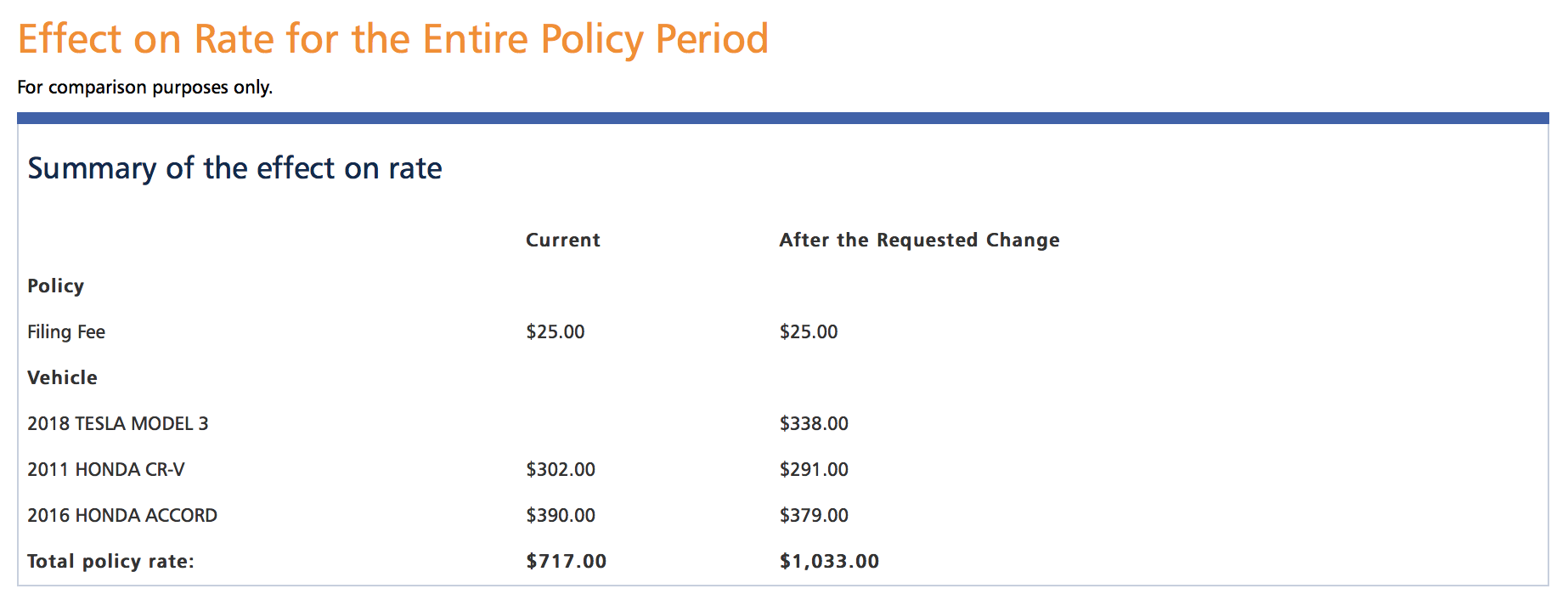

I've had progressive for 10 years so there is that but the rate was not a shock. 6 months. The total amount doesn't show the removal of one vehicle. basically my rate will stay the same give or take $10. it seems wrong that the Honda Accord is more expensive tho.

Coverages

Limits

Rate

Bodily Injury & Property Damage Liability:

$100,000 each person

$300,000 each accident

$50,000 each accident $162.00

Uninsured Motorist Bodily Injury & Property Damage: $25,000 each person

$50,000 each accident

$25,000 each accident with $200 UMPD exclusion $10.00

Medical Expense Benefits: $10,000 $28.00

Income Loss Benefits: No Coverage $0.00

Other Than Collision: $250 deductible $21.00

Collision: $500 deductible $73.00

Transportation Expenses: $600 each occurrence $8.00

Coverages

Limits

Rate

Bodily Injury & Property Damage Liability:

$100,000 each person

$300,000 each accident

$50,000 each accident $162.00

Uninsured Motorist Bodily Injury & Property Damage: $25,000 each person

$50,000 each accident

$25,000 each accident with $200 UMPD exclusion $10.00

Medical Expense Benefits: $10,000 $28.00

Income Loss Benefits: No Coverage $0.00

Other Than Collision: $250 deductible $21.00

Collision: $500 deductible $73.00

Transportation Expenses: $600 each occurrence $8.00