So, I had a thought, see if others feel like contributing...

I do this anyways, so I thought I'd keep it online for all to benefit.

I think there is great value in tracking how MaxPain changes, but not just the actual balance point. Kinda like @Artful Dodger has a spin on it, this is purely just taking a screen shot of the graph at various points during the week and comparing how they change.

Mypain main reasons are to see how the call walls are changing and secondary are the put walls.

Anywho, feel free to post screen shots of graphs if you notice there's been a big change or whatever

I like how Maximum-Pain.com does it as the timestamp is what I really like. Sometimes put and call walls can be obscured however, unlike Swaggy Stocks.

For anyone new to looking at these charts, it can be pretty easy (well at least for me) to lose track of the Y-axis. See below for reference

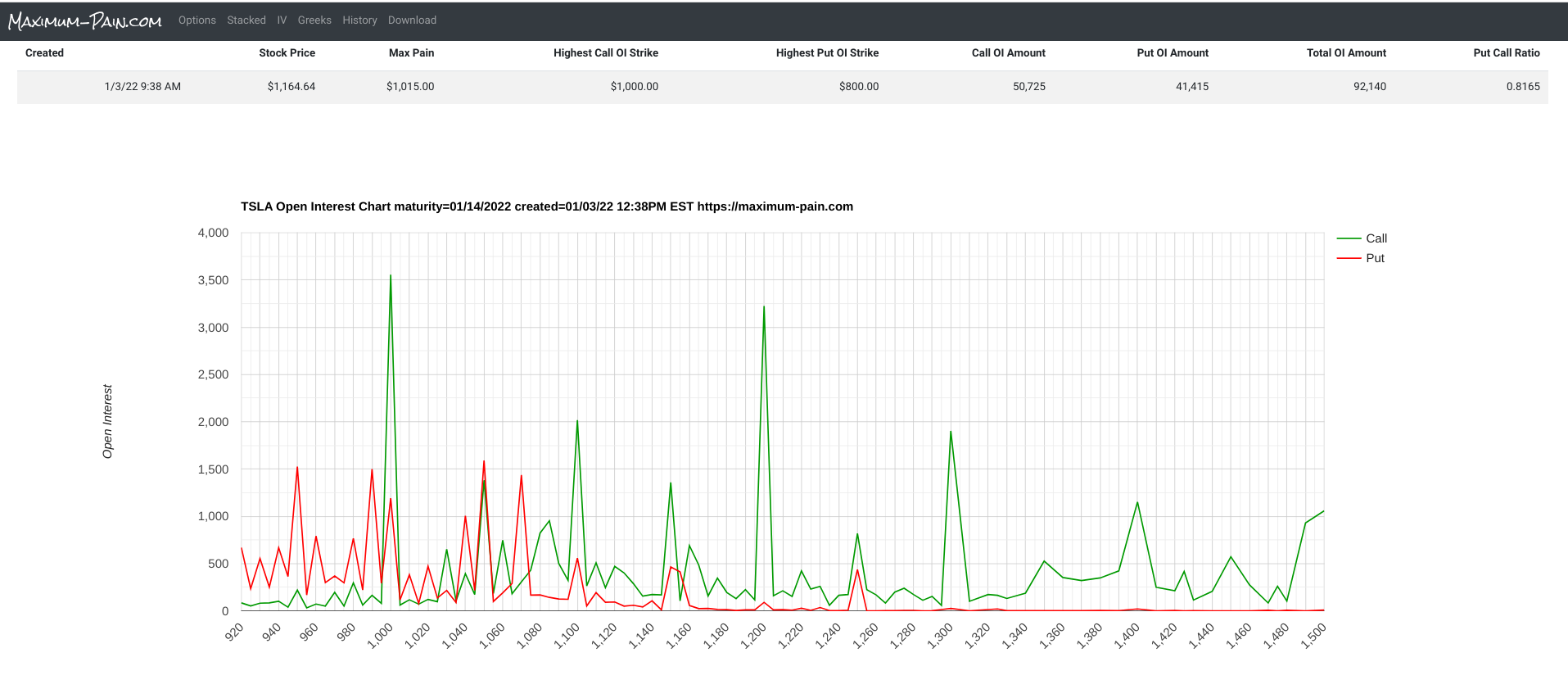

Here's a capture from 1/3/22 for 1/14/22 expiry

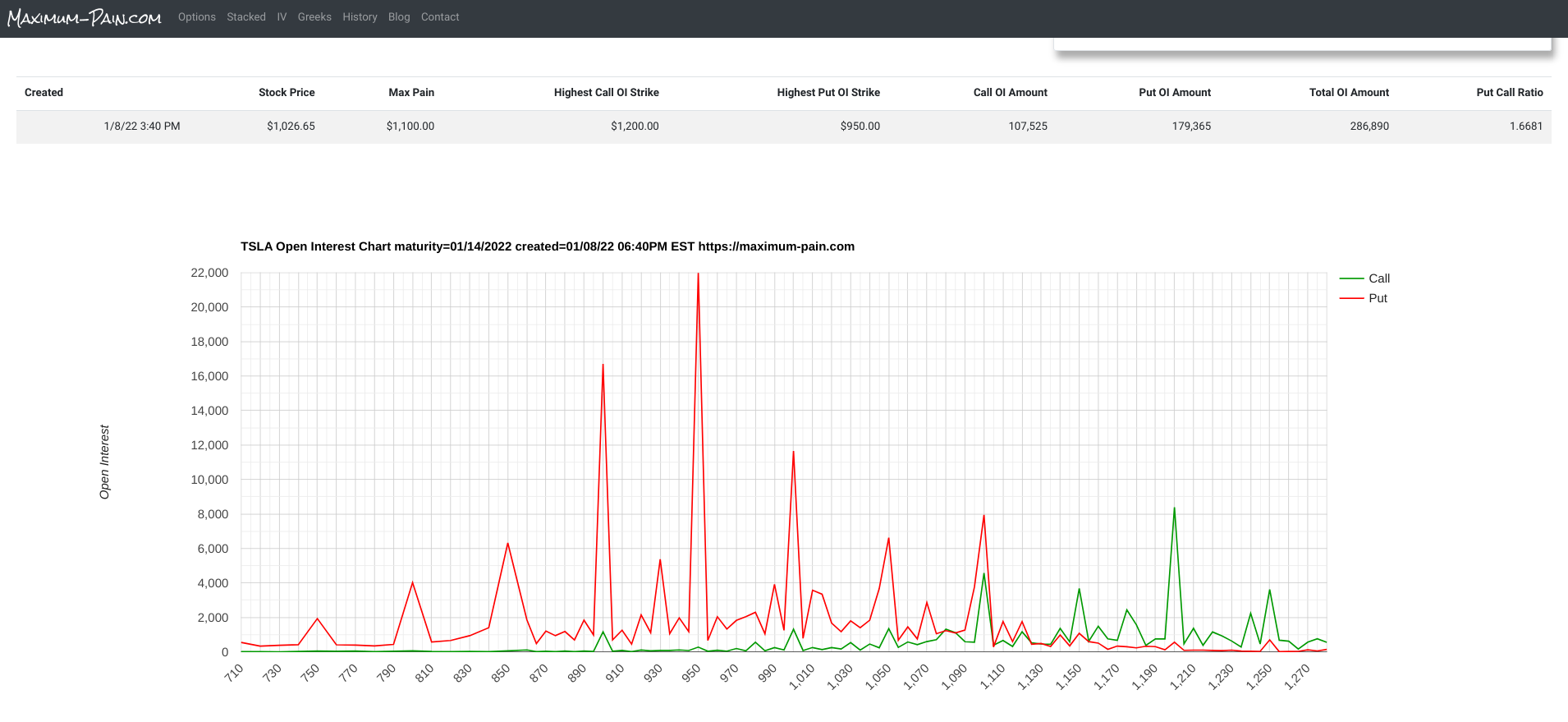

And here's one captured today 1/8/22 for 1/14/22 expiry

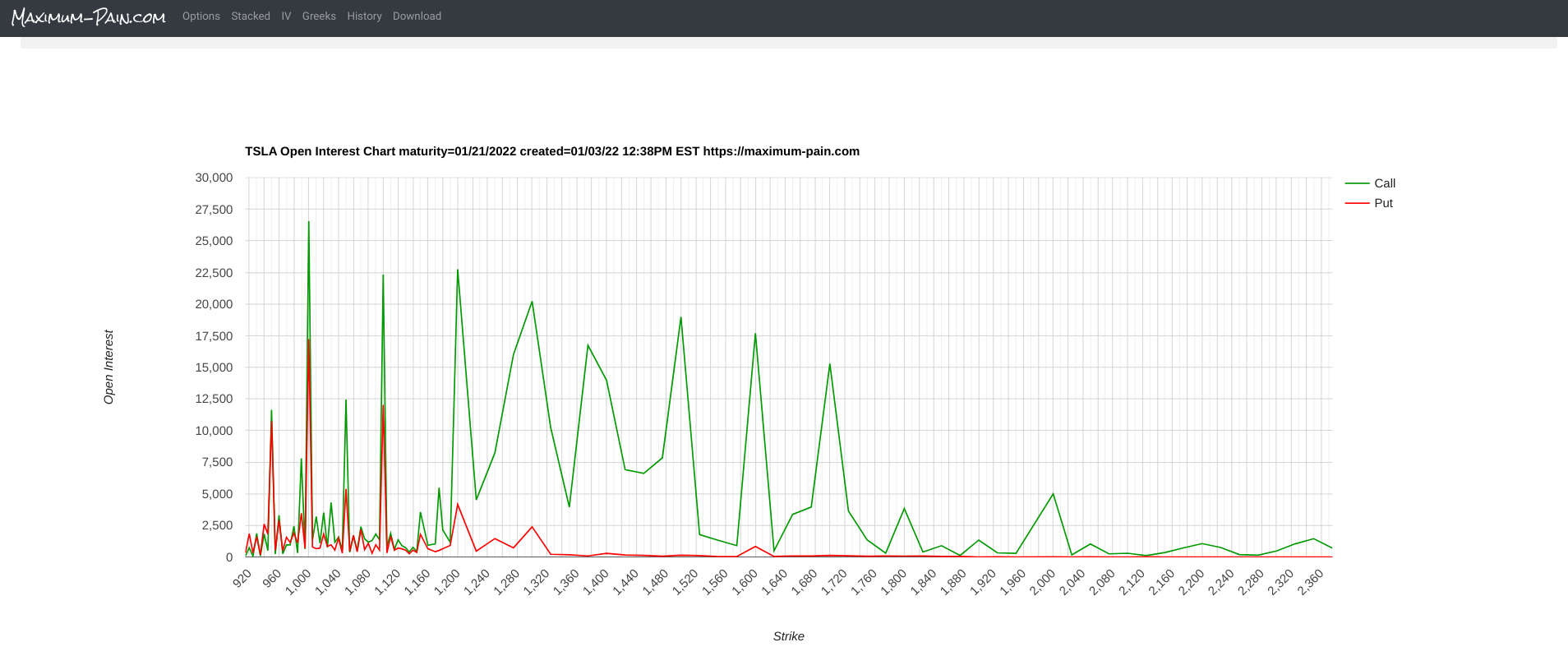

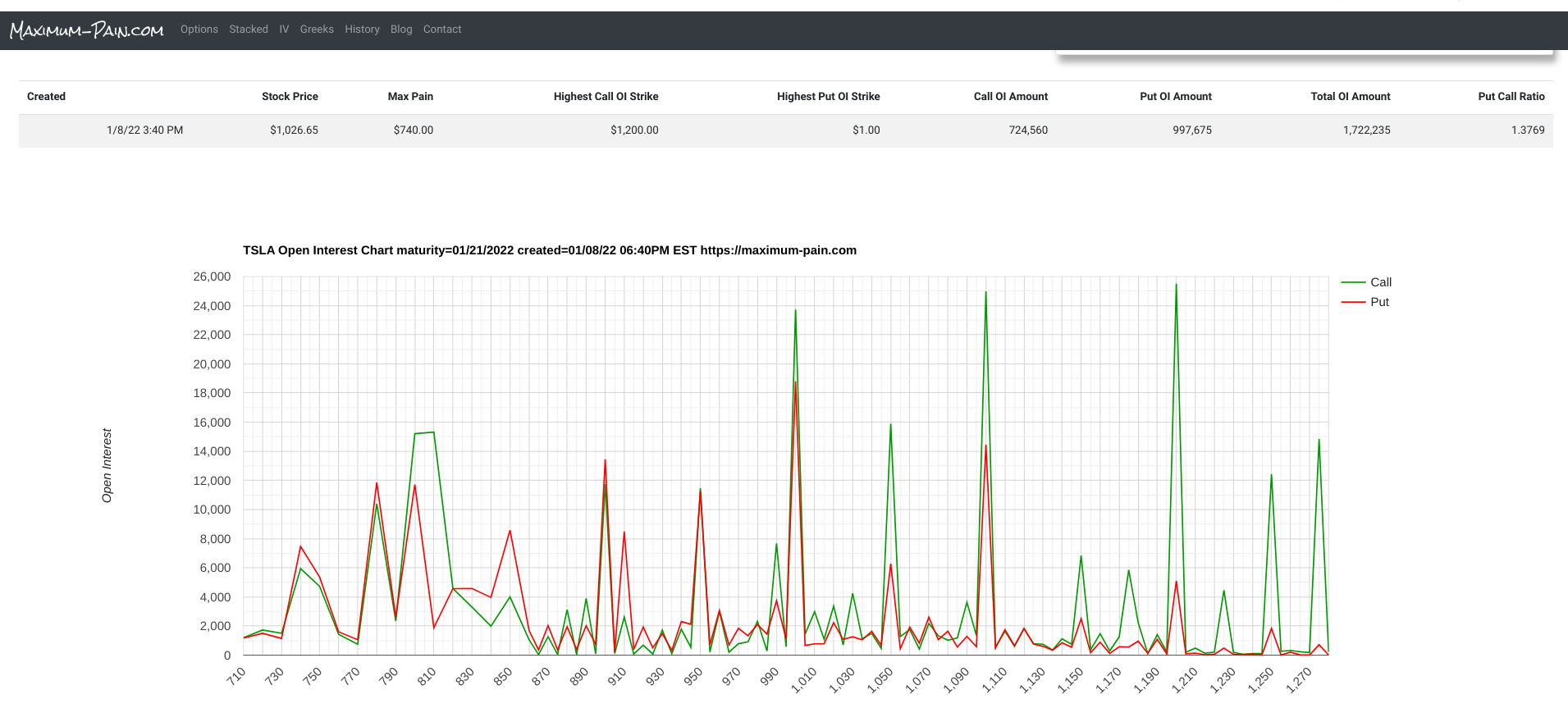

And now for 1/21/22 expiry, which, thanks to @Papafox 's analysis, seems to be something that is greatly affecting the SP even this week as it is a triple witching and was a big LEAP buy back in 2019 prior to the big rise in the stock.

Screenshot taken 1/3/22 for 1/21/22 expiry

Screenshot taken 1/8/22 for 1/21/22 expiry

I do this anyways, so I thought I'd keep it online for all to benefit.

I think there is great value in tracking how MaxPain changes, but not just the actual balance point. Kinda like @Artful Dodger has a spin on it, this is purely just taking a screen shot of the graph at various points during the week and comparing how they change.

My

Anywho, feel free to post screen shots of graphs if you notice there's been a big change or whatever

I like how Maximum-Pain.com does it as the timestamp is what I really like. Sometimes put and call walls can be obscured however, unlike Swaggy Stocks.

For anyone new to looking at these charts, it can be pretty easy (well at least for me) to lose track of the Y-axis. See below for reference

Here's a capture from 1/3/22 for 1/14/22 expiry

And here's one captured today 1/8/22 for 1/14/22 expiry

And now for 1/21/22 expiry, which, thanks to @Papafox 's analysis, seems to be something that is greatly affecting the SP even this week as it is a triple witching and was a big LEAP buy back in 2019 prior to the big rise in the stock.

Screenshot taken 1/3/22 for 1/21/22 expiry

Screenshot taken 1/8/22 for 1/21/22 expiry