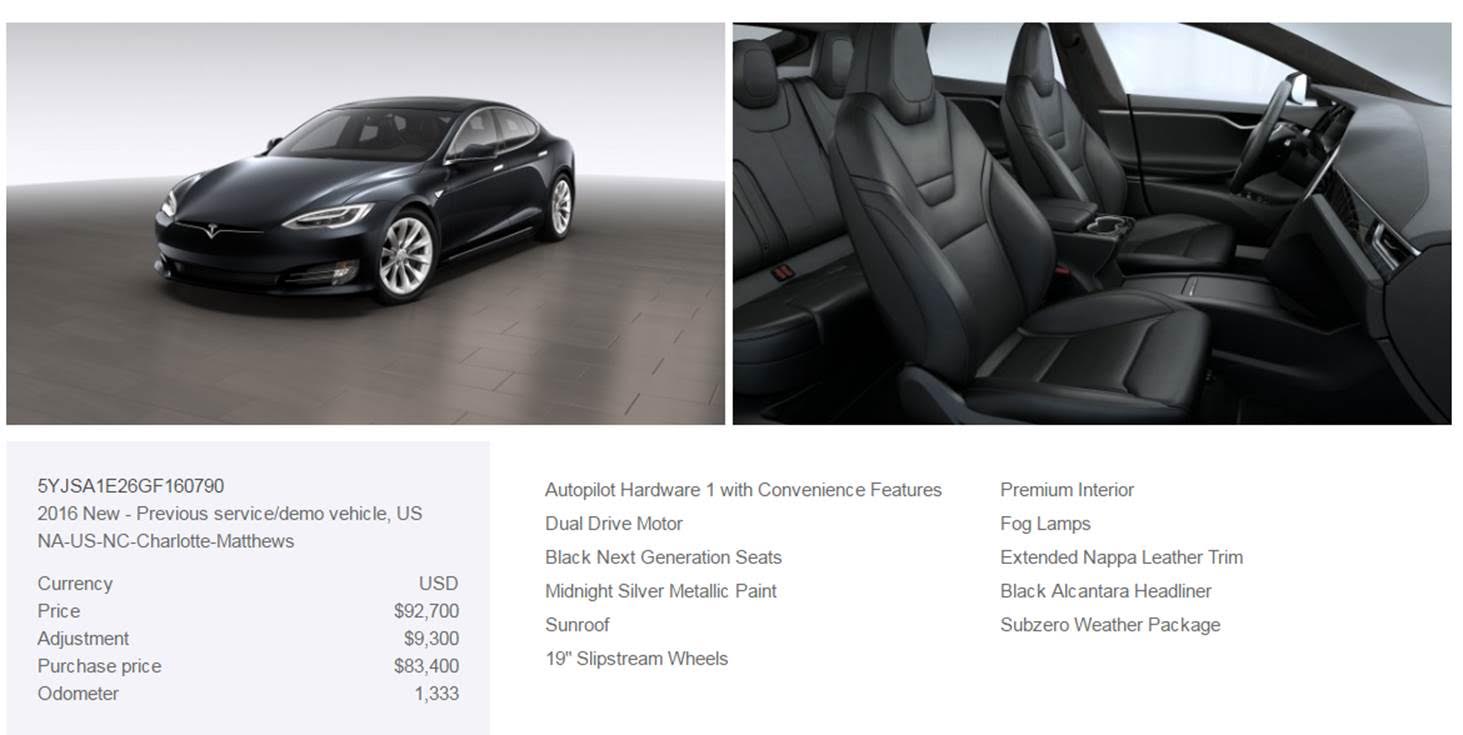

I have a 2016 Model S 75D available for lease takeover. Total payment is $1015.79 and the residual value is $54,777. Currently has 17,000 miles on it which leaves miles over 20,000 left on the lease which ends 2/8/2020. Non smoking- well kept. Pictures and specs attached.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

Lease Takeover on a Model S 75D

- Thread starter mabrett

- Start date