My Secret Master Plan of Investing on TSLA - Stock of the Decade

Inspired by Elon's secret master plan, I also have 3-steps master plan to share:

1. Invest in TSLA before getting the car, if you are cash strapped. Ideally you should invest before the epic and magnificent May 2013.

2. Shelve some gain from the investment and buy the car, to get first hand experience as an owner; tour the factory, find out what fault with the car and services in the coming years. Stay close to the company's executions in every detail.

3. Recognize TSLA is the stock of the decade, and accumulate as many as shares (delta) as you could, with the target price of $1000 by the end of the decade 2020.

My report card:

1. Fortunately I started at @35 in Feb, 2013, when Tesla took a dive after the Q4 earning. Since then I held fast and enjoy the historical run till now.

2. Fortunately my investment gain accelerates my purchase of Tesla. Originally I was going for the X, but now I can't wait so I just get a S. Will tour the factory and pick faults at the car and service later.

3. After I wrote this article:

Truth Or Myth: Most People Still Don't Get Tesla

I realized TSLA is indeed the stock of the decade. I also get the validation when I was editing email notification on SeekingAlpha:

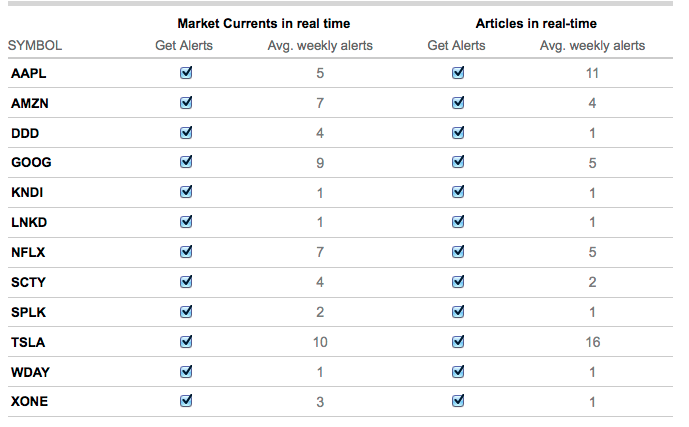

TSLA has 10 Market currents and 16 articles weekly, more than AAPL(5,11), GOOG(9,5), AMZN(7,4), NFLX(7,5) and LNKD(1,1), arguably the most admired tech stocks on Wall Street! TSLA is the undisputed darling of Wall Street at the moment.

Meanwhile, I am accumulating as many delta as I could. I increased my stack significantly at each major drop @55, @80, $90, $95. I will be writing more articles on short term trading to catch significant market swing, while keep a core position.

I hope you also enjoy the ride and share your secret plan!

My friends can only call me the lucky son of the gun... None of them were convinced enough to jump in

Inspired by Elon's secret master plan, I also have 3-steps master plan to share:

1. Invest in TSLA before getting the car, if you are cash strapped. Ideally you should invest before the epic and magnificent May 2013.

2. Shelve some gain from the investment and buy the car, to get first hand experience as an owner; tour the factory, find out what fault with the car and services in the coming years. Stay close to the company's executions in every detail.

3. Recognize TSLA is the stock of the decade, and accumulate as many as shares (delta) as you could, with the target price of $1000 by the end of the decade 2020.

My report card:

1. Fortunately I started at @35 in Feb, 2013, when Tesla took a dive after the Q4 earning. Since then I held fast and enjoy the historical run till now.

2. Fortunately my investment gain accelerates my purchase of Tesla. Originally I was going for the X, but now I can't wait so I just get a S. Will tour the factory and pick faults at the car and service later.

3. After I wrote this article:

Truth Or Myth: Most People Still Don't Get Tesla

I realized TSLA is indeed the stock of the decade. I also get the validation when I was editing email notification on SeekingAlpha:

TSLA has 10 Market currents and 16 articles weekly, more than AAPL(5,11), GOOG(9,5), AMZN(7,4), NFLX(7,5) and LNKD(1,1), arguably the most admired tech stocks on Wall Street! TSLA is the undisputed darling of Wall Street at the moment.

Meanwhile, I am accumulating as many delta as I could. I increased my stack significantly at each major drop @55, @80, $90, $95. I will be writing more articles on short term trading to catch significant market swing, while keep a core position.

I hope you also enjoy the ride and share your secret plan!

My friends can only call me the lucky son of the gun... None of them were convinced enough to jump in

Last edited: