And in any case, by the time operations scale to that level, Musk has stated they’d be using fuel in a carbon-neutral way. Most likely methane synthesis using water, atmospheric carbon dioxide and renewable power (e.g., Sabatier or Fischer-Tropsch processes).No, that guy is just spreading FUD, no different from people spreading FUD about electric cars like "electric cars produce more tire and brake pollution" or "electric cars take more resources/energy to build".

The # of Starship launches needed to maintain the constellation is only around 100 launches per year, that's not mind boggling big. In the early 80s Soviet Union regularly do around 100 launches per year, granted their launch vehicle is smaller than Starship, but they also burn kerosene which is dirtier than the methane Starship used.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Off topic galore

- Thread starter Mengy

- Start date

ZachF

Active Member

But that guy - Ronald Drimmel - makes a lot of good points. The number of Starship launches needed to get a viable constellation is truly mind boggling and the impact on our atmosphere is not going to be negligible.

The us produces 600 million tonnes of Natural Gas per year. Every starship launch would use roughly 1000 tonnes of NG and 3600 tonnes of O2.

Using 10% of that could launch starship 60,000 times per year.

None of this is close to China’s usage of 4 billion tonnes of coal per year, which is equal to 8 billion tonnes NG in terms of CO2 emissions, or roughly 8,000,000 starship launches per year.

Are you really comparing the carbon footprint of Starships to the energy consumption of 1.5 billion humans?The us produces 600 million tonnes of Natural Gas per year. Every starship launch would use roughly 1000 tonnes of NG and 3600 tonnes of O2.

Using 10% of that could launch starship 60,000 times per year.

None of this is close to China’s usage of 4 billion tonnes of coal per year, which is equal to 8 billion tonnes NG in terms of CO2 emissions, or roughly 8,000,000 starship launches per year.

Not really helpful.

Rockets (in general) compared to commercial airline usage in this Everyday Astronaut video.Are you really comparing the carbon footprint of Starships to the energy consumption of 1.5 billion humans?

Not really helpful.

TL;DR Conclusion is that rockets have negligible pollution compared to airline flights.

ZachF

Active Member

TL;dr: Compared to the airline industry rocket created pollution is an order of magnitude smaller ...

Orders (plural) of magnitude.

