- For and against Nikola the company and the stock

- Just how bad are fool sells?

- Also, is NKLA going up good for TSLA?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All discussion of Nikola Motors

- Thread starter Buckminster

- Start date

Trevor "One Size Does Not Fit All" Milton lied to our face saying that they're vertically integrated. How are you vertically integrated if you don't own anything? Said he's one of the only people who can outdo Elon Musk. Also said he sucked at manufacturing so he had someone else do it. Nothing computes with this organization.

Last edited:

willow_hiller

Well-Known Member

Honestly, I just want NKLAQ to take off so TSLAQ goes long NKLA to spite us. Can't short TSLA if you've lost all your money on NKLA calls

There're a channel on youtube that raised a valid point. NKLA billed itself as a fuel cell automaker. In a way, they're not so different from fossil fuel: their consumers will have to depend on them for fuel. In comparison, EV owners can generate their own energy if they wanted to.

Hey, I take offense to that, on behalf of my Swedish brothers! Ikea is a fine company; thousands and thousands of families, including me, depend on them to provide furniture. They also have world-class logistics.NKLA is the Ikea of EVs. Trevor "One Size Does Not Fit All" Milton lied to our face saying that they're vertically integrated. How are you vertically integrated if you don't own anything? Said he's one of the only people who can outdo Elon Musk. Also said he sucked at manufacturing so he had someone else do it. Nothing computes with this organization.

Can we change it to, I don't know, actually I can't think of a good comparison. McAfee antivirus perhaps?

I dont mean Ikea as low quality. No offense intended. I shop at Ikea a lot. People are under the impression that Ikea makes its own furniture while it fact it just repackages them under the brand Ikea. That's what I meant: NKLA doesn't make anything but it acts like it does. I got rid of that line.

Don't worry, I understood what you meantI dont mean Ikea as low quality. No offense intended. I shop at Ikea a lot. People are under the impression that Ikea makes its own furniture while it fact it just repackages them under the brand Ikea. That's what I meant: NKLA doesn't make anything but it acts like it does. I got rid of that line.

- For and against Nikola the company and the stock

- Just how bad are fool sells?

- Also, is NKLA going up good for TSLA?

1. Against NKLA's leadership, because they've done nothing but hype. Even the prototype that was unveiled a few years back might not have been a working copy, since no one got to see its guts.

2. Very bad. See:

- cost of H2 production is very high unless you use steam-reformation of natural gas to make it. At which point, it releases as much CO2 per mile as combustion engines. Only saves on the the NOx and SOx emissions.

- extremely high pressure of H2 storage tanks are dangerous to the general public. Google for last year's fuel cell depot explosion in Norway, and fire in the SF Bay Area. The public is not aware enough of what "explosive decompression" really means. Rolling bombs is not far off the mark.

- takes away attention and clean air incentive dollars from BEVs (see how much CARB credits the Mirai gets versus a model 3). It becomes a tool to slow EV adoption.

3. neutral. Once people realize that the two aren't competitors, it won't matter anymore. If you go to their investor page and check out their SEC filings, you'll see that VTIQ had less than $1M in revenue, that Trevor collected 95M shares, that many of the directors acquired their shares for $1.05 each, that VTIQ was delisted upon NKLA's IPO via a reverse merger, and that VTIQ's last 10-Q filing was in April 30th. July 30th (when their next 10-Q should be filed) will be a real eye opener! Get your popcorn ready!

