The Senate version doesn't have the EV tax or gas tax increase.The Ohio House passed the bill with the $200/year EV tax.

Ohio House passes transportation bill to increase fuel taxes

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ohio Proposed EV Ownership Fee

- Thread starter HustleSimmons

- Start date

Electric700

Active Member

The Senate version doesn't have the EV tax or gas tax increase.

Good. I hope the final signed version matches the Senate one. We need to reach out to our representatives. If anything, only gasoline powered cars should be taxed more with all the problems they cause (air pollution, international oil disputes, etc.).

Plug it in

Member

They passed it with the $200/year EV tax!

https://www.usnews.com/news/best-st...sportation-budget-bill-to-increase-fuel-taxes

https://www.usnews.com/news/best-st...sportation-budget-bill-to-increase-fuel-taxes

rtanov

Member

From an EV driiver colleague: "The Ohio governor signed into law a new transportation bill that raises fuel/diesel taxes effective July 1. For those able to renew plates before July 1 and planning to keep their cars for several years, you might want to buy a tag of up to 5 years saving a bunch of Benjamins."

I will enter the 90 day advance registration period in a few days and probably try this.

I will enter the 90 day advance registration period in a few days and probably try this.

Atari2600

Active Member

My tags are up first of August. I would be surprised if the new law did not address this somehow.From an EV driiver colleague: "The Ohio governor signed into law a new transportation bill that raises fuel/diesel taxes effective July 1. For those able to renew plates before July 1 and planning to keep their cars for several years, you might want to buy a tag of up to 5 years saving a bunch of Benjamins."

I will enter the 90 day advance registration period in a few days and probably try this.

rtanov

Member

My tags are up first of August. I would be surprised if the new law did not address this somehow.

Yeah, I would be surprised too, but one can always hope

Atari2600

Active Member

Please report how it goes because I'll be trying this in early May.Yeah, I would be surprised too, but one can always hopeWe'll soon find out.

JRD1

Member

Here is the bill (House Bill 62) as passed:

http://search-prod.lis.state.oh.us/solarapi/v1/general_assembly_133/bills/hb62/EN/06?format=pdf

Page 82 has the definitions for 'Plug-in electric motor vehicle' and 'Hybrid motor vehicle'

Page 87 has the fees and says they are imposed as of January 1, 2020.

Looks like it will be 4503.10(C)(3) and (4)

This section is where it will be (but it has NOT been updated yet):

Lawriter - ORC - 4503.10 Application for registration or renewal - transmission of fees - inspection certificates.

Here you can see the votes (Senate 22 yeas 10 nays House 70 yeas 27 nays):

House Bill 62 - Votes | The Ohio Legislature

http://search-prod.lis.state.oh.us/solarapi/v1/general_assembly_133/bills/hb62/EN/06?format=pdf

Page 82 has the definitions for 'Plug-in electric motor vehicle' and 'Hybrid motor vehicle'

Page 87 has the fees and says they are imposed as of January 1, 2020.

Looks like it will be 4503.10(C)(3) and (4)

This section is where it will be (but it has NOT been updated yet):

Lawriter - ORC - 4503.10 Application for registration or renewal - transmission of fees - inspection certificates.

Here you can see the votes (Senate 22 yeas 10 nays House 70 yeas 27 nays):

House Bill 62 - Votes | The Ohio Legislature

JRD1

Member

Their definition of hybrid (see below) is not a 'plug-in hybrid' like the Volt but a car with batteries that can be recharged by the car itself (i.e. regenerative braking, etc).

A Volt would be considered a 'Plug-in electric motor vehicle' and pay $200 just like a fully-electric vehicle.

Something like the Civic Hybrid or Camry Hybrid (that do NOT plug-in and run 100% on gasoline) would be a 'Hybrid motor vehicle' and get to pay both the gasoline tax and an extra $100 (I guess for being too fuel efficient lol).

I wonder if this can be interpreted to mean any car with a 12v battery is a hybrid?

From page 82:

(DDD) "Plug-in electric motor vehicle" means a passenger car powered

wholly or in part by a battery cell energy system that can be recharged via

an external source of electricity.

(EEE) "Hybrid motor vehicle" means a passenger car powered by an

internal propulsion system consisting of both of the following:

(1) A combustion engine;

(2) A battery cell energy system that cannot be recharged via an external

source of electricity but can be recharged by other vehicle mechanisms that

capture and store electric energy.

A Volt would be considered a 'Plug-in electric motor vehicle' and pay $200 just like a fully-electric vehicle.

Something like the Civic Hybrid or Camry Hybrid (that do NOT plug-in and run 100% on gasoline) would be a 'Hybrid motor vehicle' and get to pay both the gasoline tax and an extra $100 (I guess for being too fuel efficient lol).

I wonder if this can be interpreted to mean any car with a 12v battery is a hybrid?

From page 82:

(DDD) "Plug-in electric motor vehicle" means a passenger car powered

wholly or in part by a battery cell energy system that can be recharged via

an external source of electricity.

(EEE) "Hybrid motor vehicle" means a passenger car powered by an

internal propulsion system consisting of both of the following:

(1) A combustion engine;

(2) A battery cell energy system that cannot be recharged via an external

source of electricity but can be recharged by other vehicle mechanisms that

capture and store electric energy.

bhtooefr

Active Member

The battery has to be part of the propulsion system to count as a hybrid. So, non-hybrids don't propel the car with it and don't count. Even "micro-hybrids" with stop-start and regenerative charging (charging only when needed or under braking, instead of constantly) don't count as they don't have any propulsion from the battery.

However, a weak 48 volt mild hybrid counts as equivalent to something like a Prius, despite massive disparities in fuel consumption.

However, a weak 48 volt mild hybrid counts as equivalent to something like a Prius, despite massive disparities in fuel consumption.

rtanov

Member

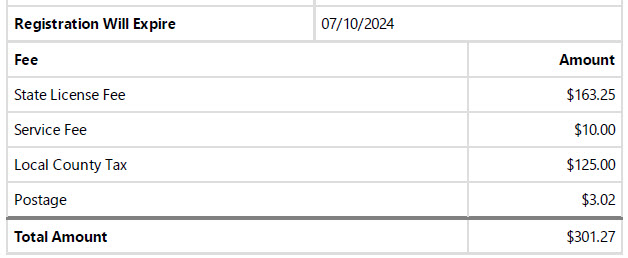

Update: I was able to renew the registrations for both my EVs for 5 years - ~$300/car with no personalized plates.

bhtooefr

Active Member

And it does increase taxes on gasoline and diesel, offsetting some of the negative effect on EVs (the EV/hybrid portion of this appears to be priced based on the whole state gas tax, though, by my calculations, not the added tax).

Atari2600

Active Member

Thanks again, I purchased my 5 years yesterday.Update: I was able to renew the registrations for both my EVs for 5 years - ~$300/car with no personalized plates.View attachment 395828

Eveque Fou

Member

We're planning on buying this summer. Any idea if you can geta five-year registration on initial purchase?

Similar threads

- Replies

- 0

- Views

- 476

- Replies

- 3

- Views

- 808

- Replies

- 24

- Views

- 3K

- Replies

- 125

- Views

- 5K