Fyi I have gotten some great responses to help sharpen my decision, and I now feel the one I've made will be the right one for me. So, thank you intelligent strangers!yea, I agree here. If OP is asking a bunch of strangers, seeking opinions, I would heed that inner voice that's seeking risk avoidance.....

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

In the face of a recession, should I buy a Y now or wait?

- Thread starter Macgyverfever

- Start date

Interesting thread. Wide ranging from micro & macro economics to politics and beyond. Didn't really offer my 2 cents as it was entertaining enough. But figured I would as the OP has made up his mind.

To each his own, but for me, I have never taken a loan for a car and never will barring interest rates for the load lower than what I'm earning on my cash. Took two loans in my life. 1 - 7 yo motorcycle as I couldn't afford a car from my future wife (yeah was smart enough to pay off before the wedding) and 2 - the house that I prepaid as much as I could afford to pay it off in 19 years.

Just don't believe in debt (no not a D Ramsey acolyte). Interest/debt? To me, devours one's soul.

To each his own, but for me, I have never taken a loan for a car and never will barring interest rates for the load lower than what I'm earning on my cash. Took two loans in my life. 1 - 7 yo motorcycle as I couldn't afford a car from my future wife (yeah was smart enough to pay off before the wedding) and 2 - the house that I prepaid as much as I could afford to pay it off in 19 years.

Just don't believe in debt (no not a D Ramsey acolyte). Interest/debt? To me, devours one's soul.

So ...basically the last 15 ish years of stupid low interest rates coupled with a very long bull market....never will barring interest rates for the load lower than what I'm earning on my cash.