Thekiwi

Active Member

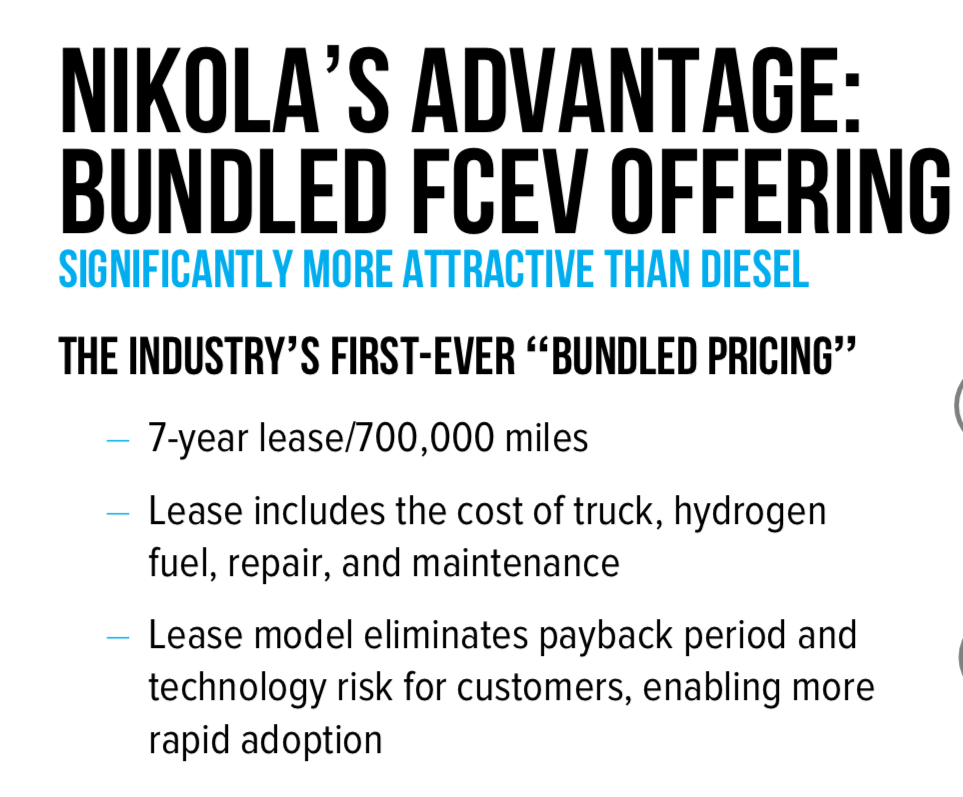

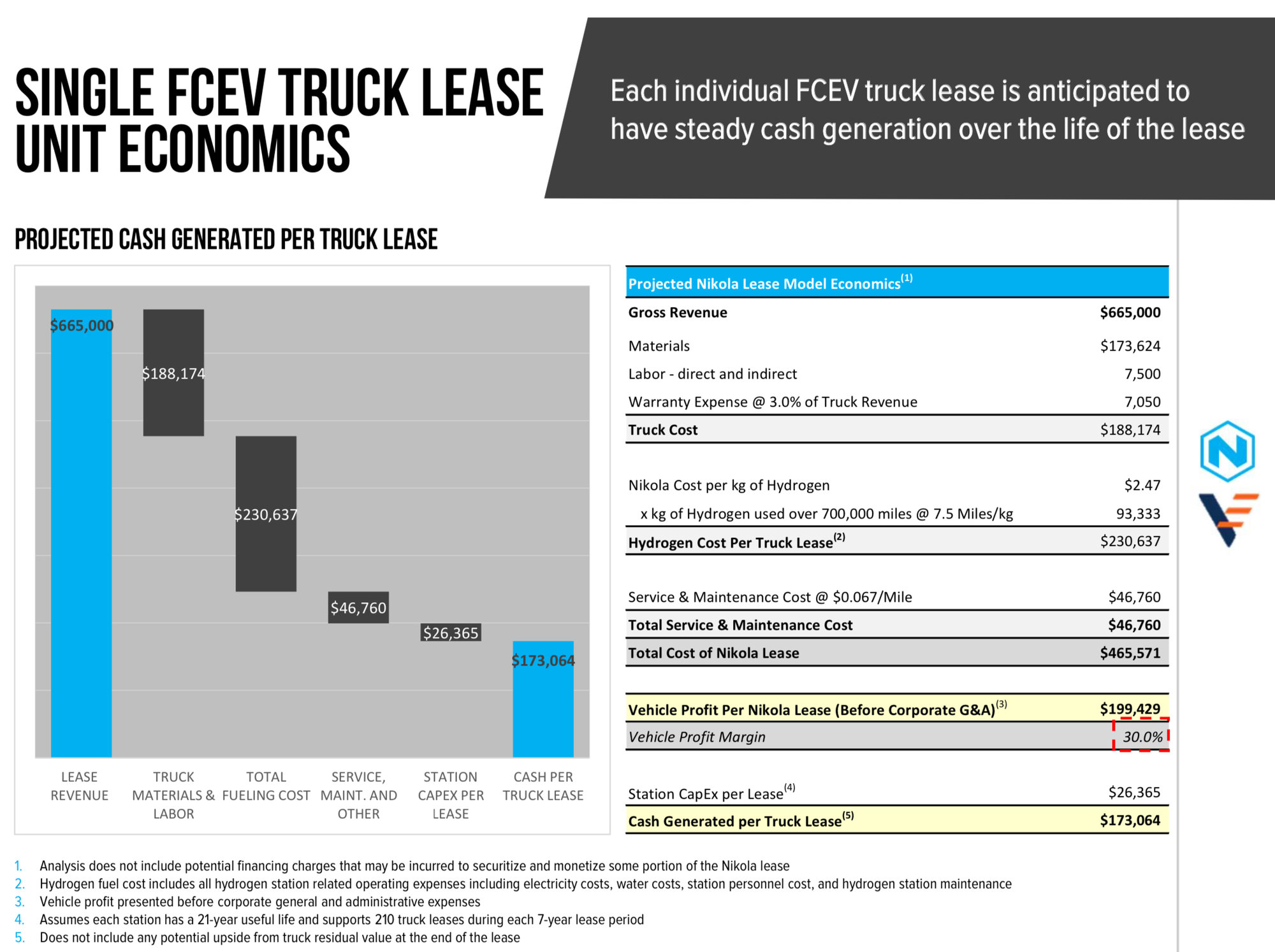

OK I’m having trouble understanding the sales model on NKLA with its Fuel cell Trucks coming in 2023 (supposedly).

They aren’t technically going to be selling them, instead they will be $665,000 cost over a 7 year lease, which includes the truck, the hydrogen fuel (up to 100,000 miles per year included, and all servicing/maintenance).

That works out at $95,000 revenue per year per truck ($665k / 7 years).

However the upfront costs for Nikola in the first year are as follows:

- cost of truck to build: $188,174

- cost of hydrogen fuel For 1 year: $33,000

- servicing / maintenance: $6,680

- capex share of refuelling station per truck: $3,766

Total 1st year cost for Nikola to ship one truck: $231,620

So less first year revenue, Nikola is negative $136,620 cashflow for every truck it sells in the first year of the lease, and it will take several more years for Nikola To become profitable on that sale.

The only way Nikola can get around then horrible economies of that business model is to either have a massive amount of cash on hand to cover the cash burn for the first half decade of operations (which they don’t have), or they securitise the lease agreements in some manner to 3rd parties (which will decrease margins).

They aren’t technically going to be selling them, instead they will be $665,000 cost over a 7 year lease, which includes the truck, the hydrogen fuel (up to 100,000 miles per year included, and all servicing/maintenance).

That works out at $95,000 revenue per year per truck ($665k / 7 years).

However the upfront costs for Nikola in the first year are as follows:

- cost of truck to build: $188,174

- cost of hydrogen fuel For 1 year: $33,000

- servicing / maintenance: $6,680

- capex share of refuelling station per truck: $3,766

Total 1st year cost for Nikola to ship one truck: $231,620

So less first year revenue, Nikola is negative $136,620 cashflow for every truck it sells in the first year of the lease, and it will take several more years for Nikola To become profitable on that sale.

The only way Nikola can get around then horrible economies of that business model is to either have a massive amount of cash on hand to cover the cash burn for the first half decade of operations (which they don’t have), or they securitise the lease agreements in some manner to 3rd parties (which will decrease margins).

