wow, where did you find a rate that low for 72 months? I was able to find 1.97% for 60 months, 2.47% for 72 months and 3.47% for 84 months.I am not against leasing, but have never leased simply due to the mileage limits being too restrictive for me. I know the math can, and sometimes does, favor leasing, especially now with some folks able to work from home and driving a lot less than usual. However, some employers are requiring staff to return to the office in the coming months so that makes the mileage piece unpredictable again.

We are still awaiting delivery of our Y and will stick to a loan instead of a lease. I definitely supported a lease if someone was buying a Model S back in 2015 or so because I could see prices falling as they offered more standard equipment. Now though I don't see Teslas getting much cheaper, and prices have been steadily climbing for all their models and demand is sky high.

The other factor is the low interest rates. Historically, I do a 36-month loan but we are approved for 1.79% (or 1.24% with direct deposit) for up to 72 months. At those terms, the difference between lease vs loan is only $50-100. With a 72-month loan, I could take the money saved from the lower payment (compared to 36-month term) and confidently invest that and easily offset the extra interest on the longer loan term. On top of that, if my proclivities change then I can sell the Model Y at any time, whereas a lease locks me in for 36 months and is a little trickier to get out of.

TL;DR version: With potential for more driving as the pandemic recovers and low interest rates, I'm more comfortable with the flexibility of loan over lease.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Model Y Buy or Lease?

- Thread starter Mpzona11

- Start date

Rippin1Gear

Member

Yes, please do share your low rates for 72 months...

Mpzona11, I don’t think I ever seen a 84 month loan from any credit unions around here on the west coast.

Mpzona11, I don’t think I ever seen a 84 month loan from any credit unions around here on the west coast.

There is only a couple I could find here but the rate isn’t bad considering it is 84 months. The others I found were over 5% for 84 months.Yes, please do share your low rates for 72 months...

Mpzona11, I don’t think I ever seen a 84 month loan from any credit unions around here on the west coast.

bl5derunner

New Member

Personally, I would not base my purchasing decisions on the whims of the US Congress, as it would have to be passed through reconciliation and I'm not so sure they'll get a certain US senator or two from WV or NM to buy in.

I think abdown payment and a security deposit is 2 different thing. Security deposit you will get it back at the end of the lease if the car is in good shape and if the leasing contract is in good term. Down payment you won't get it back at the end of the lease but it will reduce your monthly payments by a lot. It's like paying in advance. Always done that with all my leases including my MYP right now. I don't like paying big amounts per month so I make a big deposit and and enjoy the small monthly payments.I love leasing cars and have done so successfully with my last few vehicles.

However, I won't do it with Tesla. I just placed my very first order for a Tesla and the lease terms are quite bad. Here are a few things that you must adhere to when leasing a car:

1. Absolutely no money down. So when you see the deposit option, move that all the way to zero. This is because you will never get the deposit back.

2. Residual value. The residual value offered by Tesla for leasing is not good. Which means huge profit for them.

3. Money factor is very high.

So financially, it doesn't make much sense to lease a Tesla. You are better off using other financial vehicle. And this is coming from someone who had leased multiple vehicles.

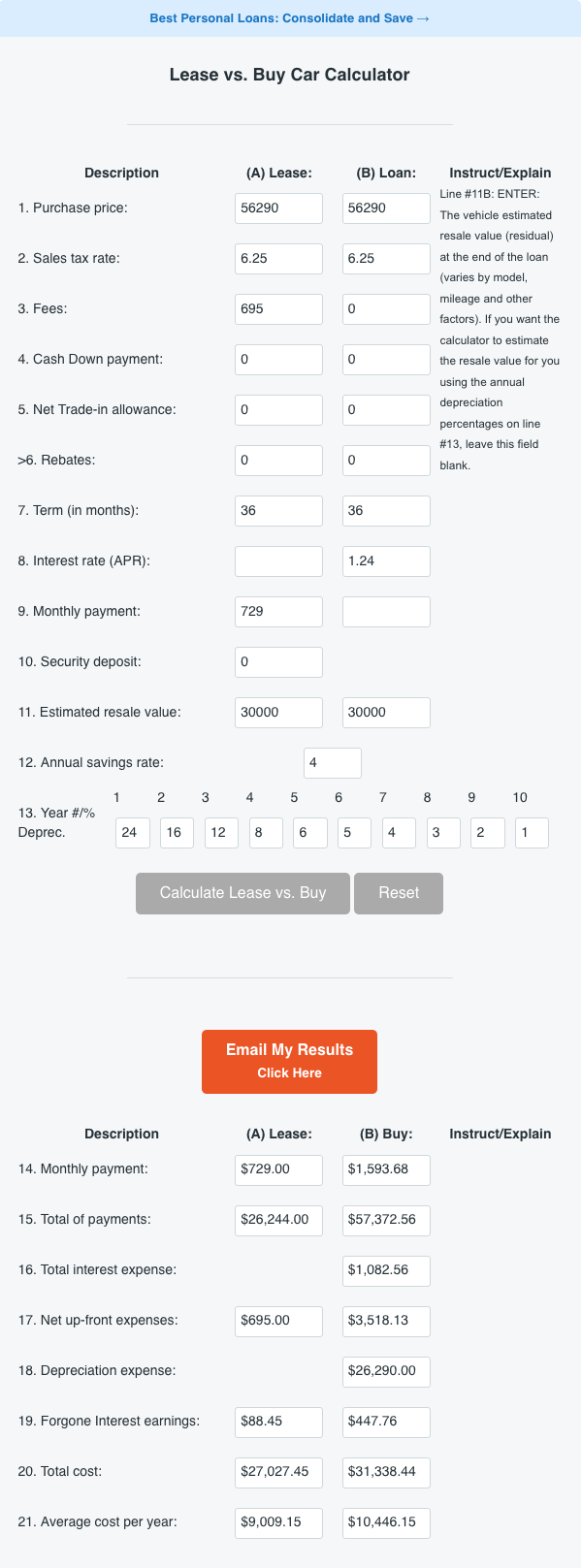

Lease vs. Buy Car Calculator

This lease vs. buy car calculator will figure out whether leasing or buying is the best deal for your next car. Compare payments with this simple to use calculator.

financialmentor.com

financialmentor.com

Run the numbers based on your assumptions. I agree with the earlier post about a tax credit being highly unlikely; especially for more expensive EVs like Tesla.

I have always just paid for cars and then kept them for 10 to 14 years. Tesla will be the first lease I do as I only intend to keep it for three years. When I run the numbers even based on fairly conservative numbers, leasing works out to be the lowest cost approach.

Bearded Tesla Guy did a video on this... He was saying that you end up ahead if your purchase, and then sell it yourself after 3 years, as opposed to leasing for 3 years. (He even did the video BEFORE the crazy used-car market thing).

Lease vs. Buy Car Calculator

This lease vs. buy car calculator will figure out whether leasing or buying is the best deal for your next car. Compare payments with this simple to use calculator.financialmentor.com

Run the numbers based on your assumptions. I agree with the earlier post about a tax credit being highly unlikely; especially for more expensive EVs like Tesla.

I have always just paid for cars and then kept them for 10 to 14 years. Tesla will be the first lease I do as I only intend to keep it for three years. When I run the numbers even based on fairly conservative numbers, leasing works out to be the lowest cost approach.

Run the numbers with your own assumptions. In my case, bearded Tesla guy’s advice is wrong.Bearded Tesla Guy did a video on this... He was saying that you end up ahead if your purchase, and then sell it yourself after 3 years, as opposed to leasing for 3 years. (He even did the video BEFORE the crazy used-car market thing).

Do you think the market will be the same in 3+ years? If you think residual values will be super high, then yes buying may make the most sense. Planning on buying and keeping the car for the long term, then yes buying makes the most sense. Given the innovation and rate of change with EVs, many (like me) may choose for the first time to keep a new car for just a few years. As for residual values, the current used car market is driven by a once in a century pandemic that led to highly unusual supply chain constraints. I am confident the situation will likely be quite different in 3 years. It does basically come down to supply and demand.

