From the energy.gov site

EV Credit Rules.

All EV automakers already know the percentages of critical minerals in their batteries. Is this published in some type of location/database?

For the above Mineral list can Tesla get to 40% as of 1/1/23? They would already be building batteries to this spec if they could correct?

Based on the US Geological Survey

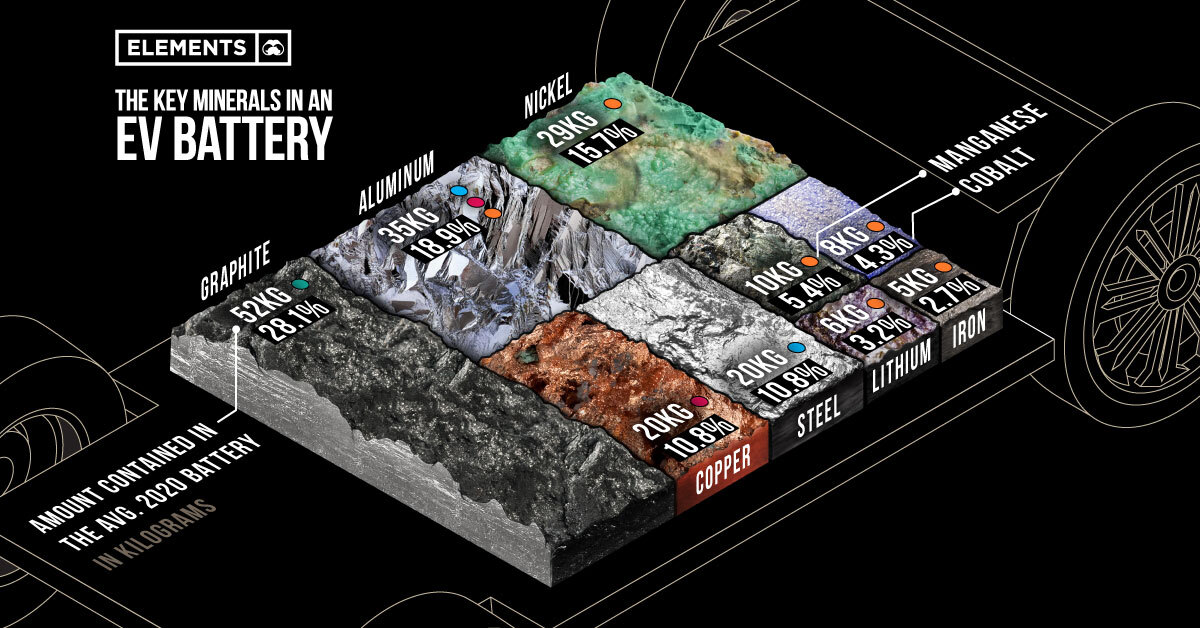

"The most commonly used varieties are lithium cobalt oxide (LCO), lithium manganese oxide (LMO), lithium iron phosphate (LFP), lithium nickel cobalt aluminum oxide (NCA) and lithium nickel manganese cobalt oxide (NMC). Graphite is currently widely used as the anode in lithium-ion batteries.These EV battery chemistries depend on five critical minerals whose domestic supply is potentially at risk for disruption: lithium, cobalt, manganese, nickel, and graphite. The U.S. Geological Survey designated these and other minerals as “critical,” according to the methodology codified in the Energy Act of 2020."

Vehicles Placed in Service After December 31, 2022

Beginning January 1, 2023, the Clean Vehicle Credit provisions remove manufacturer sales caps, expand the scope of eligible vehicles to include both EVs and FCEVs, require a traction battery that has at least seven kilowatt-hours (kWh), and establish criteria for a vehicle to be considered eligible that involve sourcing requirements for critical mineral extraction, processing, and recycling and battery component manufacturing and assembly. Vehicles that meet critical mineral requirements are eligible for $3,750 tax credit, and vehicles that meet battery component requirements are eligible for a $3,750 tax credit. Vehicles meeting both the critical mineral and the battery component requirements are eligible for a total tax credit of up to $7,500.

Critical Minerals: To be eligible for the $3,750 critical minerals portion of the tax credit, the percentage of the value of the battery’s critical minerals that are extracted or processed in the United States or a U.S. free-trade agreement partner or recycled in North America, must increase according to the following schedule:

| Year | Critical minerals minimum percent value requirement |

|---|

| 2023 | 40% |

| 2024 | 50% |

| 2025 | 60% |

| 2026 | 70% |

| 2027 and later | 80% |

Battery Components: To be eligible for the $3,750 battery components portion of the tax credit, the percentage of the value of the battery’s components that are manufactured or assembled in North America must increase according to the following schedule:

| Year | Battery components minimum percent value requirement |

|---|

| 2023 | 50% |

| 2024 and 2025 | 60% |

| 2026 | 70% |

| 2027 | 80% |

| 2028 | 90% |

| 2029 and later | 100% |

To be eligible for the credits under these provisions, vans, sport utility vehicles, and pickup trucks must meet the additional requirements of not having a manufacturer suggested retail price (MSRP) above $80,000, and all other vehicles may not have an MSRP above $55,000. Additionally, the eligibility of individuals for the tax credit is further limited by thresholds for modified adjusted gross income (MAGI); only individuals having a MAGI below the following thresholds are eligible for the tax credit:

- $300,000 for joint filers

- $225,000 for head-of-household filers

- $150,000 for single filers