Hi all, I made 2 important updates to the model. (1) electriclove on HN discovered a bug in one of the formulas where the Ody's fuel cost was being overcounted. (2) I added in $1200 every 3rd year for tires. The end result is the Ody is now $37K and the Tesla is $42K, a slightly less than $5K difference or about $600/yr.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

My Tesla Story - and why a Model S is less expensive than a Honda Odyssey

- Thread starter pl804

- Start date

EarlyAdopter

Active Member

Charging losses are 15% from the wall, as measured by the EPA, me, and several other people here. So if you averaged 333 Wh/mi driving, then your meter draw will be 383 Wh/mi charging.

gglockner

Member

So something doesn't add up.

There's too many assumptions for my taste. For starters, there is no consideration that the Tesla Model S costs $50K more up front. If you are buying with cash, you could buy the Odyssey, invest the $50K and make another $25K or so.

AndreyATC

Member

I am having a hard time to believe that Ody will only spend 2700/y on gasHi all, I made 2 important updates to the model. (1) electriclove on HN discovered a bug in one of the formulas where the Ody's fuel cost was being overcounted. (2) I added in $1200 every 3rd year for tires. The end result is the Ody is now $37K and the Tesla is $42K, a slightly less than $5K difference or about $600/yr.

22mpg seems too optimistic, almost EPA-ideal, not real life average you'd get

I had many cars with 27-30mpg highway rating and drove them roughly 14k a year

My gas bill for a year was always around 4K

There are winters, traffics, idles, etc, this "bus" is not averaging 22mpg

It's be lucky to get 17, just like my friend's Ody

SFOTurtle

Active Member

I am having a hard time to believe that Ody will only spend 2700/y on gas

22mpg seems too optimistic, almost EPA-ideal, not real life average you'd get

I had many cars with 27-30mpg highway rating and drove them roughly 14k a year

My gas bill for a year was always around 4K

There are winters, traffics, idles, etc, this "bus" is not averaging 22mpg

It's be lucky to get 17, just like my friend's Ody

I agree. Our Highlander averages about 17 as well despite having 22 highway rating, and I think Odyssey is pretty much the same. With gas prices here in CA now north of $4/gallon again after having been in the mid to high $3s for most of the past 12 months, I would have spent about $3500-3750 in gas over the last year if I had driven the Highlander for the same miles. Having good access to work charging stations and maybe half the miles on road trips with Superchargers and other free charging, I'm estimating I spent only about $300 on my utility bills powering my Model S over the past 12 months, with much of that spent before I switched to EV rate plan, so I no longer get dinged at the end of the billing cycle on higher kWh rates.

Geez, just in the two months I've probably put on 2,000 miles just on the weekend using Superchargers for long roadtrips (granted I forked over $2K to enable my 60 for this option). But I figure at the rate I'm using the Superchargers, I will have made back the $2k investment in gas savings sometime over the next year.

Tesla Model S is cheaper than a Honda Odyssey minivan in the long-run

I've explained this simple concept to many people over last few months and many couldn't wrap their heads around the concept of long term vehicle cost. I've found the barrier for most is the starting price and they can't move beyond that.

Have a read.....

http://www.extremetech.com/extreme/...might-be-cheaper-than-a-honda-odyssey-minivan

Cheers

I've explained this simple concept to many people over last few months and many couldn't wrap their heads around the concept of long term vehicle cost. I've found the barrier for most is the starting price and they can't move beyond that.

Have a read.....

http://www.extremetech.com/extreme/...might-be-cheaper-than-a-honda-odyssey-minivan

Cheers

David_Cary

Active Member

EPA - hwy 28; city - 19. People who study these things have shown repeatedly that Honda does the best relative to the EPA ratings (ref - Wayne Gerdes)

15k miles a year at $4 for $2700 puts his mpg at 22. That is a pretty pessimistic assumption - worse than the weighted average city/highway. Getting 30 mpg out of a Ody on the highway is probably simple.

