Introduction:

I decided to start this thread as a place to share information and opinions, about topics that I believe are under appreciated by most Investors. I hope that having access to this information helps many of you invest successfully.

I am starting beginning this thread with a large post with information about Cell and Battery Technology, the cost of Tesla's Battery Packs (lower than most of us think), the GF and Stationary Storage Margins. If they don't lower their prices, by the end of 2017 their Stationary Storage Margins should be at least 50%! That figure is derived using the 15% current margin claim. With a target market of $3 billion to $5 billion by 2017!

I performed these calculations using IMO conservative estimates. For every unknown I am including the reasons for all of my assumptions, so if you think any of my prices are too high or too low you can easily revise my figures and obtain estimates that you feel comfortable with.

I am using the Powerpack prices for the foundation of my estimates. Having these on the market makes it possible to make much more accurate estimates of their car pack costs than were possible before they were introduced.

I believe that (reasons provided where I do the calculations) their current Stationary Storage margins are about 25% (not 15%), which I believe is a major reason for their confidence in their 2016 positive cash flow projections. IMO the 25% Stationary Storage margin the only aggressive figure that I use in my calculations. So I am including figures that assume both a 15% margin and a 25% margin.

Results:

My "TE 25%-margin" based estimates for automobile pack costs are:

At the end of 2015 $165 per kWh

By the end of 2017 $107 per kWh

By the end of 2020 $66 per kWh

My "TE 15%-margin" based estimates for automobile pack costs are:

At the end of 2015 $190 per kWh

By the end of 2017 $124 per kWh

By the end of 2020 $76 per kWh

I believe that the GF is a major reason for JB's optimism:

Energy Storage Tipping Point Within 10 Years, Tesla Motors CTO JB Straubel Contends | CleanTechnica

AUTOS: Tesla chief predicts price parity with gasoline-powered cars within 10 years -- Friday, August 1, 2014 -- www.eenews.net

The 2020s could be the 'decade of the electric car' - Business Insider

Electric Cars To Cost Same As ICE Within A Decade

Notes:

IMO it doesn't ultimately matter which of these price figures you use, because by the end of 2017, they are all very low.

It's also possible IMO to absolutely confident that:

1. Considering the increased costs to build legal ICE's (emissions devices, 6-8sp dual clutch transmissions etc.), by the 2017-2019 time frame it will cost Tesla substantially less to build EV's with ranges of about 250 miles, than it costs their competitors to build comparable ICE's, hybrids or PHEV's.

2. There is absolutely no doubt that by the end of 2017 Tesla will be able to make a substantial profit on a $35k EV with a 250 mile (or greater) range. For comparison Bolt Cell cost is $145 per kWh and my estimates for Tesla Pack cost are $107-$124 per kWh.

3. When they have sufficient GF Cell's available Tesla will be able to produce MS and MS sized packs for about $6k-$8k less than their current costs.

4. There is absolutely no doubt that by the end of 2017 Tesla will be able to either have drastically higher margins or drastically lower the prices of their Stationary Storage Products, by using cells produced at the GF.

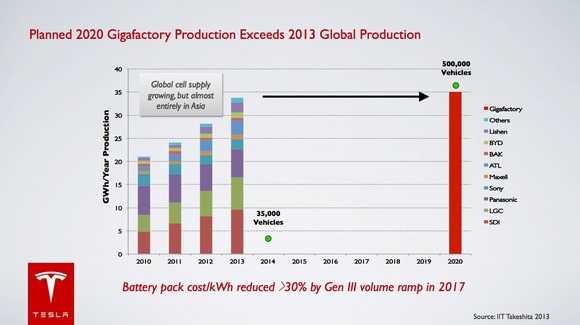

For the reductions in costs due to the Gigafactory I used their numbers of "the Gigafactory will drive down the cost of its battery packs 30% by 2017 and 50% by 2020" which they have repeated frequently. They have also frequently said that a 30% reduction by 2017 was a conservative prediction.

Cell and Pack Information:

Energy Density:

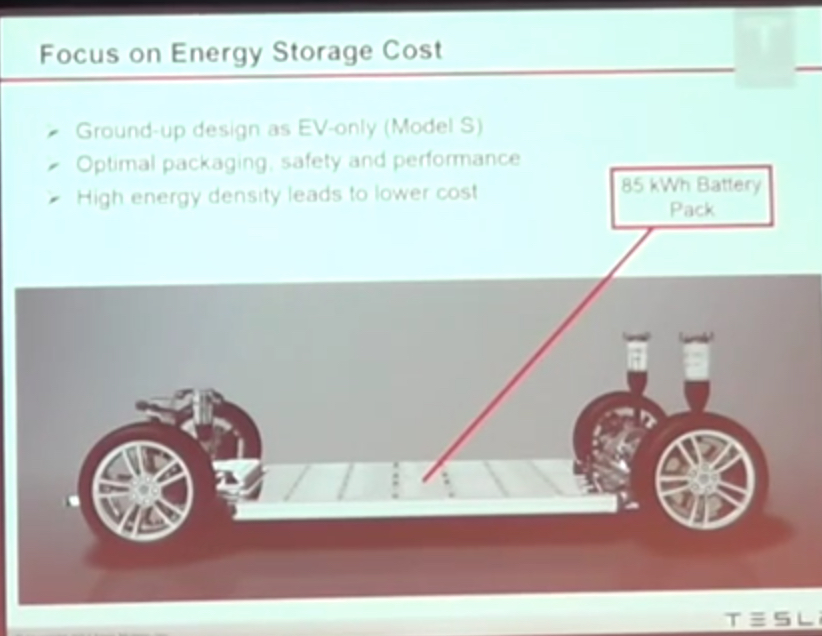

Elon recently said that the most important Battery Parameter to improve is the Cost. That doesn't mean that improvements in other area's are unimportant, but less important. So Tesla's main advantage in terms of Batteries is that their Battery pack costs are the lower than any existing other producer of OEM quality Automobile Packs. They also have the lowest prices and costs for high quality stationary storage packs.

And JB Straubel said, in the following talk, at about 10 minutes:

"energy density is the key pathway to low cost"

2014 Energy Storage Symposium - JB Straubels Keynote - YouTube

The costs of a battery pack are mainly dependent on the price of the cell materials, the relative complexity of producing the cells, and the materials and production costs for the pack (enclosure, interconnects etc.). Increased energy density reduces the costs of all of these items by reducing the number of cells required. Of course its possible for there to be some increases in cell related materials and production costs, but since Tesla's main priority is reducing prices, and is the main factor driving their improvements in cell chemistry, it is safe to assume that as they continue to increase the cell energy density that will cause their total pack prices to decline.

Energy Density - Powerwall example:

The price for Tesla's 7kWh Powerwall is $3,000 (NMC, $429 per kWh), while the 10kWh one is $3500 (NCA, $350 per kWH). Which is 1.43x the energy (density) for 1.17x the cost. For the Powerwall's on a per kWh basic the materials for the NCA cells, with greater volumetric energy density do cost slightly more, but that slight extra cost is overshadowed by the additional capacity.

Power (C-rate):

Batteries - Learn

Some people believe that Tesla's cells have high power, and that this is important for Tesla or for BEV cars. The Powerwall specs for the backup chemistry (quite similar to the car) has a wimpy C-rate of .33. I believe that the car packs have a higher peak rate (about 4 C), but that still isn't very high. The Chevy Volt Packs are rated conservatively by GM at 7.8C but the Chevy Bolt Pack is rated at 2.33C. The reason that is not important for Tesla (and BEV's in general) is that using Cells with a high C-rate is much less important with larger packs. OTOH high power cells are generally rated to allow faster charging, so using cells with a higher C-rate, would allow faster Supercharging.

Battery Chemistry Tweaks - Major Advantage:

I believe that Tesla has a major advantage in developing and testing low level battery chemistry tweaks, due to their recent hiring of Jeff Dahn's team, and their earlier hiring of one of his PHD Students.

Charged EVs | Tesla hires prominent battery researcher Jeff Dahn

The video above from 2013 details his work. In a nutshell it is pretty easy to quickly determine all of the performance characteristics of Li-ion Batteries, except for cycle life. He and his team have figured out a much faster method to determine cycle life, which is a huge advantage in developing and evaluating cell chemistries. I believe that they will continue to physically test cells before using them in production, but being able to quickly test a large variety of cell varieties to narrow the field should be a huge help.

Larger Cell Format:

I have wondered why I have seen statements that the new larger cell format would lead to 30% increased pack energy density. It will not. I think that the source of the confusion is the following statement by EM:

To simplify the calculation in the following example I used an increase of 100%. But with a 30% increase the results would be similar. A circle with twice the diameter has four times the volume. But if the cells have twice the diameter only one fourth the number of cells will fit in a given space, e.g.:

A 100mm x 100mm space will accommodate 100 cells with a diameter of 10mm (10 x 10), but only 25 20mm diameter cells (5 x 5). So it roughly evens out, four times the capacity per cell, but in a space with the same dimensions only one fourth the number of cells will fit.

The reason they are changing the cell size is to reduce the cost, probably largely due to decreased pack complexity:

The GF Will Use Custom Cell Manufacturing Equipment:

I just noticed that Tesla and Panasonic will be using custom cell manufacturing equipment at the GF, and that will have a big impact on the costs:

The Calculations:

Attempting to Convert PowerPack Prices to Car Pack Costs Requires Accounting For Three Variables (I believe that assembling the cells into modules will be almost identical for both types of packs); Enclosure Costs, Cell Costs and Profit Margin:

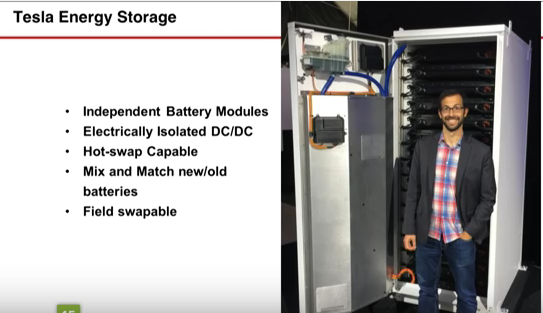

Enclosure Costs:

I think that the major differences are that the PowerPack Enclosures are more complex (hot swappable cell modules) and more robust (designed for freestanding outdoor usage for 20-30 years). OTOH they are probably made of steel instead of more expensive aluminum. I'm calling this a wash with these two caveats:

1. I do not have a high level of confidence in this assumption.

2. I do not believe it's an important issue, because in addition to the offsetting factors I believe that Tesla is doing an excellent job of driving down enclosure and pack related costs, to the point that I don't think they represent more than 10-20% of their total pack costs.

Cell Costs:

The quotes below are from the 2015 Q1 eeking FUD Earnings Call Transcript:

Tesla Motors' (TSLA) CEO Elon Musk on Q1 2014 Results - Earnings Call Transcript | Seeking Alpha

The price for Tesla's 7kWh Powerwall is $3,000 ($429 per kWH), while the 10kWh one is $3500 ($350 per kWH). Which means that the Powerwall's with cell "chemistry is quite similar to the car" are priced at 18% less than the Powerwall's with the same cells used in the Powerpack's that are priced at $250 per kWh. I think it's a safe assumption that the car pack cell prices are closer to the cells that are "quite similar", so I believe that splitting the difference (deducting 9% from the $250 per kWh price) is very conservative.

Stationary Storage Profit Margin:

Musk Says Tesla Gross Margin to Approach Porsche’s - Bloomberg Business

I think that most investors and analysts assumed that included the 30%-50% GF cost reductions, which doesn't add up, unless they were selling Powerpacks and Powerwalls produced in Fremont at a huge loss (at least 15%)...

Which means that he must have been referring to setting up the [/b]"automated assembly line at the Gigafactory".

The 15% figure came from Colin Langan. EM and JB said respectively that "...going to be any problem meeting a 15% margin target" and "it should be in excess of 15%".

Tesla gives much more precision in their MX and MX profits than on their stationary storage profits, despite the fact that EM stated that "we’re constantly agonizing about cell cost and pack cost". In other words they are trying to avoid disclosing their pack costs by understating their stationary storage margins.

The only way I can interpret the statements above, that makes sense to me, is this: Tesla set an internal target of 25-30% margins for Powerpacks and Powerwalls that would be produced when they started production on an automated assembly line. As long as they made sure that they were making something like 10-15% on the packs produced by hand in Fremont, they were probably ok with that, as they were always planning on setting up an automated assembly line very soon anyway. So I am deducting 25% from the $250 per kWh price for my conservative, and deducting 15% for my worst case figure. Part of what I mean by "makes sense to me" is that there is no possible way IMO that EM and JB would launch a multi-billion dollar business, with pricing so disruptively low that it's products generate "off-the-hook" demand at substantially lower margins than their stated goal of 25%.

Even if you believe that the 15% figure is correct for current production, that's obviously before incorporating the 35% (30% + 5% cell chemistry) reductions due to using cells produced at the GF. So by the end of 2017 the TE margins should be at least (15% + 30% + 5% cell) or 50% (they might lower their prices)! With a target of $3 billion to $5 billion by 2017!

Current Car Pack Cost Results from PowerPack Prices:

TE 25%-margin: $165.00 per kWh ($250 - 34% (9% cell + 25% margin)

TE 15%-margin: $190.00 per kWh ($250 - 24% (9% cell + 15% margin))

Gigafactory Cost Reduction Estimates:

Tesla's endgame: Why electric vehicles are just the beginning | Utility Dive

Those figures do not include cost reductions due to cell chemistry improvements:

Musk: Tesla Gigafactory will produce cells with battery technology improvement over current products | Electrek

My assumptions are that moderate means a five percent decrease in costs, plus another five percent decrease by the end of 2020.

Complete TE 25%-margin based estimates for automobile pack costs:

At the end of 2015 $165 per kWh

By the end of 2017 $107 per kWh ($165 - 35% (30% GF + 5% cell)

By the end of 2020 $66 per kWh ($165 - 60% (50% GF + 10% cell)

Complete TE 15%-margin based estimates for automobile pack costs:

At the end of 2015 $190 per kWh

By the end of 2017 $124 per kWh ($190 - 35% (30% GF + 5% cell)

By the end of 2020 $76 per kWh ($190 - 60% (50% GF + 10% cell)

This might not happen until after the M3 production ramp , but at some point they will be producing less expensive cells for the MS-MS, in addition to TE and the M3.

There is a very large market for large UPS's (e.g. Data centers). The author of the quote below worked as a datacenter engineer for Microsoft:

I decided to start this thread as a place to share information and opinions, about topics that I believe are under appreciated by most Investors. I hope that having access to this information helps many of you invest successfully.

I am starting beginning this thread with a large post with information about Cell and Battery Technology, the cost of Tesla's Battery Packs (lower than most of us think), the GF and Stationary Storage Margins. If they don't lower their prices, by the end of 2017 their Stationary Storage Margins should be at least 50%! That figure is derived using the 15% current margin claim. With a target market of $3 billion to $5 billion by 2017!

I performed these calculations using IMO conservative estimates. For every unknown I am including the reasons for all of my assumptions, so if you think any of my prices are too high or too low you can easily revise my figures and obtain estimates that you feel comfortable with.

I am using the Powerpack prices for the foundation of my estimates. Having these on the market makes it possible to make much more accurate estimates of their car pack costs than were possible before they were introduced.

I believe that (reasons provided where I do the calculations) their current Stationary Storage margins are about 25% (not 15%), which I believe is a major reason for their confidence in their 2016 positive cash flow projections. IMO the 25% Stationary Storage margin the only aggressive figure that I use in my calculations. So I am including figures that assume both a 15% margin and a 25% margin.

Results:

My "TE 25%-margin" based estimates for automobile pack costs are:

At the end of 2015 $165 per kWh

By the end of 2017 $107 per kWh

By the end of 2020 $66 per kWh

My "TE 15%-margin" based estimates for automobile pack costs are:

At the end of 2015 $190 per kWh

By the end of 2017 $124 per kWh

By the end of 2020 $76 per kWh

I believe that the GF is a major reason for JB's optimism:

Energy Storage Tipping Point Within 10 Years, Tesla Motors CTO JB Straubel Contends | CleanTechnica

JB Straubel said:“I think we’re at the beginning of a new cost-decline curve, and, you know, this is something where there’s a lot of similarities to what happened with photovoltaics. Almost no one [would have predicted] that photovoltaic prices would have dropped as fast as they have, and storage is right at the cliff, heading down that price curve. It’s soon going to be cheaper to drive a car on electricity — a pure EV on electricity — than it is to drive a gasoline car. And as soon as we see that kind of shift in the actual cost of operation in a car that you can actually use for your daily driver, you know, from all manufacturers I believe we’re going to see electric vehicles come to dominate the whole transportation fleet.

“Also, that same battery cost decrease is going to drive batteries in the grid. There’s going to be much faster growth of grid energy storage than I think most people expected. You suddenly get to have energy that’s 100% firm and buffered from photovoltaics that’s cheaper than fossil energy. And we’re within sort of grasping distance of that goal, which is very, very exciting.

“Because once we get to that, and there really is no going back, it will make sense to do this economically without any environmental consideration whatsoever. So that’s the amazing tipping point that’s going to happen within I’m quite certain the next 10 years.”

AUTOS: Tesla chief predicts price parity with gasoline-powered cars within 10 years -- Friday, August 1, 2014 -- www.eenews.net

Friday, August 1, 2014

Tesla announced yesterday that it had signed a formal agreement with Panasonic Corp. to build a large-scale battery manufacturing plant, dubbed the "Gigafactory." In light of the technical and logistical advances the factory would bring, Musk said he would be "disappointed" if it took Tesla 10 years to make a $100-per-kWh pack, suggesting it could happen before the end of the decade.

"It's heading to a place of no contest with gasoline," said Musk speaking to the expected drop in battery cost on a second-quarter earnings call.

The 2020s could be the 'decade of the electric car' - Business Insider

It sounds like Bloomberg's analysts and Elon and JB are living in different universes. This disconnect isn't limited to Bloomberg's analysts. If you believe JB knows what he's talking about, and was not lying (it's exactly the opposite, he and Elon have been understating Tesla' Battery costs for years). IMO this knowledge represents a huge investment opportunity.Bloomberg's Tom Randall summarized the research and offered four critical drivers for the predictions to become reality and for EVs to reach a tipping point:

According to BNEF's Colin McKerracher, "At the core of this forecast is the work we have done on EV battery prices."

Governments must offer incentives to lower the costs.

Manufacturers must accept extremely low profit margins.

Customers must be willing to pay more to drive electric.

The cost of batteries must come down.

"Lithium-ion battery costs have already dropped by 65% since 2010, reaching $350 per kWh last year," he added in a statement. "We expect EV battery costs to be well below $120 per kWh by 2030, and to fall further after that as new chemistries come in." (Emphasis added.).

Electric Cars To Cost Same As ICE Within A Decade

Within the next decade, the cost of electric cars will equal or undercut ICE automobiles, according to Deutsche Bank analyst Rod Lache. This downward movement in costs will “serve as a catalyst for significant expansion” of electric car sales.

According to Lache, there are two factors that could eliminate the cost gap.

The first is that battery prices are expected to drop by more than half to $100 per kilowatt hour—not because of a scientific leap, but due to engineering improvements and economies of scale, particularly at Tesla’s “gigafactory.”

