If you have a car on order they will be updating your loan agreement today. But their system is having issues. I received 5 emails asking to re-sign the agreement that I signed yesterday. Picking up the car in 2 hours... perfect timing. If you already made you final payment (as I did) you should receive a refund check in 4-6 weeks. Original thread here Picking up MY in a few hours, now blank account screen?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New $1500 rebate for CA owners

- Thread starter Kodemonkey

- Start date

To my knowledge it sounded like the Clean Air rebate - but that is supposed to be $2000. I will post more when I actually can access the loan agreement and get any other information from the service center.

kishkaru

Member

The program is for new EV/PHEV purchases/leases starting today, for all CA residents (no income cap). This is essentially a replacement for the old Edison/PG&E/SDG&E rebate thing. The difference here is that there’s no paperwork involved, and you get the discount off the purchase/lease price at the dealer directly, before you even drive off the lot.

Note, this is separate from the state CVRP rebate, which is currently $2000 (was $2500 for BEV or $1500 for PHEVs).

So now the total is $7500 (fed) - $2000 (state) - $1500 (state) (for qualifying EVs, Tesla/GM excluded from $7500 fed)

Keep in mind that the $2000 CVRP state one has an income cap (I think $160k?), and a max of 2 uses, lifetime per person.

One more thing about the new rebate-- it is taxed. See the program agreement for details (paragraph 4)

As an example, with 9.25% tax, you only end up getting: $1500 * (1-0.0925) = $1361.

I believe the CVRP and PGEdison/PG&E/SDG&E rebates was not taxed (although you were supposed to disclose them on your tax returns as additional income)

Note, this is separate from the state CVRP rebate, which is currently $2000 (was $2500 for BEV or $1500 for PHEVs).

So now the total is $7500 (fed) - $2000 (state) - $1500 (state) (for qualifying EVs, Tesla/GM excluded from $7500 fed)

Keep in mind that the $2000 CVRP state one has an income cap (I think $160k?), and a max of 2 uses, lifetime per person.

One more thing about the new rebate-- it is taxed. See the program agreement for details (paragraph 4)

As an example, with 9.25% tax, you only end up getting: $1500 * (1-0.0925) = $1361.

I believe the CVRP and PGEdison/PG&E/SDG&E rebates was not taxed (although you were supposed to disclose them on your tax returns as additional income)

Undisclosed

Member

The program is for new EV/PHEV purchases/leases starting today, for all CA residents (no income cap). This is essentially a replacement for the old Edison/PG&E/SDG&E rebate thing. The difference here is that there’s no paperwork involved, and you get the discount off the purchase/lease price at the dealer directly, before you even drive off the lot.

Note, this is separate from the state CVRP rebate, which is currently $2000 (was $2500 for BEV or $1500 for PHEVs).

So now the total is $7500 (fed) - $2000 (state) - $1500 (state) (for qualifying EVs, Tesla/GM excluded from $7500 fed)

Keep in mind that the $2000 CVRP state one has an income cap (I think $160k?), and a max of 2 uses, lifetime per person.

One more thing about the new rebate-- it is taxed. See the program agreement for details (paragraph 4)

As an example, with 9.25% tax, you only end up getting: $1500 * (1-0.0925) = $1361.

I believe the CVRP and PGEdison/PG&E/SDG&E rebates was not taxed (although you were supposed to disclose them on your tax returns as additional income)

$1361 is better than $800

kishkaru

Member

The old program was better, when CVRP was $2500 last year. You would've gotten $2500 CVRP + $1000 CFRP (Edison) = $3500

Now you only get $2000 CVRP + $1346 CCFR = $3346

But it's also unclear if the $1000 CFRP is going away, as Edison still advertises it.

If they both stack, then its $2500 CVRP + $1346 (CCFR) + $1000 CFRP (Edison) = $4346

For now, I think this is all too new for anyone to make the call.

Just so we don't get lost in acronyms :

:

CVRP - Clean Vehicle Rebate Program

CFRP - Clean Fuel Reward Program

CCFR - California Clean Fuel Reward

Now you only get $2000 CVRP + $1346 CCFR = $3346

But it's also unclear if the $1000 CFRP is going away, as Edison still advertises it.

If they both stack, then its $2500 CVRP + $1346 (CCFR) + $1000 CFRP (Edison) = $4346

For now, I think this is all too new for anyone to make the call.

Just so we don't get lost in acronyms

CVRP - Clean Vehicle Rebate Program

CFRP - Clean Fuel Reward Program

CCFR - California Clean Fuel Reward

Last edited:

kishkaru

Member

Yes, now I do believe it's a replacement for the old Edison/PG&E/SDG&E rebates. PG&E has updated their website to depreciate the program:

I think it makes sense to have a single statewide program than all these separate utility rebates. At the end of the day, the funds for those utility rebates came from the states so it's not like they were paying for it.