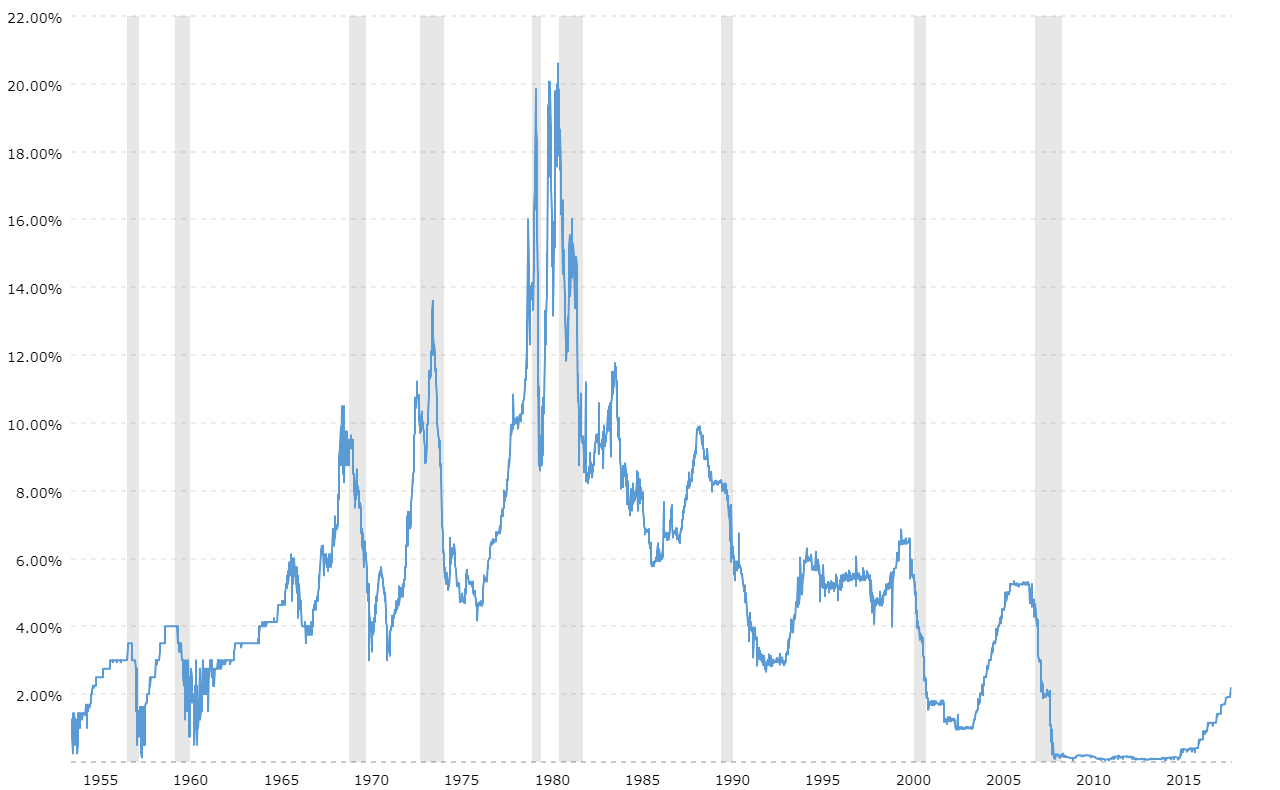

Federal Funds Rate - 62 Year Historical Chart

Shows the daily level of the federal funds rate back to 1954. The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis. The Federal Open Market Committee...

not at all.

fed rate isn't the same as my credit union or the car dealer rate. When treasuries are negative, I don't see the banks or car dealers offering negative auto loans.

just looked and my credit union auto rate varies from 2.39 to 8.11. The highest earning is 2.85 on a 5 yr CD.

Dsicover bank is a bit better at 3.2 for a 5 yr CD

here is the current averages https://cars.usnews.com/cars-trucks/average-auto-loan-interest-rates

Yes, my I-Bonds are doing better but they aren't really ready cash.

fed rate isn't the same as my credit union or the car dealer rate. When treasuries are negative, I don't see the banks or car dealers offering negative auto loans.

just looked and my credit union auto rate varies from 2.39 to 8.11. The highest earning is 2.85 on a 5 yr CD.

Dsicover bank is a bit better at 3.2 for a 5 yr CD

here is the current averages https://cars.usnews.com/cars-trucks/average-auto-loan-interest-rates

Yes, my I-Bonds are doing better but they aren't really ready cash.

(edited to add some clarity)not at all.

fed rate isn't the same as my credit union or the car dealer rate. When treasuries are negative, I don't see the banks or car dealers offering negative auto loans.

just looked and my credit union auto rate varies from 2.39 to 8.11. The highest earning is 2.85 on a 5 yr CD.

Dsicover bank is a bit better at 3.2 for a 5 yr CD

here is the current averages https://cars.usnews.com/cars-trucks/average-auto-loan-interest-rates

I don't know anyone in their right mind that considers CD's a financially prudent way for *all* your cash to earn interest. After your emergency fund is , uh, funded, there are a variety of index funds that dilute the risk and cost associated with directly owning specific stocks that are widely considered the way to evaluate interest rates (the "cost of borrowing money) vs rate of return.

If my financial choice is taking a chunk of non-emergency cash and buying a vehicle outright, or taking a low interest loan and investing that cash in an index fund, the latter handily wins.

You can't buy the Tesla vehicle equivalent in US treasury bonds outright, it's capped at $15k / year - $10k you can buy outright, another $5k you can purchase if you're owed a fed tax refund (you pick the bonds in lieu of the money basically).

