Nope, Elon's award package is new shares. Since he's holding for a long tine, float will be mostly unchanged (other than the sale of some to cover taxes and the exercise price, if he goes that route).Thx, so this will pull more free float shares from the market I presume?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

-

- Tags

- elon is an ass

Thx, so this will pull more free float shares from the market I presume?

Usually these shares are authorized to be issued from company’s treasury. So, while not pulling from free float it will dilute every other shareholder.

The Accountant

Active Member

Here is my estimate for revenue:

Excellent, our numbers are very close. I think the main difference may be that I am adding $294m in Auto sales for a Foreign Currency benefit due to the weaker US$ in Q4. It's a rough calculation that I do, so I may not be accurate with that number.

Excellent, our numbers are very close. I think the main difference may be that I am adding $294m in Auto sales for a Foreign Currency benefit due to the weaker US$ in Q4. It's a rough calculation that I do, so I may not be accurate with that number.

View attachment 630933

Interesting, in this metric you are both within the range of analysts according to yahoo finance:

Low: 9.1 billion

Average: 10.32 billion

-Troy: 10.69 billion

-TheAccountant: 11.01 billion

High: 11.13 billion

Tesla, Inc. (TSLA) Analyst Ratings, Estimates & Forecasts - Yahoo Finance

dc_h

Active Member

Not a near future estimate, but Microsoft had earnings today. Revenue was over 40 billion and a blowout great number. Now Tesla is about to report about 1/4 of that, but based on planned growth, will be close to 30 billion a quarter in 2022 and poised to pass 40 billion quarterly in 2023. Microsoft market cap is 1.7 trillion and growing less than 1/2 Tesla. If Tesla Energy and Semi ramp faster, the growth rate could hold up over 60% for at least 3 more years.

Their gross margins is 68%. Soooo FSD needs to get here before we start comparing revenuesNot a near future estimate, but Microsoft had earnings today. Revenue was over 40 billion and a blowout great number. Now Tesla is about to report about 1/4 of that, but based on planned growth, will be close to 30 billion a quarter in 2022 and poised to pass 40 billion quarterly in 2023. Microsoft market cap is 1.7 trillion and growing less than 1/2 Tesla. If Tesla Energy and Semi ramp faster, the growth rate could hold up over 60% for at least 3 more years.

Here is my estimate for revenue:

Actual number is 10,744 (vs. your estimate of 10,689)for total revenues in Q4, congrats

The Accountant

Active Member

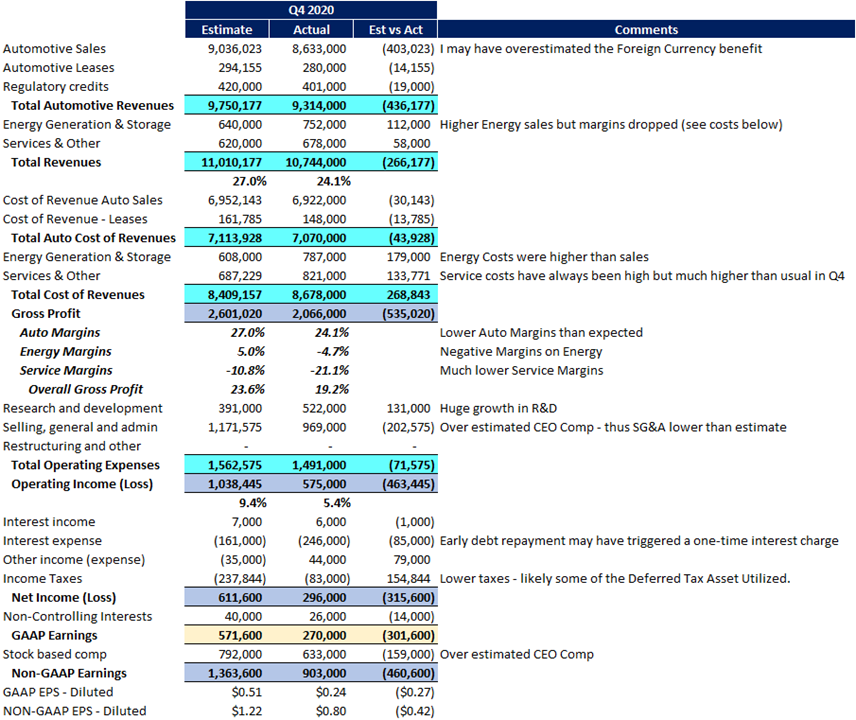

We will learn more once the 10K is published; here is a quick comparison of my estimates to the actual results:

We will learn more once the 10K is published; here is a quick comparison of my estimates to the actual results:

View attachment 631297

Overall, it was an earnings report and Q&A filled with gems, some of my more financials oriented takeaways:

- Growth in solar and storage were well ahead of my expectations;

- I think the ASP overestimate may actually be FSD take rates being lower in China relative to other markets. Elon mentioned during ER that it was "something like only 2-3%", relative to the 20%+ (I don't have a source for that) in other markets;

- I was surprised at the hit to margins in energy, would have liked an analyst to have asked about that explicitly, but instead we asked about X Holding Co; /s

- I don't think they released any of the DTA, the lower tax rate (almost 8% lower than expected) possibly just driven by the SBC tax deductions; ordering of deductions would consume current year deductions before you start dipping in to DTAs;

- Much lower operating margin than I was anticipating, which going back to DTA, may have been a reason why there wasn't a full release, as expected;

- Zach made a comment about the SBC also being baked in to COGS and impacting GM %; that had to have been a material variance for it to be top of mind for him;

- Growth in R&D may also be partially SBC related, but also likely related to scale-up of the R&D team in Shanghai;

- That 50% CAGR on auto is expected for several years, with a chance they may MATERIALLY exceed in 2021 (Zach's words), and likely materially exceed in 2022 (Elon's words); with Cybertruck being pushed in 2022, I actually think we are extremely likely to see 70-80% CAGR over next two years and flattening out to 50% in 2023-2025;

I look forward to the 10-K!

willow_hiller

Well-Known Member

I was surprised at the hit to margins in energy, would have liked an analyst to have asked about that explicitly, but instead we asked about X Holding Co; /s

There was a recent policy change at Tesla that might explain the solar margins, somewhat. In the summer, Tesla would offer an upfront discount in exchange for the rights to the Solar Renewable Energy Credits (SRECs), but if you called and asked they would let you retain them. But this quarter, they've been telling customers in some states they no longer install solar systems without retaining the SREC rights.

So it's possible they are deliberately exchanging immediate solar margins for long-term regulatory credits.

That, and solar was probably more susceptible to the chip shortage and supply chain issues faced by the vehicle side due to the dependence on third-party hardware from SolarEdge and Delta. The introduction of their own brand solar inverter this quarter should help mitigate that.

Last edited:

Overall, it was an earnings report and Q&A filled with gems, some of my more financials oriented takeaways:

I absolutely loved Elon's approach to rationalizing the valuation, calling out that true FSD is not priced in, and that Auto + FSD alone would be a trillion+ market cap.

- Growth in solar and storage were well ahead of my expectations;

- I think the ASP overestimate may actually be FSD take rates being lower in China relative to other markets. Elon mentioned during ER that it was "something like only 2-3%", relative to the 20%+ (I don't have a source for that) in other markets;

- I was surprised at the hit to margins in energy, would have liked an analyst to have asked about that explicitly, but instead we asked about X Holding Co; /s

- I don't think they released any of the DTA, the lower tax rate (almost 8% lower than expected) possibly just driven by the SBC tax deductions; ordering of deductions would consume current year deductions before you start dipping in to DTAs;

- Much lower operating margin than I was anticipating, which going back to DTA, may have been a reason why there wasn't a full release, as expected;

- Zach made a comment about the SBC also being baked in to COGS and impacting GM %; that had to have been a material variance for it to be top of mind for him;

- Growth in R&D may also be partially SBC related, but also likely related to scale-up of the R&D team in Shanghai;

- That 50% CAGR on auto is expected for several years, with a chance they may MATERIALLY exceed in 2021 (Zach's words), and likely materially exceed in 2022 (Elon's words); with Cybertruck being pushed in 2022, I actually think we are extremely likely to see 70-80% CAGR over next two years and flattening out to 50% in 2023-2025;

I look forward to the 10-K!

Had to look up some abbreviations due to lack of financial background, might be of help to others:

- ASP: Average Sales Price

- DTA: Deferred Tax Asset

- SBC: Stock Based Compensation

- COGS: Cost of Goods Sold

- CAGR: Compounded Annua Growth Rate

MODERATOR EDIT: Let this be a lesson to all NTUA (NOT TO USE ABBREVIATIONS), unless if your post uses a term more than once, then you may use it with the words properly spelled out after the first such usage. AND...if you are going to use especially sector-specific terminology just once, then use neither the abbreviation nor the combination. Rather, be kind and responsible to all and simply spell out the term.