The manufacturing capacity that Tesla is bringing online with Austin, Berlin, Shanghai is massive. In parallel, other EV OEMs are coming online as are ICE OEMs with their EV offerings. China has the potential to be highly disruptive in the EV market both in terms of supply and pricing pressure. Even using some of the most conservative (high residual value) projections for depreciation for EVs comparing a 3 year lease to even a longer 5 year time frame for buying, the lease had a lower cost per year (based on my specific situation and assumptions).

I encourage anyone considering a buy vs. lease to run the actual numbers based on their specifics and assumptions.

Last edited:

TSLY

Member

I leased because I believe the technology 3 years from now will eclipse what is currently available. It's also my first EV so I'm dipping my toes in the water. Model Y may be cheaper in 3 years and there will be many more EVs to choose from. I'm putting the maximum, $15K, down, which will save me over $1K in finance charges. My monthly lease payments come to $328 a month. If congress reinstate tax incentives it could be retroactive.

Never looked at something like this before but used this calculator, Lease vs. Buy Car Calculator

To evaluate the two choices a bit. I don't know if I am doing it right but it seems like if one intends to keep the car for only 3 years it is better to lease.

I ran this scenario as well with a 60 month loan (and $20k residualvalue ) and the difference per year was only $500 for leasing.

To evaluate the two choices a bit. I don't know if I am doing it right but it seems like if one intends to keep the car for only 3 years it is better to lease.

I ran this scenario as well with a 60 month loan (and $20k residualvalue ) and the difference per year was only $500 for leasing.

TSLY

Member

Unless you keep a car 6 years or longer, the cost is a wash (almost equal) due to depreciation, maintenance, and liability. I'd rather get a new car every 3 years considering the monthly price to own the same car 6 years will cost you the same amount every month. You'll then face the hassle, and cost, of trying to sell an old car to scammers, looky-Lous, and low ballers.Never looked at something like this before but used this calculator, Lease vs. Buy Car Calculator

To evaluate the two choices a bit. I don't know if I am doing it right but it seems like if one intends to keep the car for only 3 years it is better to lease.

I ran this scenario as well with a 60 month loan (and $20k residualvalue ) and the difference per year was only $500 for leasing.

View attachment 692650

TravelFree

Active Member

Last I heard you don't get the Tax incentives if you lease.My monthly lease payments come to $328 a month. If congress reinstate tax incentives it could be retroactive.

The Lease v buy calculator doesn't include the added cost of car insurance when you lease. Admittedly, I only ever leased one time and it worked out for me because I negotiated a buy out at the end of the lease.

The third negative on the lease is you have to know for the lease term you will not exceed the contract miles.

On a positive side for a lease is if you lease the vehicle for a business you can expense the monthly payments and operating costs. This lowers your income taxes. If you buy a vehicle under 6000 pounds you must depreciate it over a 5 to 6 year period. There are different depreciation rules. The best way I found is to lease for 4 years, then buy it at the end of the lease and depreciate it for 6 years. Gives your business 10 years of tax benefits against income.

At least in our case, there is zero cost difference for insurance with a lease vs buy. We’re thinking of switching providers, so had estimates from State Farm, Nationwide and Chubb. To my surprise, there was also no cost difference between long range vs. performance.Last I heard you don't get the Tax incentives if you lease.

The Lease v buy calculator doesn't include the added cost of car insurance when you lease. Admittedly, I only ever leased one time and it worked out for me because I negotiated a buy out at the end of the lease.

The third negative on the lease is you have to know for the lease term you will not exceed the contract miles.

On a positive side for a lease is if you lease the vehicle for a business you can expense the monthly payments and operating costs. This lowers your income taxes. If you buy a vehicle under 6000 pounds you must depreciate it over a 5 to 6 year period. There are different depreciation rules. The best way I found is to lease for 4 years, then buy it at the end of the lease and depreciate it for 6 years. Gives your business 10 years of tax benefits against income.

