Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

New VA Tax Credit for EV's

- Thread starter kingjamez

- Start date

-

- Tags

- Mid-Atlantic USA

DFibRL8R

Active Member

Time to call/write your local representatives if you support this EV incentive.

Xenius

Active Member

Saw this last night and sent it to my dad. He'll be taking delivery of his model 3 in Richmond, once AWD is out.

Yep, I just wrote my new Delegate. She just got sworn in yesterday.Time to call/write your local representatives if you support this EV incentive.

I focused on ways to convince the republicans that this is a good idea:

1. Reduce the dependence on foreign oil.

2. The bill will pay for itself by encouraging people to buy more expensive cars, and thus pay more personal property tax.

-Jim

DFibRL8R

Active Member

Great points. And for Virginians, it’s not just foreign oil and gas. We really dont produce much (?any) oil and gas in Virginia. The beauty of electricity for transport is Virginians can choose to generate it from many different sources. Personally, I generate more electricity from solar than I consume.Yep, I just wrote my new Delegate. She just got sworn in yesterday.

I focused on ways to convince the republicans that this is a good idea:

1. Reduce the dependence on foreign oil.

2. The bill will pay for itself by encouraging people to buy more expensive cars, and thus pay more personal property tax.

-Jim

I also agree that EVs (and hybrids) have tended to cost more due to new tech and expensive batteries. This higher cost and value hits EV/hybrid owners at time of purchase and every year in personal property taxes. Giving a tax break to support wider adoption makes sense until the cost of buying an EV comes down.

DFibRL8R

Active Member

Seeing the Marylanders' thread Maryland - Support EVSE Rebates & EV Tax Credits on enhancing the funding for their existing State EV credit has inspired me to follow up on this.

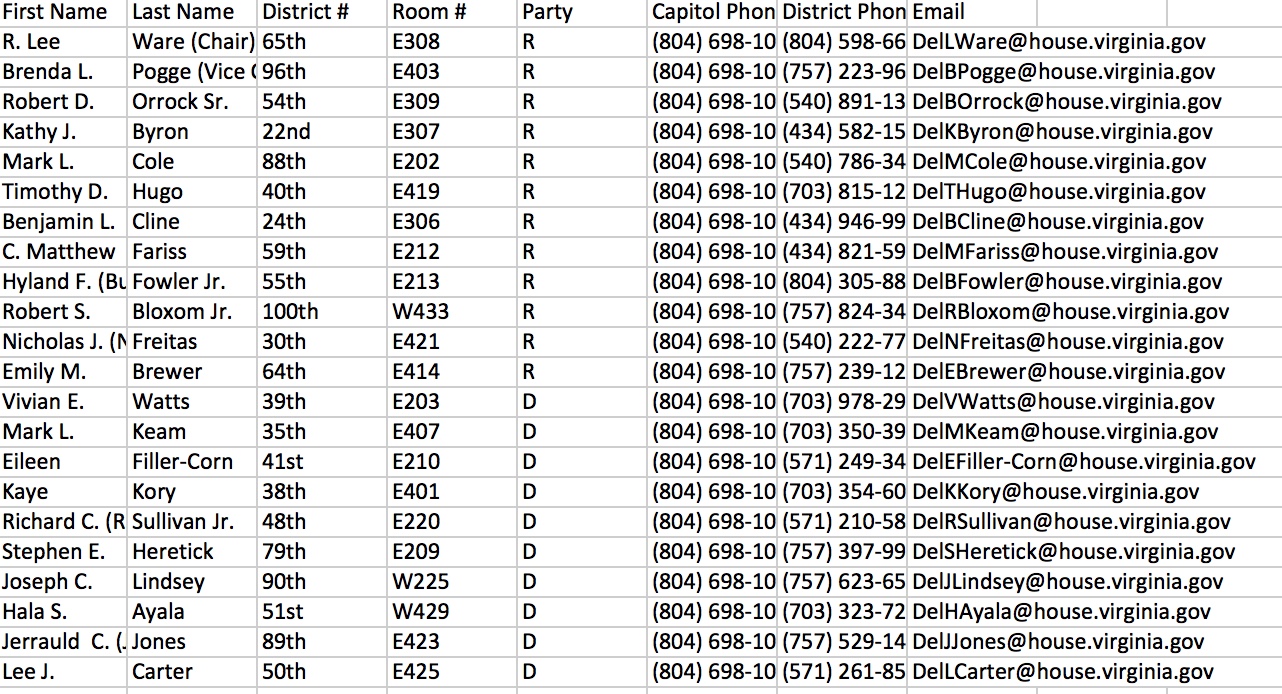

It appears the bill HB 469 which was introduced by David Reid from Loudoun County is in the finance committee right now. I have attached a list of the finance committee members for reference. I would strongly encourage anyone who lives in the same district as any of these committee members to reach out to them directly (email or call) if you feel strongly about this bill.

It sounds like (if approved) the bill would give a 10% State tax credit up to $3,500 on the purchase of a BEV (not a plug-in Hybrid) effective January 1st 2018 for the next 5 years or until EVs are 20% of the new vehicles sold. Cap is $6 million per year.