I made a 8 year comment in reply to someone who posted that if the battery doesn't last 8 years, then it is on Tesla. That is a false assumption. Of course the battery will still have some life after 8 years but unlike an ICE, it will degrade over time. The ICE may completely fail but I suspect the failure rate for a Honda engine at 8 years is very low.

OP - did you put the residual value in as your cost rather than depreciation? That would be a $30k mistake and makes sense.

NPV seems like a fairly complicated concept for us non-accountants....

It really is pretty simple - pay 90k for a car that is worth $30k after 8 years and you are $60k poorer. Throw in time value of money, and you are even poorer. Sure you will save some money in fuel - usually to the tune of $2k a year for average drivers. You may save some money on maintenance (or you may not) depends on the comparable car.

TCO wins out best comparing a luxury car driven a lot of miles. You can then save $4k a year in fuel and that $32k really makes a dent. Then it can beat even an Ody (but you still have to neglect the time value of money).

15k miles a year at $4 for $2700 puts his mpg at 22. That is a pretty pessimistic assumption - worse than the weighted average city/highway. Getting 30 mpg out of a Ody on the highway is probably simple.

I made a 8 year comment in reply to someone who posted that if the battery doesn't last 8 years, then it is on Tesla. That is a false assumption. Of course the battery will still have some life after 8 years but unlike an ICE, it will degrade over time. The ICE may completely fail but I suspect the failure rate for a Honda engine at 8 years is very low.

OP - did you put the residual value in as your cost rather than depreciation? That would be a $30k mistake and makes sense.

NPV seems like a fairly complicated concept for us non-accountants....

It really is pretty simple - pay 90k for a car that is worth $30k after 8 years and you are $60k poorer. Throw in time value of money, and you are even poorer. Sure you will save some money in fuel - usually to the tune of $2k a year for average drivers. You may save some money on maintenance (or you may not) depends on the comparable car.

TCO wins out best comparing a luxury car driven a lot of miles. You can then save $4k a year in fuel and that $32k really makes a dent. Then it can beat even an Ody (but you still have to neglect the time value of money).

No Tailpipe

Member

Pl804

THANK YOU, Needed this to convince my friends that a Teska isn't "that" expensive compared to a regular gas vehicle. Now I have the data to support.

+1 to you!

THANK YOU, Needed this to convince my friends that a Teska isn't "that" expensive compared to a regular gas vehicle. Now I have the data to support.

+1 to you!

Last edited:

The writeup on transportevolved.com refers to your fellow HBS alum as a "Brain consultant with a PhD in Physics" :smile:

cantdecide

Member

I'd be careful about using a 10 year old version of any car as a proxy for today's models, MPG or otherwise. I have a 2004 Mini Cooper S and a 2004 911 GT3. Both are 2 generations back from the 2014 models, have completely different engines, etc. The 996 GT3's engine is bulletproof. 991? Well, not so much...I have had my Ody van for 10 years and 120k miles and I averaged around 18 to 20 mpg.

That is around 5500 gallons and at $3.50 it cost me $19k+ to fuel it.

Of course the 8 year warranty does not cover degradation. Any claim that the battery will be the same as new at 200k miles in 8 years is just wrong. Any likelihood that Tesla will replace such a battery when warranty specifically excludes degradation?

I find it unlikely (not impossible) to get 200 miles from a 200k battery. I suspect 20% per 100k miles with only minimal slowdown for the second 100k miles. There maybe no slowdown as the depth of charge will tend to increase.

It is entirely possible that degradation will speed up and 50% is about what a 240k mile battery will have left.

Does anyone know what the performance of a P85 would be with a 50% degraded battery? It sounds like the P model taps the battery maximally. So if the battery is 50% degraded, does that mean 50% less power?

The current battery retails for $40k. Expecting 50% price drop in 8 years is IMO wildly optimistic. 30% I could see.