Paracelsus

Active Member

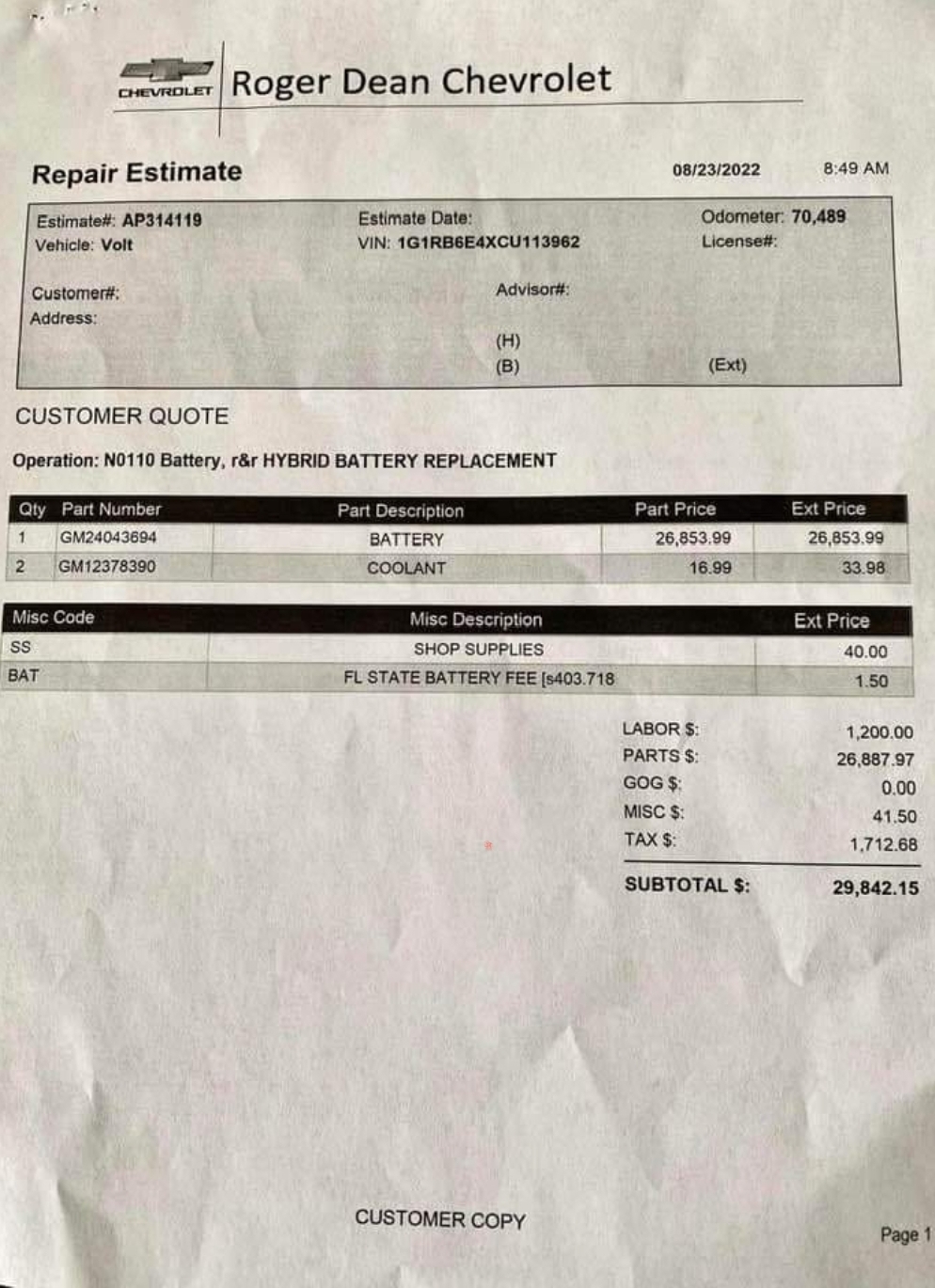

This is making the texting circles today:

I’ll field this.

It’s a mistake. It’s the wrong PN for the battery. The actual cost is about $10k.

Last edited:

dhanson865

Well-Known Member

Might be fake, I checked r/volt and r/electricvehicles and found no discussion of it. Also I'd expect a customer to walk out instead of paying that.

That stills seems like a lot for a 16kWh battery.I’ll field this. It’s a mistake. It’s the wrong PN for the battery. The actual cost is about $10k.

It's a 2012 model. So at least he got 10 good years out of it. If this happened a couple of years earlier he would have gotten a replacement for free.

They probably don't want anyone to buy the few Volt battery packs they have left in stock for fear that they won't be able to cover warranty replacements.

Dealer + that vehicle is discontinued no? Either way it's a predictable bit of FUD for the EV haters.That stills seems like a lot for a 16kWh battery.

Artful Dodger

"Neko no me"

NASA's Artemis 1 Rocket Launch Scrubbed Due To Stuck Valve #shorts | Scott Manley

Turns out, the Artemis 1 launch attempt was scrubbed today because NASA engineers couldn't open a bleed valve on Engine #3 in order to pre-chill the engine.

This was an item that should have been tested during the wet dress rehersal, but could not be completed because the return line was leaking.

NASA gambled that the valve would work on launch day, and lost that bet.

Turns out, the Artemis 1 launch attempt was scrubbed today because NASA engineers couldn't open a bleed valve on Engine #3 in order to pre-chill the engine.

This was an item that should have been tested during the wet dress rehersal, but could not be completed because the return line was leaking.

NASA gambled that the valve would work on launch day, and lost that bet.

Last edited:

I though the change in institutional ownership due to debt grading was specifically the item of interest as regards Tesla. The time lag is an interesting data point.Really gots ta keep charts of non tesla stuff out of here, especially since this one has ZERO reference to apple in the frame of reference.

Police: Employee shot customer during dispute at Bedford car dealership

Bedford police said a customer was shot by an employee at a car dealership on Friday.

Customer: I am tired of your dealer markup and price gouging

Employee: Ill show you who's sick and tired of your constant complaining and haggling

What is this world coming to?

CLK350

Member

Police: Employee shot customer during dispute at Bedford car dealership

Bedford police said a customer was shot by an employee at a car dealership on Friday.www.cleveland19.com

Customer: I am tired of your dealer markup and price gouging

Employee: Ill show you who's sick and tired of your constant complaining and haggling

What is this world coming to?

Hot off the press.. thanks to the ubiquitous cameras everywhere, Man's Rolex stolen off his wrist by moped-riding thief in series of attacks

Brazilian style muggings (bandits on scooter swiping jewelry from passers by or people sitting in cars etc.) The situation is so bad the government made it legal to shoot /kill (run over w/car) robbers on sight. Not kidding

Truth is this really is caused by widespread poverty recently exacerbated by our (mis) handling or the COVID pandemic (plandemic?)

B

betstarship

Guest

Welp, volcanoes aside (just earlier this year) - a 1 year old was killed in Catalonia area due to orange-sized hail

While both are involved in energy, the Department of Energy handles nuclear along with technology, infrastructure, and renewables, while Bureau of Land Management within the Department of Interior oversees oil & gas production.DoE (pronounced "Doh!") is the abbreviation for the US Ministry of Oil. Once you know that, it explains a lot.

Programs: Energy and Minerals: Oil and Gas | Bureau of Land Management

I moved to off-topic to reply. I joined Qualcomm in 1996, and worked in standards, particularly w.r.t. security and cryptography. (Your cellphone literally has my code.) So I lived through the time you refer to above. The whole company knew that something was in the works, but not what. Except that the IT people, who I worked closely with for security issues, had to know. I was at a party for a friend's wedding rehearsal, and managed to wheedle it out of one of them that it was Ericsson. "You don't understand! This means we won!" I said to him. At the time, in all the international standards groups for mobile phones, the CDMA camp (Qualcomm, Nortel, Panasonic and some smaller players) were being vehemently opposed by Ericsson, Nokia, Motorola, Siemens in particular, who all claimed that CDMA couldn't deliver on the performance promises (despite the fact that it already was). That Ericsson split their alliance by buying Qualcomm's infrastructure division paved the way for 3G/UMTS to be Wideband CDMA, and it took off.Two or three quarters is a flash in the pan to an investor with conviction. I would wait more than 2 or 3 years for TSLA to start appreciating again (as long as the fundamental reasons I bought the stock remain intact) but that's not going to be necessary. I can't say that as a fact, but I can say it with conviction. Conviction should never be blind; it should always be based on real things.

In 1997 I started buying QCOM with the conviction they held the keys to high-bandwidth cellular data. Cellular data was, at the time, slower than molasses and as expensive as caviar. People actually thought the common person didn't need high-bandwidth cellular data. I knew they wanted high bandwidth cellular data; they just didn't know it yet.

In 1998 QCOM went down, not up. It made no sense as Qualcomm was profitable and growing. So, I bought more. It got cheaper still! It was about 30-35% cheaper than the very low price I had already Identified as a bargain even though adoption of Qualcomm's technology was growing rapidly and proving its abilities in the real world with millions of users. I even sold highly appreciated MSFT stock that still had a bright future to buy more QCOM. It was our biggest position of just a handful, by far. Then we moved into our tiny uninsulated summer vacation cabin in the neighboring County, sold our real house (that we owned outright) and put 90% of the proceeds into more QCOM which showed no signs of life if all you looked at was the market price. In the spring of 1999 Ericsson settled out of court with Qualcomm and the stock quickly doubled. I watched with mild amusement as greedy people, not wanting to lose their unrealized profits, sold for two, three or four times what they had originally paid. They thought payday had finally come! Over the next 9 months QCOM continued to appreciate until it was worth 36 times the doldrums of 1998. Every $100,000 invested had turned into $3.6 million. I didn't sell a single share until the day before it peaked, the last trading day of 1999. This is what I had waited 3 years for, and it was worth the wait! Investing is not for the impatient or those quick to take profits. That said, I am not expecting TSLA to perform just like that! But the longer the price is held down, the more it will resemble a rocket ship again. If markets were not so spastic, TSLA would more closely resemble a locomotive of the kind that steam-rolls your way to great wealth. Instead, it goes in unpredictable and irrational fits and spurts that have little to do with the actual value of the company.

Always judge the value of a company by your own analysis, not the current share price or recent share price movements! That's how you lose. And remember that 2 or 3 quarters in the investment world is like 5 minutes to a day trader. Don't invest with impatience - that's not how you become wealthy Manipulators rely on other's impatience to finally get their way. And never sell a stock simply because it doubled or tripled quickly, only sell because it has become abundantly clear the future of the company is not bright enough to justify the price. Even then I would caution against selling too soon as momentum and market FOMO will typically push the price far higher than it has any right to be. If the company is as good as your analysis showed, it will likely be OK to hold through a multi-year period of doldrums if you get caught in the downdraft that stagnates for a multi-year period. Ideally, you would sell before such an event but it's almost always better to hold too long than to sell too early (unless the company has no substance or staying power).

I would argue that TSLA, as a long-term, core holding, is undervalued at more than triple the current price even if I assume FSD will never work. And that's an assumption I'm not willing to make.

I had a bet with that friend "$200 within a week of the announcement" -- I think it was about $125 at the time. That was a Friday evening, and it hit $199.xx on Monday. He still owes me that dinner.

The relevance to Tesla is clear, that companies that once poo-poohed EVs are starting to try to catch up. An unpredictable event along these lines, where one of the big anti-Tesla makers caves, would be huge for TSLA. Although, unlike Qualcomm, Tesla had to go it alone for a much longer time. But suppose (total hypothetical) BMW announced a deal with Tesla to manufacture skateboard based BMW branded cars. Or something like that. It's true that there were Tesla drivetrains in RAV-4s and Mercedes cars, but they were clearly stop-gaps, not capitulation.

Artful Dodger

"Neko no me"

Similar threads

- Replies

- 0

- Views

- 307

- Replies

- 21

- Views

- 1K

- Replies

- 2

- Views

- 354

- Replies

- 6

- Views

- 233