Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

-

- Tags

- elon is an ass

The Accountant

Active Member

The Accountant

Active Member

The Accountant

Active Member

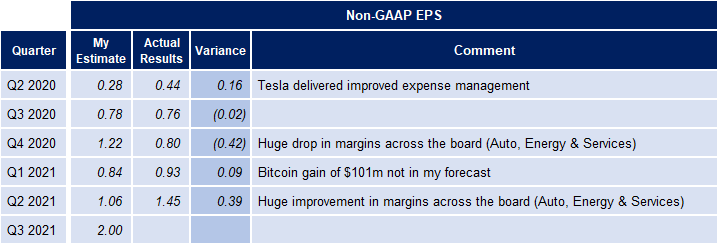

How have my estimates compared to actual results in the past:

I had huge misses in Q4 2020 (when Tesla disappointed on margins) and Q2 2021 (when Tesla surprised on margins).

For this Quarter, $2.00 is my base case but I expect a range from $1.90 to $2.10 (excluding any impairment charge for Bitcoin for which I have none).

I had huge misses in Q4 2020 (when Tesla disappointed on margins) and Q2 2021 (when Tesla surprised on margins).

For this Quarter, $2.00 is my base case but I expect a range from $1.90 to $2.10 (excluding any impairment charge for Bitcoin for which I have none).

The Accountant

Active Member

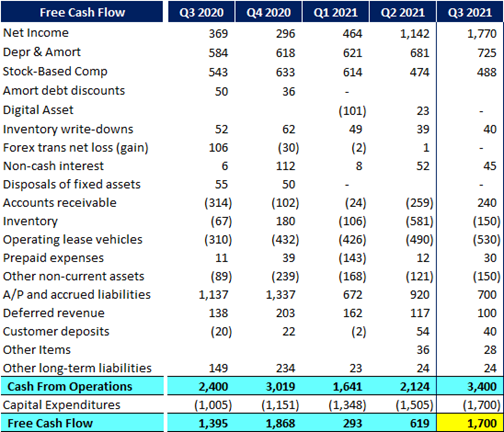

Free Cash Flow - $1.7 Billion

Always tough to project, but Cash Flow should be enormous this Quarter.

Always tough to project, but Cash Flow should be enormous this Quarter.

dc_h

Active Member

I believe they were reported to have paid off a 1.4 billion loan for the Shanghai plant, so cash levels may be fairly steady versus the prior quarter. This will help future quarters though, as debt levels continue to be hammered down. Recourse and non-recourse debt was only 5.1 billion last quarter, so this should be about 3.5 billion or less now. They seem to be on track to paying off all long term debt by mid to late 2022, when cash flow really takes off.Free Cash Flow - $1.7 Billion

Always tough to project, but Cash Flow should be enormous this Quarter.

View attachment 720952

kengchang

Active Member

China loan agreement is already gone by the end of Q2.I believe they were reported to have paid off a 1.4 billion loan for the Shanghai plant, so cash levels may be fairly steady versus the prior quarter. This will help future quarters though, as debt levels continue to be hammered down. Recourse and non-recourse debt was only 5.1 billion last quarter, so this should be about 3.5 billion or less now. They seem to be on track to paying off all long term debt by mid to late 2022, when cash flow really takes off.

But they have paid off the 2025 Notes in Q3. From the 10Q report for Q2:

"On July 16, 2021, we issued a notice of redemption to the holders of the 2025 Notes informing the holders that we will redeem the notes in full in

August 2021 at a redemption price equal to 102.65% of outstanding principal amount, plus accrued and unpaid interest, if any."

kengchang

Active Member

Ya, but my comment is specific to the China loan agreementBut they have paid off the 2025 Notes in Q3. From the 10Q report for Q2:

"On July 16, 2021, we issued a notice of redemption to the holders of the 2025 Notes informing the holders that we will redeem the notes in full in

August 2021 at a redemption price equal to 102.65% of outstanding principal amount, plus accrued and unpaid interest, if any."