It appears the bill HB 469 which was introduced by David Reid from Loudoun County is in the finance committee right now. I have attached a list of the finance committee members for reference. I would strongly encourage anyone who lives in the same district as any of these committee members to reach out to them directly (email or call) if you feel strongly about this bill.

It sounds like (if approved) the bill would give a 10% State tax credit up to $3,500 on the purchase of a BEV (not a plug-in Hybrid) effective January 1st 2018 for the next 5 years or until EVs are 20% of the new vehicles sold. Cap is $6 million per year.

DFibRL8R

Active Member

Also, if you're not sure who your legislator is, this is link to a nice map where you can enter an address or drop a pin to see:

Who's My Legislator

Who's My Legislator

DFibRL8R

Active Member

Here's another link to the fiscal impact statement:

http://lis.virginia.gov/cgi-bin/legp604.exe?181+oth+HB469F161+PDF

http://lis.virginia.gov/cgi-bin/legp604.exe?181+oth+HB469F161+PDF

Last edited:

DFibRL8R

Active Member

I heavily plagiarized the letter in the Maryland thread (thanks @ Pollux) and sent to my local legislator. Feel free to adapt, edit, add your own local spin, criticize etc:

My name is ________. I am a resident in the 10th House of Delegates district in Loudoun County, living at ____________ with my wife and children. We have lived and worked in Loudoun for 15 years.

I write to you today in support of the passage of House Bill 469, an act concerning “Electric Vehicle; establishes tax credit on purchase or lease price” which was introduced by David Reid.

I strongly support this program and others like it as a way to accelerate the electrification of the transportation sector of our economy. I have owned an electric vehicle for 5 years and just recently purchased my second. These vehicles use new technology and as such, can initially cost more than a comparable internal combustion car. This initial higher purchase cost results in higher sales tax and also higher yearly personal property tax. To make matters worse, an extra fee was recently tacked on to the registration of EVs due to the fact that EV drivers supposedly aren’t paying their fair share of gas taxes. This is despite the fact that I pay tax on the electricity I use to charge the vehicle and the higher overall sales and personal property taxes as mentioned above. I strongly believe Virginia should create more incentives to transition away from internal combustion vehicles. This will help Virginians make the transition to using clean EVs sooner. Electrifying our transportation will result in a number of substantial benefits to the voters and citizens of Virginia, such as:

(1) substantial reduction in airborne pollutants

(2) substantial reduction in carbon emissions pollution, which is critical in our fight against climate change

(3) substantial reduction in noise pollution

(4) reduction in total life-cycle transportation cost for voters and residents due to lower cost of electricity versus gasoline and lower vehicle maintenance costs

(5) health benefits from (1), (2) and (3)

(6) property benefits from (1) and (2)

(7) reducing our reliance on petroleum products which are toxic, hazardous materials that are not produced in our state and must be imported on our rails, roads and waterways at great risk to the general public (not to mention causing excess wear and tear on our roadways from fuel transports).

Tanker Leaks 700 Gallons of Fuel After Crash in Hamilton

Train derails in downtown Lynchburg, leaving crude burning on James River

The use of a wisely-targeted incentive such as the one addressed by HB469 aids careful consumers in reaching a purchasing decision with the wide benefits outlined above.

Thank you for your consideration.

My name is ________. I am a resident in the 10th House of Delegates district in Loudoun County, living at ____________ with my wife and children. We have lived and worked in Loudoun for 15 years.

I write to you today in support of the passage of House Bill 469, an act concerning “Electric Vehicle; establishes tax credit on purchase or lease price” which was introduced by David Reid.

I strongly support this program and others like it as a way to accelerate the electrification of the transportation sector of our economy. I have owned an electric vehicle for 5 years and just recently purchased my second. These vehicles use new technology and as such, can initially cost more than a comparable internal combustion car. This initial higher purchase cost results in higher sales tax and also higher yearly personal property tax. To make matters worse, an extra fee was recently tacked on to the registration of EVs due to the fact that EV drivers supposedly aren’t paying their fair share of gas taxes. This is despite the fact that I pay tax on the electricity I use to charge the vehicle and the higher overall sales and personal property taxes as mentioned above. I strongly believe Virginia should create more incentives to transition away from internal combustion vehicles. This will help Virginians make the transition to using clean EVs sooner. Electrifying our transportation will result in a number of substantial benefits to the voters and citizens of Virginia, such as:

(1) substantial reduction in airborne pollutants

(2) substantial reduction in carbon emissions pollution, which is critical in our fight against climate change

(3) substantial reduction in noise pollution

(4) reduction in total life-cycle transportation cost for voters and residents due to lower cost of electricity versus gasoline and lower vehicle maintenance costs

(5) health benefits from (1), (2) and (3)

(6) property benefits from (1) and (2)

(7) reducing our reliance on petroleum products which are toxic, hazardous materials that are not produced in our state and must be imported on our rails, roads and waterways at great risk to the general public (not to mention causing excess wear and tear on our roadways from fuel transports).

Tanker Leaks 700 Gallons of Fuel After Crash in Hamilton

Train derails in downtown Lynchburg, leaving crude burning on James River

The use of a wisely-targeted incentive such as the one addressed by HB469 aids careful consumers in reaching a purchasing decision with the wide benefits outlined above.

Thank you for your consideration.

Last edited:

Xenius

Active Member

AMPUP

Member

Tax credits are not the way to go here, we’re already screwed in Virginia with personal property tax and sales tax. If anything they should try to do something in those two areas.. sales tax exemption for EV’s would help both the new and used EV market and personal property tax exemption would really cause major ev adoption as it’s the gift that keeps giving and would save S/X owners about 15k over 5 years.

DFibRL8R

Active Member

Tax credits are not the way to go here, we’re already screwed in Virginia with personal property tax and sales tax. If anything they should try to do something in those two areas.. sales tax exemption for EV’s would help both the new and used EV market and personal property tax exemption would really cause major ev adoption as it’s the gift that keeps giving and would save S/X owners about 15k over 5 years.

I don't disagree but I look at $3,500 in savings for an EV owner as a positive regardless of which pot it comes from. Interestingly, Loudoun County used to offer a significantly reduced personal property tax rate for hybrids and EVs but quietly eliminated it January 2013 (the month before I got my Model S). If a State level incentive fails, there is still an opportunity for individual localities to institute a break for EVs.

NCAviator

Member

I am against the government at any level picking winners and losers. I am really against them trying to force behavior with tax policy. If they have to tax; it it should be to operate their services as efficiently as possible. If they have too many $ to give some back to some citizens; then lower everyone's tax. Any consumer product should stand on it's own merits. I am tried of my tax $ going to others. Give the $ back to all tax payers and let them decided how to spend what they worked for.

DFibRL8R

Active Member

I am against the government at any level picking winners and losers. I am really against them trying to force behavior with tax policy. If they have to tax; it it should be to operate their services as efficiently as possible. If they have too many $ to give some back to some citizens; then lower everyone's tax. Any consumer product should stand on it's own merits. I am tried of my tax $ going to others. Give the $ back to all tax payers and let them decided how to spend what they worked for.

I understand your position and I'm sure you feel you don't benefit as much as you should from all the taxes you have paid. The current reality in all 50 States is the government taking tax money in different amounts from each citizen and choosing to spend it various ways that cannot possibly impact everyone the same. There will always be "winners" and "losers" depending on how much any given citizen gets taxed and how much they are directly and indirectly benefited (or not) by any government funded programs. The current system in Virginia penalizes people who buy EVs (that cost more than a comparable ICE vehicle) through higher sales tax and annual personal property tax (rates are the same but the cars with newer tech cost more). There is also an extra registration fee for EV owners supposedly to offset what they don't pay in gas taxes even though the electricity to charge the EV is already taxed. These are financial disincentives created through existing tax policy that make EV ownership more costly and may further discourage consumers from switching to an EV. On the contrary, a (temporary) tax break would do the opposite, creating a more level playing field for EVs in terms of State and local taxes. ICE drivers indirectly enjoy many tax breaks afforded to the petroleum industry that subsidize that industry despite it's obvious negative impact on those of us that breathe air.

Last edited:

Xenius

Active Member

Bad news on HB 469, the Virginia $3,500 EV tax credit bill.

On Friday, the subcommittee voted to recommend "passing by indefinitely" (PBI) which means that the committee reserves the right to reconsider the bill at a later meeting but usually it means it's dead.

Here's the subcommittee vote on Virginia HB469.

YEAS--Pogge, Ware, Orrock, Byron, Hugo--5.

NAYS--Keam, Kory, Lindsey--3.

ABSTENTIONS--0.

NOT VOTING--0.

Electric Vehicle Legislation Tracker - 2018 | PlugInSites

On Friday, the subcommittee voted to recommend "passing by indefinitely" (PBI) which means that the committee reserves the right to reconsider the bill at a later meeting but usually it means it's dead.

Here's the subcommittee vote on Virginia HB469.

YEAS--Pogge, Ware, Orrock, Byron, Hugo--5.

NAYS--Keam, Kory, Lindsey--3.

ABSTENTIONS--0.

NOT VOTING--0.

Electric Vehicle Legislation Tracker - 2018 | PlugInSites

Xenius

Active Member

@Xenius, The following Tweet is from the bill's sponsor.

DavidReidVA

DavidReidVA

HB469 was killed on a party line vote with the Ds voting in favor, and Rs voting against. Missed economic opportunity for Virginia to lead the way in electric vehicle adoption!

Feb 2, 2018, 9:31 AM

HB469 was killed on a party line vote with the Ds voting in favor, and Rs voting against. Missed economic opportunity for Virginia to lead the way in electric vehicle adoption!

Feb 2, 2018, 9:31 AM

Similar threads

- Replies

- 1

- Views

- 491

- Replies

- 0

- Views

- 88

- Replies

- 66

- Views

- 6K