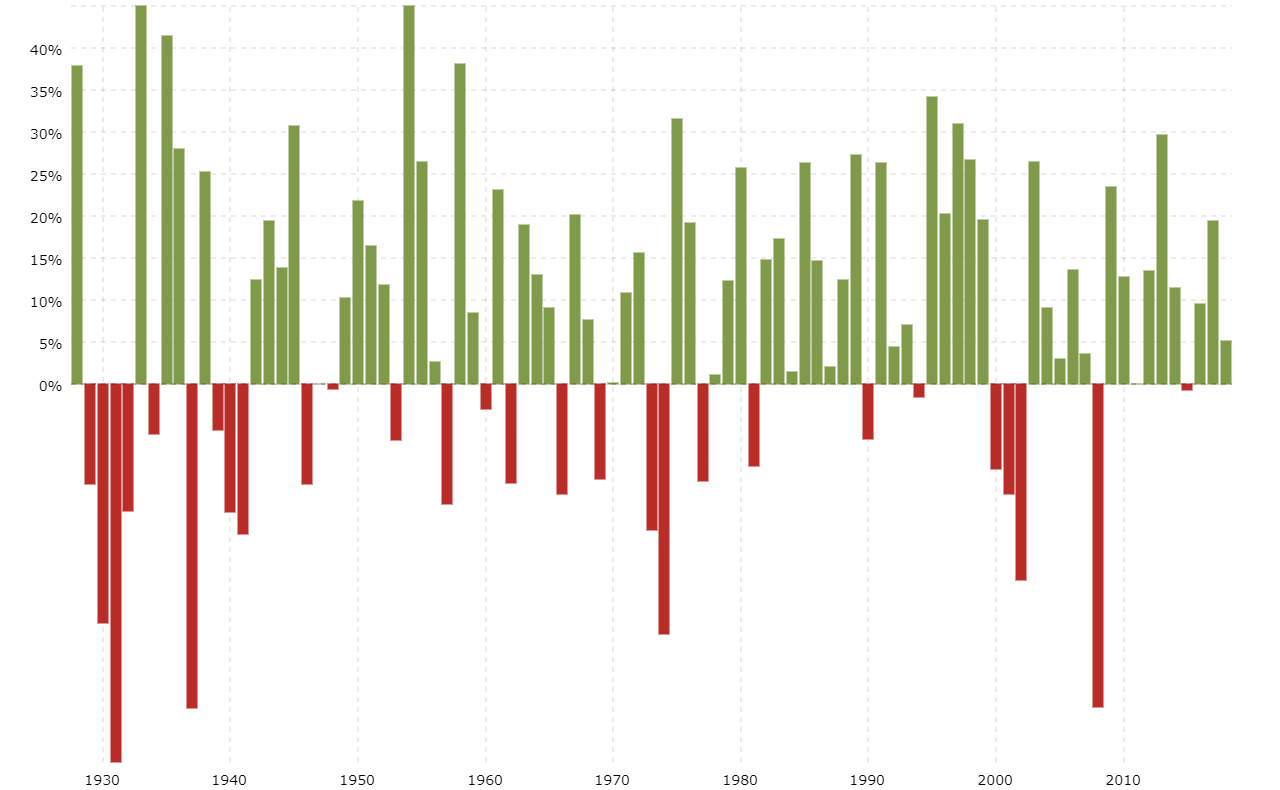

S&P 500 Historical Annual Returns

Interactive chart showing the annual percentage change of the S&P 500 index back to 1927. Performance is calculated as the % change from the last trading day of each year from the last trading day of the previous year.

US - Federal Funds Rate vs. S&P 500 | US Market | Collection | MacroMicro

The chart shows that when the Fed enters a rate-rising cycle, the economy grows faster and the stock market can yield higher returns than the bond market.

Last edited:

Maybe not in my right mind but I think it is a prudent way for your day to day savings / rainy day etc. Indexes are fine but too volatile to use for your daily living, rainy day savings etc.

Two Vanguard index funds I have (both admiral which tend to be a bit higher than non-admiral)

Current YTD

Vanguard 500 Index Fund Admiral Shares - -19.22%

Vanguard Total Stock Market Index Fund Admiral Shares - -21.05

12 month

Vanguard 500 Index Fund Admiral Shares - -5.13%

Vanguard Total Stock Market Index Fund Admiral Shares - -7.84

5 year

Vanguard 500 Index Fund Admiral Shares - 12.67%

Vanguard Total Stock Market Index Fund Admiral Shares - 13.9

so yeah, pulling $55-65K from those funds would be a great idea right now

Two Vanguard index funds I have (both admiral which tend to be a bit higher than non-admiral)

Current YTD

Vanguard 500 Index Fund Admiral Shares - -19.22%

Vanguard Total Stock Market Index Fund Admiral Shares - -21.05

12 month

Vanguard 500 Index Fund Admiral Shares - -5.13%

Vanguard Total Stock Market Index Fund Admiral Shares - -7.84

5 year

Vanguard 500 Index Fund Admiral Shares - 12.67%

Vanguard Total Stock Market Index Fund Admiral Shares - 13.9

so yeah, pulling $55-65K from those funds would be a great idea right now

Noooo come baaaaaaackkk...... (lol)Leaving this thread now (unwatch) and I am sure OP left long time ago. LOL

Have fun...

