service, like so many of their other endeavors. I honestly can't fathom why people would trust them with something so important.

OrbiterTI4

Member

BigNick

Infamous Fat Sweaty Guy

I don’t think Tesla has a clue, let alone repotting to anyone other than EM.Of note - I don't know if Tesla Insurance will report to CLUE or not, but if they do report you as having had a lapse in coverage from Feb - Jul, you may find quotes from other companies to be significantly higher for the next 2-3 years.

I can’t imagine not reporting to C.L.U.E. But since that is for losses, I think OP is good to go.Of note - I don't know if Tesla Insurance will report to CLUE or not, but if they do report you as having had a lapse in coverage from Feb - Jul, you may find quotes from other companies to be significantly higher for the next 2-3 years.

The one (minor) problem with the OP starting a new policy is that he now does have that 4 month or so gap In insurance coverage. If he stays with Tesla Insurance for the foreseeable future (several years) it won’t matter in the long run from an insurance standpoint.

The one could be large problem is if the State of California finds out about the lapse in coverage. While that probably won’t happen unless OP had a violation in the meantime, California could decide to punish an uninsured that was on the road.

Agreed. Rather than rely on luck I will just need to verify payment on my bill every month.Sounds like a happy ending story. But I am not sure you'll be lucky next time when you might get in an accident and Tesla Insurance would realize that it had not deducted your scheduled premium.

I’ve had no claims or infractions. My understanding is that if the state applies a penalty it still be less than the missed payments. Unfortunately Tesla is quite a bit cheaper than other quotes I had, so will continue to roll the dice (and check monthly payment from now on).The one could be large problem is if the State of California finds out about the lapse in coverage. While that probably won’t happen unless OP had a violation in the meantime, California could decide to punish an uninsured that was on the road.

If they can’t figure out how to take your payment properly, or notify you of non payment, for five months- why in the world do you think they’ll be coordinated to handle your claim in a stressful situation whenever you actually need insurance?I’ve had no claims or infractions. My understanding is that if the state applies a penalty it still be less than the missed payments. Unfortunately Tesla is quite a bit cheaper than other quotes I had, so will continue to roll the dice (and check monthly payment from now on).

you get what you pay for. In this case it’s cheaper because it straight up is a joke.

Despite the cost savings, this is why I opted to stick with Allstate. I can’t imagine having Tesla properly handle a complex claim or total loss.

cwerdna

Well-Known Member

For anyone newer who might stumble across this thread, there were also these threads:

teslamotorsclub.com

teslamotorsclub.com

teslamotorsclub.com

teslamotorsclub.com

teslamotorsclub.com

teslamotorsclub.com

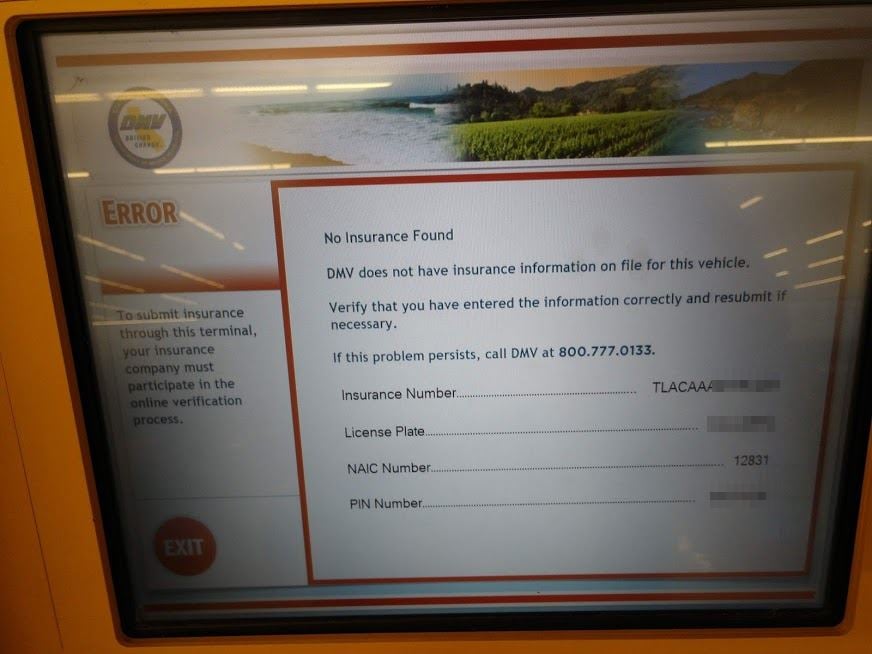

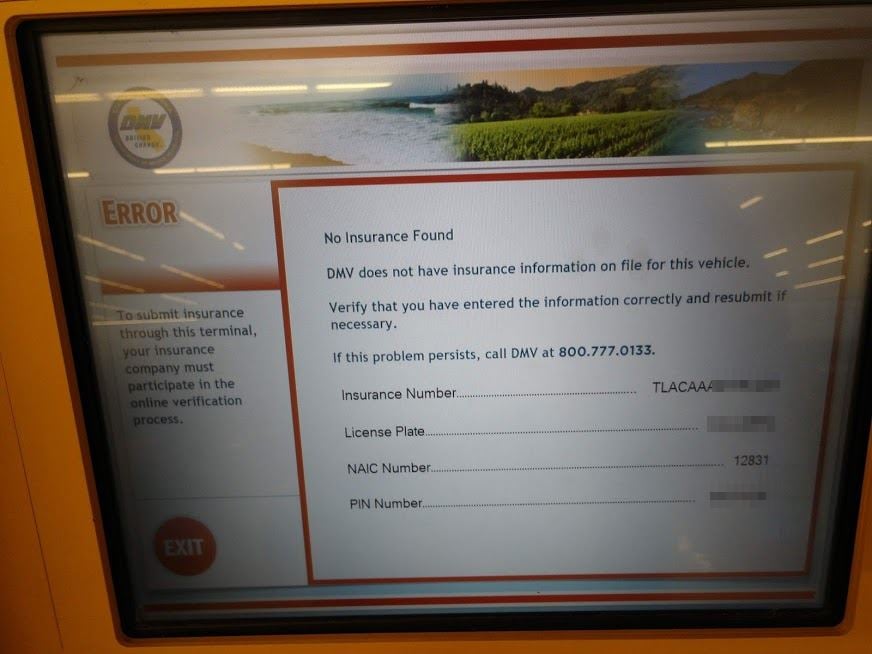

Have Tesla insurance, just got DMV letter "Intent to Suspend" for lack of insurance

So, anyone else with Tesla insurance experiencing this odd quirk? I imagine it'd only be rearing its head right about now, as I got Tesla insurance just as soon as it was available (it was significantly cheaper than my existing plan, for significantly better coverage in all categories). Opened...

Tesla Insurance causes registration suspension

I have Tesla Insurance on my Model 3 and received a "Notice of Intent to Suspend" my registration due to the CA DMV claiming that they could not verify that I had insurance. I called T.I. and they said they would take care of it. I also emailed the DMV with my CA ID Card as requested. Tesla...

Tesla Insurance Major Oversight

I’m posting this again because I believe i posed it to the wrong group last time. I got a notice from the DMV that i don’t have proof of insurance and my car registration will be suspended in a month. The notice allows you to rectify this online but i followed the instructions and it didn’t...

whitex

Well-Known Member

Sounds completely on par for Tesla products, great idea, hype marketing, alpha quality implementation.Back in December 2020 I had a new credit card issued. As I updated all recurring bills I went to my tesla insurance page and entered the new number. Everything seemed to save fine. Well, apparently it didn't. I got a phone message yesterday asking if I wanted to " re-instate" my tesla insurance. Of course that made no sense so I logged in and discovered I had not been getting billed since the update. When I called today they said that I have not had insurance since FEBRUARY. She explained that credit card updates can only be done through customer service. Yes, you can enter new card in your account but you must call customer service to actually change to the new card WTF?! I asked why nobody had reached out until yesterday and she said I should have been emailed but they had a whole batch of customer account emails corrupted. again, WTF?!

