Care of @Blue horseshoe :

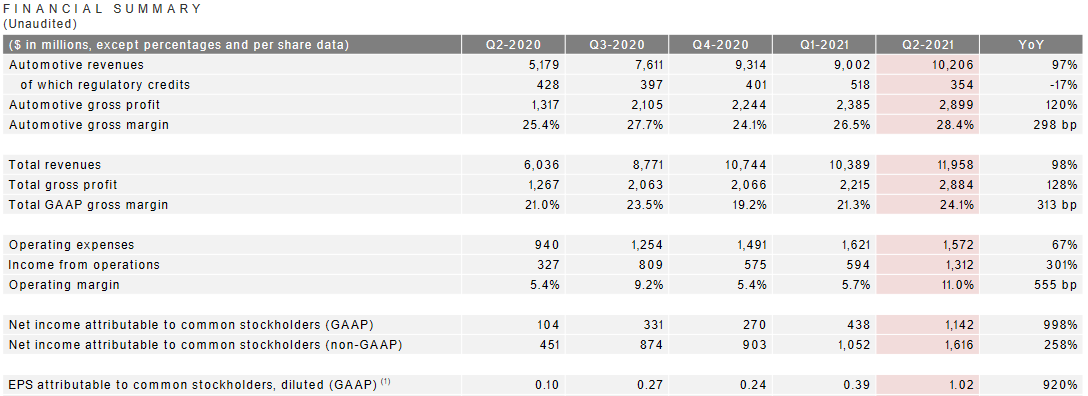

Using EPS (GAAP) we had a trailing twelve month (ttm) EPS of $1 and a corresponding 658 P/E (rounding up TSLA's share price at market close of $658 and ignoring AH). With Q2's $1.02 EPS (GAAP) the ttm EPS was $1.92 and a corresponding 342 P/E.

If Tesla grows EPS by 15% in Q3 and Q4 we should see EPS of $1.1 and $1.35 resulting in an end of year EPS (ttm) of $3.93.

With a ttm EPS (GAAP) of $3.93 here are some share prices we could see using P/E at end of year:

658 P/E = $2,585

342 P/E = $1,344

200 P/E = $786

Bear case: EPS freezes at Q2 rates of 1.02 for Q3 and Q4. That would result in EPS (ttm) at end of year of $3.45.

With a ttm EPS (GAAP) of $3.45 here are some share prices we could see using P/E at end of year:

658 P/E = $2,270

342 P/E = $1,180

200 P/E = $690

Also, since I prefer P/S ratios here is some revenue numbers:

Q2 to Q1 saw a 15% increase. If Tesla continues on that trend we should see Q3 13.8B and Q4 15.9B (rounded) for a total of $52.1B in revenue for 2021.

At a 20 P/S ratio the corresponding price would be: $1,082.

Of note, Elon's Stock Based Compensation anticipates his next tranche to likely be accomplished and the corresponding revenue number they need to hit is $55 billion.

Blue Horseshoe likes TSLA and reiterates $1,000+ for TSLA by year end.