The second factor is that combustion engines will get a lot more expensive, Lache says. US gasoline efficiency standards, which require that light vehicle fleets average 54.5 miles a gallon by 2025, will incur added costs of $2,000 to $2,600 per vehicle. That will raise the total cost of a typical drive train—an engine, transmission, and fuel and exhaust system—to $7,000 to $7,600 per vehicle in the United States, he writes.

As for electric car costs, Lache says that using the $100 per kilowatt hour cost that Deutsche Bank expects, to see within the next decade, a 47 kilowatt-hour battery pack would cost only $4,700. Add in electric motor cost and you’ve got a complete powertrain for ~ $6,000, claims Lache.

Notes:

IMO it doesn't ultimately matter which of these price figures you use, because by the end of 2017, they are all very low.

It's also possible IMO to absolutely confident that:

1. Considering the increased costs to build legal ICE's (emissions devices, 6-8sp dual clutch transmissions etc.), by the 2017-2019 time frame it will cost Tesla substantially less to build EV's with ranges of about 250 miles, than it costs their competitors to build comparable ICE's, hybrids or PHEV's.

2. There is absolutely no doubt that by the end of 2017 Tesla will be able to make a substantial profit on a $35k EV with a 250 mile (or greater) range. For comparison Bolt Cell cost is $145 per kWh and my estimates for Tesla Pack cost are $107-$124 per kWh.

3. When they have sufficient GF Cell's available Tesla will be able to produce MS and MS sized packs for about $6k-$8k less than their current costs.

4. There is absolutely no doubt that by the end of 2017 Tesla will be able to either have drastically higher margins or drastically lower the prices of their Stationary Storage Products, by using cells produced at the GF.

For the reductions in costs due to the Gigafactory I used their numbers of "the Gigafactory will drive down the cost of its battery packs 30% by 2017 and 50% by 2020" which they have repeated frequently. They have also frequently said that a 30% reduction by 2017 was a conservative prediction.

Cell and Pack Information:

Energy Density:

Elon recently said that the most important Battery Parameter to improve is the Cost. That doesn't mean that improvements in other area's are unimportant, but less important. So Tesla's main advantage in terms of Batteries is that their Battery pack costs are the lower than any existing other producer of OEM quality Automobile Packs. They also have the lowest prices and costs for high quality stationary storage packs.

And JB Straubel said, in the following talk, at about 10 minutes:

"energy density is the key pathway to low cost"

2014 Energy Storage Symposium - JB Straubels Keynote - YouTube

The costs of a battery pack are mainly dependent on the price of the cell materials, the relative complexity of producing the cells, and the materials and production costs for the pack (enclosure, interconnects etc.). Increased energy density reduces the costs of all of these items by reducing the number of cells required. Of course its possible for there to be some increases in cell related materials and production costs, but since Tesla's main priority is reducing prices, and is the main factor driving their improvements in cell chemistry, it is safe to assume that as they continue to increase the cell energy density that will cause their total pack prices to decline.

Energy Density - Powerwall example:

The price for Tesla's 7kWh Powerwall is $3,000 (NMC, $429 per kWh), while the 10kWh one is $3500 (NCA, $350 per kWH). Which is 1.43x the energy (density) for 1.17x the cost. For the Powerwall's on a per kWh basic the materials for the NCA cells, with greater volumetric energy density do cost slightly more, but that slight extra cost is overshadowed by the additional capacity.

Power (C-rate):

Batteries - Learn

ebikes.ca said:C-rate Definition:

One term you will frequently come across is the 'C' rate of a battery pack. This is a way of normalizing the performance characteristics so that batteries of different capacity are compared on equal terms. Suppose you have an 8 amp-hour pack. Then 1C would be is 8 amps, 2C would be 16 amps, 0.25C would be 2 amps etc. A higher 'C' rate of discharge is more demanding on the cells, and often requires specialty high rate batteries.

Some people believe that Tesla's cells have high power, and that this is important for Tesla or for BEV cars. The Powerwall specs for the backup chemistry (quite similar to the car) has a wimpy C-rate of .33. I believe that the car packs have a higher peak rate (about 4 C), but that still isn't very high. The Chevy Volt Packs are rated conservatively by GM at 7.8C but the Chevy Bolt Pack is rated at 2.33C. The reason that is not important for Tesla (and BEV's in general) is that using Cells with a high C-rate is much less important with larger packs. OTOH high power cells are generally rated to allow faster charging, so using cells with a higher C-rate, would allow faster Supercharging.

Battery Chemistry Tweaks - Major Advantage:

I believe that Tesla has a major advantage in developing and testing low level battery chemistry tweaks, due to their recent hiring of Jeff Dahn's team, and their earlier hiring of one of his PHD Students.

Charged EVs | Tesla hires prominent battery researcher Jeff Dahn

Why do Li-ion Batteries die ? and how to improve the situation? - YouTubeWhy do Li-ion Batteries die? and how to improve the situation?