Live a little.... Buy wtf you want that makes you happy.... Do your 401k match, save 5,% of your income into an emergency fund, don't spend more than 25% of your income on rent or mortgage, if you can. Live a balanced life. Enjoy the Tesla. We can't predict anything. Nothing is guaranteed!!! Not stocks, not index funds, not real estate, not a job, not even your life ....

pepperoni

Member

This reminded me of Ben Franklin’s famous quote that “in this world, nothing is certain except death and taxes.” So there are two things we can all count on. But I agree with @mrazndead . As long as you have the essentials covered (including setting something aside for retirement and emergencies) I say go for it. It’s a great car.Live a little.... Buy wtf you want that makes you happy.... Do your 401k match, save 5,% of your income into an emergency fund, don't spend more than 25% of your income on rent or mortgage, if you can. Live a balanced life. Enjoy the Tesla. We can't predict anything. Nothing is guaranteed!!! Not stocks, not index funds, not real estate, not a job, not even your life ....

Live a little.... Buy wtf you want that makes you happy.... Do your 401k match, save 5,% of your income into an emergency fund, don't spend more than 25% of your income on rent or mortgage, if you can. Live a balanced life. Enjoy the Tesla. We can't predict anything. Nothing is guaranteed!!! Not stocks, not index funds, not real estate, not a job, not even your life .....

I'm at 22% on mortgage over income, I have no car payment and haven't had one for years. My wife and I know and both agree to save hard for an emergency fund for the next 15 months. Your answer doesn't make me feel like a spoiled brat who doesn't whip himself every night and instead makes me sigh relief. Tesla is due for delivery Aug 22nd to Sep 5th (woohoo FINALLY!)

Cheers Everyone!

I know I’m old school (getting ready to retire for a second time, don’t Facebook) but why anyone would throw out something like this to a bunch of strangers is beyond me. These are personal financial decisions and we sure as hell don’t know the whole picture and even if we did so what, we don’t live with the consequences.

I know I’m old school (getting ready to retire for a second time, don’t Facebook) but why anyone would throw out something like this to a bunch of strangers is beyond me. These are personal financial decisions and we sure as hell don’t know the whole picture and even if we did so what, we don’t live with the consequences.

Well, gosh I was about to publish my social security number but, well I guess I see your point..

All joking aside, it's a big purchase, and I wanted to gain one thing: perspective.

Enjoy retirement! (Fun fact: I haven't been on facebook since I was 24)

We’ll, no Facebook so I guess there’s hope for you after all…Well, gosh I was about to publish my social security number but, well I guess I see your point..

All joking aside, it's a big purchase, and I wanted to gain one thing: perspective.

Enjoy retirement! (Fun fact: I haven't been on facebook since I was 24)

There was no facebook when I was 24. Or 44. I guess there was by the time I hit 64.Enjoy retirement! (Fun fact: I haven't been on facebook since I was 24)

Enjoy the car

pepperoni

Member

Dumping your index funds when the market is down doesn’t sound like a good investment strategy to me. Better to wait it out, it will come back.Maybe not in my right mind but I think it is a prudent way for your day to day savings / rainy day etc. Indexes are fine but too volatile to use for your daily living, rainy day savings etc.

Two Vanguard index funds I have (both admiral which tend to be a bit higher than non-admiral)

Current YTD

Vanguard 500 Index Fund Admiral Shares - -19.22%

Vanguard Total Stock Market Index Fund Admiral Shares - -21.05

12 month

Vanguard 500 Index Fund Admiral Shares - -5.13%

Vanguard Total Stock Market Index Fund Admiral Shares - -7.84

5 year

Vanguard 500 Index Fund Admiral Shares - 12.67%

Vanguard Total Stock Market Index Fund Admiral Shares - 13.9

so yeah, pulling $55-65K from those funds would be a great idea right now

Haha thanks! Respect to my elders btwThere was no facebook when I was 24. Or 44. I guess there was by the time I hit 64.At 24 there weren't PCs.

Enjoy the car

yep. That's why I like to keep a wad of cash around even if the interest sucks. Let me buy toys like teslas.Dumping your index funds when the market is down doesn’t sound like a good investment strategy to me. Better to wait it out, it will come back.

GBMaryland

Member

Tesla gave me $48k for my 3 year old M3LR... and I bought an MYP. ...that's a fairly small car payment, given that I owned the M3LR outright.

Under those conditions it was worth getting the MYP.

Under those conditions it was worth getting the MYP.

After you max out the I bonds I hopeyep. That's why I like to keep a wad of cash around even if the interest sucks. Let me buy toys like teslas.

Similar threads

- Replies

- 30

- Views

- 1K

- Replies

- 6

- Views

- 3K

- Replies

- 28

- Views

- 734

- Replies

- 2

- Views

- 430