OK I’m having trouble understanding the sales model on NKLA with its Fuel cell Trucks coming in 2023 (supposedly).

They aren’t technically going to be selling them, instead they will be $665,000 cost over a 7 year lease, which includes the truck, the hydrogen fuel (up to 100,000 miles per year included, and all servicing/maintenance).

That works out at $95,000 revenue per year per truck ($665k / 7 years).

However the upfront costs for Nikola in the first year are as follows:

- cost of truck to build: $188,174

- cost of hydrogen fuel For 1 year: $33,000

- servicing / maintenance: $6,680

- capex share of refuelling station per truck: $3,766

Total 1st year cost for Nikola to ship one truck: $231,620

So less first year revenue, Nikola is negative $136,620 cashflow for every truck it sells in the first year of the lease, and it will take several more years for Nikola To become profitable on that sale.

The only way Nikola can get around then horrible economies of that business model is to either have a massive amount of cash on hand to cover the cash burn for the first half decade of operations (which they don’t have), or they securitise the lease agreements in some manner to 3rd parties (which will decrease margins).View attachment 550627 View attachment 550628

Couldn't help but notice that they're planning on their cost of H2 as $2.47/kg - 1/7th current prices. I've seen optimistic projections of H2 being "price competitive" with gasoline within 5 years (ASSUMING significant production volume), but that translates to ~$6/kg in 2025.

Not sure how Nikola intends to bring H2 production costs down?

Couldn't help but notice that they're planning on their cost of H2 as $2.47/kg - 1/7th current prices. I've seen optimistic projections of H2 being "price competitive" with gasoline within 5 years (ASSUMING significant production volume), but that translates to ~$6/kg in 2025.

Not sure how Nikola intends to bring H2 production costs down?

From their 8K:

Our inability to cost-effectively source the energy requirements to conduct electrolysis at our fueling stations may impact the profitability of our bundled leases by making our hydrogen uneconomical compared to other vehicle fuel sources.

Our ability to economically produce hydrogen for our FCEV trucks requires us to secure a reliable source of electricity for each of our fueling stations at a price per kilowatt hour that is below the current retail rates in the geographic areas we target. An increase in the price of energy used to generate hydrogen through electrolysis would likely result in a higher cost of fuel for our FCEV trucks as well as increase the cost of distribution, freight and delivery and other operating costs related to vehicle manufacturing. We may not be able to offset these cost increases or pass such cost increases onto customers in the form of price increases, because of our bundled lease model for FCEV trucks, which could have an adverse impact on our results of operations and financial condition.

We may not be able to produce or source the hydrogen needed to establish our planned hydrogen fueling stations.

As a key component of our business model, we intend to establish a series of hydrogen fueling stations, and we intend to include the cost of hydrogen in the purchase price of our trucks. We intend to produce the hydrogen needed for these stations on site through electrolysis. To the extent we are unable to produce the hydrogen, we may be unable to establish these fueling stations and severely limit the usefulness of our trucks, or, if we are still able to establish these stations, we may be forced to sell hydrogen at a loss in order to maintain our commitments.

Essentially they are planning to build their stations where they can get really cheap, free, or even negative cost, electricity during off hours that the grid would normally need curtail, or dump, power to use in their hydrogen generation.

I think the biggest flaw in their plan is that by the time they get around to building these stations Tesla will already have come through and setup Megacharger stations, each with at least one Megapack, and Tesla will already be soaking up all of that cheap/free energy.

They don't get to choose to build the refueling stations where the energy is cheap. They have to be where they're needed for long distance transport. Not the same places at all.From their 8K:

Essentially they are planning to build their stations where they can get really cheap, free, or even negative cost, electricity during off hours that the grid would normally need curtail, or dump, power to use in their hydrogen generation.

I think the biggest flaw in their plan is that by the time they get around to building these stations Tesla will already have come through and setup Megacharger stations, each with at least one Megapack, and Tesla will already be soaking up all of that cheap/free energy.