Why not go with a different, reputable company instead?My options were to backpay the last 5 months to re-instate my policy, and pay for insurance I never had, or just start a new policy. Every part of the conversation seemed a little more bizarre then the previous. I chose to start a new policy.

Until one day you have an accident and find out you don't have coverage due to some other process (or lack thereof) which you didn't know about. Maybe you don't have coverage at all, maybe you didn't know you only had partial coverage in some category because you were supposed to call in person to confirm something. Or maybe it turns out Tesla insurance customer service is like Tesla customer service, everything takes forever, nobody has any authority to do anything, and you're left hanging for months. Many possibilities.The silver lining? My new policy is cheaper than my original one.

Using Tesla insurance is like using Tesla dashcam, yea it's free, it seems to work, except every once in a while when an update screws it up and it doesn't record, or records with gaps - you don't find out until you go to retrieve the footage to try to prove it was the other guy's car which changed lanes into you instead of what he claims, that you changed lanes into him. If you are unlucky, you're on a version of software which has a bug you didn't know about.

whitex

Well-Known Member

Actually a bigger problem could be if @Flyguy has a loan or a lease on the car. Most loan or lease contracts have a clause that the owner must keep the car insured at all times while the loan/lease contract is in place . Having a clear, provable gap, could be a cause to terminate the loan/lease or charge penalties. This might not show up for a while until the bank does an audit. I'm not sure whether such loan terms violation affects credit history or not, but I would not be surprised if it did.I can’t imagine not reporting to C.L.U.E. But since that is for losses, I think OP is good to go.

The one (minor) problem with the OP starting a new policy is that he now does have that 4 month or so gap In insurance coverage. If he stays with Tesla Insurance for the foreseeable future (several years) it won’t matter in the long run from an insurance standpoint.

The one could be large problem is if the State of California finds out about the lapse in coverage. While that probably won’t happen unless OP had a violation in the meantime, California could decide to punish an uninsured that was on the road.

True, but unlikely there as well. The finance company is typically notified by the insurance company that insurance has lapsed and Tesla is too inept to do that.Actually a bigger problem could be if @Flyguy has a loan or a lease on the car. Most loan or lease contracts have a clause that the owner must keep the car insured at all times while the loan/lease contract is in place . Having a clear, provable gap, could be a cause to terminate the loan/lease or charge penalties. This might not show up for a while until the bank does an audit. I'm not sure whether such loan terms violation affects credit history or not, but I would not be surprised if it did.

Barklikeadog

Active Member

Extra like for that. The one time I had to make a claim (allstate) it was ridiculously easy and 1st class start to finish.Despite the cost savings, this is why I opted to stick with Allstate. I can’t imagine having Tesla properly handle a complex claim or total loss.

I'm financed though Tesla (@0.99%). The ultimate irony will be Tesla finance screwing me because Tesla insurance screwed me. If Farmers hadn't raised my rates by 40% after owning the car for 3 years I would not be here right now. None the less, seems pretty clear I need to find different coverage, if I'm able to get it now with a gap.Actually a bigger problem could be if @Flyguy has a loan or a lease on the car. Most loan or lease contracts have a clause that the owner must keep the car insured at all times while the loan/lease contract is in place . Having a clear, provable gap, could be a cause to terminate the loan/lease or charge penalties. This might not show up for a while until the bank does an audit. I'm not sure whether such loan terms violation affects credit history or not, but I would not be surprised if it did.

You can get coverage, it is the price that you may get stuck on.I'm financed though Tesla (@0.99%). The ultimate irony will be Tesla finance screwing me because Tesla insurance screwed me. If Farmers hadn't raised my rates by 40% after owning the car for 3 years I would not be here right now. None the less, seems pretty clear I need to find different coverage, if I'm able to get it now with a gap.