McKinsey forecasts a drop from $600/kWh in 2012 to $200/kWh in 2020 (6 years away).

Battery technology charges ahead | McKinsey Company

- - - Updated - - -

EPA - hwy 28; city - 19. People who study these things have shown repeatedly that Honda does the best relative to the EPA ratings (ref - Wayne Gerdes)

15k miles a year at $4 for $2700 puts his mpg at 22. That is a pretty pessimistic assumption - worse than the weighted average city/highway. Getting 30 mpg out of a Ody on the highway is probably simple.

I made a 8 year comment in reply to someone who posted that if the battery doesn't last 8 years, then it is on Tesla. That is a false assumption. Of course the battery will still have some life after 8 years but unlike an ICE, it will degrade over time. The ICE may completely fail but I suspect the failure rate for a Honda engine at 8 years is very low.

OP - did you put the residual value in as your cost rather than depreciation? That would be a $30k mistake and makes sense.

NPV seems like a fairly complicated concept for us non-accountants....

It really is pretty simple - pay 90k for a car that is worth $30k after 8 years and you are $60k poorer. Throw in time value of money, and you are even poorer. Sure you will save some money in fuel - usually to the tune of $2k a year for average drivers. You may save some money on maintenance (or you may not) depends on the comparable car.

TCO wins out best comparing a luxury car driven a lot of miles. You can then save $4k a year in fuel and that $32k really makes a dent. Then it can beat even an Ody (but you still have to neglect the time value of money).

EPA ratings for Ody vs. Tesla:

http://www.fueleconomy.gov/feg/Find.do?action=sbs&id=33717&id=34775

I used the 2014 combined EPA ratings for the Ody, and worse than the EPA rating for the Tesla (255 instead of 265). I gave the Tesla a penalty to be conservative. From the conversation so far, it sounds like this should cover the add'l draw from the wall, but I'd love to see more data there.

Residual in both the depreciation and cash flow models comes back as income in Year 8. The time value that you mention explains why the cash flow model has higher values than the depreciation model.

- - - Updated - - -

The writeup on transportevolved.com refers to your fellow HBS alum as a "Brain consultant with a PhD in Physics" :smile:

Haha, that's hilarious. Maybe they thought my write-up had a typo there. =)

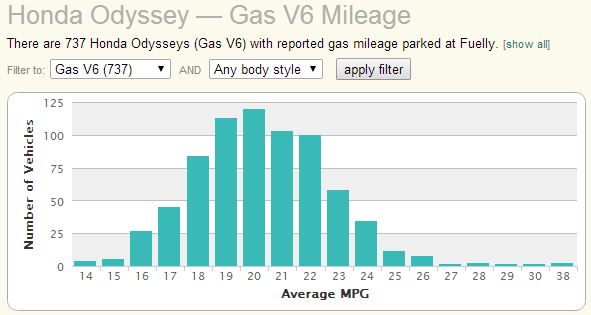

The following info graphic courtesy of Fuelly - Track and Compare Your MPG shows real world usage reports for the Odyssey with the 2014 models averaging 21 MPG.

David_Cary

Active Member

The problem with that McKinsey study is that $600 per kwh in 2012 is/was not what Tesla paid. No one seems to know for sure what Tesla pays but they charge just over $40k for 85 kwh or $500 (give or take). Presumably they pay more like $350 based on their margins. I think it is reasonable to presume $200 in 2020 but that is not really a 50% decline. And since when is McKinsey a reliable technology forecasting company. As far as I can tell, the lead author has never written anything else about the subject.

Tesla has been a low priced battery all along.

Even at $200, you are talking $17k + 25% markup or $21k. Not insignificant.

I would definitely concede to fuelly on the real world MPG of the Ody but 21 is awfully close to 22.

Again I ask, how does $60k in depreciation not trump everything else? Usually the unrealistic TCOs have an unrealistic residual value. How do you have $60k in depreciation and have that magically cost less than a $45k vehicle. Fuel only costs so much....