They don't get to choose to build the refueling stations where the energy is cheap. They have to be where they're needed for long distance transport. Not the same places at all.

That is true, but I swear I saw them mention somewhere that the may be building some as just a refueling station, and not a production station, and that they would truck the hydrogen in from a production plant located elsewhere.

jhm

Well-Known Member

Examining the hydrogen marginal and capex assumption...OK I’m having trouble understanding the sales model on NKLA with its Fuel cell Trucks coming in 2023 (supposedly).

They aren’t technically going to be selling them, instead they will be $665,000 cost over a 7 year lease, which includes the truck, the hydrogen fuel (up to 100,000 miles per year included, and all servicing/maintenance).

That works out at $95,000 revenue per year per truck ($665k / 7 years).

However the upfront costs for Nikola in the first year are as follows:

- cost of truck to build: $188,174

- cost of hydrogen fuel For 1 year: $33,000

- servicing / maintenance: $6,680

- capex share of refuelling station per truck: $3,766

Total 1st year cost for Nikola to ship one truck: $231,620

So less first year revenue, Nikola is negative $136,620 cashflow for every truck it sells in the first year of the lease, and it will take several more years for Nikola To become profitable on that sale.

The only way Nikola can get around then horrible economies of that business model is to either have a massive amount of cash on hand to cover the cash burn for the first half decade of operations (which they don’t have), or they securitise the lease agreements in some manner to 3rd parties (which will decrease margins).View attachment 550627 View attachment 550628

7.5 miles/kg is 6 kWh/mile assuming ~75% efficiency on the electrolyzer, 45 kWh consumed to produce 1 kg of H2. Compression is more.

To get to operating (marginal) cost of $2.47/kg, you need to buy power below 5.5c/kWh. (This leaves nothing for maintenance, staffing, compression, etc.)

I looks like they will need to generate their own power from solar or have a PPA for wind or solar to get to suitably low prices of power. This also means they cannot run the electrolyzers at near 100% load factor (constant running). Plus variable demand at each station from day to day means that load factor must be substantially lower than 100%. I think 50% load factor would be at the high end.

How much electrolyzer capacity do they need to serve one lease. 700,000 miles over 7 years at 6 kWh/mile is 1,644 kWh/day. Let's assume 50% load capacity. Thus, they need 137 kW of electrolyzer capacity per lease.

How much does this cost? Nikola has been touting that they are buying electrolyzers from Nel at $350/kW. (There's a bunch more hardware they have to buy to put up a station, compressors, tanks, filling hardware, and other property plus installation.) The electrolyzers alone will incur $47,945 per initial lease. Over 21 years this asset can serve 3 consecutive truck leases. Assuming nikola can get financing at 8%, lease on the first 7 years of this electrolyzer capacity has a present value of $24,920.

At 50% load factor, the cost of electrolyzer pretty much blows through the $26,365 they claim as total capex per lease. This leaves practically nothing for all the other hardware, installation and property that a station will need. If the load factor in practice proves to be a little less optimistic, they will absolutely blow through this assumption.

My strong suspicion is that they are being wildly optimistic about load factors and ignoring financing costs. Just because a certain capacity can serve 3 truck over 21 years does not mean that it can serve 3 trucks in the same 7 years.

Even if they do eventually get the financing right, this still means the business model for hydrogen stations will be heavily front loaded with capex. Growth of there overall business model will be heavily dependent on financing. Heck the trucks are leased! So this is very dangerous in a similar way as SolarCity was dangerous. A Jim Chanos style short attack would go after their need for capital to keep turning the growth crank. Scare away financing and the stock loses value, the trucks on lease lose resale value and the fueling stations become stranded assets. This is really much worse than SolarCity ever was because at least retail electricity is likely to hold its value for many decades. But if Nikola has difficulty leasing enough vehicles 7 years later they will never make back the investment on infrastructure (stations, PPAs and solar power systems) and trucks (if they are assumed to have any residual value after 7 years).