The video above from 2013 details his work. In a nutshell it is pretty easy to quickly determine all of the performance characteristics of Li-ion Batteries, except for cycle life. He and his team have figured out a much faster method to determine cycle life, which is a huge advantage in developing and evaluating cell chemistries. I believe that they will continue to physically test cells before using them in production, but being able to quickly test a large variety of cell varieties to narrow the field should be a huge help.

Larger Cell Format:

I have wondered why I have seen statements that the new larger cell format would lead to 30% increased pack energy density. It will not. I think that the source of the confusion is the following statement by EM:

Elon Musk - Chairman and CEO said:Right. We've done a lot of modeling trying to figure out what's the optimal cell size. And it's really not much -- it's not a lot different from where we are right now, but we're sort of in the roughly 10% more diameter, maybe 10% more height. But then the cubic function effectively ends up being, just from a geometry standpoint, probably a third more energy for the cell, if you -- maybe 30%-ish. And then the actual energy density per unit mass increases,...

To simplify the calculation in the following example I used an increase of 100%. But with a 30% increase the results would be similar. A circle with twice the diameter has four times the volume. But if the cells have twice the diameter only one fourth the number of cells will fit in a given space, e.g.:

A 100mm x 100mm space will accommodate 100 cells with a diameter of 10mm (10 x 10), but only 25 20mm diameter cells (5 x 5). So it roughly evens out, four times the capacity per cell, but in a space with the same dimensions only one fourth the number of cells will fit.

The reason they are changing the cell size is to reduce the cost, probably largely due to decreased pack complexity:

JB Straubel - Chief Technology Officer said:Yeah. Yeah, fundamentally the chemistry of what's inside is what really defines the cost position now. It's often debated what shape and size, but at this point we're developing basically what we feel is the optimum shape and size for the best cost efficiency for an automotive cell.

The GF Will Use Custom Cell Manufacturing Equipment:

I just noticed that Tesla and Panasonic will be using custom cell manufacturing equipment at the GF, and that will have a big impact on the costs:

Elon Musk - Chairman and CEO said:In your question you had [indiscernible] should be corrected, like the -- so the 30% savings is not just due to logistics. Logistics is a big factor. We are --

JB Straubel - Chief Technology Officer said:It's not even the biggest though.

Elon Musk - Chairman and CEO said:Logistics [indiscernible] the fact that it's just go to one station to the next instead of going from multiple entities to multiple entities. But really when you get to the kinds of scale that we're talking about, you really get to design customer equipment that's much better at processing each step. And you really get to design the machine that makes the machine, not just do so with off-the-shelf equipment. So it took -- everything about it is going to get a whole lot better. That's why we think the 30% number when the Giga Factory is at full production is a conservative number...

The Calculations:

Attempting to Convert PowerPack Prices to Car Pack Costs Requires Accounting For Three Variables (I believe that assembling the cells into modules will be almost identical for both types of packs); Enclosure Costs, Cell Costs and Profit Margin:

Enclosure Costs:

I think that the major differences are that the PowerPack Enclosures are more complex (hot swappable cell modules) and more robust (designed for freestanding outdoor usage for 20-30 years). OTOH they are probably made of steel instead of more expensive aluminum. I'm calling this a wash with these two caveats:

1. I do not have a high level of confidence in this assumption.

2. I do not believe it's an important issue, because in addition to the offsetting factors I believe that Tesla is doing an excellent job of driving down enclosure and pack related costs, to the point that I don't think they represent more than 10-20% of their total pack costs.

Cell Costs:

The quotes below are from the 2015 Q1 eeking FUD Earnings Call Transcript:

Tesla Motors' (TSLA) CEO Elon Musk on Q1 2014 Results - Earnings Call Transcript | Seeking Alpha

Elon Musk (Chairman and CEO) said:There are two applications which are quite different. One is backup power, or peak-up -- the equivalent, on a utility scale of like a peaker plant, which is a high-energy application. And there is the daily cycler application. There are different chemistries, depending upon what you have.

The backup power chemistry is quite similar to the car, which is a nickel cobalt aluminum or a cathode. The daily cycling control constituent is nickel manganese cobalt. It's quite a lot of manganese in there.

One is meant for, call it maybe 60 or 70 cycles per year. And the other one is meant for daily cycling -- daily deep cycling, so it's 365 cycles a year. The daily cycler one, we expected to be able to daily cycle for something on the order of 15 years. Obviously warranty period would be a little bit less than that. We expected to be something that's in the 5000-cycle range capability. Whereas the high-energy pack is more like around the maybe, depending on how it's used, anywhere from 1000 to 1500 cycles. They have comparable calendar lives.

The price for Tesla's 7kWh Powerwall is $3,000 ($429 per kWH), while the 10kWh one is $3500 ($350 per kWH). Which means that the Powerwall's with cell "chemistry is quite similar to the car" are priced at 18% less than the Powerwall's with the same cells used in the Powerpack's that are priced at $250 per kWh. I think it's a safe assumption that the car pack cell prices are closer to the cells that are "quite similar", so I believe that splitting the difference (deducting 9% from the $250 per kWh price) is very conservative.