Tesla has been a low priced battery all along.

Even at $200, you are talking $17k + 25% markup or $21k. Not insignificant.

I would definitely concede to fuelly on the real world MPG of the Ody but 21 is awfully close to 22.

Again I ask, how does $60k in depreciation not trump everything else? Usually the unrealistic TCOs have an unrealistic residual value. How do you have $60k in depreciation and have that magically cost less than a $45k vehicle. Fuel only costs so much....

Which line in the google doc captures the cost of insurance?

I'm not seeing those costs reflected, and of course, insuring a Tesla Model S is going to be substantially higher than insuring a Honda odyssey. I applaud your otherwise thorough writeup, but you can't do a total cost of ownership analysis and ignore insurance...

I'm not seeing those costs reflected, and of course, insuring a Tesla Model S is going to be substantially higher than insuring a Honda odyssey. I applaud your otherwise thorough writeup, but you can't do a total cost of ownership analysis and ignore insurance...

David Witt

New Member

Great analysis

Hi Paul,

A very interesting story and analysis.

I'd very much like to receive a copy of the xl file to do some sensitivity of my own as I am in Canada.

Would that be possible?

I am reached on gmail or at [email protected]

Thank you,

Dave

Hi Paul,

A very interesting story and analysis.

I'd very much like to receive a copy of the xl file to do some sensitivity of my own as I am in Canada.

Would that be possible?

I am reached on gmail or at [email protected]

Thank you,

Dave

I like your analysis, though I do have one comment and one question. I am curious how you got such a great deal on your Rav4 EV. Please PM me, I'd like be able to replicate that

As for my comment, I think your depreciation is less than it should be. Tesla's 3 year guaranteed buyback price is roughly 47% and you're using 65% at three years. At 5 years, I would expect the Tesla to be at about 30%, and you're using 50%. At 8 years you're using 32%, which is clearly too high, though it's hard to say what it would be. My guess is that 20% would be generous. Your residuals for the other models are high too. I would check out http://www.cars.com/go/alg/ for better residual data to improve your assumptions.

As for my comment, I think your depreciation is less than it should be. Tesla's 3 year guaranteed buyback price is roughly 47% and you're using 65% at three years. At 5 years, I would expect the Tesla to be at about 30%, and you're using 50%. At 8 years you're using 32%, which is clearly too high, though it's hard to say what it would be. My guess is that 20% would be generous. Your residuals for the other models are high too. I would check out http://www.cars.com/go/alg/ for better residual data to improve your assumptions.

ken830

Model S 85, Model 3 Performance, Model X LongRange

It would also be nice to add in a "Supercharger-enabled Roadtrip Miles per year" field. That number of miles would be subtracted from the Tesla's annual fuel costs computation. This change would apply to many families' use-case. If the car isn't used for long-distance road trips, then a RAV4 EV would be a better pick than the Tesla is most cases anyhow.

Objective1

Member

A couple questions:

The spreadsheet seems to be assuming electricity cost of recharging at $0.12 per kWh. That is very low for California, New York, and many other places Tesla buyers live, isn't it?

And it assumes gas retail prices will rise over 8 years. Why is that? Gas prices are not on an upward curve the last couple years, and a production revolution is underway thanks to fracking (and not, in the long term, just in the US).

Thanks for any insight you can provide.

The spreadsheet seems to be assuming electricity cost of recharging at $0.12 per kWh. That is very low for California, New York, and many other places Tesla buyers live, isn't it?

And it assumes gas retail prices will rise over 8 years. Why is that? Gas prices are not on an upward curve the last couple years, and a production revolution is underway thanks to fracking (and not, in the long term, just in the US).

Thanks for any insight you can provide.

Last edited:

Similar threads

- Replies

- 2

- Views

- 225

- Replies

- 10

- Views

- 746

- Replies

- 19

- Views

- 644