Edit, they are saying "Cash generated per truck lease." This is potentially misleading because on a cash basis they actually need 3 consecutive truck leases to cover the cash to capex spending. Cash generated over a 21 year period really ought to be properly discounted.

Last edited:

jhm

Well-Known Member

Let's also compare that 7-year lease for the Nikola semi to Tesla Semi from the customer view point.

Nikola

Customer pays $665k over 7 years for use of truck, refueling and maintenance. That is 95c/mile.

Tesla

Customer pays about $180k spread out over a 7-year lease (8% financing) on the long range (500 mile) Semi which coincidentally lists for $180k. (Note the residual value of the Semi at the end of 7-year lease pretty much covers the cost of financing.)

Assume $47k for maintenance (Nikola is actually copying Tesla's assumption here.)

Charging assume 14c/mile ( 2 kWh/mile (conservative) X 7c/kWh (Tesla claim, but pricier than the power cost to Nikola). Total for 700k miles is $98k. (Note this is substantially cheaper than the $231k opex to Nikola.)

Total cost to Tesla customer over 7 years, $325k, is 46c/mile.

So even if 95c/mile to the Nikola customer is competitive to diesel, it really sucks wind compared to 46c/mile for the Tesla customer. The key advantage Nikola asserts for the extra 49c/mile is time savings of refueling faster with H2 than charging the battery. Apparently they think that advantage is worth $134 per day (traveling an average 274 miles per day, 100k miles per year). Maybe, but a lot of cleaver operators can find ways to save that kind of money.

Another thing really messed up with the package that Nikola would like to offer (if I understand correctly) is that it creates no incentive for the customer to substitute cheep power for hydrogen which is pricey to Nikola. Last I heard the Nikola semi would have something like a 350kWh battery pack. In principle you could charge that up overnight for about 7 c/kWh (or whatever cheap rates you could find), for 14c/mile. But under the lease, you get hydrogen inclusive so no marginal cost to you. So for the customer it is marginally 0c/mile to use hydrogen, but this forces Nikola to pay for 6kWh/mile to run the electrolyzer for you, a cost of 33c/mile to Nikola. Hopefully for Nikola, I am interpreting this wrong. If they are going to charge something like more than $3/kg for hydrogen, then the truck operator can save money by charging at below 20c/kWh, as well as avoiding trips to the H2 station. Maximizing charging of the battery would both save Nikola and their customers a lot of money.

The fundamental problem here is that Nikola is trying to sell an EV truck that requires more than 6 kWh/mile while Tesla is shooting for 1.5 to 2 kWh/mile. In the long haul, efficiency wins.

Nikola

Customer pays $665k over 7 years for use of truck, refueling and maintenance. That is 95c/mile.

Tesla

Customer pays about $180k spread out over a 7-year lease (8% financing) on the long range (500 mile) Semi which coincidentally lists for $180k. (Note the residual value of the Semi at the end of 7-year lease pretty much covers the cost of financing.)

Assume $47k for maintenance (Nikola is actually copying Tesla's assumption here.)

Charging assume 14c/mile ( 2 kWh/mile (conservative) X 7c/kWh (Tesla claim, but pricier than the power cost to Nikola). Total for 700k miles is $98k. (Note this is substantially cheaper than the $231k opex to Nikola.)

Total cost to Tesla customer over 7 years, $325k, is 46c/mile.

So even if 95c/mile to the Nikola customer is competitive to diesel, it really sucks wind compared to 46c/mile for the Tesla customer. The key advantage Nikola asserts for the extra 49c/mile is time savings of refueling faster with H2 than charging the battery. Apparently they think that advantage is worth $134 per day (traveling an average 274 miles per day, 100k miles per year). Maybe, but a lot of cleaver operators can find ways to save that kind of money.