Stationary Storage Profit Margin:

Musk Says Tesla Gross Margin to Approach Porsche’s - Bloomberg Business

http://www.forbes.com/sites/jeffmcmahon/2015/05/05/why-tesla-batteries-are-cheap-enough-to-prevent-new-power-plants/#6629099f3f87Elon Musk said:June 5, 2013

Tesla, based in Palo Alto, California, has set a goal of attaining a 25 percent gross margin this year, Musk told investors yesterday at the company’s annual meeting.

Teslas Battery Strategy Receives Little Discussion, But It ShouldElon Musk said:May 5, 2015

Tesla’s utility-scale Powerpack battery, unveiled late Thursday night, will sell for $250/kWh.

“There’s nothing remotely at these price points,” said Tesla product architect Elon Musk.

teslarati.com said:During Tesla’s latest earning’s call, Musk and JB Straubel commented on the recent claim by GM that they would have an “industry-leading” $145 per kWh cell cost, and that both companies expect the cost to dip below $100 per kWh by 2021

Elon Musk said:I mean we’re constantly agonizing about cell cost and pack cost, and we don’t think anyone is on a path to be even close to us. If they are, I would be the first to congratulate them.

Jason Wheeler (CFO) said:Sure. So, as we said in the letter, 25% by the end of the year for Model X. Sorry. I'm a little under the weather, and 30% for the Model S. You can do the math on what the blended rate will look like. In terms of getting to 25% for Model X, the way you have to think about it, we have many years of history with the Model S and that is learning that can certainly be applied to what we are doing with Model X...

Elon Musk (Chairman and CEO) said:Yes, in the long run we expect the gross margins of the S and X to converge around the 30% number, so that they should -- in the long run, both will be around 30%. That is our target. It's just, as Jason was

saying, because the X is a newer vehicle, we are earlier in the learning curve for the X than S.

Elon Musk said:From the Tesla Motors (TSLA) Earnings Report: Q1 2015 Conference Call

The gross margin revenue obviously is going to change with time. When it's low volume, made in three months, it will be relatively low margin. Once we get to Gigafactory up and running and high-volume, get the economies of scale working, this is just a guess right now, but maybe it's somewhere around 20%. This is not like -- it's like we don't have enough information to say exactly what that would be, but probably 20% is a reasonable guess.

I think that most investors and analysts assumed that included the 30%-50% GF cost reductions, which doesn't add up, unless they were selling Powerpacks and Powerwalls produced in Fremont at a huge loss (at least 15%)...

From the Tesla Fourth Quarter & Full Year 2015 Letter said:Faced with growing demand for Powerpacks and Powerwalls, we have accelerated our plans to expand manufacturing capacity. In early Q4, we relocated production from Fremont to an automated assembly line at the Gigafactory.

Which means that he must have been referring to setting up the [/b]"automated assembly line at the Gigafactory".

From the Q4 2015 Conference Call said:Colin Michael Langan - UBS Securities LLC said:Okay. And can you give an update on stationary storage? Is that still trending to your targeted $3 billion to $5 billion (6:02) by 2017?

The gross margin, is it still at your – is it still trending to the 15% target I think you mentioned on the last call?

Elon Musk said:Production limited thing, if we imagine the most we could possibly make make in 2016, we've already sold out of that. If even a small percentage of the orders are valid we're already sold out of 2016, and well into 2017... So it's mostly about predicting our production rate, and we expect very dramatic increases in the stationary storage production. The reason I feel a bit cautious about giving exact estimates is because when you have an exponential increase, the exact calendar window...

Oh, 15%, yeah. Yeah, I don't think it's going to be any problem meeting a 15% margin target. Obviously, the margin improves as the production ramps up, so, yeah.

Jeffrey B. Straubel - Chief Technology Officer said:Yeah, I don't know if we want to discuss the specific margin targets, but it should be in excess of 15%. That is our internal target.

The 15% figure came from Colin Langan. EM and JB said respectively that "...going to be any problem meeting a 15% margin target" and "it should be in excess of 15%".

Tesla gives much more precision in their MX and MX profits than on their stationary storage profits, despite the fact that EM stated that "we’re constantly agonizing about cell cost and pack cost". In other words they are trying to avoid disclosing their pack costs by understating their stationary storage margins.

The only way I can interpret the statements above, that makes sense to me, is this: Tesla set an internal target of 25-30% margins for Powerpacks and Powerwalls that would be produced when they started production on an automated assembly line. As long as they made sure that they were making something like 10-15% on the packs produced by hand in Fremont, they were probably ok with that, as they were always planning on setting up an automated assembly line very soon anyway. So I am deducting 25% from the $250 per kWh price for my conservative, and deducting 15% for my worst case figure. Part of what I mean by "makes sense to me" is that there is no possible way IMO that EM and JB would launch a multi-billion dollar business, with pricing so disruptively low that it's products generate "off-the-hook" demand at substantially lower margins than their stated goal of 25%.

