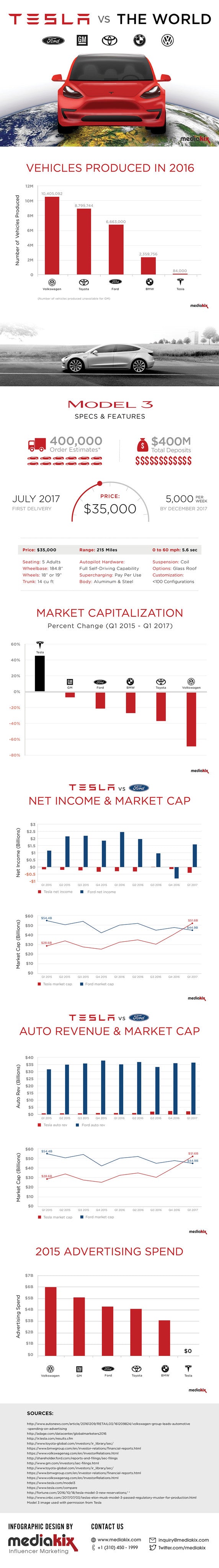

Julian Cox compared the 5 year cost of ownership between an $18,000 Toyota Corolla and a $35,000 Model 3. Even assuming a modest used value after 5 years (average depreciation), the Model 3 was a little cheaper than the Corolla. It gets even cheaper if you have solar power.

I think the market for CPO Model 3s will be very robust for some time and if they were shipped to 3rd world countries they would be competing against cheaper new cars from China. The Chinese EV makers are taking the road Hyundai took to get onto the world stage, they are beginning to introduce their cars that wouldn't pass safety tests in developed countries to third world markets. They are only doing so in small numbers right now because the huge demand at home sucks up most of the supply, but that's the route they are taking. They will use these countries as guinea pigs working out the flaws before introducing them to developed countries en masse with all the safety features required in those countries added.

There is also the problem that in the poorest countries, there isn't enough of an electrical grid to support EVs right now. They are getting solar, but just enough to power some lights, a TV, and maybe a refrigerator. In many of these countries the gasoline infrastructure is so poor gasoline is sold in jars or jerry cans by roadside vendors.

There are many developing countries that have enough of an infrastructure like India or Brazil, but these countries also have a growing domestic car manufacturing market.