JimBob 909

Little Red Raven

I had one of those messages last year. Called Tesla and they took care of it. This year I had no trouble renewing online, which means Sacramento has the insurance in their system. Last year the insurance was fairly new, as it only started in 2019. My experience is these are a non-issue now.For anyone newer who might stumble across this thread, there were also these threads:

Have Tesla insurance, just got DMV letter "Intent to Suspend" for lack of insurance

So, anyone else with Tesla insurance experiencing this odd quirk? I imagine it'd only be rearing its head right about now, as I got Tesla insurance just as soon as it was available (it was significantly cheaper than my existing plan, for significantly better coverage in all categories). Opened...teslamotorsclub.com

Tesla Insurance causes registration suspension

I have Tesla Insurance on my Model 3 and received a "Notice of Intent to Suspend" my registration due to the CA DMV claiming that they could not verify that I had insurance. I called T.I. and they said they would take care of it. I also emailed the DMV with my CA ID Card as requested. Tesla...teslamotorsclub.com

Tesla Insurance Major Oversight

I’m posting this again because I believe i posed it to the wrong group last time. I got a notice from the DMV that i don’t have proof of insurance and my car registration will be suspended in a month. The notice allows you to rectify this online but i followed the instructions and it didn’t...teslamotorsclub.com

wwu123

Active Member

After being with Allstate for 20 years for home and auto, I had no choice to switch off given their ridiculous rate for Tesla (x2 since we have two of them). I've since experienced similarly annoying service issues with Geico.com and Progressive, but I guess it's my fault for going online (though you don't fully avoid interacting with customer reps/agents).

First, after signing up with Geico for auto, they similarly suddenly dropped me after a few months claiming a critical document was missing. They claimed they'd reached out several times by phone or e-mail, but I never received anything. When I asked what the missing document was, it was merely a current copy of the car registration, something easily furnished, and probably actually did if it was needed to sign up.

Second, after switching auto to Progressive, I later moved my home policy from Allstate to Progressive shortly later. But Progressive themselves don't do home, so it was one of 2-3 affiliated home insurers. Though all billing went through Progressive, I had to talk to the third-party to get insurance documents, and can't see this policy on Progressive's website. Then a year later, that insurer pulls out of California before my renewal, and neither Progressive nor the third-party insurer ever contacts me to even say that they won't offer a renewal at all. So several months later, I realize I never received a bill, after calling Progressive I find out I've bee uninsured for home for months. And since I now had an official lapse in home coverage, none of Progressive's home insurers will even make an offer for home insurance. I ended up going to Geico for home, despite my anger about the previous incident...

First, after signing up with Geico for auto, they similarly suddenly dropped me after a few months claiming a critical document was missing. They claimed they'd reached out several times by phone or e-mail, but I never received anything. When I asked what the missing document was, it was merely a current copy of the car registration, something easily furnished, and probably actually did if it was needed to sign up.

Second, after switching auto to Progressive, I later moved my home policy from Allstate to Progressive shortly later. But Progressive themselves don't do home, so it was one of 2-3 affiliated home insurers. Though all billing went through Progressive, I had to talk to the third-party to get insurance documents, and can't see this policy on Progressive's website. Then a year later, that insurer pulls out of California before my renewal, and neither Progressive nor the third-party insurer ever contacts me to even say that they won't offer a renewal at all. So several months later, I realize I never received a bill, after calling Progressive I find out I've bee uninsured for home for months. And since I now had an official lapse in home coverage, none of Progressive's home insurers will even make an offer for home insurance. I ended up going to Geico for home, despite my anger about the previous incident...

Similar threads

- Replies

- 15

- Views

- 652

- Replies

- 6

- Views

- 689

- Replies

- 4

- Views

- 234

- Replies

- 2

- Views

- 2K