To summarize: in the Investor Forum, you are NTUA.

JohnnyEnglish

Member

Would the Kato Road pilot line be in R&D? They also significantly ramped the Dojo team.Overall, it was an earnings report and Q&A filled with gems, some of my more financials oriented takeaways:

7. Growth in R&D may also be partially SBC related, but also likely related to scale-up of the R&D team in Shanghai

I look forward to the 10-K!

It will be interesting to see if the R&D costs remain at this higher level.

Agree it was an ER filled with gems which seem to confirm they are spending/investing for the future together with a continuing focus on efficiency. My only slight concern was the negative margin in energy. Hopefully this will be reversed quickly.

Doggydogworld

Active Member

Solar always had good gross margins (~30%), but storage gross margin is generally negative. Mostly due to utility-scale, where competition is stiff, the Tesla brand doesn't help much and they've used the wrong chemistry. So margins deteriorate when storage ramps.I was surprised at the hit to margins in energy, would have liked an analyst to have asked about that explicitly, but instead we asked about X Holding Co; /s

Solar roof margins are also poor, but refusal to disclose any numbers prevents us from even guessing if it's material.

I didn't really get that. He was talking about Q4 in general and SBC specifically. He only mentioned COGS in passing. He then specifically addressed Automotive Gross Margins, which were "primarily" affected by product changes and logistics issues, not SBC.Zach made a comment about the SBC also being baked in to COGS and impacting GM %; that had to have been a material variance for it to be top of mind for him

I agree the (vague) growth guidance is the real story. I'm not sure what to expect for Q1, though.[/QUOTE]

I didn't really get that. He was talking about Q4 in general and SBC specifically. He only mentioned COGS in passing. He then specifically addressed Automotive Gross Margins, which were "primarily" affected by product changes and logistics issues, not SBC.

From the ER transcript: “Stock-based comp increased, part of which is driven by the rise of the stock price over the course of our 2020 employee performance grant process and a portion of which is unique to Q4 only. The impact of SBC increases is seen across both COGS as well as operating expenses.”

Could be just a passing comment, but I wouldn’t be surprised if it was a material contributor to the drop in GM% from Q3.

Q1 is going to be one to watch with MiC Model Y ramp up, and S/X refresh, being great lifts to potential margins.

Would the Kato Road pilot line be in R&D? They also significantly ramped the Dojo team.

It will be interesting to see if the R&D costs remain at this higher level.

Agree it was an ER filled with gems which seem to confirm they are spending/investing for the future together with a continuing focus on efficiency. My only slight concern was the negative margin in energy. Hopefully this will be reversed quickly.

Dojo definitely would be. Kato, given its scale, may have moved off the R&D expense line at this point and on to inventory and capital assets.

JohnnyEnglish

Member

In the main investors' thread @SOULPEDL speculated about the timing of Tesla offering FSD subscriptions. It raised a couple of questions in my mind and thought it would be great to get the opinion of those of you with an accounting background (e.g. yourself and @The Accountant):Dojo definitely would be. Kato, given its scale, may have moved off the R&D expense line at this point and on to inventory and capital assets.

- When Tesla has FSD on general release and offers FSD on subscription in addition to one-off purchase do you think this will impact the way that it is reported in the accounts - perhaps it will get a distinct line under automotive revenues?

- In this case would you expect the ongoing costs of developing FSD to move from R&D to cost of revenues?

When Tesla has FSD on general release and offers FSD on subscription in addition to one-off purchase do you think this will impact the way that it is reported in the accounts - perhaps it will get a distinct line under automotive revenues?

I don't think so. There isn't a line item for the premium connectivity subscriptions is there? Or maybe they will add a subscription revenue line item that includes FSD, premium connectivity, and maybe a gaming subscription.

When Tesla has FSD on general release and offers FSD on subscription in addition to one-off purchase do you think this will impact the way that it is reported in the accounts - perhaps it will get a distinct line under automotive revenues?

I would love to see this line-item compared to legacy. It further separates "auto business" from "other new revenue" for investors trying to understand TSLA valuation today. (Johnny English... is Mr. Bean. Is that you sir? You never know in this place.)

Similar threads

- Replies

- 192

- Views

- 20K

- Replies

- 41

- Views

- 7K