Last edited:

Don't forget the hidden costs in some leases. Sometimes there are clauses around refurbishment. They can stick you for paying for a complete set of tires and other things. Read the fine print carefully to see what costs you might be responsible for when you turn the car back in. Some even hit you up for a disposal fee. Keep in mind any significant (see what the define as significant) issue may be your responsibility to fix or pay for when turning it back in.

brandon8387

Member

I have no idea why this is so frowned upon. A lease is a lease. At the end of the term U give it up. Down payment or not. U pay a lot now and smaller chunks every month. Or you pay nothing up front and big chunks every month later. Either way you spending it. Now if I don’t finish out the lease due to a wreck I can see how it’ll not be goodI think abdown payment and a security deposit is 2 different thing. Security deposit you will get it back at the end of the lease if the car is in good shape and if the leasing contract is in good term. Down payment you won't get it back at the end of the lease but it will reduce your monthly payments by a lot. It's like paying in advance. Always done that with all my leases including my MYP right now. I don't like paying big amounts per month so I make a big deposit and and enjoy the small monthly payments.

I leased because I believe the technology 3 years from now will eclipse what is currently available. It's also my first EV so I'm dipping my toes in the water. Model Y may be cheaper in 3 years and there will be many more EVs to choose from. I'm putting the maximum, $15K, down, which will save me over $1K in finance charges. My monthly lease payments come to $328 a month. If congress reinstate tax incentives it could be retroactive.

I’m sorry but as soon as I read about 15K downpayment on a lease I stopped reading the rest LOL.

Never ever put downpayment on a lease..

Gigawatt_Chris

Member

Are you planning to keep the car long term? I was in the same position as you but as soon as I test drove one, I instantly fell in love with the car (thus bought it)

Tesla also has poor lease terms so you have to take that into account as well.

Tesla also has poor lease terms so you have to take that into account as well.

brandon8387

Member

Poor lease terms? I keep seeing this. How is it any diff?Are you planning to keep the car long term? I was in the same position as you but as soon as I test drove one, I instantly fell in love with the car (thus bought it)

Tesla also has poor lease terms so you have to take that into account as well.

phantom701

Member

Poor lease terms? I keep seeing this. How is it any diff?

Leasing itself is a very different financial vehicle and most people do not understand it. It is a huge difference from loans.

If you are not educated about lease, you could stand to lose thousands of dollars. The terminologies are quite different with things like capitalized cost, residual values, money factors, etc. If you treat it like a loan, you will be in for a huge surprise.

You should never put any money down for leases, never ever. The exception is where you see manufacturers offering refundable MSDs in the form of discounted MFs.

If you don't understand any of the terminologies above, you should read up on leasing vehicles.

And yes, Tesla terms are HORRIBLE!!!

heymanhn

Member

With leasing and financing, the key number to monitor is the interest rate.

This rate is clearly delineated in the fine print for a financing contract. You pay this much down, borrow the rest and pay it back at a rate of #.##% every N months.

In leasing, this rate is embedded into a number called the Money Factor. The MF is not presented as a percentage so you have to be diligent about how much interest you're really paying when you see an MF quoted in the lease terms.

If you use a MF => interest rate calculator you'll notice that Tesla's MF equates to > 5% APR. In comparison, with a decent credit score you can take a car loan for 3% APR.

So if money is your main concern, don't lease a Tesla.

This rate is clearly delineated in the fine print for a financing contract. You pay this much down, borrow the rest and pay it back at a rate of #.##% every N months.

In leasing, this rate is embedded into a number called the Money Factor. The MF is not presented as a percentage so you have to be diligent about how much interest you're really paying when you see an MF quoted in the lease terms.

If you use a MF => interest rate calculator you'll notice that Tesla's MF equates to > 5% APR. In comparison, with a decent credit score you can take a car loan for 3% APR.

So if money is your main concern, don't lease a Tesla.

Similar threads

- Replies

- 25

- Views

- 2K

- Replies

- 30

- Views

- 1K

- Replies

- 7

- Views

- 756