Purchase/Lease Time Frame

You purchased or leased an EV between March 1, 2019, and November 16, 2020.

Will this credit be offered next year?

When this limited-time-only credit expires, it will be replaced with the Clean Fuel Reward Program (CFR). The CFR starts November 17, 2020, and applies to new electric vehicle purchases.

I think it makes sense to have a single statewide program than all these separate utility rebates. At the end of the day, the funds for those utility rebates came from the states so it's not like they were paying for it.

Last edited:

This is crazy... 19 emails asking to review my loan agreement today. Now 20. It's now one every minute...

Yes, now I do believe it's a replacement for the old Edison/PG&E/SDG&E rebates. PG&E has updated their website to depreciate the program:

I think it makes sense to have a single statewide program than all these separate utility rebates. At the end of the day, the funds for those utility rebates came from the states so it's not like they were paying for it.

Did you mean SDGE because the link you provided was for SDGE. PGE still has it on their site: Electric vehicle (EV) rebates

EDIT: When you try to apply for it, you get this message:

PG&E and other California electric utilities are teaming up with the California Air Resources Board (CARB) to offer the California Clean Fuel Reward (CCFR), a point-of-sale incentive of up to $1,500 for the purchase or lease of any eligible new Battery Electric or Plug-in Hybrid vehicle from a participating automotive retailer. The incentive is available starting November 17, 2020.

PG&E customers are eligible for either the Clean Fuel Rebate or the California Clean Fuel Reward, but not both. Clean Fuel Rebate applications will be screened for eligibility and rejected if the CCFR was received at the time of purchase.

JPZ1129

New Member

I just looked at my order confirmation on Tesla website. I have already applied for financing now just waiting for them to draft up the contract for the payment. I don't show the $1,500 credit on the price details. Does anyone know if/when they will be updating this?

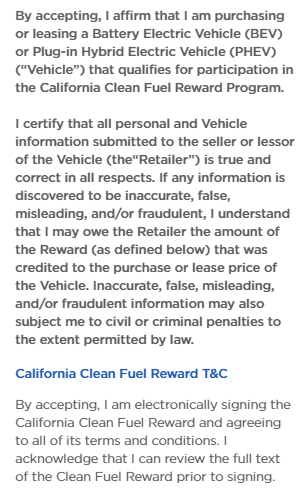

about to leave to pick up my new MY and I checked one last time to see if the website was working. It was, and this was added to the things I had to "accept"

I just looked at my order confirmation on Tesla website. I have already applied for financing now just waiting for them to draft up the contract for the payment. I don't show the $1,500 credit on the price details. Does anyone know if/when they will be updating this?

They re-did my entire loan and applied it as a down payment. Which is fine. It lowered my payment $25 a month. I was just able to accept the loan agreement, and now I can't see the damn PDF. Literally going out the door to pick it up.

kishkaru

Member

I just looked at my order confirmation on Tesla website. I have already applied for financing now just waiting for them to draft up the contract for the payment. I don't show the $1,500 credit on the price details. Does anyone know if/when they will be updating this?

This is what it should look like when it's updated. Just be patient.

Alternatively, add up "Car Price" plus everything under "Additional Charges". If its greater than the displayed "Total Cost of Vehicle", then the CCFR is already applied, but they haven't added the line item yet. Here's an example from mine:

$55,290 + "additional charges" = $61,072.33.

$61,072.33 - $59,572.33 (total cost of vehicle) = $1500.

Last edited:

Did you have to contact them or they did it automatically?

They did it automatically. I was 2 hours from picking up the car and all of a sudden my agreements were missing from the page. Called the SC where the car was and that’s when I found out about it. I’m sure they gave people like me that had a delivery date today priority. So, if it isn’t updated by your day of delivery I would call.

jmatero

Member

kishkaru

Member

No, the program is only for new BEV/PHEV purchases/leases starting 11/17/2020.

If you purchased earlier in the year or last year, you can still apply via one of the legacy programs until 12/31/2020, depending on your utility:

SCE - Clean Fuel Reward Program - $1000 - for purchases 1/1/2019 - 11/16/2020

PG&E - Clean Fuel Rebate - $800 - for purchases until 11/16/2020

SDG&E - Limited EV Purchase Credit - funds undisclosed - for purchases 3/1/2019 - 11/16/2020

If you purchased earlier in the year or last year, you can still apply via one of the legacy programs until 12/31/2020, depending on your utility:

SCE - Clean Fuel Reward Program - $1000 - for purchases 1/1/2019 - 11/16/2020

PG&E - Clean Fuel Rebate - $800 - for purchases until 11/16/2020

SDG&E - Limited EV Purchase Credit - funds undisclosed - for purchases 3/1/2019 - 11/16/2020

Similar threads

- Replies

- 9

- Views

- 913

- Replies

- 10

- Views

- 787