Causalien

Prime 8 ball Oracle

Whoa, I stepped away for a while and Tesla's margin improved tremendously.

It was always something I brush off as Elon brag, but they are actually making progress towards it and looks to be reachable.

It was always something I brush off as Elon brag, but they are actually making progress towards it and looks to be reachable.

Todd Burch

14-Year Member

@The Accountant Rob Maurer is expecting a Bitcoin impairment charge. I think you are still showing no charge for Q3, correct?

I checked the BTC price history and indeed, BTC closed at $35,040.84 on Jun 30 and hit $29,807.35 on Jul 20. This was significantly lower than at any time in Q2, which was the previous impairment charge.

I don't know exact numbers for the impairment (not sure if it used intraday low or closing low, etc.) but it seems certain there will be an impairment for Q3.

I checked the BTC price history and indeed, BTC closed at $35,040.84 on Jun 30 and hit $29,807.35 on Jul 20. This was significantly lower than at any time in Q2, which was the previous impairment charge.

I don't know exact numbers for the impairment (not sure if it used intraday low or closing low, etc.) but it seems certain there will be an impairment for Q3.

This is so silly. Bitcoin is now $61k, Tesla are up a billion in profit and they are gonna have to write down earnings. Wallstreet will be saying Tesla shouldn’t have bought bitcoins, meanwhile sane retail investors will see the profit on the investment…@The Accountant Rob Maurer is expecting a Bitcoin impairment charge. I think you are still showing no charge for Q3, correct?

I checked the BTC price history and indeed, BTC closed at $35,040.84 on Jun 30 and hit $29,807.35 on Jul 20. This was significantly lower than at any time in Q2, which was the previous impairment charge.

I don't know exact numbers for the impairment (not sure if it used intraday low or closing low, etc.) but it seems certain there will be an impairment for Q3.

The Accountant

Active Member

I have never been able to recreate the Q2 impairment charge of 23m which led me to conclude it is not as simple as taking the lowest price in the quarter.@The Accountant Rob Maurer is expecting a Bitcoin impairment charge. I think you are still showing no charge for Q3, correct?

I checked the BTC price history and indeed, BTC closed at $35,040.84 on Jun 30 and hit $29,807.35 on Jul 20. This was significantly lower than at any time in Q2, which was the previous impairment charge.

I don't know exact numbers for the impairment (not sure if it used intraday low or closing low, etc.) but it seems certain there will be an impairment for Q3.

Tesla does a poor job at providing details. They could for example tell us how many bitcoins they hold but they don't.

My gut tells me we will see some sort of impairment because I believe that Zach takes a conservative approach with the financials.

See my post here for my reasoning to not record an impairment for Q3.

Bitcoin - Potential Q2 2021 Impact

I guess in general we over estimated the impairment amount: https://tesla-cdn.thron.com/static/ZBOUYO_TSLA_Q2_2021_Update_DJCVNJ.pdf?xseo=&response-content-disposition=inline;filename="q2_2021.pdf" But I got pretty close: Pretty Close? I would say you nailed it !!!!!

ByeByeJohnny

Active Member

Or they could have been smart about it. If the impairment is $50 million and they were up say 50% at some point towards the end of the quarter they could have sold for $100 million to make a $50 profit and it would be a wash. Most of August and September the price was around $45k so that would have been easy.This is so silly. Bitcoin is now $61k, Tesla are up a billion in profit and they are gonna have to write down earnings. Wallstreet will be saying Tesla shouldn’t have bought bitcoins, meanwhile sane retail investors will see the profit on the investment…

Tesla very likely doesn't care about this but if they 'needed' to avoid the impairment they could.

Not sure if they could re-buy immediately if they did this or would have to wait till the next quarter. But they could perhaps have sold on September 30, and rebought on October 1 if they wanted to maintain their position.

Last edited:

The Accountant

Active Member

I looked at Rob's Q3 video and at the 24min mark and he states he does not expect an impairment.@The Accountant Rob Maurer is expecting a Bitcoin impairment charge. I think you are still showing no charge for Q3, correct?

I checked the BTC price history and indeed, BTC closed at $35,040.84 on Jun 30 and hit $29,807.35 on Jul 20. This was significantly lower than at any time in Q2, which was the previous impairment charge.

I don't know exact numbers for the impairment (not sure if it used intraday low or closing low, etc.) but it seems certain there will be an impairment for Q3.

I believe Dave Lee computed something like 100m a while ago and I saw one analyst estimate about 75m.

I did see the Bitcoin drop in July - so an impairment can come.

I however believe my forecast of $2.00 is balanced with potential upsides offsetting downsides.

Risks I see to my forecast are:

Bitcoin impairment: 75m to 100m

Taxes may be too low: 50m to 100m

Opportunities I see to my forecast are:

Average Selling Price may be too low: 75m

Margins may be better: 100m

ByeByeJohnny

Active Member

Rob did an adjustment regarding the bitcoin the next day. Yesterday I guess. His new total number is because of this down from 2.16 to 2.10.I looked at Rob's Q3 video and at the 24min mark and he states he does not expect an impairment.

I believe Dave Lee computed something like 100m a while ago and I saw one analyst estimate about 75m.

I did see the Bitcoin drop in July - so an impairment can come.

I however believe my forecast of $2.00 is balanced with potential upsides offsetting downsides.

Risks I see to my forecast are:

Bitcoin impairment: 75m to 100m

Taxes may be too low: 50m to 100m

Opportunities I see to my forecast are:

Average Selling Price may be too low: 75m

Margins may be better: 100m

It's close to the start of that video.

@The Accountant Rob Maurer is expecting a Bitcoin impairment charge. I think you are still showing no charge for Q3, correct?

I checked the BTC price history and indeed, BTC closed at $35,040.84 on Jun 30 and hit $29,807.35 on Jul 20. This was significantly lower than at any time in Q2, which was the previous impairment charge.

I don't know exact numbers for the impairment (not sure if it used intraday low or closing low, etc.) but it seems certain there will be an impairment for Q3.

Yeah, data source and type have a big impact.I have never been able to recreate the Q2 impairment charge of 23m which led me to conclude it is not as simple as taking the lowest price in the quarter.

Tesla does a poor job at providing details. They could for example tell us how many bitcoins they hold but they don't.

My gut tells me we will see some sort of impairment because I believe that Zach takes a conservative approach with the financials.

See my post here for my reasoning to not record an impairment for Q3.

Bitcoin - Potential Q2 2021 Impact

I guess in general we over estimated the impairment amount: https://tesla-cdn.thron.com/static/ZBOUYO_TSLA_Q2_2021_Update_DJCVNJ.pdf?xseo=&response-content-disposition=inline;filename="q2_2021.pdf" But I got pretty close: Pretty Close? I would say you nailed it !!!!!teslamotorsclub.com

Per: Bitcoin Historical Data - Investing.com daily data:

Q2 low (previous all time low for Tesla's holding period [if starting Jan 28]) : 29,927

Q3 low: 29,341

$586 difference * 42,000 coin = $24.6 Million / 1 Billion shares = $0.02 impairment

If they did Musk would have have been lying about their intentions to not sell. Musk doesn’t care what wallstreet thinks, at this point Tesla doesn’t have to. He will take that impairment and not care at all that Wallstreet are retarded.Or they could have been smart about it. If the impairment is $50 million and they were up say 50% at some point towards the end of the quarter they could have sold for $100 million to make a $50 profit and it would be a wash. Most of August and September the price was around $45k so that would have been easy.

Tesla very likely doesn't care about this but if they 'needed' to avoid the impairment they could.

Not sure if they could re-buy immediately if they did this or would have to wait till the next quarter. But they could perhaps have sold on September 30, and rebought on October 1 if they wanted to maintain their position.

The whole thing is so unbalanced, report downsides but not upsides. So messed up that this is GAAP.

Similar threads

- Replies

- 192

- Views

- 20K

- Replies

- 41

- Views

- 7K