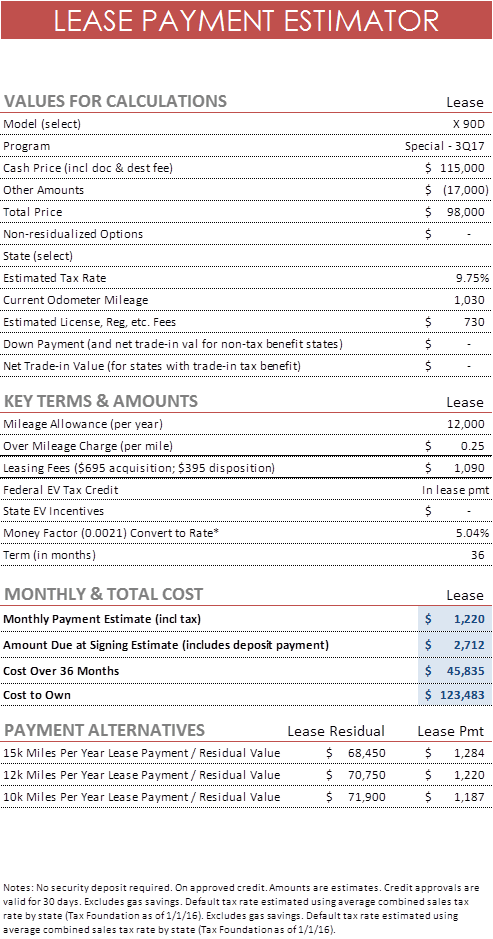

I reserved a X90D with a $17,000 (discount), the car was listed at $98,000 with FSD, I asked the OA and he advised that FSD can be removed and quoted me a lease of $1080 a month for 12K miles on a 3yr lease, but when i received the monthly quote from Tesla finance its a lot higher ($1220 per month), one mistake that tesla has done in the calculation is that they have not removed FSD, but even if i reduce the price of the car by $3000(price of FSD), i cannot get to the quoted $1080, i have emailed the OA to get his thoughts but wanted to reach out to TMC members to get their thoughts

TESLA Lease numbers

Based on the above calculations i am not getting any Federal Tax Credit in the lease payments, are the above calculations correct? does anyone know how much federal tax credit is given to the lessee, is it the full 100%?

TESLA Lease numbers

Based on the above calculations i am not getting any Federal Tax Credit in the lease payments, are the above calculations correct? does anyone know how much federal tax credit is given to the lessee, is it the full 100%?