Even if you believe that the 15% figure is correct for current production, that's obviously before incorporating the 35% (30% + 5% cell chemistry) reductions due to using cells produced at the GF. So by the end of 2017 the TE margins should be at least (15% + 30% + 5% cell) or 50% (they might lower their prices)! With a target of $3 billion to $5 billion by 2017!

Current Car Pack Cost Results from PowerPack Prices:

TE 25%-margin: $165.00 per kWh ($250 - 34% (9% cell + 25% margin)

TE 15%-margin: $190.00 per kWh ($250 - 24% (9% cell + 15% margin))

Gigafactory Cost Reduction Estimates:

Tesla's endgame: Why electric vehicles are just the beginning | Utility Dive

utilitydive said:Tesla believes the Gigafactory will drive down the cost of its battery packs 30% by 2017 and 50% by 2020.

Those figures do not include cost reductions due to cell chemistry improvements:

Musk: Tesla Gigafactory will produce cells with battery technology improvement over current products | Electrek

electrek said:Musk said that the battery cells the company will produce at the Gigafactory in partnership with Panasonic will feature some “moderate improvements” in technology over those in production today.

During his talk at the AGU meeting, Musk said that the technology improvements at the Gigafactory will not be small nor big, but moderate – without specifying any change in chemistry. He then added that the battery industry is generally seeing a 5 to 8 percent increase in energy density every year.

My assumptions are that moderate means a five percent decrease in costs, plus another five percent decrease by the end of 2020.

Complete TE 25%-margin based estimates for automobile pack costs:

At the end of 2015 $165 per kWh

By the end of 2017 $107 per kWh ($165 - 35% (30% GF + 5% cell)

By the end of 2020 $66 per kWh ($165 - 60% (50% GF + 10% cell)

Complete TE 15%-margin based estimates for automobile pack costs:

At the end of 2015 $190 per kWh

By the end of 2017 $124 per kWh ($190 - 35% (30% GF + 5% cell)

By the end of 2020 $76 per kWh ($190 - 60% (50% GF + 10% cell)

This might not happen until after the M3 production ramp , but at some point they will be producing less expensive cells for the MS-MS, in addition to TE and the M3.

There is a very large market for large UPS's (e.g. Data centers). The author of the quote below worked as a datacenter engineer for Microsoft:

Dedicated rooms to monitor and vent unsafe H2 levels. Acidic fumes that tend to destroy most things in the same room with them. Regular failures by design of a lead-acid cell, realistic shallow cycle capacity of 20-30% of name-plate. In exchange for all these absurd drawbacks and faults of lead-acid, you end up paying a premium over the clean compact and high efficiency Tesla battery.

The Tesla pack costs you less money up front, doesn't require sacrificing a room of your house to acid-fumes, and includes it's own DC/DC converter electronics to enable you to feed it the input from solar cells directly and have it manage itself and supply the voltage bus out directly to your AC inverter (or whatever thing you were wanting to power with it).

Lead's last hold-out function was stationary UPS supplies due to cost. Now with this pack having a lower system cost than lead, it seems the last useful function for lead-acid is boat anchors.

And why I recommended the modern sealed version, AGM or Gel or otherwise, because, well they're sealed and noxious fumes, etc, are not an issue.

Learn about lead acid. Sealed ones are a joke for longevity.

I spent 5 years in the datacenter UPS industry at the MWh scale, with everything deployed in big installations being lead-acid. I can tell you if your definition of "it works" includes repeated random and regular cell failures, never delivering even 50% of the claims with respect to the ability to extract useful energy from them, constant vampire current needs to keep them charged (many 10's of kW 24-7 in big installations), complete replacement after every couple years, and destroying virtually anything they share a room with from acid fumes than yes, "it works."

The industry standard there is 2,000-4,000Ah 2V flooded lead-acid cells, which they pay an extra big premium for to be carefully screened and binned. You tediously measure specific gravity on the electrolyte of all the new cells before and after installation at full charge, you observe the float balance is perfect between the cells in the string, and that you're running them at exactly the mfg's specs for longest service life. You are running them in a temp and humidity controlled room, mounted in stationary racks with minimal vibration. Then, randomly a cell in the string dies of infant mortality (every other cell shows no issues). They pay another few hundred grand to replace everything with all brand new cells (because the cell mfg's don't recommend having different aged cells in a string together), in a year or two, one dies and you start over. Repeat this cycle indefinitely. AFAIK, that is still the current state of the art in lead for UPS backup as I know it from wasting years of my life dabbling in it.

I realize that during the times a lead acid battery isn't being replaced or maintained or cleaned or tested that it does work as a very disappointing and lossy battery that can make a big UPS system work, and that people have been putting up with them for so long that the industry is used to the exceptionally poor performance and keeps buying them. My hope is that this Tesla battery will end the cycle of making throw-away lead batteries that are just waiting to fail by design.

Last edited: