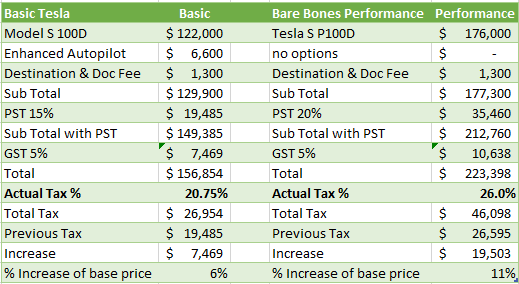

British Columbia's new luxury tax increase will cost most consumers 20.75% for 125k to under 150k and 26% for above 150k. That's a 6% increase for a basic Tesla and 11% for a Performance trim. Ouch. The BC Government thinks paying an extra 6 to 11% on such purchases are affordable to those making these purchases. The forecasts is for $20 million additional tax revenue over two years.

Existing leases will see an increase in their prices too. The tax on their original purchase is subject to these new luxury tax rates.

The federal 5% GST is also now compounded on top of the provincial PST tax rate of 15% for 125k to under 150k and 20% for 150k and above. So hence its effectively 20.75% not 20% and 26% not 25%.

Existing leases will see an increase in their prices too. The tax on their original purchase is subject to these new luxury tax rates.

The federal 5% GST is also now compounded on top of the provincial PST tax rate of 15% for 125k to under 150k and 20% for 150k and above. So hence its effectively 20.75% not 20% and 26% not 25%.