Has anyone started the leasing process since the adoption of the new program ... with USA Bank.

I don't intend for this to be a pro/con thread of leasing vs buying.

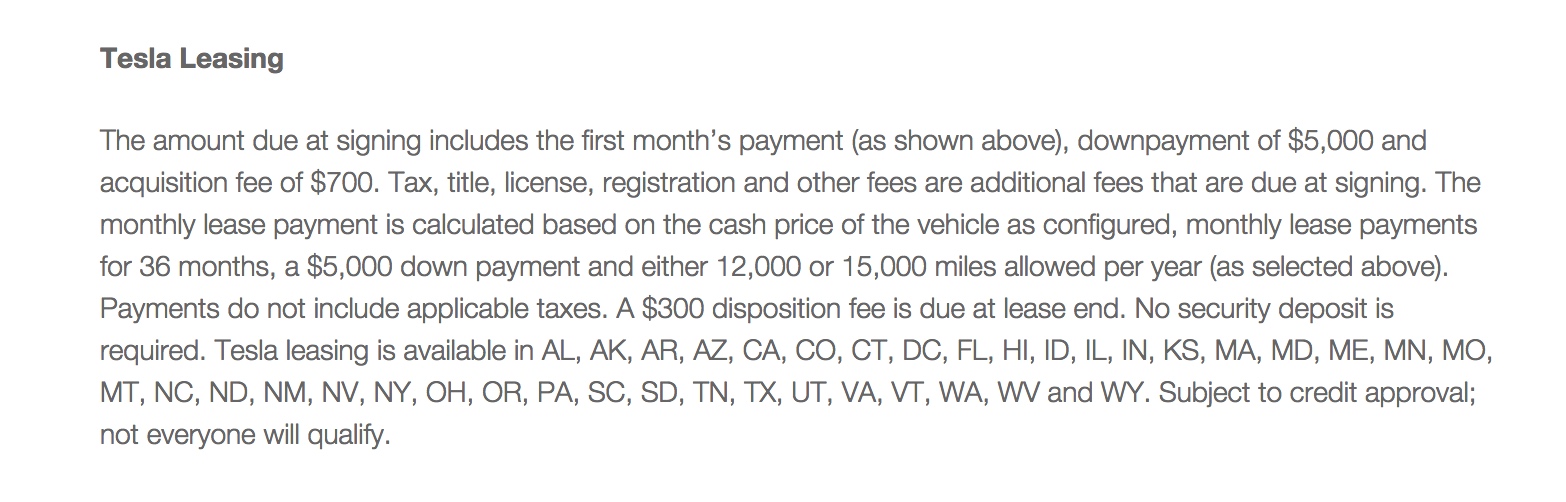

I notice the fine print of the lease states that a down payment is due @ the time of signing, of course, that includes $5,000 down, 1st lease payment, and $700 acquisition fee.

Understandable of any lease. My question is with the next line: "Tax, title, license, registration and other fees are additional fees that are due at the time of signing."

Does this mean that in addition to the lease down payment above, there will be an ADDITIONAL down payment for those additional fees, or are these incorporated into the lease payment?

I put my $2500 down yesterday, filled out the financing application today. I expect Tesla to get back to me next week for more specific details on the lease.

I don't want to push my car into production obviously until I have all the leasing info up front.

There is a big difference between closing on the car with $6,900 versus $6,900 PLUS tax/title/registration on a $95,000 car. Seems like the up front cash for a lease would be closer to $12,000+.

Not much detailed information on the website about the specifics of the new leasing program.

I know I'm just jumping the gun, excited to pull the trigger. I'm expecting a call from Tesla Financing early next week to clarify. I just really want to push that car into production!!!

I don't intend for this to be a pro/con thread of leasing vs buying.

I notice the fine print of the lease states that a down payment is due @ the time of signing, of course, that includes $5,000 down, 1st lease payment, and $700 acquisition fee.

Understandable of any lease. My question is with the next line: "Tax, title, license, registration and other fees are additional fees that are due at the time of signing."

Does this mean that in addition to the lease down payment above, there will be an ADDITIONAL down payment for those additional fees, or are these incorporated into the lease payment?

I put my $2500 down yesterday, filled out the financing application today. I expect Tesla to get back to me next week for more specific details on the lease.

I don't want to push my car into production obviously until I have all the leasing info up front.

There is a big difference between closing on the car with $6,900 versus $6,900 PLUS tax/title/registration on a $95,000 car. Seems like the up front cash for a lease would be closer to $12,000+.

Not much detailed information on the website about the specifics of the new leasing program.

I know I'm just jumping the gun, excited to pull the trigger. I'm expecting a call from Tesla Financing early next week to clarify. I just really want to push that car into production!!!