Hello,

Many are waiting for the Moody’s and S&P to upgrade Tesla to investment grade. It might be a substantial catalyzer for the share price.

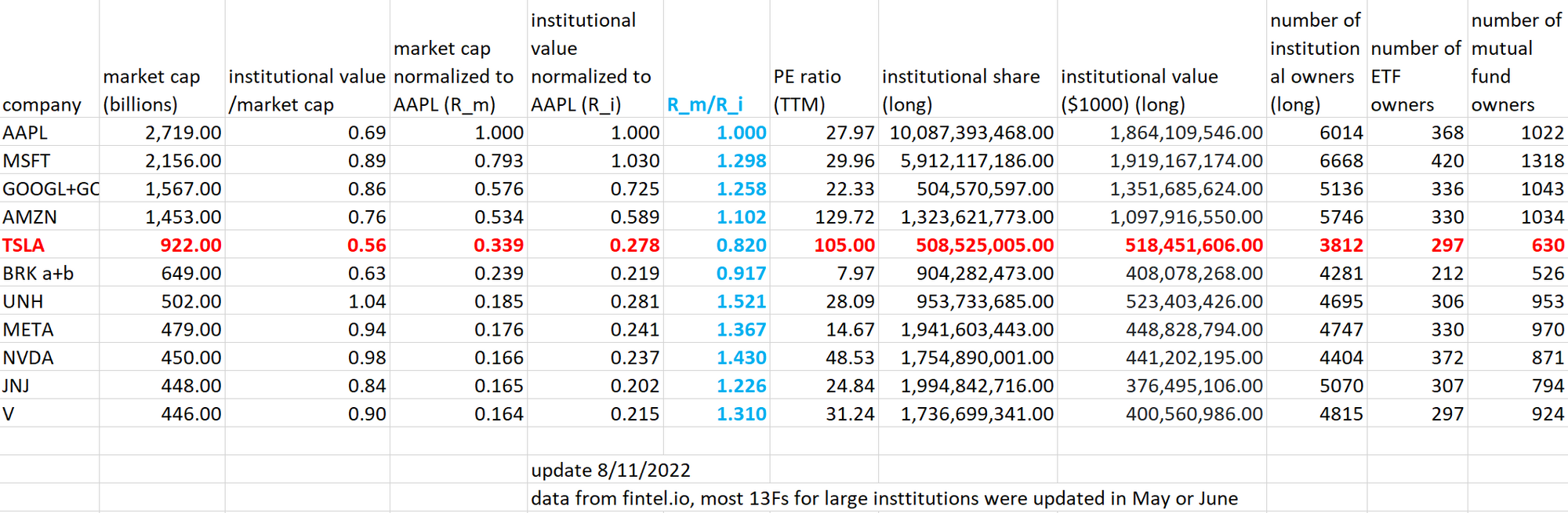

Since the rating would be mostly advisory to mutual fund, pension fund, it is important to understand the institutional ownership at present. I made the following table showing the top 11 largest companies by market cap (data from fintel.io).

Compared with AAPL, TSLA is 0.339 of its market cap, but the institution owned value is only 0.278 of AAPL, indicating substantially less appreciated by institutions than by retail investors (like us) and founders (like Musk). The blue column indicates TSLA is actually the most underappreciated stock by these funds. Of course, the number of ETFs and mutuals suggest the same.

Assuming funds start to compensate this by buying shares after the credit upgrade, and assuming they accumulate 0.339 institution ownership, the same as they own AAPL. It means they need to purchase $113 billion dollars of TSLA, or 122 million shares, which is 12% of current market cap. Recall that the buying was about 108 million share when TSLA was included to S&P 500.

How will this affect TSLA share price?

Many are waiting for the Moody’s and S&P to upgrade Tesla to investment grade. It might be a substantial catalyzer for the share price.

Since the rating would be mostly advisory to mutual fund, pension fund, it is important to understand the institutional ownership at present. I made the following table showing the top 11 largest companies by market cap (data from fintel.io).

Compared with AAPL, TSLA is 0.339 of its market cap, but the institution owned value is only 0.278 of AAPL, indicating substantially less appreciated by institutions than by retail investors (like us) and founders (like Musk). The blue column indicates TSLA is actually the most underappreciated stock by these funds. Of course, the number of ETFs and mutuals suggest the same.

Assuming funds start to compensate this by buying shares after the credit upgrade, and assuming they accumulate 0.339 institution ownership, the same as they own AAPL. It means they need to purchase $113 billion dollars of TSLA, or 122 million shares, which is 12% of current market cap. Recall that the buying was about 108 million share when TSLA was included to S&P 500.

How will this affect TSLA share price?