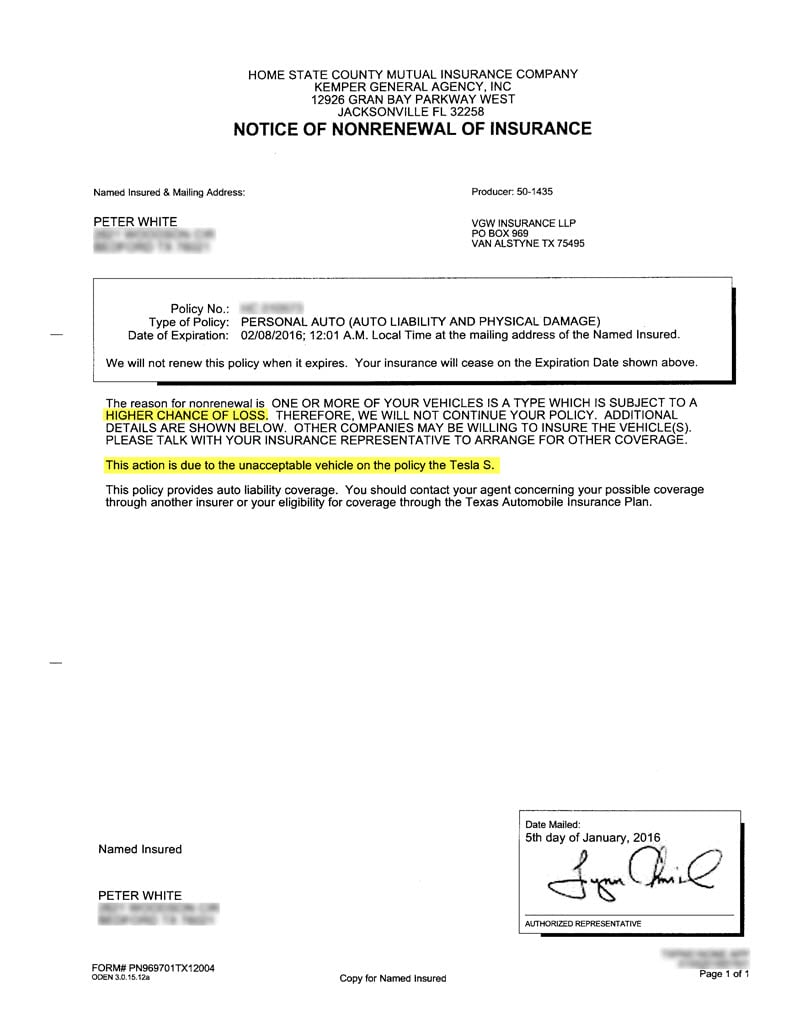

So I received this fun letter from my auto insurance yesterday, apparently the Model S has a higher chance of loss, so they're no longer willing to insure me (it was a multi-car policy, no claims/tickets at all in the past 5yrs for either of us). I've highlighted the relevant bits. Anyone else getting these letters? Any recommendations for alternatives? This was via Kemper, who up until now have been very cheap for me, last year it was $1407 for the S and a Q5 with all the usual coverage limits, nothing weird.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mike K

Member

I'm torn. On the one hand I want to chalk this up to horrible insurance companies. On the other hand, I can't blame them. So many of these cars are totaled out with minor damage because of the unknowns. The insurance companies know they have to send the car to Tesla to check the battery and other equipment and they know if the battery is damaged it's $40,000+ to replace it. With S85's solidly approaching values of $50,000 - $60,000 almost any accident is going to be a guaranteed total loss unless they can say unequivocally that the battery was not damaged.

The worst thing for an insurance company is to put $10,000 of body work into a $50,000 car and find out there's a battery fault. It's easier for them to just wash their hands of it. That's why I think there are so many nice salvage Model S's out there. It really doesn't take much to total one out.

The worst thing for an insurance company is to put $10,000 of body work into a $50,000 car and find out there's a battery fault. It's easier for them to just wash their hands of it. That's why I think there are so many nice salvage Model S's out there. It really doesn't take much to total one out.

Super_Popular

Well-Known Member

1101011

Proud TSLA/SCTY shareholder since 2013.

SabrToothSqrl

Active Member

Progressive wants to **** me $200 for 6 months for a NOT AT FAULT accident. Apparently people who are the victims of others get punished fr 3 years.

insurance is such a scam.

insurance is such a scam.

Last edited by a moderator:

mknox

Well-Known Member

I'm in Canada, so that may make a difference but my rates actually went down for 2016 in spite of the fact I had a minor "at fault" accident (rubbed bumpers in a parking lot).

theslimshadyist

Active Member

This is something that I hadn't considered, figured it was a no brainer because of the solid safety ratings. I better hurry up and check the rates prior to paying my deposit. FWIW, I have State Farm for home, auto, and umbrella and would be curious to see what others are paying who have State Farm.

Last edited:

Please edit your post to remove the highly OFFENSIVE word? You know the one.Progressive wants to **** me $200 for 6 months for a NOT AT FAULT accident. Apparently people who are the victims of others get punished fr 3 years.

insurance is such a scam.

Last edited by a moderator:

mknox

Well-Known Member

I thought that was considered a polite greeting in the great frozen north?

Well, the woman I backed in to didn't think so! Actually, we were both moving in tight quarters trying to park and I'm not 100% sure she wasn't backing up too. Not sure how much the claim was for. I scuffed the right rear corner of the plastic bumper and got a wee tiny scratch on the metal just where the bumper skin and fender meets. For some reason, the Tesla-authorized shop re-painted the entire rear quarter panel. Her car had a barely visible scuff on the bumper. I offered to pay for her damage, but she worked for an insurance company herself and didn't want to go that route.

tom66

Member

I thought insurers in the US couldn't increase rates for not-at-fault accidents.Progressive wants to **** me $200 for 6 months for a NOT AT FAULT accident. Apparently people who are the victims of others get punished fr 3 years.

insurance is such a scam.

In the UK they most definitely do increase rates, even if you aren't at fault. Their reasoning is if you make a claim, even a nonfault claim, you are more likely to make a fault claim in the future.

Last edited by a moderator:

AMPd

Well-Known Member

That's terrible reasoning!I thought insurers in the US couldn't increase rates for not-at-fault accidents.

In the UK they most definitely do increase rates, even if you aren't at fault. Their reasoning is if you make a claim, even a nonfault claim, you are more likely to make a fault claim in the future.

tstafford

Active Member

OP - I recommend calling Progressive (or just doing it on-line). They were substantially cheaper than Allstate for me.

Please edit your post to remove the highly OFFENSIVE word? You know the one.

Word removed -mod.

disillusioned

Member

Similar threads

- Replies

- 12

- Views

- 1K

- Replies

- 15

- Views

- 648

- Replies

- 2

- Views

- 425