The topic of the Model 3 ramp and its implications on the US federal EV tax credit continue to pop up in other threads, and I couldn't find a thread dedicated to the subject, so I am creating this so that discussion can take place.

The big question is whether the tax credit itself will survive the GOP Tax Reform effort. The following thread covers that subject: EV Tax Credit

Assuming that the credit survives (perhaps a big assumption, but if it doesn't, the picture quickly becomes very clear!), the next big question on people's minds is when will the credit for Teslas phase out and will they be able to get a standard battery, non-PUP vehicle, AWD, bridge to their lease end, etc.

As a reminder, the way the credit works is that if you take delivery of a qualified vehicle in a given tax year, and you have a tax liability (not refund, or shortfall, but liability--the net amount of tax you actually pay, whether it's through withholding or you write a check) of up to $7500, you are entitled to a credit (a reduction in the amount of tax you owe) up to that $7500. You effectively get this tax credit back when you file your taxes the next calendar year (although you could decrease your withholdings so as effectively get the credit back in small chunks in each paycheck).

Once a given car manufacturer (Tesla in this context) sells it's 200,000th vehicle in the US, the credit starts to phase out (presumably because by that time, the manufacturer has achieved economies of scale necessary to price a vehicle competitively with ICE vehicles). For the quarter in which the 200,000th vehicle is sold AND the subsequent quarter, the full $7500 credit applies. It then reduces to 50% ($3750) for the next two quarters, and then finall to 25% ($1875) for the following two quarters. It then phases out entirely and is gone. Note that whether the 200,000th vehicle is sold on the first day of a quarter or the last day, the full credit is only available for THAT calendar quarter and the NEXT calendar quarter. It is not 6 months after car 200,000 is sold. The implication here is that it is most beneficial to sell car #200,000 as early as possible in a given quarter to gain full advantage of the remaining credit. And Elon has implied that Tesla would "do the right thing" with regards to maximizing the tax credit. I take this to mean that if they near the end of a quarter and are approaching that 200,000th vehicle that they will withhold sales, or divert sales to foreign countries, until the beginning of the next quarter.

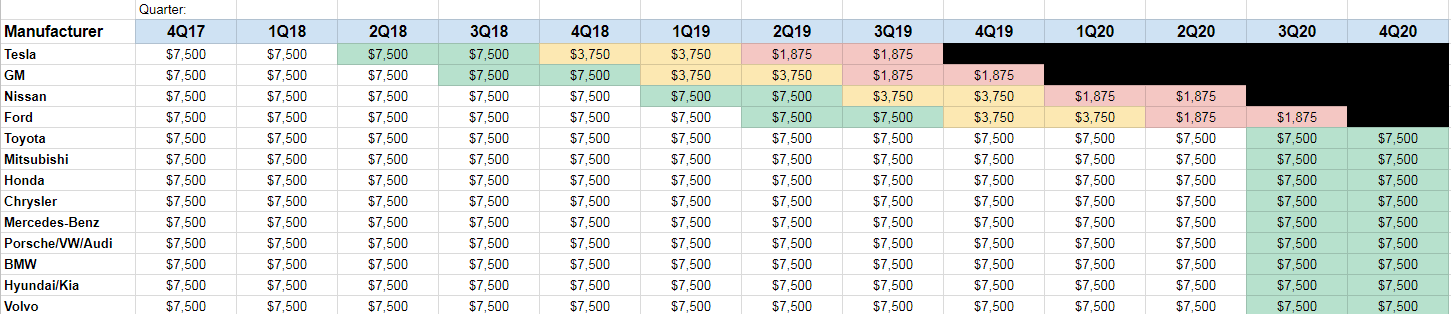

The following illustrates the phaseout process. Note that this is for illustrative purposes only. This is NOT a prediction of how I think the phaseout will occur.

So with that out of the way, let the discussion commence. Where do you think Tesla stands with respect to the phase out?

The big question is whether the tax credit itself will survive the GOP Tax Reform effort. The following thread covers that subject: EV Tax Credit

Assuming that the credit survives (perhaps a big assumption, but if it doesn't, the picture quickly becomes very clear!), the next big question on people's minds is when will the credit for Teslas phase out and will they be able to get a standard battery, non-PUP vehicle, AWD, bridge to their lease end, etc.

As a reminder, the way the credit works is that if you take delivery of a qualified vehicle in a given tax year, and you have a tax liability (not refund, or shortfall, but liability--the net amount of tax you actually pay, whether it's through withholding or you write a check) of up to $7500, you are entitled to a credit (a reduction in the amount of tax you owe) up to that $7500. You effectively get this tax credit back when you file your taxes the next calendar year (although you could decrease your withholdings so as effectively get the credit back in small chunks in each paycheck).

Once a given car manufacturer (Tesla in this context) sells it's 200,000th vehicle in the US, the credit starts to phase out (presumably because by that time, the manufacturer has achieved economies of scale necessary to price a vehicle competitively with ICE vehicles). For the quarter in which the 200,000th vehicle is sold AND the subsequent quarter, the full $7500 credit applies. It then reduces to 50% ($3750) for the next two quarters, and then finall to 25% ($1875) for the following two quarters. It then phases out entirely and is gone. Note that whether the 200,000th vehicle is sold on the first day of a quarter or the last day, the full credit is only available for THAT calendar quarter and the NEXT calendar quarter. It is not 6 months after car 200,000 is sold. The implication here is that it is most beneficial to sell car #200,000 as early as possible in a given quarter to gain full advantage of the remaining credit. And Elon has implied that Tesla would "do the right thing" with regards to maximizing the tax credit. I take this to mean that if they near the end of a quarter and are approaching that 200,000th vehicle that they will withhold sales, or divert sales to foreign countries, until the beginning of the next quarter.

The following illustrates the phaseout process. Note that this is for illustrative purposes only. This is NOT a prediction of how I think the phaseout will occur.

So with that out of the way, let the discussion commence. Where do you think Tesla stands with respect to the phase out?