Another thing really messed up with the package that Nikola would like to offer (if I understand correctly) is that it creates no incentive for the customer to substitute cheep power for hydrogen which is pricey to Nikola. Last I heard the Nikola semi would have something like a 350kWh battery pack. In principle you could charge that up overnight for about 7 c/kWh (or whatever cheap rates you could find), for 14c/mile. But under the lease, you get hydrogen inclusive so no marginal cost to you. So for the customer it is marginally 0c/mile to use hydrogen, but this forces Nikola to pay for 6kWh/mile to run the electrolyzer for you, a cost of 33c/mile to Nikola. Hopefully for Nikola, I am interpreting this wrong. If they are going to charge something like more than $3/kg for hydrogen, then the truck operator can save money by charging at below 20c/kWh, as well as avoiding trips to the H2 station. Maximizing charging of the battery would both save Nikola and their customers a lot of money.

The fundamental problem here is that Nikola is trying to sell an EV truck that requires more than 6 kWh/mile while Tesla is shooting for 1.5 to 2 kWh/mile. In the long haul, efficiency wins.

Thekiwi

Active Member

I feel like this thread is going to prove very illuminating, but will fuel much exasperation as to when the stock price will begin to reflect the reality. It could take 7 days, 7 weeks or 7 months before crashing to A reasonable valuation.

It wouldn’t surprise me if Nikola ends up only ever shipping their shorter range BEV Trucks.

It wouldn’t surprise me if Nikola ends up only ever shipping their shorter range BEV Trucks.

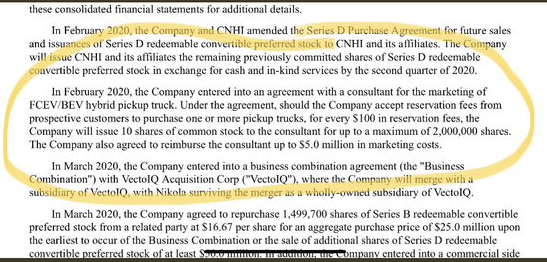

Where can I get in on a deal like this?

I can spend $5 million of your money to market a truck and I get 10 shares of NKLA per $100 of reservations? So if the reservation price is $1,000 I get $6,400 in stock per reserved truck? (Up to a total of $128 million worth of stock at the current valuation if I can get 200k reservations with your $5 million of market budget.)

Talk about a sweet referral program.

Edit: I see that he has said that the Diesel Brothers are the consultant that got this sweet gig.

I can spend $5 million of your money to market a truck and I get 10 shares of NKLA per $100 of reservations? So if the reservation price is $1,000 I get $6,400 in stock per reserved truck? (Up to a total of $128 million worth of stock at the current valuation if I can get 200k reservations with your $5 million of market budget.)

Talk about a sweet referral program.

Edit: I see that he has said that the Diesel Brothers are the consultant that got this sweet gig.

Last edited:

LN1_Casey

Draco dormiens nunquam titillandus

Where can I get in on a deal like this?

View attachment 552984

I can spend $5 million of your money to market a truck and I get 10 shares of NKLA per $100 of reservations? So if the reservation price is $1,000 I get $6,400 in stock per reserved truck? (Up to a total of $128 million worth of stock at the current valuation if I can get 200k reservations with your $5 million of market budget.)

Talk about a sweet referral program.

Edit: I see that he has said that the Diesel Brothers are the consultant that got this sweet gig.

So that’s why the reservations are free?

So that’s why the reservations are free?

This is for the Badger, and they aren't opening for reservations until the 29th.

Nkla will have both bev and hfc trucks, the fuel cell will have a 3ookwh? Battery.

- ..

- Just how bad are fool sells?

- ..

Wild 1st pass approximation, is the energy stored in the h2 system is about 5-10x higher than in its captive li ion battery. So 1.5MWh to 3 MWh equivalent.

Thats

A) a lot of weight saved compared to li ion

B) A LOT MORE SPACE taken up compares to li ion.

So it could work on a long haul truck in a manner not applicable to passenger vehicles.

Similar threads

- Replies

- 0

- Views

- 105

- Replies

- 1

- Views

- 504

- Locked

- Replies

- 84

- Views

- 2K

- Replies

- 28

- Views

- 1K

- Replies

- 3

- Views

- 1K